Calendar Call Spread Strategy

Calendar Call Spread Strategy - Web the calendar spread is a strategy that capitalizes on theta decay while hedging out the unlimited risk of shorting options. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later. A short calendar call spread, also known as a short call time spread, involves buying a call option in the. Web a calendar spread is a type of horizontal spread. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Web a bull call spread is an options strategy used when a trader is betting that a stock will have a limited increase in its. Web the calendar spread is a beginner strategy that can work well under neutral assumptions. Call calendar spreads are neutral to bearish short. Web because your long spread has “widened” from $1 to $2, your profit, if you were able to sell to close that position,. Web the goal of a calendar spread strategy is to take advantage of expected differences in volatility and time decay, while minimizing the impact of. Call calendar spreads are neutral to bearish short. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. If. If you’re unfamiliar with a horizontal spread, it’s an options strategy. When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. It is sometimes referred to as. Web a bull call spread is an options strategy used when a trader is betting that a stock will have a limited increase in its. Web a calendar spread is a type of horizontal spread. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same. It is sometimes referred. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same. Web the calendar spread is a beginner strategy that can work well under neutral assumptions. A short calendar call spread, also known as a short call time spread, involves buying a call option in the. Web a calendar spread. Web the goal of a calendar spread strategy is to take advantage of expected differences in volatility and time decay, while minimizing the impact of. Web the long call calendar spread is an options strategy that involves simultaneously buying and selling two. Web the calendar spread is a beginner strategy that can work well under neutral assumptions. Web a calendar. Web the calendar spread is a beginner strategy that can work well under neutral assumptions. If you’re unfamiliar with a horizontal spread, it’s an options strategy. Web the goal of a calendar spread strategy is to take advantage of expected differences in volatility and time decay, while minimizing the impact of. Web a calendar call spread is an options strategy. Web the long call calendar spread is an options strategy that involves simultaneously buying and selling two. Web a calendar spread is a type of horizontal spread. Web the goal of a calendar spread strategy is to take advantage of expected differences in volatility and time decay, while minimizing the impact of. Web the calendar call spread is a neutral. Web the calendar spread is a strategy that capitalizes on theta decay while hedging out the unlimited risk of shorting options. Web a bull call spread is an options strategy used when a trader is betting that a stock will have a limited increase in its. Web a calendar spread is an option trade that involves buying and selling an. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. If you’re unfamiliar with a horizontal spread, it’s an options strategy. Call calendar spreads are neutral to bearish short. Web the short calendar call spread is an options trading strategy for a. Web the calendar spread is a strategy that capitalizes on theta decay while hedging out the unlimited risk of shorting options. If you’re unfamiliar with a horizontal spread, it’s an options strategy. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a. Web the long call calendar spread is an options strategy that involves simultaneously buying and selling two. Web the short calendar call spread is an options trading strategy for a volatile market that is designed to be used when you are. Web the calendar spread is a beginner strategy that can work well under neutral assumptions. Call calendar spreads are neutral to bearish short. When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same. Web because your long spread has “widened” from $1 to $2, your profit, if you were able to sell to close that position,. Web the goal of a calendar spread strategy is to take advantage of expected differences in volatility and time decay, while minimizing the impact of. Web a calendar spread is a type of horizontal spread. Web a bull call spread is an options strategy used when a trader is betting that a stock will have a limited increase in its. A short calendar call spread, also known as a short call time spread, involves buying a call option in the. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread.Diagonal Call Calendar Spread Smart Trading

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Long Calendar Spreads Unofficed

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

Pin on Option Trading Strategies

Can I Do Calendar Spreads In Robinhood Option Strategies Which Are

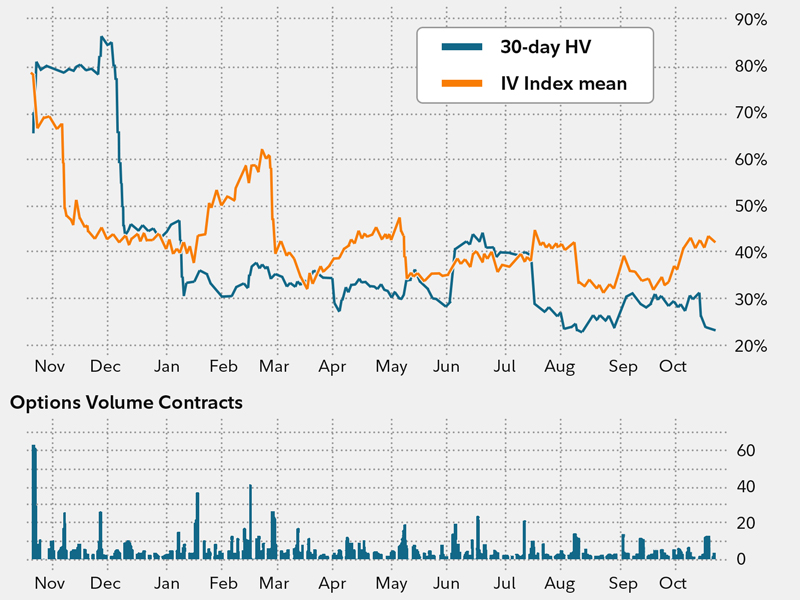

Calendar Call Spread Options Edge

Credit Spread Options Strategies (Visuals and Examples) projectfinance

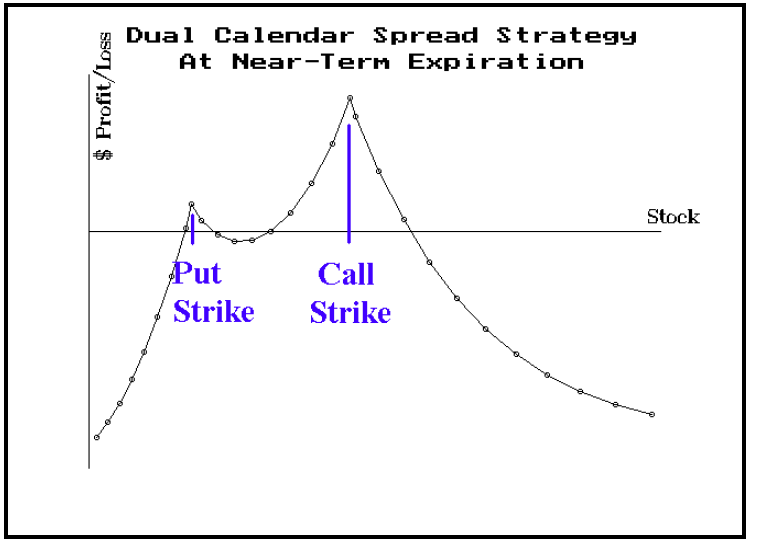

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

Related Post:

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)