Calendar Spread Options

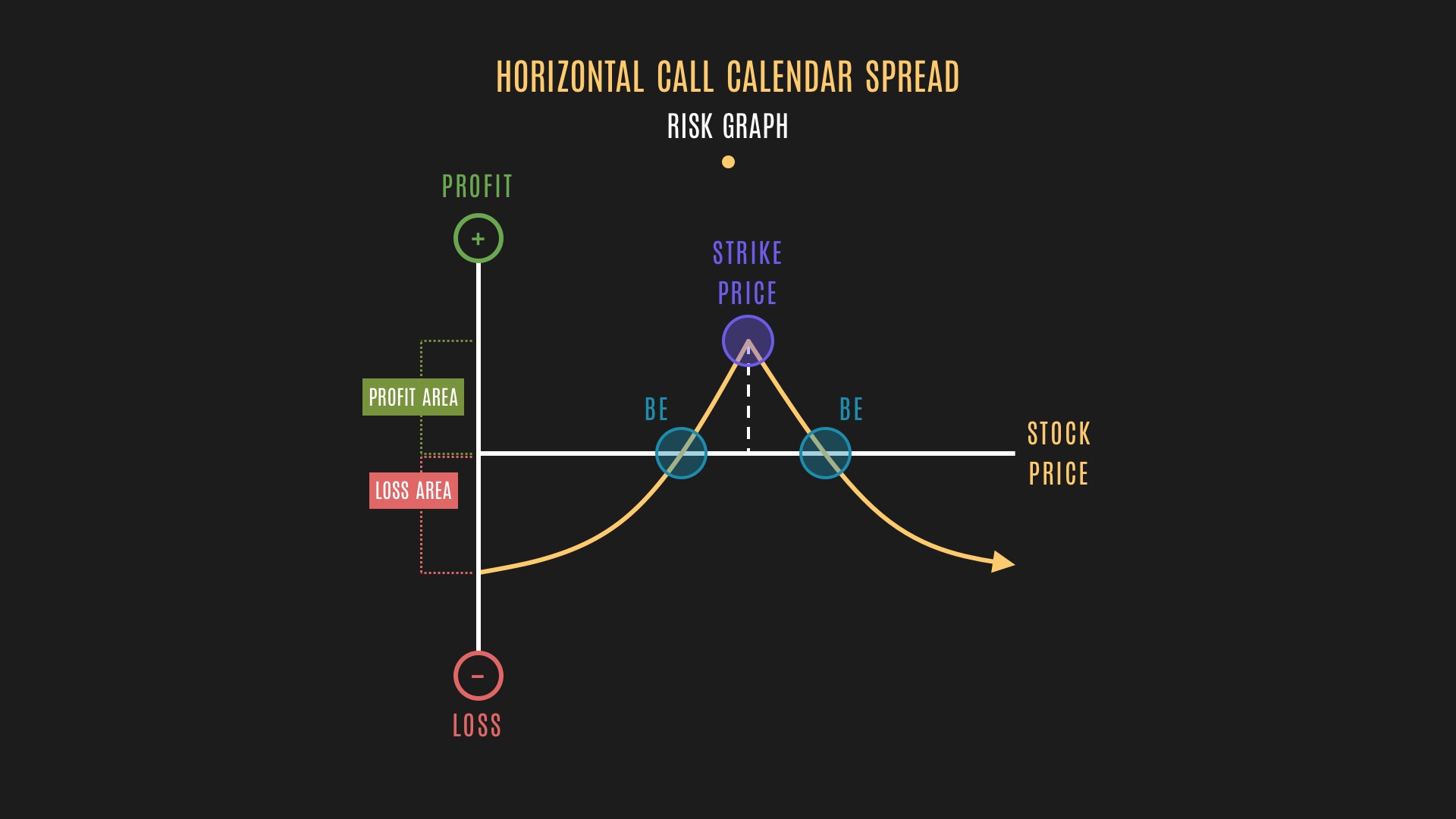

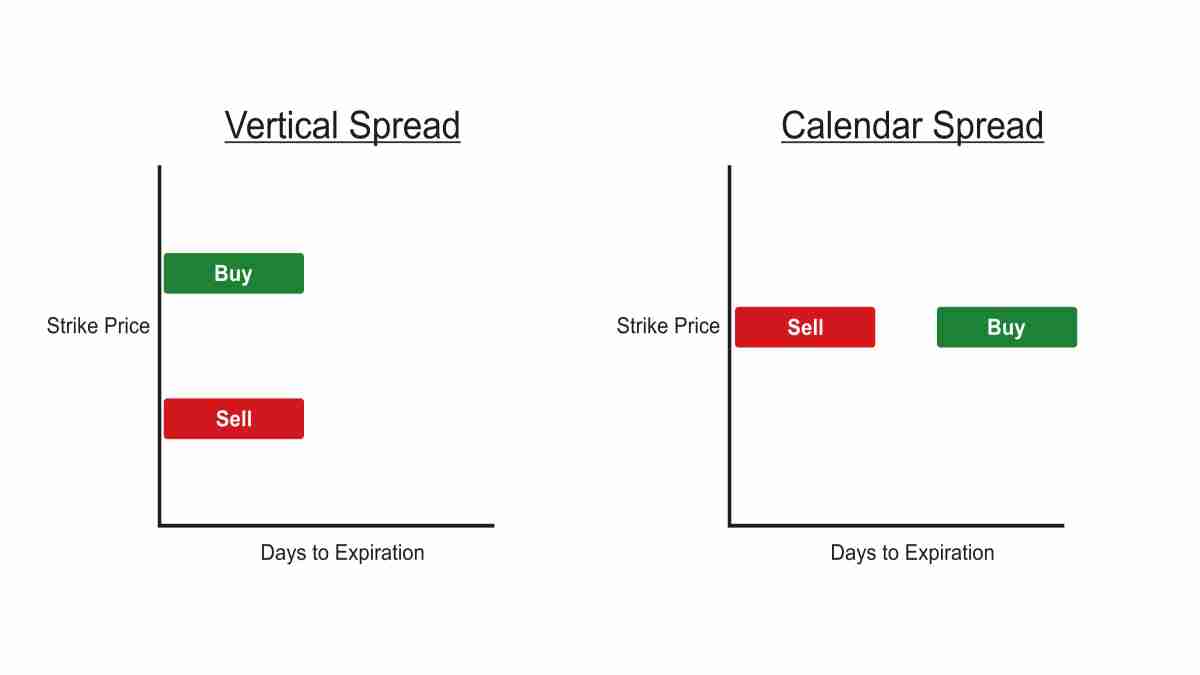

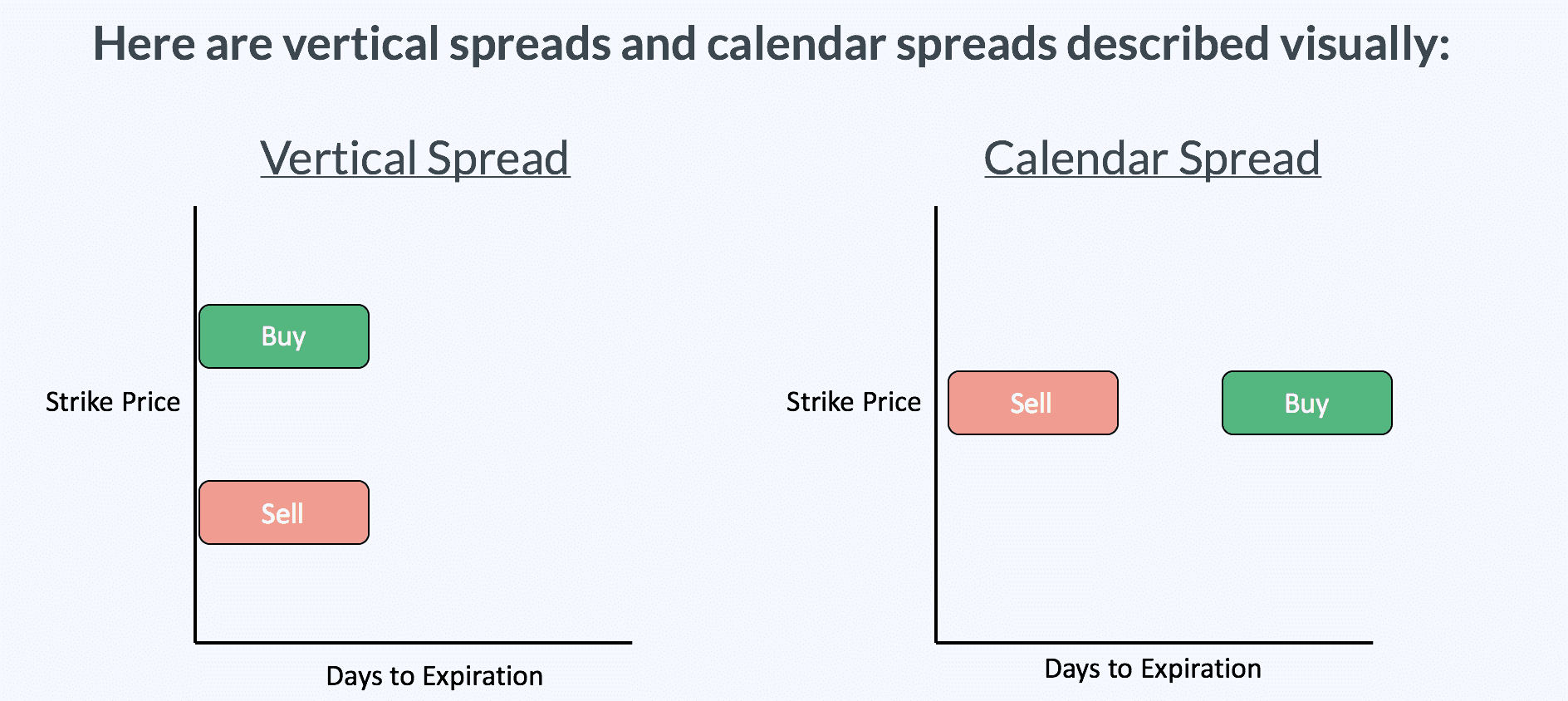

Calendar Spread Options - Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or. Web the calendar spread is a beginner strategy that can work well under neutral assumptions. Web calendar spread options are options on the price differential between 2 contract months, rather than on the underlying asset itself. Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different. Web calendar spread c ompared to other options strategies? Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web the calendar spread refers to a family of spreads involving options of the same underlying stock, same strike prices, but. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. A calendar spread offers limited risk and possibly limited. A calendar spread offers limited risk and possibly limited. Web the calendar spread is a beginner strategy that can work well under neutral assumptions. Web the calendar spread refers to a family of spreads involving options of the same underlying stock, same strike prices, but. Web the calendar spread strategy can be effective during sideways markets and periods of low. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web the calendar spread is a beginner strategy that can work well under neutral assumptions.. Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or. Web calendar spread options are options on the price differential between 2 contract months, rather than on the. A calendar spread offers limited risk and possibly limited. Web a calendar spread is a strategy used in options and futures trading: Web the calendar spread strategy can be effective during sideways markets and periods of low volatility. Web the calendar spread is a beginner strategy that can work well under neutral assumptions. Web a calendar spread is an options. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web the key to making money with calendar spread options lies in a characteristic of all options: Web a calendar spread is an options trading strategy in which you enter a long or short position in the stock with. Web the calendar spread refers to a family of spreads involving options of the same underlying stock, same strike prices, but. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter. Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different. Web a calendar spread is a strategy used in options and futures trading: I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Web a calendar spread is a strategy used. Web a calendar spread is a strategy used in options and futures trading: Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Web a long calendar. Web the calendar spread strategy can be effective during sideways markets and periods of low volatility. Web the calendar spread refers to a family of spreads involving options of the same underlying stock, same strike prices, but. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the. I. I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web a. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or. Web the calendar spread strategy can be effective during sideways markets and periods of low volatility. A calendar spread offers limited risk and possibly limited. Web calendar spread c ompared to other options strategies? Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different. Web a calendar spread is a strategy used in options and futures trading: Web calendar spread options are options on the price differential between 2 contract months, rather than on the underlying asset itself. I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Web a calendar spread is an options trading strategy in which you enter a long or short position in the stock with the same. Web the calendar spread refers to a family of spreads involving options of the same underlying stock, same strike prices, but. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web a calendar spread is a strategy used in options and futures trading: Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web the calendar spread is a beginner strategy that can work well under neutral assumptions. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. Web the key to making money with calendar spread options lies in a characteristic of all options:Glossary Definition Horizontal Call Calendar Spread Tackle Trading

Pin on CALENDAR SPREADS OPTIONS

Pin on CALENDAR SPREADS OPTIONS

Pair Trading Strategy Spread Trading Strategy Calendar Spread

Pin on CALENDAR SPREADS OPTIONS

CALENDAR SPREAD OPTION STRATEGY ADJUSTMENTS YouTube

Pin on CALENDAR SPREADS OPTIONS

Options Strategy Calendar Spread (Setting Up the Calendar) Tradersfly

Pin on Option Trading Strategies

How Calendar Spreads Work (Best Explanation) projectoption

Related Post: