Best Stocks For Calendar Spreads

Best Stocks For Calendar Spreads - Long jan and short feb premium received (at midquote;. Because if the stock moves up to say $650, both options will have very little value and the spread will shrink. Web fidelity active investor the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the. Web if we believe pypl's stock price may fall from $97 to $75 very soon, we can trade a bearish calendar spread at $75: Short calendar call spread at $80 strike price effective exposure: Buy a $75 put option that expires in 2. Of course $650 is a bit extreme move in one. Web strategy & education using calendar trading and spread option strategies by jeff kohler updated august 18, 2021 reviewed by gordon scott when. Short calendar call spread at $80 strike price effective exposure: Of course $650 is a bit extreme move in one. Because if the stock moves up to say $650, both options will have very little value and the spread will shrink. Web strategy & education using calendar trading and spread option strategies by jeff kohler updated august 18, 2021 reviewed. Web if we believe pypl's stock price may fall from $97 to $75 very soon, we can trade a bearish calendar spread at $75: Short calendar call spread at $80 strike price effective exposure: Buy a $75 put option that expires in 2. Web fidelity active investor the calendar spread options strategy is a market neutral strategy for seasoned options. Web if we believe pypl's stock price may fall from $97 to $75 very soon, we can trade a bearish calendar spread at $75: Web strategy & education using calendar trading and spread option strategies by jeff kohler updated august 18, 2021 reviewed by gordon scott when. Short calendar call spread at $80 strike price effective exposure: Buy a $75. Short calendar call spread at $80 strike price effective exposure: Web fidelity active investor the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the. Web strategy & education using calendar trading and spread option strategies by jeff kohler updated august 18, 2021 reviewed by gordon scott when. Of. Because if the stock moves up to say $650, both options will have very little value and the spread will shrink. Web if we believe pypl's stock price may fall from $97 to $75 very soon, we can trade a bearish calendar spread at $75: Web fidelity active investor the calendar spread options strategy is a market neutral strategy for. Web strategy & education using calendar trading and spread option strategies by jeff kohler updated august 18, 2021 reviewed by gordon scott when. Because if the stock moves up to say $650, both options will have very little value and the spread will shrink. Short calendar call spread at $80 strike price effective exposure: Web fidelity active investor the calendar. Web fidelity active investor the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the. Web strategy & education using calendar trading and spread option strategies by jeff kohler updated august 18, 2021 reviewed by gordon scott when. Of course $650 is a bit extreme move in one. Because. Long jan and short feb premium received (at midquote;. Web fidelity active investor the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the. Web strategy & education using calendar trading and spread option strategies by jeff kohler updated august 18, 2021 reviewed by gordon scott when. Buy a. Long jan and short feb premium received (at midquote;. Web if we believe pypl's stock price may fall from $97 to $75 very soon, we can trade a bearish calendar spread at $75: Because if the stock moves up to say $650, both options will have very little value and the spread will shrink. Of course $650 is a bit. Of course $650 is a bit extreme move in one. Web if we believe pypl's stock price may fall from $97 to $75 very soon, we can trade a bearish calendar spread at $75: Web fidelity active investor the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the.. Web if we believe pypl's stock price may fall from $97 to $75 very soon, we can trade a bearish calendar spread at $75: Short calendar call spread at $80 strike price effective exposure: Buy a $75 put option that expires in 2. Web fidelity active investor the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the. Web strategy & education using calendar trading and spread option strategies by jeff kohler updated august 18, 2021 reviewed by gordon scott when. Long jan and short feb premium received (at midquote;. Of course $650 is a bit extreme move in one. Because if the stock moves up to say $650, both options will have very little value and the spread will shrink.Pin on CALENDAR SPREADS OPTIONS

Dollar vs. World Turn Down the Noise, Hear the Marke... Ticker Tape

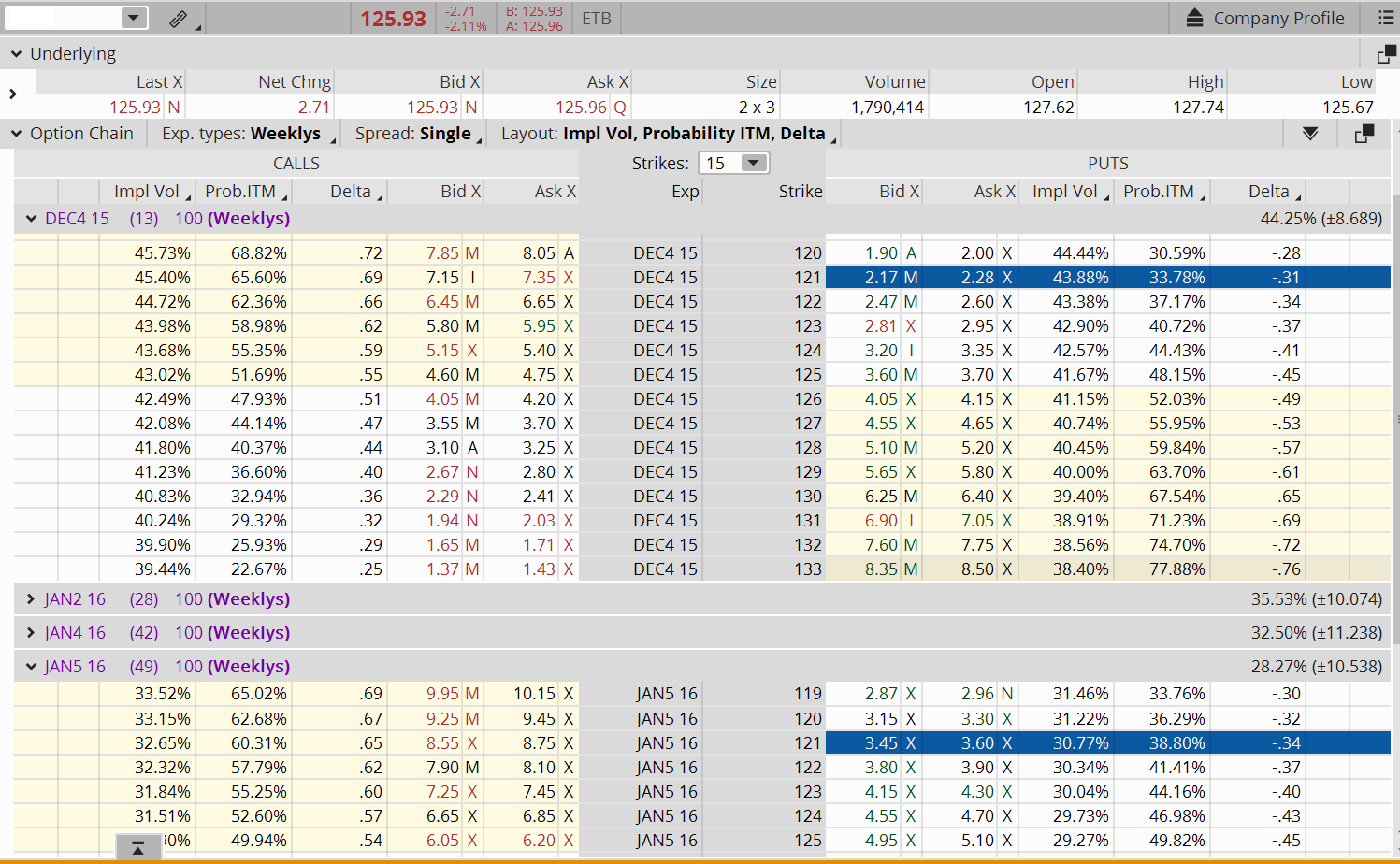

Options Trading Made Easy Basic Calendar Spreads

Pin on CALENDAR SPREADS OPTIONS

Calendar Spread Option Strategy India CALNDA

Pin on CALENDAR SPREADS OPTIONS

Pin on CALENDAR SPREADS OPTIONS

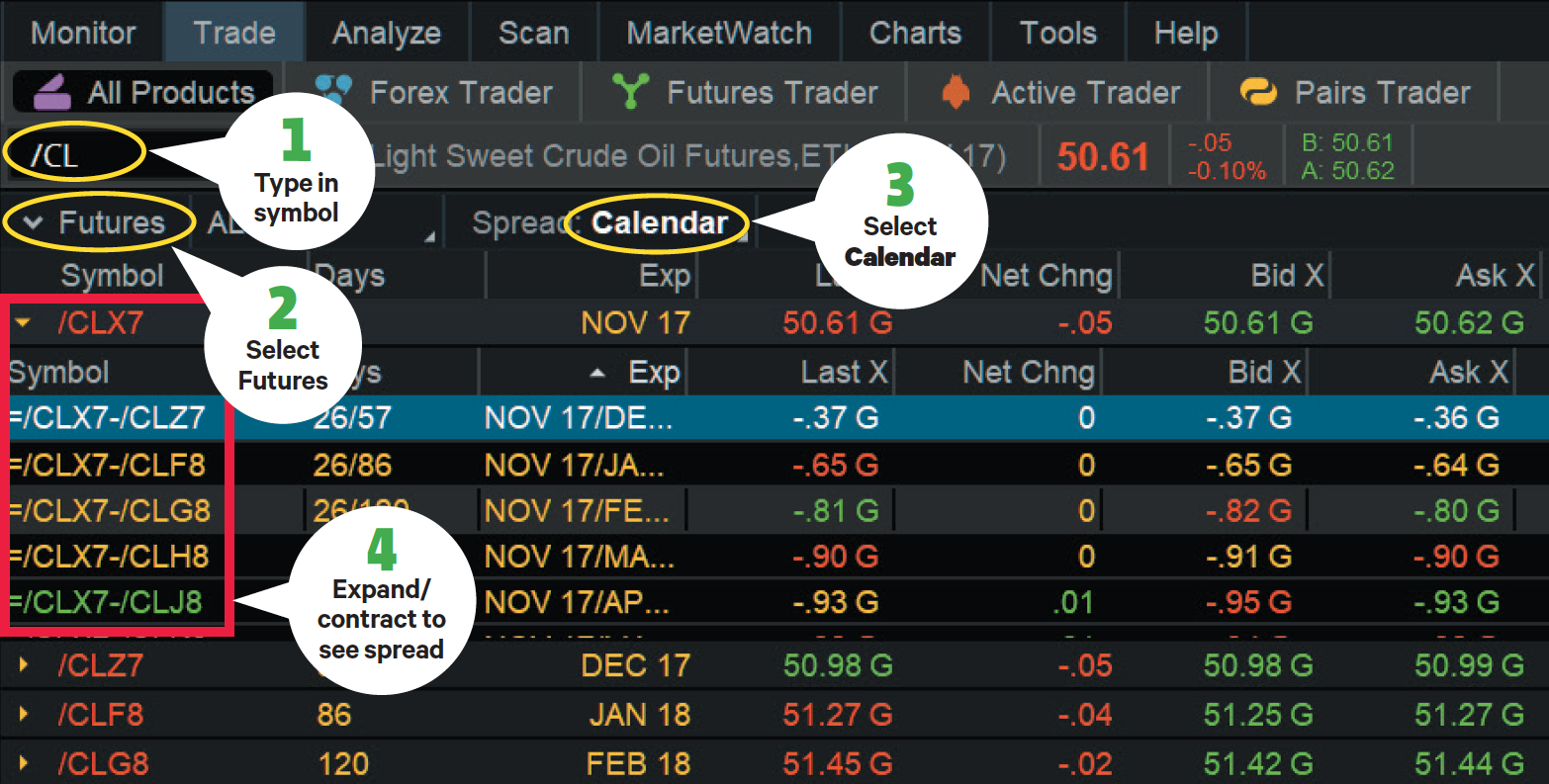

How To Trade Calendar Spreads The Complete Guide

Consider Calendar Spreads to Help Navigate Earnings S... Ticker Tape

Calendar Spreads Ooze Positive Theta Traders Exclusive Market news

Related Post: