Calendar Put Spread

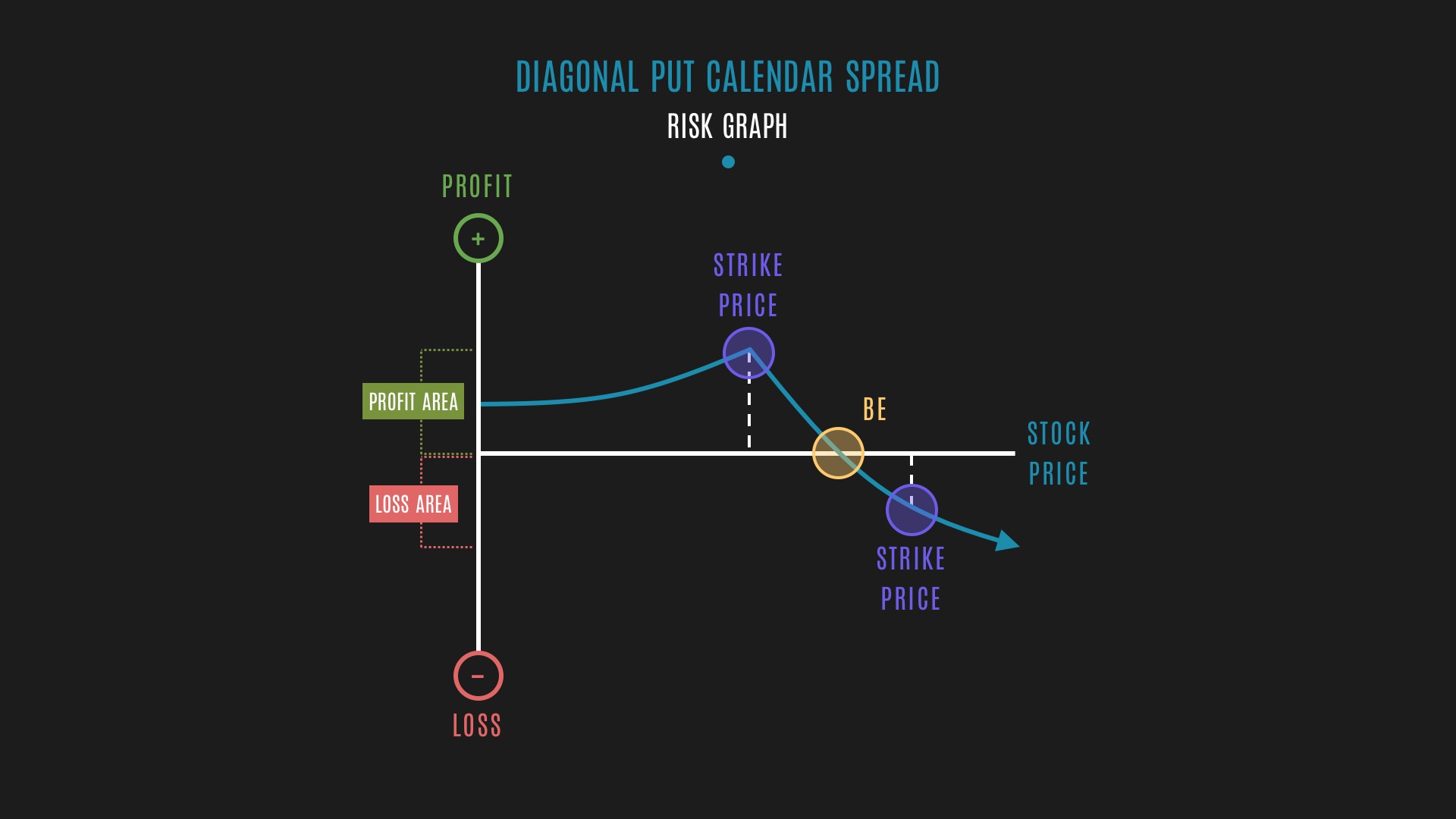

Calendar Put Spread - Both put options will have the same strike. A long calendar spread—often referred to as a time spread—is the buying and selling of a call. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of time decay to profit from a security remaining stable in price. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different (albeit small. Web what is a calendar spread? Web using calendar trading and spread option strategies long calendar spreads. Calendar spreads allow traders to construct a trade that. A long calendar spread—often referred to as a time spread—is the buying and selling of a call. Both put options will have the same strike. Web what is a calendar spread? Web using calendar trading and spread option strategies long calendar spreads. Calendar spreads allow traders to construct a trade that. Web using calendar trading and spread option strategies long calendar spreads. Both put options will have the same strike. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different (albeit small. A long calendar spread—often referred to as a time spread—is. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of time decay to profit from a security remaining stable in price. A long calendar spread—often referred to as a time spread—is the buying and selling of a call. Web what is a calendar spread? A calendar spread. Both put options will have the same strike. Calendar spreads allow traders to construct a trade that. Web using calendar trading and spread option strategies long calendar spreads. Web what is a calendar spread? A long calendar spread—often referred to as a time spread—is the buying and selling of a call. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different (albeit small. A long calendar spread—often referred to as a time spread—is the buying and selling of a call. The calendar put spread is very similar to the calendar call spread,. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different (albeit small. Web what is a calendar spread? A long calendar spread—often referred to as a time spread—is the buying and selling of a call. Calendar spreads allow traders to construct. Web what is a calendar spread? A long calendar spread—often referred to as a time spread—is the buying and selling of a call. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different (albeit small. Both put options will have the. A long calendar spread—often referred to as a time spread—is the buying and selling of a call. Web using calendar trading and spread option strategies long calendar spreads. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of time decay to profit from a security remaining stable. Web what is a calendar spread? Calendar spreads allow traders to construct a trade that. A long calendar spread—often referred to as a time spread—is the buying and selling of a call. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of time decay to profit from. Web what is a calendar spread? Web using calendar trading and spread option strategies long calendar spreads. Both put options will have the same strike. Calendar spreads allow traders to construct a trade that. A long calendar spread—often referred to as a time spread—is the buying and selling of a call. Web using calendar trading and spread option strategies long calendar spreads. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of time decay to profit from a security remaining stable in price. Both put options will have the same strike. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different (albeit small. A long calendar spread—often referred to as a time spread—is the buying and selling of a call. Web what is a calendar spread? Calendar spreads allow traders to construct a trade that.Options Trading Made Easy Ratio Put Calendar Spread

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

Calendar Put Spread Options Edge

Glossary Diagonal Put Calendar Spread example Tackle Trading

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Trading on Time Decay How to Approach Calendar Spreads Ticker Tape

How Calendar Spreads Work (Best Explanation) projectoption

Bearish Put Calendar Spread Option Strategy Guide

Calendar Spread Put Options CALNDA

Glossary Archive Tackle Trading

Related Post:

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)