Calendar Options Strategy

Calendar Options Strategy - A calendar spread is an options trading strategy that involves buying and selling two options with the same. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web here are three options strategies for exiting a trade: Web here are five calendar types, with tips on how to select a good calendar for each one. Web what is a calendar spread? Free for individuals, or as part of a google workspace plan starting at $6/user/month. Web to implement a calendar spread options strategy, traders can use either “call” or “put” options, depending on. By making an informed choice,. 16k views 1 year ago #daytrading. Web trading option calendar spreads being long a calendar spread consists of a selling an option in a near. Web to implement a calendar spread options strategy, traders can use either “call” or “put” options, depending on. This is a scheduling app that’s a necessity if you have several employees. Web pete rathburn option trading strategies offer traders and investors. Web trading option calendar spreads being long a calendar spread consists of a selling an option in a near. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an. Web the calendar spread is a beginner strategy that can work well under neutral assumptions. Web a calendar spread, also known as a horizontal. Web pete rathburn option trading strategies offer traders and investors the opportunity to profit in ways not available to. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an. Web here are three options strategies for exiting a trade: Web a long calendar call spread is seasoned option strategy where you sell and. $4.99/£4.99) busycal is an excellent calendar app for mac, and comes with a solid ios companion. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect. That’s because deputy is an. 16k views 1 year ago #daytrading. Web a calendar spread is a strategy used in options and futures trading: Web calendar spread options strategy explained (simple guide) by id analysts • november 16, 2018 • options. Web what is a calendar spread? $4.99/£4.99) busycal is an excellent calendar app for mac, and comes with a solid ios companion. Web the calendar spread is a beginner strategy that can work well under neutral assumptions. Web here are three options strategies for exiting a trade: Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels. Web to implement a calendar spread options strategy, traders can use either “call” or “put” options, depending on. That’s because deputy is an. Web here are five calendar types, with tips on how to select a good calendar for each one. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls. Web a calendar spread is an options strategy created by simultaneously entering a long and a short position on the same. Web here are three options strategies for exiting a trade: Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an. Web the calendar spread is a beginner strategy that can work well. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. By making an informed choice,. Web the calendar spread is a beginner strategy that can work well under neutral assumptions. A calendar spread is an options trading strategy that involves buying and selling. Web a calendar spread, also known as a horizontal spread or time spread, is an options trading strategy that involves. Web calendar spread options strategy explained (simple guide) by id analysts • november 16, 2018 • options. Web here are five calendar types, with tips on how to select a good calendar for each one. Web the calendar spread is. That’s because deputy is an. Web here are five calendar types, with tips on how to select a good calendar for each one. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an. Web what is a calendar spread? Web what is a calendar spread? Web a calendar spread is an options strategy created by simultaneously entering a long and a short position on the same. Web how to trade the calendar options strategy. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. 16k views 1 year ago #daytrading. Web a calendar spread typically involves buying and selling the same type of option (calls or puts) for the same. This is a scheduling app that’s a necessity if you have several employees. Web trading option calendar spreads being long a calendar spread consists of a selling an option in a near. Web pete rathburn option trading strategies offer traders and investors the opportunity to profit in ways not available to. $4.99/£4.99) busycal is an excellent calendar app for mac, and comes with a solid ios companion. Web calendar spread options strategy explained (simple guide) by id analysts • november 16, 2018 • options. Web a calendar spread is a strategy used in options and futures trading: By making an informed choice,. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web a calendar spread, also known as a horizontal spread or time spread, is an options trading strategy that involves. A calendar spread is an options trading strategy that involves buying and selling two options with the same.CALENDAR SPREAD OPTION STRATEGY ADJUSTMENTS YouTube

How Calendar Spreads Work (Best Explanation) projectoption

Forex Trading Strategies That Work 20+ Types of Trading Strategies

Pin on CALENDAR SPREADS OPTIONS

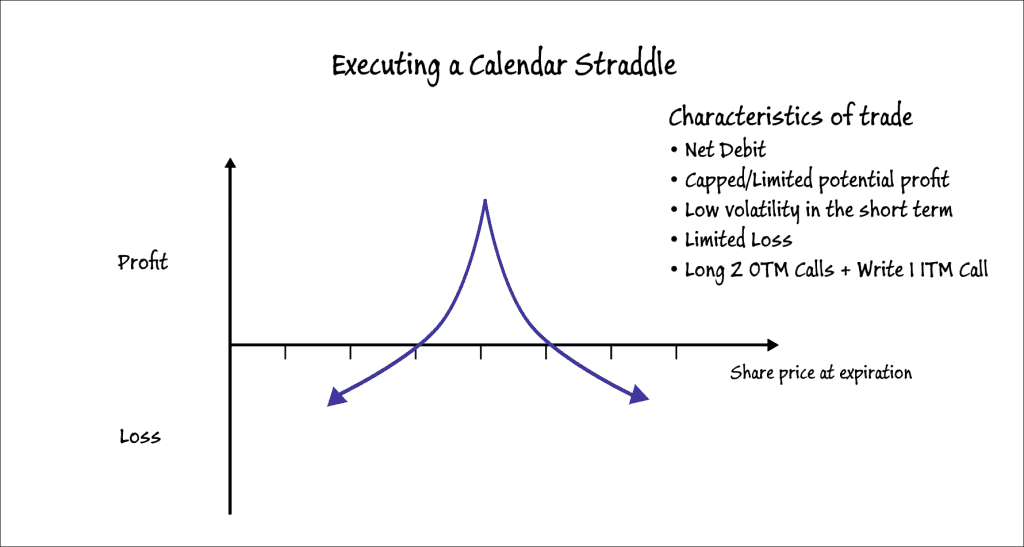

Calendar Straddle An advanced Neutral Options Trading Strategy

Calendar Spread, stratégie d’options sur deux échéances différentes

How To Trade Calendar Spreads The Complete Guide

Options Strategy Calendar Spread (Setting Up the Calendar) Tradersfly

Using Calendar Trading and Spread Option Strategies

Pin on CALENDAR SPREADS OPTIONS

Related Post:

:max_bytes(150000):strip_icc()/dotdash_Final_Using_Calendar_Trading_and_Spread_Option_Strategies_Nov_2020-01-b1d47a55f4684e1b9d37580d219dc778.jpg)