Calendar Spread Futures

Calendar Spread Futures - At the futures dropdown, select “all” for active contract and set the spread to “calendar.” 3. Calendar spreads allow traders to construct a trade that. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product spreads, and more. From the “all products” screen on the trade page, enter a future in the symbol entry field 2. Web key takeaways a futures spread is an arbitrage technique in which a trader takes offsetting positions on a commodity in order to. At the futures dropdown, select “all” for active contract and set the spread to “calendar.” 3. From the “all products” screen on the trade page, enter a future in the symbol entry field 2. Web key takeaways a futures spread is an arbitrage technique in which a trader takes offsetting positions on a commodity in order to. Calendar spreads allow. At the futures dropdown, select “all” for active contract and set the spread to “calendar.” 3. From the “all products” screen on the trade page, enter a future in the symbol entry field 2. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a. From the “all products” screen on the trade page, enter a future in the symbol entry field 2. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. Calendar spreads allow traders to construct. From the “all products” screen on the trade page, enter a future in the symbol entry field 2. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. Web learn about spreading futures contracts,. At the futures dropdown, select “all” for active contract and set the spread to “calendar.” 3. Calendar spreads allow traders to construct a trade that. Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product spreads, and more. Web a long calendar spread—often referred to as a time spread—is the buying and selling of. Web key takeaways a futures spread is an arbitrage technique in which a trader takes offsetting positions on a commodity in order to. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. Calendar. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. From the “all products” screen on the trade page, enter a future in the symbol entry field 2. Web learn about spreading futures contracts,. From the “all products” screen on the trade page, enter a future in the symbol entry field 2. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. At the futures dropdown, select “all”. From the “all products” screen on the trade page, enter a future in the symbol entry field 2. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. Web key takeaways a futures spread. Web key takeaways a futures spread is an arbitrage technique in which a trader takes offsetting positions on a commodity in order to. At the futures dropdown, select “all” for active contract and set the spread to “calendar.” 3. Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product spreads, and more. Web a. Web key takeaways a futures spread is an arbitrage technique in which a trader takes offsetting positions on a commodity in order to. From the “all products” screen on the trade page, enter a future in the symbol entry field 2. Calendar spreads allow traders to construct a trade that. At the futures dropdown, select “all” for active contract and set the spread to “calendar.” 3. Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product spreads, and more. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different.Calendar Spread In Futures CALNDA

Futures Calendar Spread trading Crude Oil scalping YouTube

Spread Definition Telegraph

Seasonal Futures Spreads Calendar Spread with Feeder Cattle futures

Seasonal Futures Spreads Trading charts, Seasons, Chart

Calendar Spread In Futures CALNDA

Futures Curve by Accutic Treasury Futures Calendar Spreads

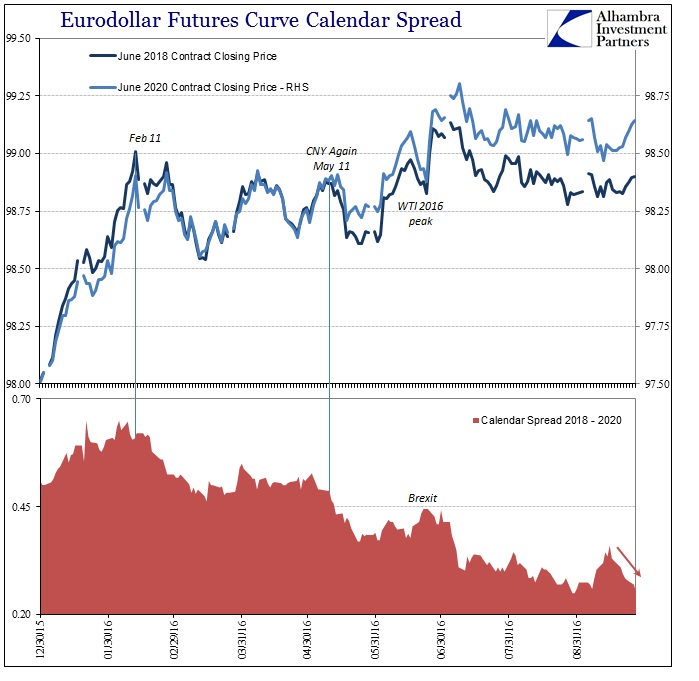

No Need For Yield Curve Inversion (There Is Already Much Worse

Calendar Spread In Futures CALNDA

Seasonal Futures Spreads Calendar Spread with Feeder Cattle futures X5F6

Related Post: