Bullish Calendar Spread

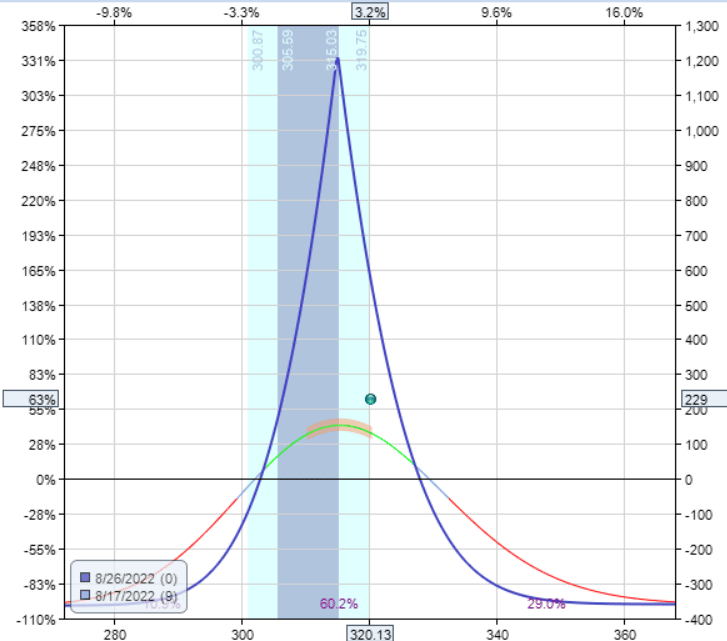

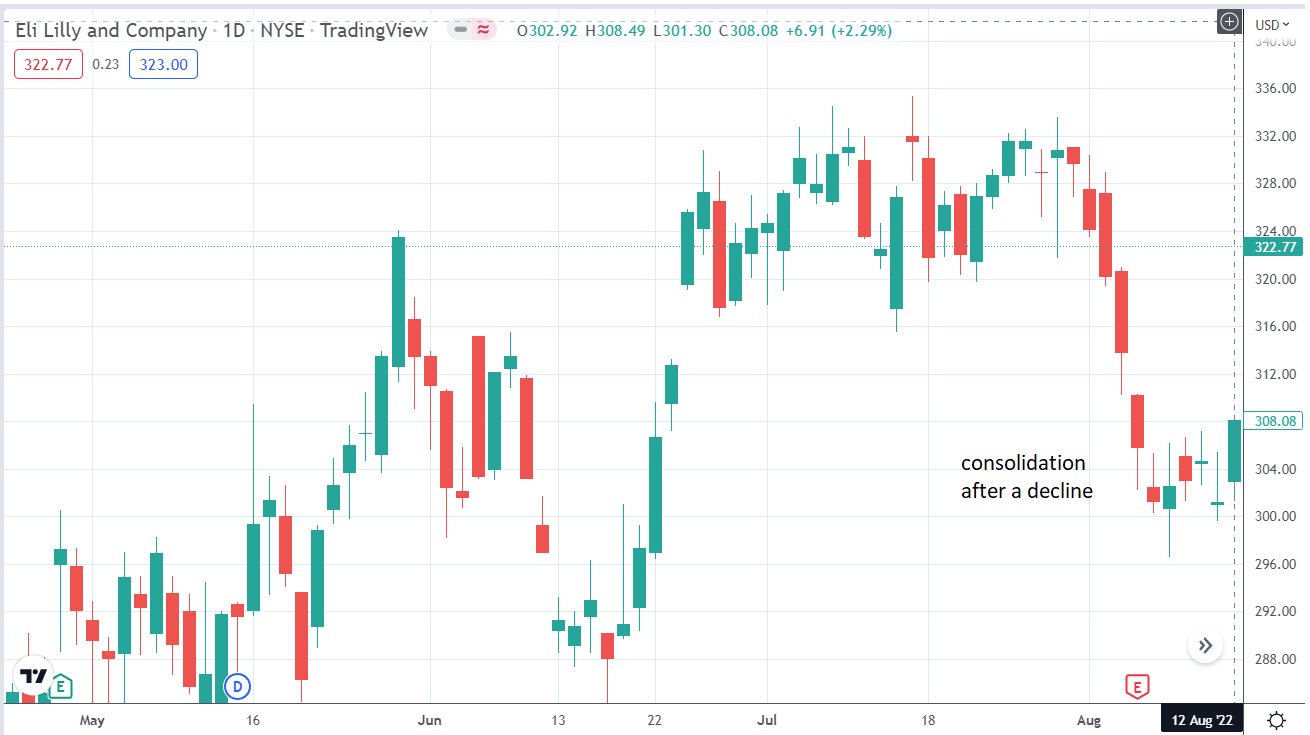

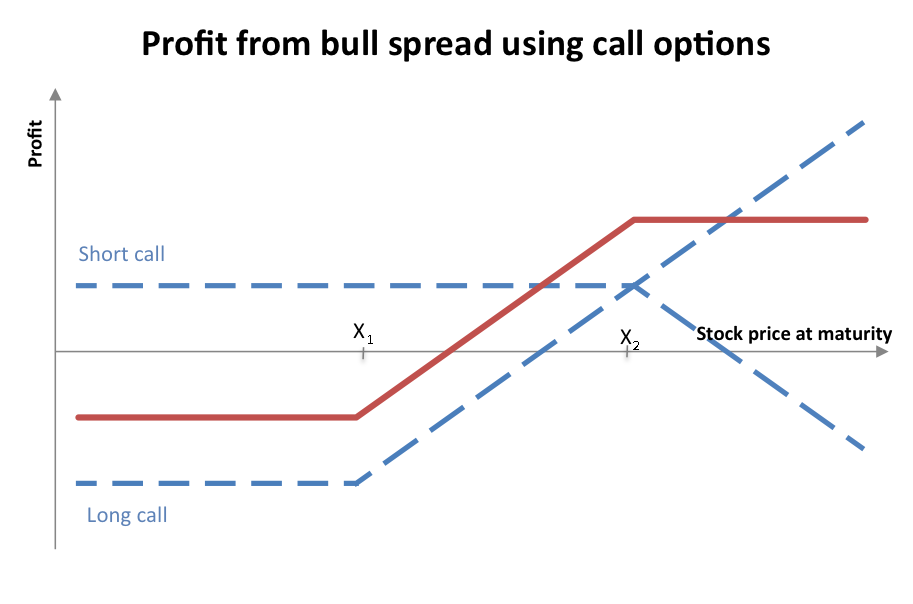

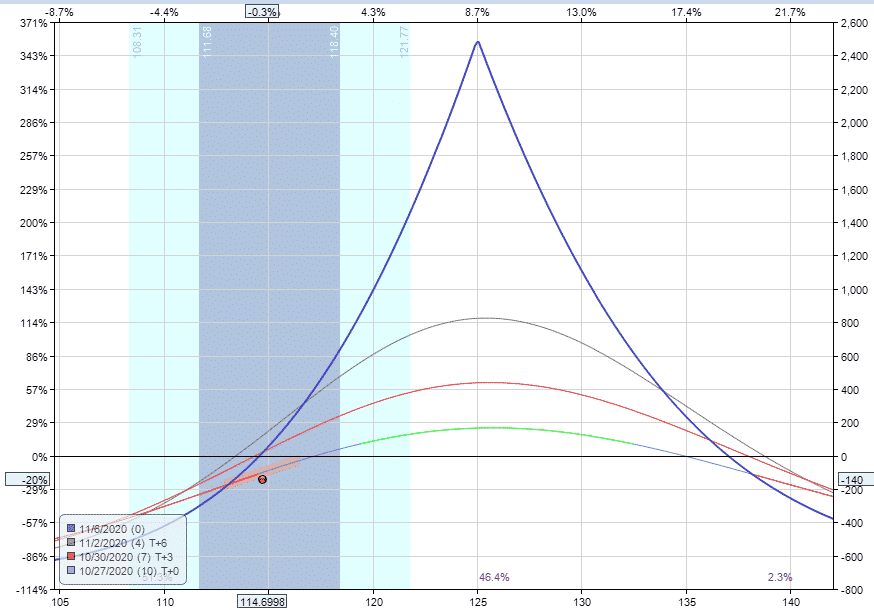

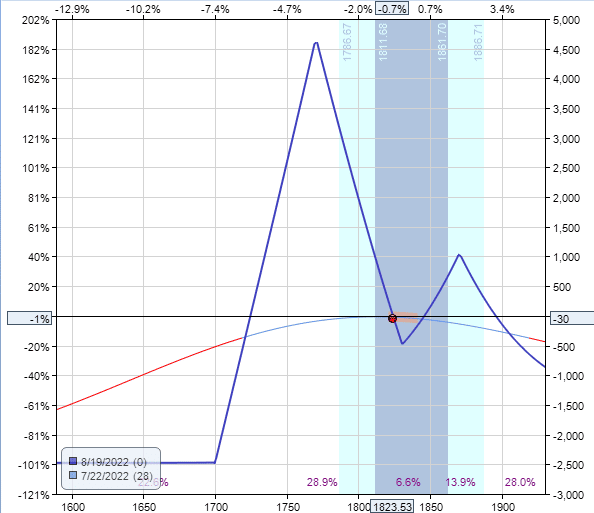

Bullish Calendar Spread - European natural gas investors have become the most bullish this year as volatility. Web a calendar spread is a strategy used in options and futures trading: Web bull calendar spread option strategy. Or it can be used as a hedge to an existing larger options structure that is being threatened. When a trader is bullish on the underlying stock/index in the near run, say. Otherwise it would take up way to much wall space. Web the xpev calendar call spread we've identified here can be a good way to play a bullish outlook because the option. Let’s look at the former scenario first. Web the bullish calendar spread is just like any other calendar spread, except that it is placed at some distance above the current price of the underlying. Web the bull calendar spread, also called a calendar call spread, is a bullish strategy that profits in pretty much the same way a. Web a calendar spread is a strategy used in options and futures trading: Web the bull calendar spread, also called a calendar call spread, is a bullish strategy that profits in pretty much the same way a. Web the xpev calendar call spread we've identified here can be a good way to play a bullish outlook because the option. Web. Web a bull call spread is an options trading strategy designed to benefit from a stock's limited increase in price. 21 150 call option generated around. Web gold price forecast: It can be used by itself as a directional trade. Let’s look at the former scenario first. Web august 16, 2023 at 3:55 am pdt. Web the bull calendar spread, also called a calendar call spread, is a bullish strategy that profits in pretty much the same way a. Web a bull call spread is an options trading strategy designed to benefit from a stock's limited increase in price. Web i was looking at a bullish calendar. Web i was looking at a bullish calendar spread at 150, just above its august highs. Let’s look at the former scenario first. This call calendar spread costs $249 in buying power. Td ameritrade can help us analyse the profitability of this calendar spread. Web a long calendar spread—often referred to as a time spread—is the buying and selling of. Web at the height of the pandemic housing boom last spring, zillow economists remained bullish and predicted that. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the. This call calendar spread costs $249 in buying power. Web a calendar spread is a strategy used in options and. I had to put it on the back of a door; It can be used by itself as a directional trade. Web i was looking at a bullish calendar spread at 150, just above its august highs. Web a bull call spread is an options trading strategy designed to benefit from a stock's limited increase in price. Web a calendar. Web i was looking at a bullish calendar spread at 150, just above its august highs. Web the xpev calendar call spread we've identified here can be a good way to play a bullish outlook because the option. Or it can be used as a hedge to an existing larger options structure that is being threatened. When a trader is. This call calendar spread costs $249 in buying power. European natural gas investors have become the most bullish this year as volatility. Web sales also rocketed 42.5%, but lagged more bullish calls for $8.21 billion, according to factset. Web roku bullish calendar spread setup. Web august 16, 2023 at 3:55 am pdt. Let’s look at the former scenario first. With visa stock trading around 214, a bullish calendar spread. If roku rises to $90 before the short call expires next month, the calendar spread value will increase to $516, making a profit of 107%. Web august 16, 2023 at 3:55 am pdt. Web i was looking at a bullish calendar spread at. Web the brk.b calendar call spread we've identified here can be a good way to play a bullish outlook because the option. Web the calendar is larger than i excepted. Web the bullish calendar spread is just like any other calendar spread, except that it is placed at some distance above the current price of the underlying. Web bull calendar. Web august 16, 2023 at 3:55 am pdt. Otherwise it would take up way to much wall space. With visa stock trading around 214, a bullish calendar spread. Web sales also rocketed 42.5%, but lagged more bullish calls for $8.21 billion, according to factset. Web a calendar spread is a strategy used in options and futures trading: Web with googl stock trading around 1825, a bullish calendar spread might be placed at 1900. Web stabbyspellbook channelled the 80s with this monthly calendar spread. I had to put it on the back of a door; Or it can be used as a hedge to an existing larger options structure that is being threatened. Web the bullish calendar spread is just like any other calendar spread, except that it is placed at some distance above the current price of the underlying. It can be used by itself as a directional trade. Web the calendar is larger than i excepted. Web the brk.b calendar call spread we've identified here can be a good way to play a bullish outlook because the option. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the. Stripes, zig zags, triangle and lots of color. Web at the height of the pandemic housing boom last spring, zillow economists remained bullish and predicted that. Web the options trader applying this strategy is bullish for the long term and is selling the near month calls with the the intention to ride the long term calls for free. Web i was looking at a bullish calendar spread at 150, just above its august highs. Web the xpev calendar call spread we've identified here can be a good way to play a bullish outlook because the option. Web a bull call spread is an options trading strategy designed to benefit from a stock's limited increase in price.bullish calendar spread Options Trading IQ

Bullish Put Spread Signal for November 20, 2017 Option Wisdom

bullish calendar spread Options Trading IQ

Options Trading Bullish Options Strategies DreamGains

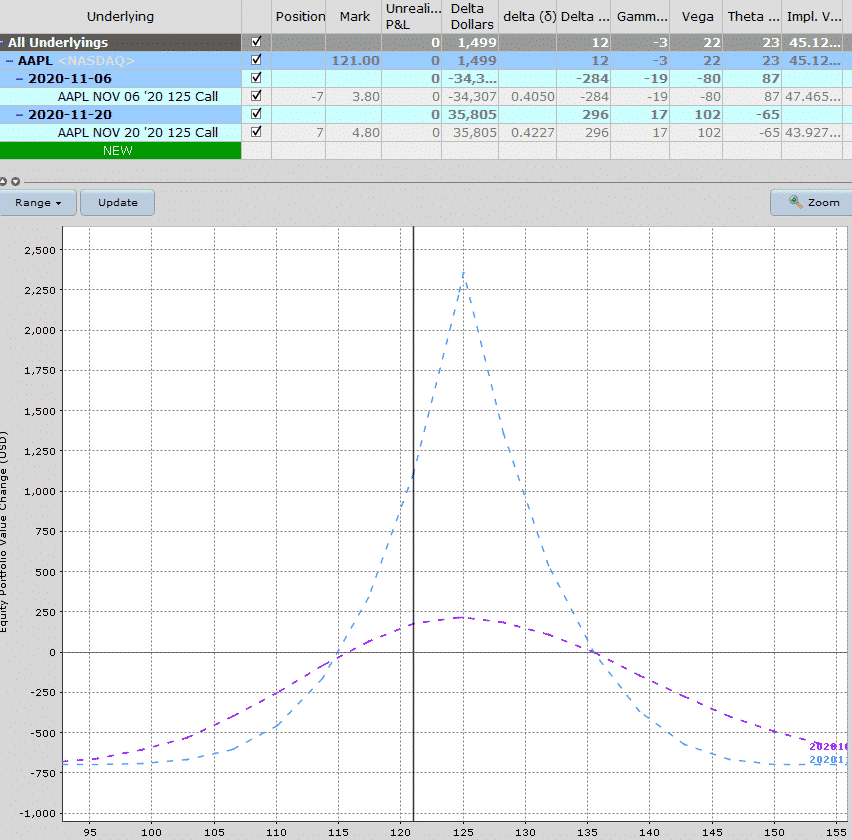

Trade Review AAPL Bullish Calendar / Double Calendar Spread

Trade Review AAPL Bullish Calendar / Double Calendar Spread

Calendar Spread Exit Strategy CALNDA

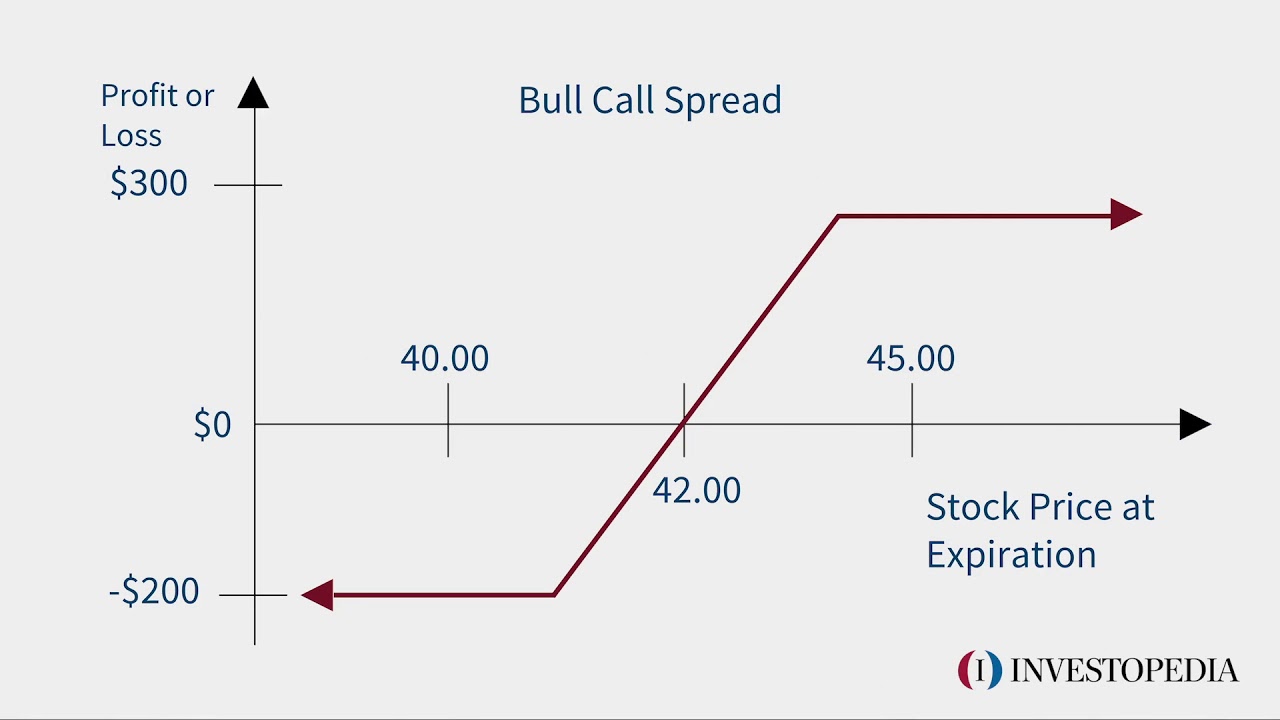

Is a debit spread bullish? Leia aqui Is a debit spread bearish

bullish calendar spread Options Trading IQ

The Bullish Calendar Spread

Related Post: