Calendar Spread Options Example

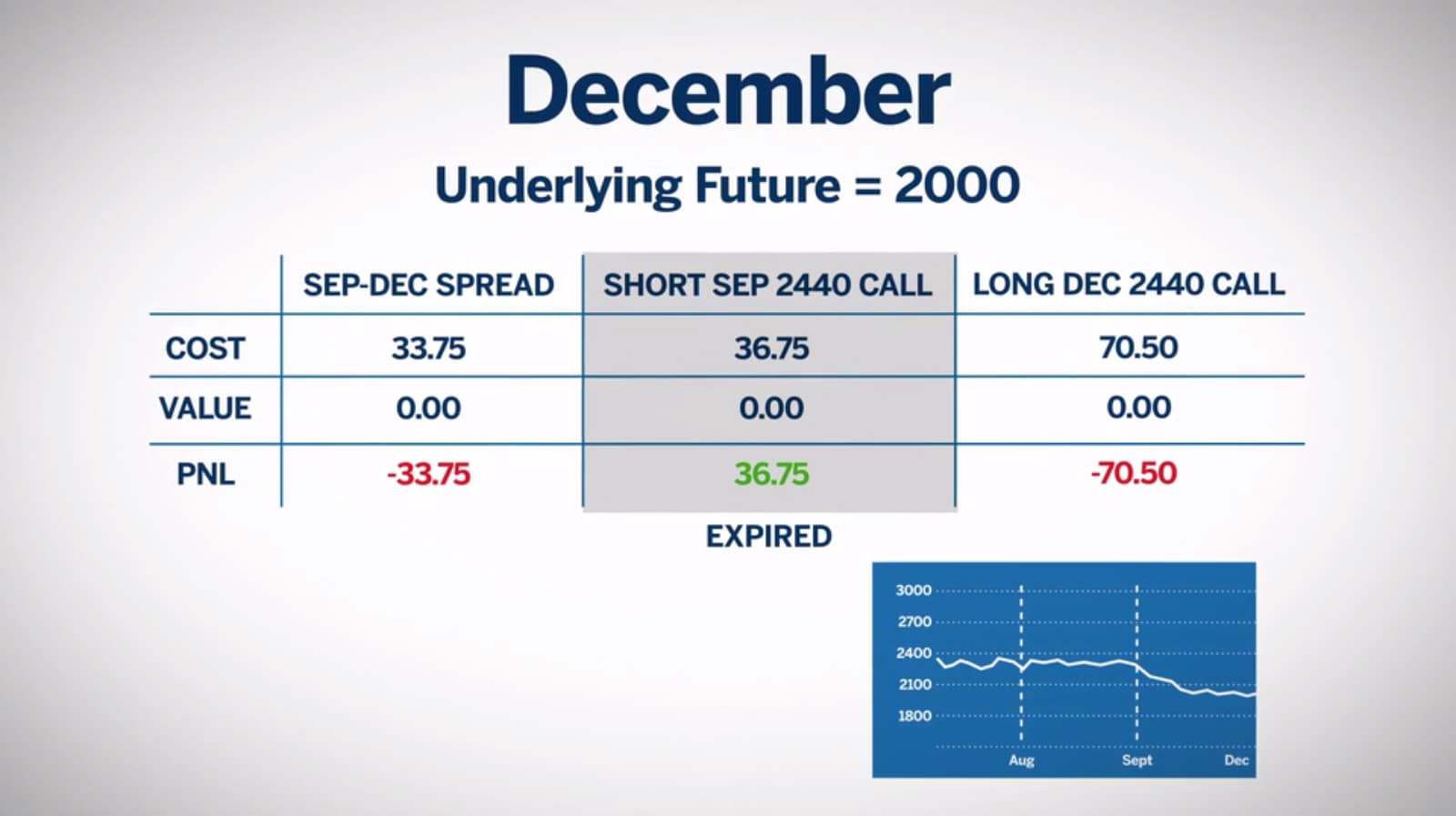

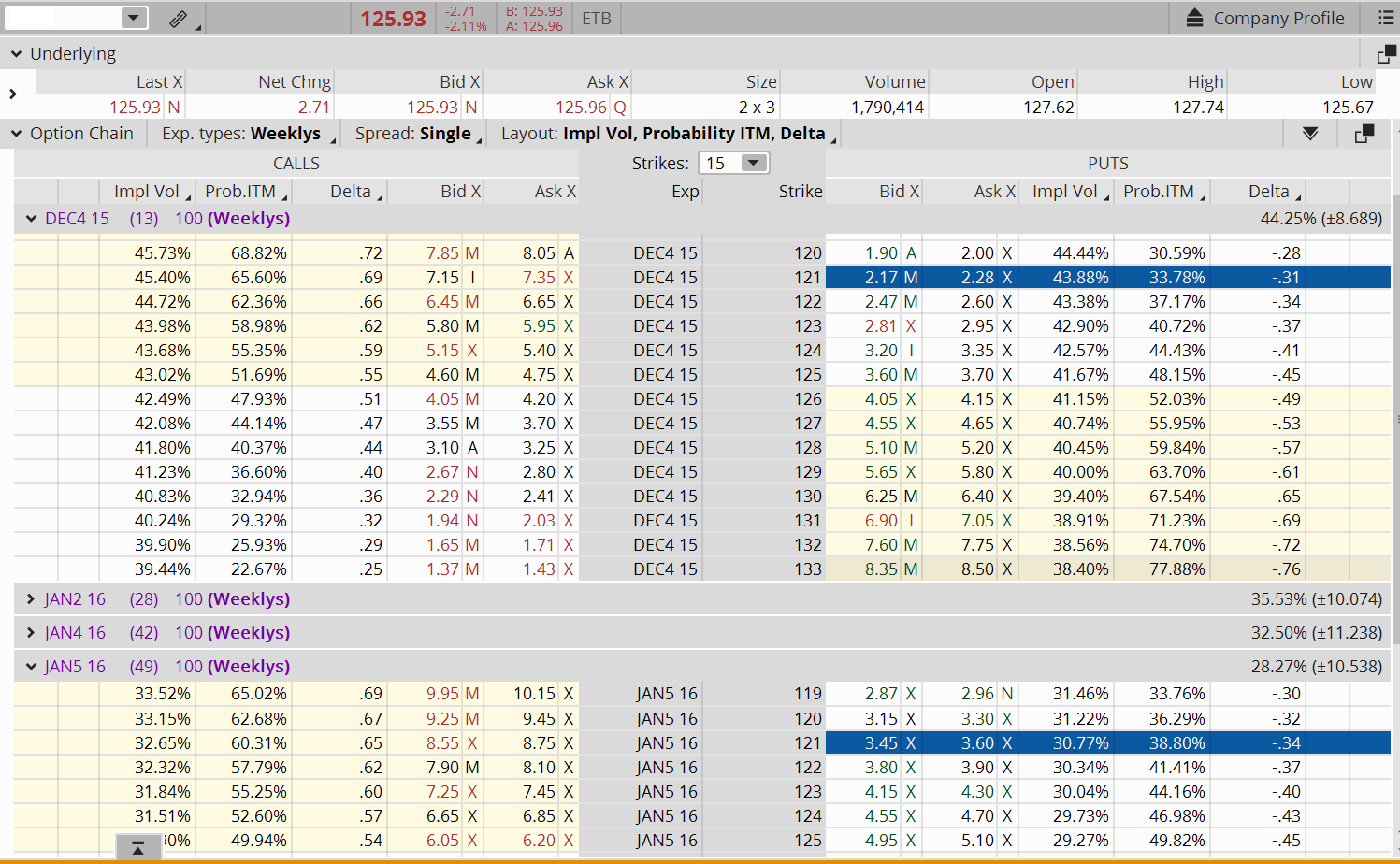

Calendar Spread Options Example - Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same. What is a calendar spread option? A trader believes that the market. Web usually, you’ll pick strike prices that are close to the underlying stock’s current price. Name your spreadsheet and add. Web an example helps to understand how calendar spread options work. Select the cell that says. Web let’s look at an example. Add days of the week. This is a debit position, meaning you pay at the. Web in a neutral market, the calendar spread provides a method for the trader to earn income by profiting from time decay. Suppose xyz stock is $100, and the. Bull put spread option strategy; Web july 26, 2022 at 4:50 pm a calendar spread allows option traders to take advantage of elevated premium in near. Web a calendar call spread. Web losing examples faq summary introduction a calendar spread is an option trade that involves buying and. Web usually, you’ll pick strike prices that are close to the underlying stock’s current price. Add days of the week. This is a debit position, meaning you pay at the. Suppose xyz stock is $100, and the. Bear call spread option strategy; Bull put spread option strategy; Web in the above example, the trader would pay $2.00 for the call calendar: Web bull call spread option strategy; Name your spreadsheet and add. Web in a neutral market, the calendar spread provides a method for the trader to earn income by profiting from time decay. Web in the above example, the trader would pay $2.00 for the call calendar: Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same. Web let’s look. Bear call spread option strategy; A trader believes that the market will be quiet and move sideways until after the december. Web for example, since the trader sold the $170 call for $5.50 and it decreased by $3.94 (table 1), the p&l on the short $170 call is +$394. First things first, create a new spreadsheet in google sheets. Bull. Select the cell that says. Web in a neutral market, the calendar spread provides a method for the trader to earn income by profiting from time decay. A trader believes that the market will be quiet and move sideways until after the december. This is a debit position, meaning you pay at the. Add days of the week. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same. Web losing examples faq summary introduction a calendar spread is an option trade that involves buying and. Web let’s look at an example. Web calendar templates are formatted by using themes that enable you to apply fonts, colors, and. A trader believes that the market. Name your spreadsheet and add. What is a calendar spread option? Web in a neutral market, the calendar spread provides a method for the trader to earn income by profiting from time decay. A handy example let’s say you’re watching company abc, which is currently trading at $50 per. Web you’ll see a table on the right with calendar month, calendar year, and 1st day of week. Name your spreadsheet and add. Web losing examples faq summary introduction a calendar spread is an option trade that involves buying and. Select the cell that says. A trader believes that the market. Bear call spread option strategy; Add days of the week. Web let’s look at an example. What is a calendar spread option? Name your spreadsheet and add. Bull put spread option strategy; Add days of the week. Web calendar templates are formatted by using themes that enable you to apply fonts, colors, and graphic formatting effects throughout. Bear call spread option strategy; A trader believes that the market. Web for example, since the trader sold the $170 call for $5.50 and it decreased by $3.94 (table 1), the p&l on the short $170 call is +$394. Web usually, you’ll pick strike prices that are close to the underlying stock’s current price. Web in a neutral market, the calendar spread provides a method for the trader to earn income by profiting from time decay. Web trading calendar spread options: A trader believes that the market will be quiet and move sideways until after the december. A handy example let’s say you’re watching company abc, which is currently trading at $50 per. Suppose xyz stock is $100, and the. Web bull call spread option strategy; Web july 26, 2022 at 4:50 pm a calendar spread allows option traders to take advantage of elevated premium in near. Web let’s look at an example. First things first, create a new spreadsheet in google sheets. This is a debit position, meaning you pay at the. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same. Name your spreadsheet and add. On the other hand, the.Pin on CALENDAR SPREADS OPTIONS

Option Calendar Spreads

How Calendar Spreads Work (Best Explanation) projectoption

Pin on CALENDAR SPREADS OPTIONS

Pin on Option Trading Strategies

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

Pin on CALENDAR SPREADS OPTIONS

Pin on CALENDAR SPREADS OPTIONS

Pair Trading Strategy Spread Trading Strategy Calendar Spread

Consider Calendar Spreads to Help Navigate Earnings S... Ticker Tape

Related Post: