Calendar Spread Options Examples

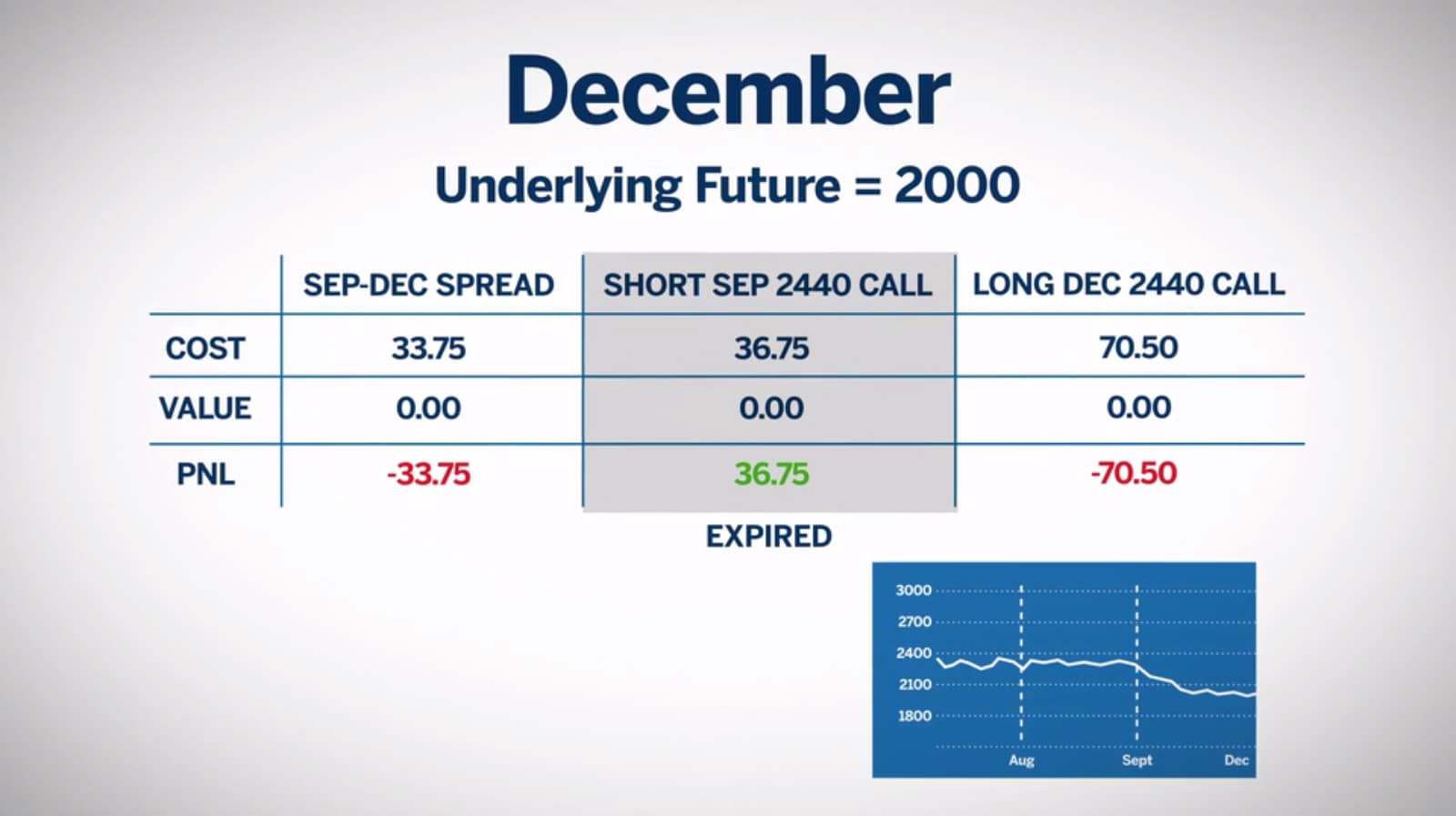

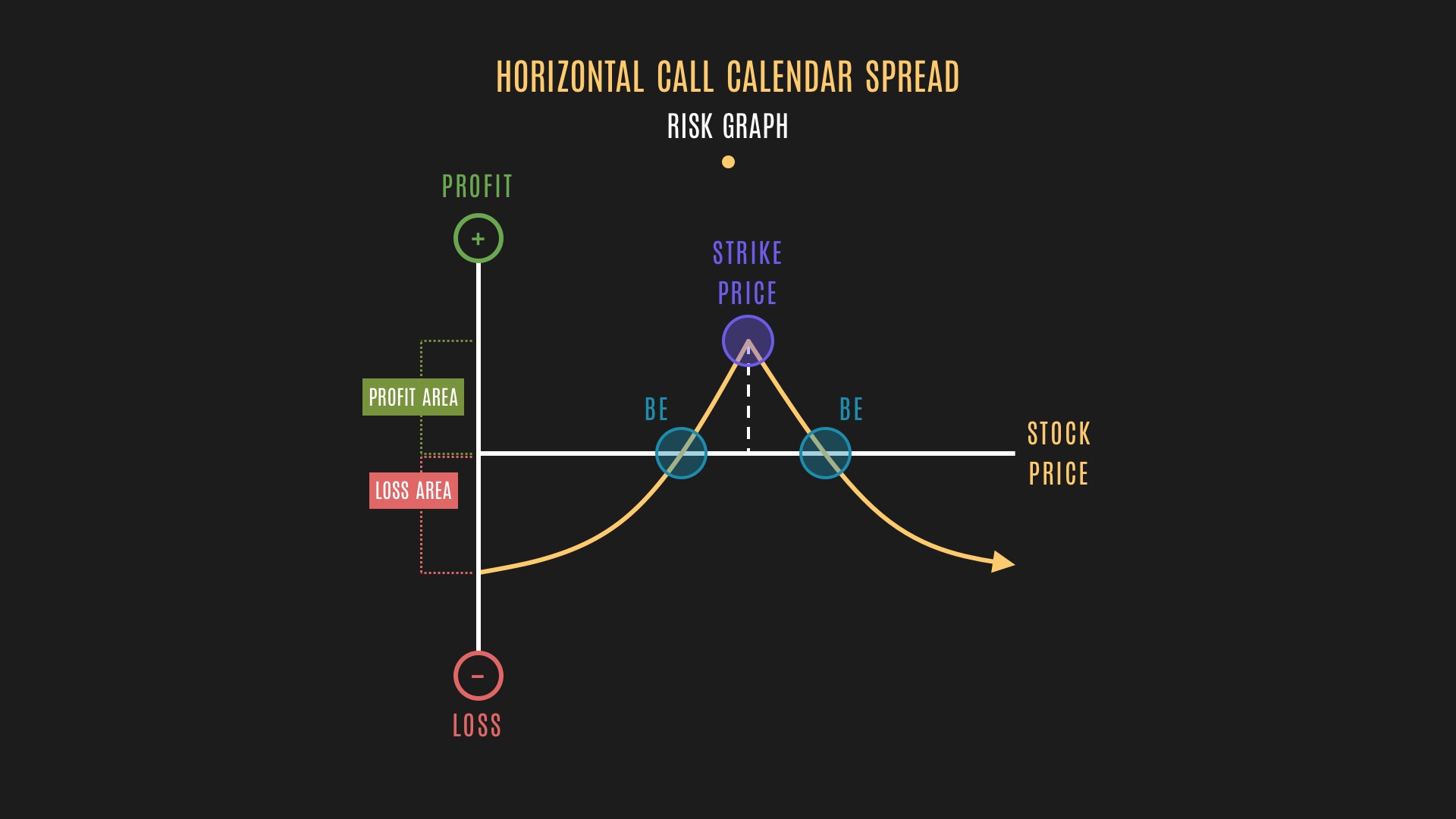

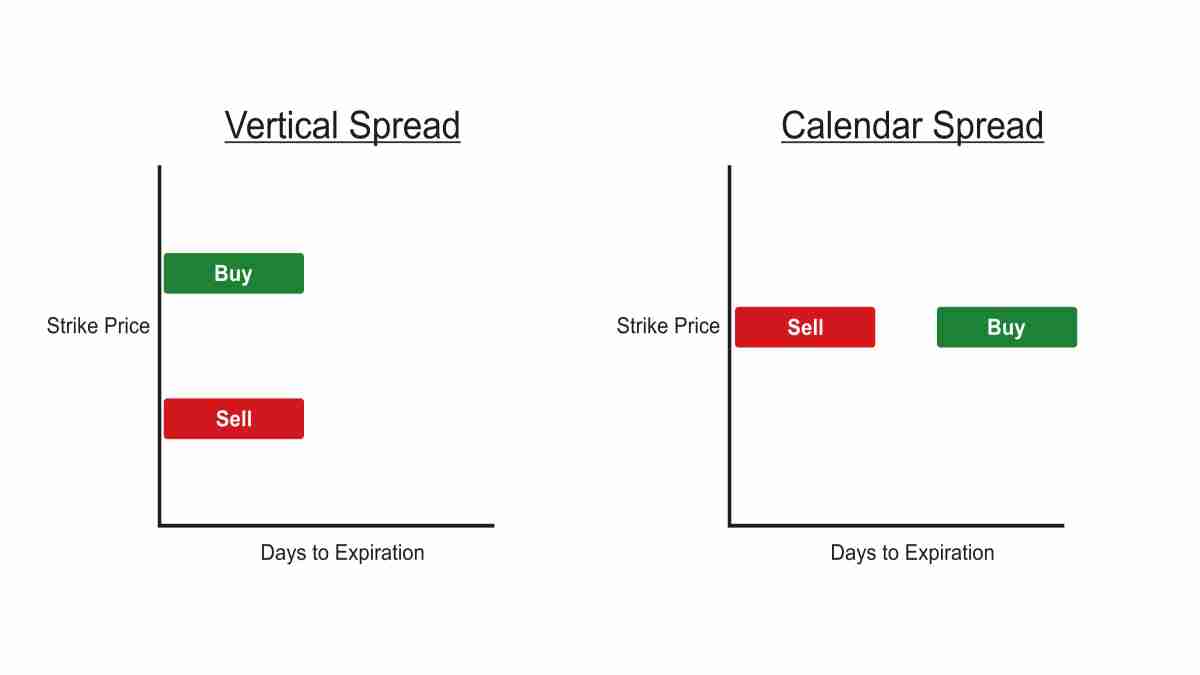

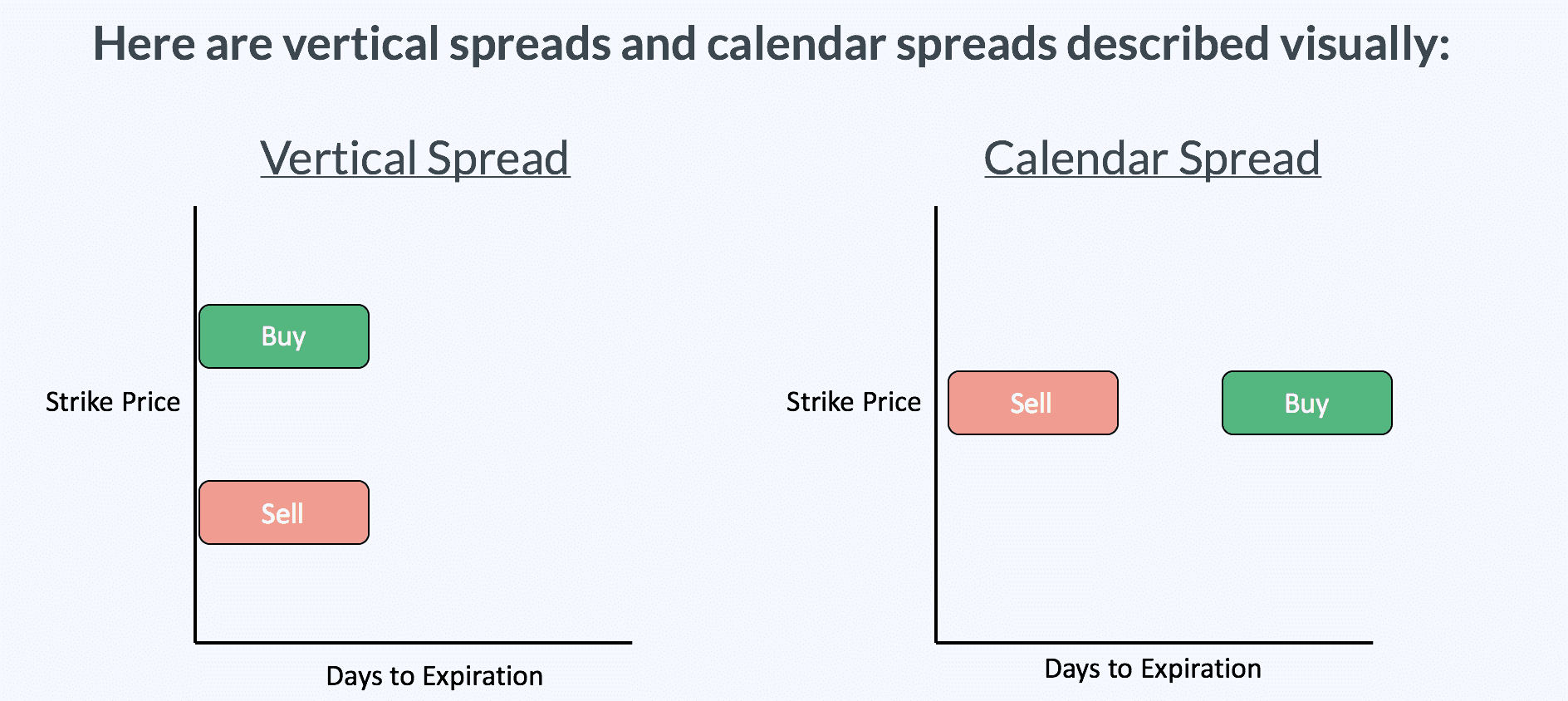

Calendar Spread Options Examples - A handy example let’s say you’re watching company abc, which is currently trading at $50 per. | tastylive market concepts probabilities & statistics beginner options. Web for example, if you buy the apple $190 call option that expires in two months for $10.60 while simultaneously. An investor sells a $65 strike call with 30. Add days of the week. What is a calendar spread option? Web the calendar spread strategy can be effective during sideways markets and periods of low volatility. Web for those utilising the date picker control option, the procedures to create a calendar in excel are as follows:. This is a debit position, meaning you pay at the. Web for example if you trade a calendar spread that has a 30 dte/60 dte structure you are selling the option with 30. Let’s take an example of xyz stock trading at $65 to understand the calendar spread strategy. Web definition and examples of calendar spread implementing a calendar spread strategy involves buying and selling the same type of option or. What is a calendar spread option? Web a calendar spread is an option trading strategy that makes it possible for a trader. Web for example if you trade a calendar spread that has a 30 dte/60 dte structure you are selling the option with 30. Web calendar spread examples. A trader believes that the market will be quiet and move sideways until after the december. Here are some examples of calendar spreads: An investor sells a $65 strike call with 30. Name your spreadsheet and add. Web at 4:50 pm a calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. This is a debit position, meaning you pay at the. What is a calendar spread option? Web trading calendar spread options: Web calendar spread examples. Let’s take an example of xyz stock trading at $65 to understand the calendar spread strategy. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. Web calendar templates are formatted by using themes that enable you to apply fonts, colors, and. Web for those utilising the date picker control option, the procedures to create a calendar in excel are as follows:. Web in the above example, the trader would pay $2.00 for the call calendar: Web calendar spread examples. Web for example if you trade a calendar spread that has a 30 dte/60 dte structure you are selling the option with. Web in the above example, the trader would pay $2.00 for the call calendar: Web definition and examples of calendar spread implementing a calendar spread strategy involves buying and selling the same type of option or. Web for example, if you buy the apple $190 call option that expires in two months for $10.60 while simultaneously. Add days of the. Add days of the week. This is a debit position, meaning you pay at the. First things first, create a new spreadsheet in google sheets. Web definition and examples of calendar spread implementing a calendar spread strategy involves buying and selling the same type of option or. Web for example, if you buy the apple $190 call option that expires. Web in the above example, the trader would pay $2.00 for the call calendar: What is a calendar spread option? Web the calendar spread strategy can be effective during sideways markets and periods of low volatility. An investor sells a $65 strike call with 30. Name your spreadsheet and add. Web the calendar spread strategy can be effective during sideways markets and periods of low volatility. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. This is a debit position, meaning you pay at the. A handy example let’s say you’re watching company abc, which. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. Web trading calendar spread options: Name your spreadsheet and add. A trader believes that the market will be quiet and move sideways until after the december. Web for example, if you buy the apple $190 call. Web losing examples faq summary introduction a calendar spread is an option trade that involves buying and. Web in the above example, the trader would pay $2.00 for the call calendar: Web calendar spread examples. | tastylive market concepts probabilities & statistics beginner options. This is a debit position, meaning you pay at the. Let’s take an example of xyz stock trading at $65 to understand the calendar spread strategy. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. What is a calendar spread option? Web for example, if you buy the apple $190 call option that expires in two months for $10.60 while simultaneously. Web trading calendar spread options: Web calendar templates are formatted by using themes that enable you to apply fonts, colors, and graphic formatting effects throughout. First things first, create a new spreadsheet in google sheets. Web for example if you trade a calendar spread that has a 30 dte/60 dte structure you are selling the option with 30. Web the calendar spread strategy can be effective during sideways markets and periods of low volatility. A diagonal spread allows option traders to collect premium and time decay similar to the calendar spread, except these trades take a directional bias. A trader believes that the market will be quiet and move sideways until after the december. Web definition and examples of calendar spread implementing a calendar spread strategy involves buying and selling the same type of option or. Name your spreadsheet and add. An investor sells a $65 strike call with 30. Web for those utilising the date picker control option, the procedures to create a calendar in excel are as follows:.What Is A Calendar Spread

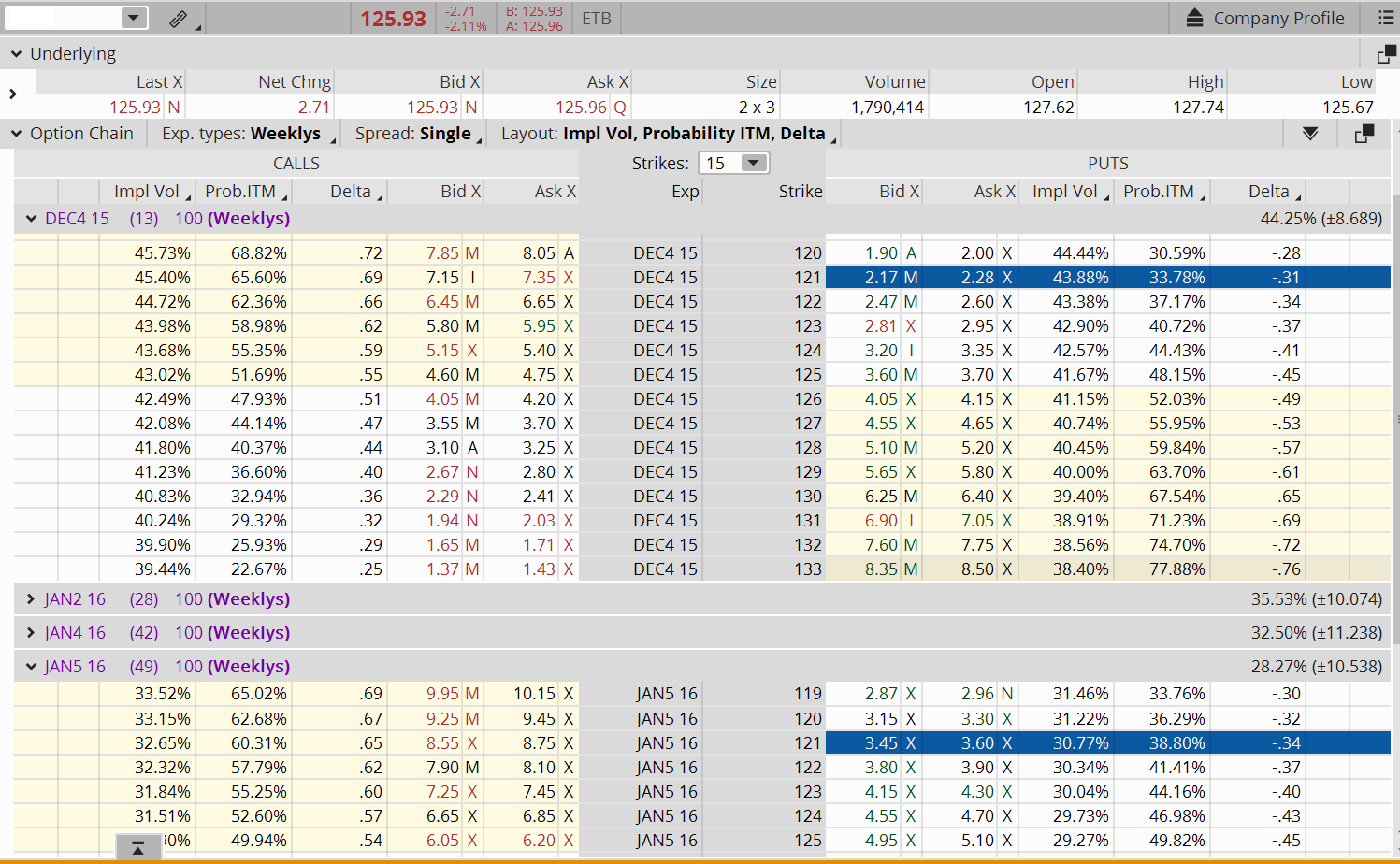

Consider Calendar Spreads to Help Navigate Earnings S... Ticker Tape

CALENDAR SPREAD OPTION STRATEGY ADJUSTMENTS YouTube

Pin on CALENDAR SPREADS OPTIONS

Option Calendar Spreads

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

Pair Trading Strategy Spread Trading Strategy Calendar Spread

How Calendar Spreads Work (Best Explanation) projectoption

Pin on Option Trading Strategies

Pin on CALENDAR SPREADS OPTIONS

Related Post: