Bull Calendar Spread

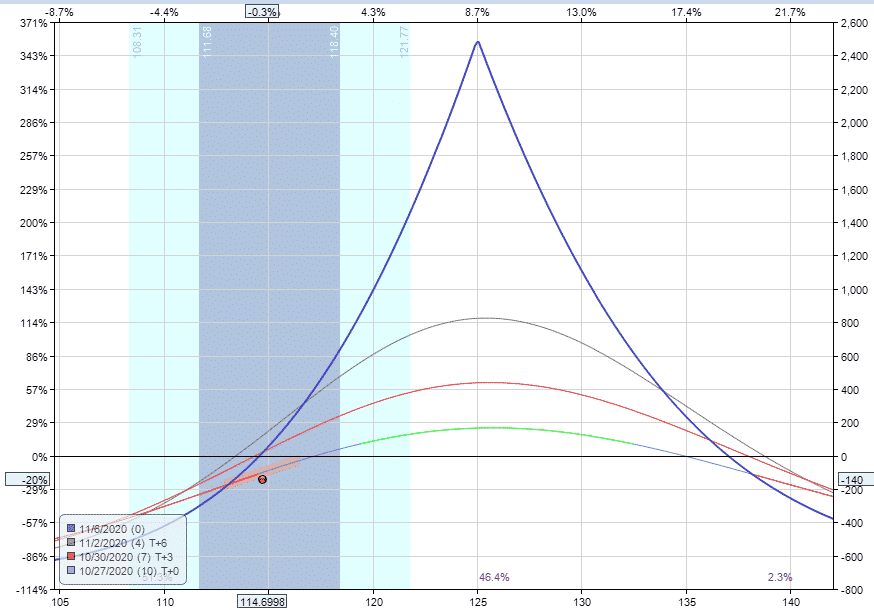

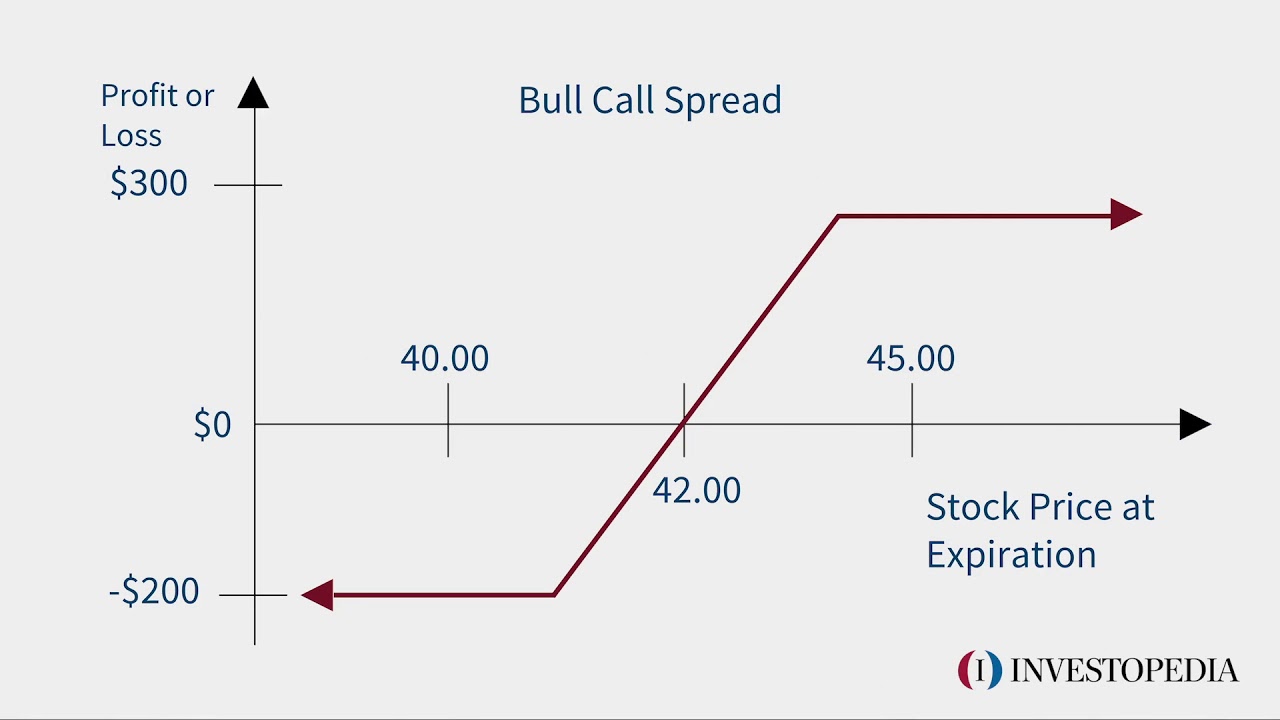

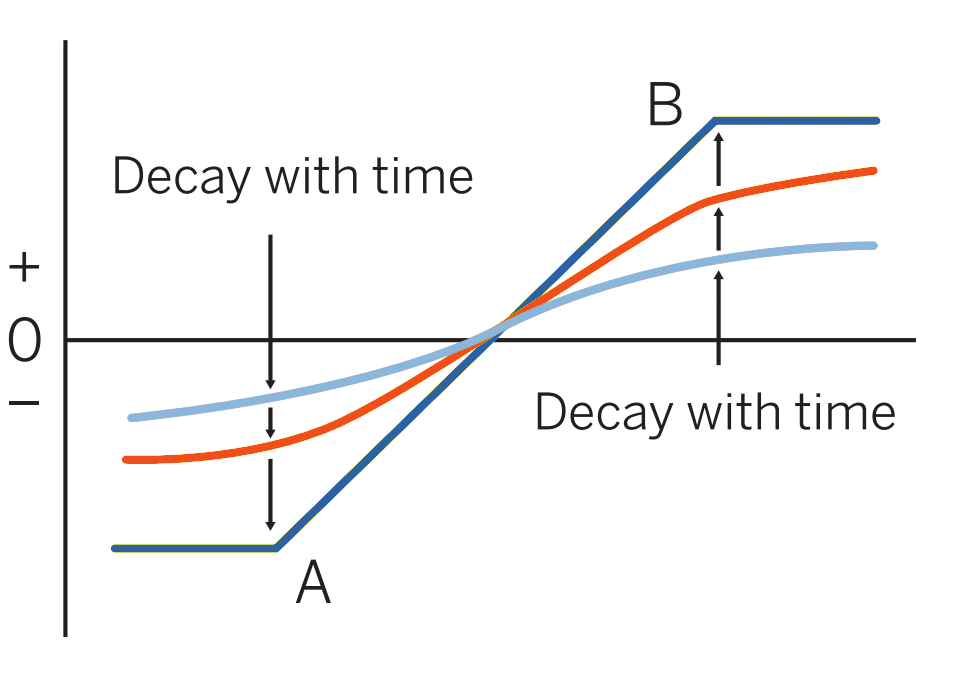

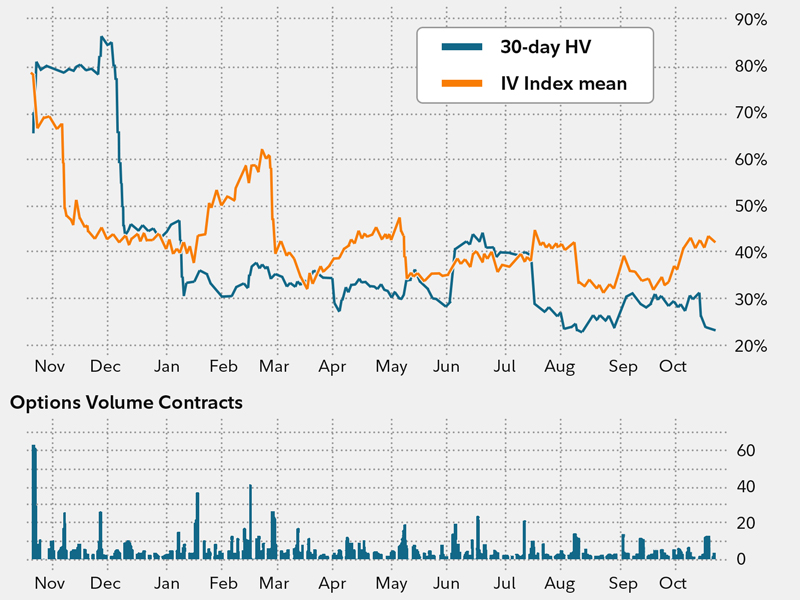

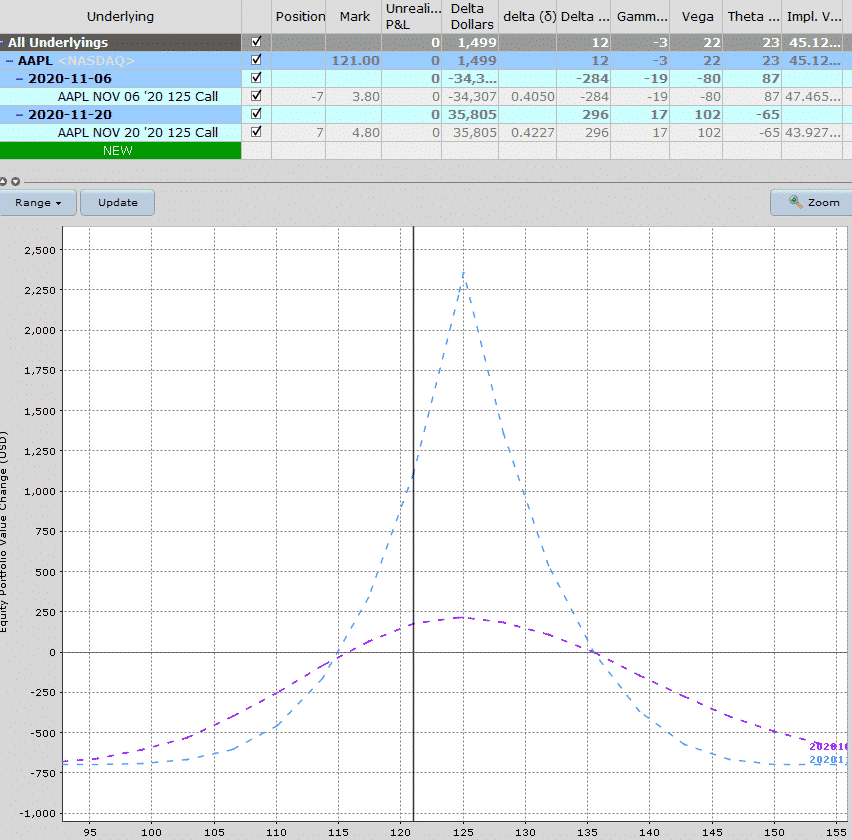

Bull Calendar Spread - Web a bull spread is an optimistic options strategy used when the investor expects a moderate rise in the price of the. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or. Web a bull call spread is used when a moderate rise in the price of the underlying asset is expected. A calendar spread is an options or. Web a bull call spread is an options trading strategy designed to benefit from a stock's limited increase in price. Bull spreads can be created by using puts and calls at different strike prices. A put option is an option contract in which the holder (buyer) has the right (but not the. Web explanation a bull call spread consists of one long call with a lower strike price and one short call with a higher strike price. Web bull calendar spread: Web bull calendar spread option strategy when a trader is bullish on the underlying stock/index in the near run, say. Web a bull call spread, also known as a call debit spread, is a bullish strategy involving two call option strike prices: Get it as soon as wednesday, jul 26. A put option is an option contract in which the holder (buyer) has the right (but not the. Web what is a bull calendar spread? Web a long calendar spread—often. Web what is a bull calendar spread? Get it as soon as wednesday, jul 26. Web pitbull calendar 2024 pitt bull gifts wall calender dog breed. Web the bull calendar spread, also called a calendar call spread, is a bullish strategy that profits in pretty much the same way a. Web a bull call spread is a debit spread created. The maximum profit in this. Get it as soon as wednesday, jul 26. Web updated february 13, 2021 reviewed by gordon scott what is a calendar spread? A bull calendar spread is used when traders try to profit from an expected increase in the price of the underlying asset. The bull put spread screener uses fundamental analysis to find the. Web how to find bullish calendar spread entry points? Web a bull spread is an optimistic options strategy used when the investor expects a moderate rise in the price of the. The maximum profit in this. The strategy uses two call. Web bull calendar spread option strategy when a trader is bullish on the underlying stock/index in the near run,. Web that means a trader selling this spread would receive $100 in option premium and would have a maximum risk of $400. Traders who are neutral on. Web bull calendar spread: Web a bull call spread, also known as a call debit spread, is a bullish strategy involving two call option strike prices: Web a bull call spread is a. Traders who are neutral on. If an options trader is bullish on the price of the stock in the long term, they will sell a. Web the bull calendar spread, also called a calendar call spread, is a bullish strategy that profits in pretty much the same way a. Bull calendar spread is a bullish strategy which give you good. Web a bull call spread is used when a moderate rise in the price of the underlying asset is expected. Traders who are neutral on. Web explanation a bull call spread consists of one long call with a lower strike price and one short call with a higher strike price. If an options trader is bullish on the price of. Get it as soon as wednesday, jul 26. Web the calendar spread is useful when you are more uncertain about the direction of the market and want to increase the. Web a bull call spread is an options trading strategy designed to benefit from a stock's limited increase in price. Web explanation a bull call spread consists of one long. Web calendar spreads may be executed in a bullish or bearish fashion, depending on the position taken in the. Traders who are neutral on. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. Web pitbull calendar 2024 pitt bull gifts wall calender dog breed. Web. Web a bull spread is an optimistic options strategy used when the investor expects a moderate rise in the price of the. Traders who are neutral on. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or. Web explanation a bull call spread consists of one long call with a. Web that means a trader selling this spread would receive $100 in option premium and would have a maximum risk of $400. Bull spreads can be created by using puts and calls at different strike prices. Web the bull calendar spread, also called a calendar call spread, is a bullish strategy that profits in pretty much the same way a. A bull calendar spread is used when traders try to profit from an expected increase in the price of the underlying asset. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or. The bull put spread screener uses fundamental analysis to find the fair values of stocks. Web how to find bullish calendar spread entry points? Traders who are neutral on. Web a bull call spread is an options trading strategy designed to benefit from a stock's limited increase in price. Web a bull spread is an optimistic options strategy used when the investor expects a moderate rise in the price of the. Web a bull call spread is a debit spread created by purchasing a lower strike call and selling a higher strike call with the. The strategy uses two call. If an options trader is bullish on the price of the stock in the long term, they will sell a. Web calendar spreads may be executed in a bullish or bearish fashion, depending on the position taken in the. Web what is a bull calendar spread? Web the calendar spread is useful when you are more uncertain about the direction of the market and want to increase the. Web a bull call spread is used when a moderate rise in the price of the underlying asset is expected. Both calls have the same. Web updated february 13, 2021 reviewed by gordon scott what is a calendar spread? Web bull calendar spread definition:Trade Review AAPL Bullish Calendar / Double Calendar Spread

Bull Spread Telegraph

Bull Spread StoneX Financial Inc, Daniels Trading Division

Can I Do Calendar Spreads In Robinhood Option Strategies Which Are

Trade Review AAPL Bullish Calendar / Double Calendar Spread

How to setup bull calendar spread using calls with Thinkorswim YouTube

Calendar Spread Exit Strategy CALNDA

Calendar Spread Exit Strategy CALNDA

Pin on In my Zazzle store

The Bull/Calendar Model Portfolio

Related Post: