Calendar Spreads Options

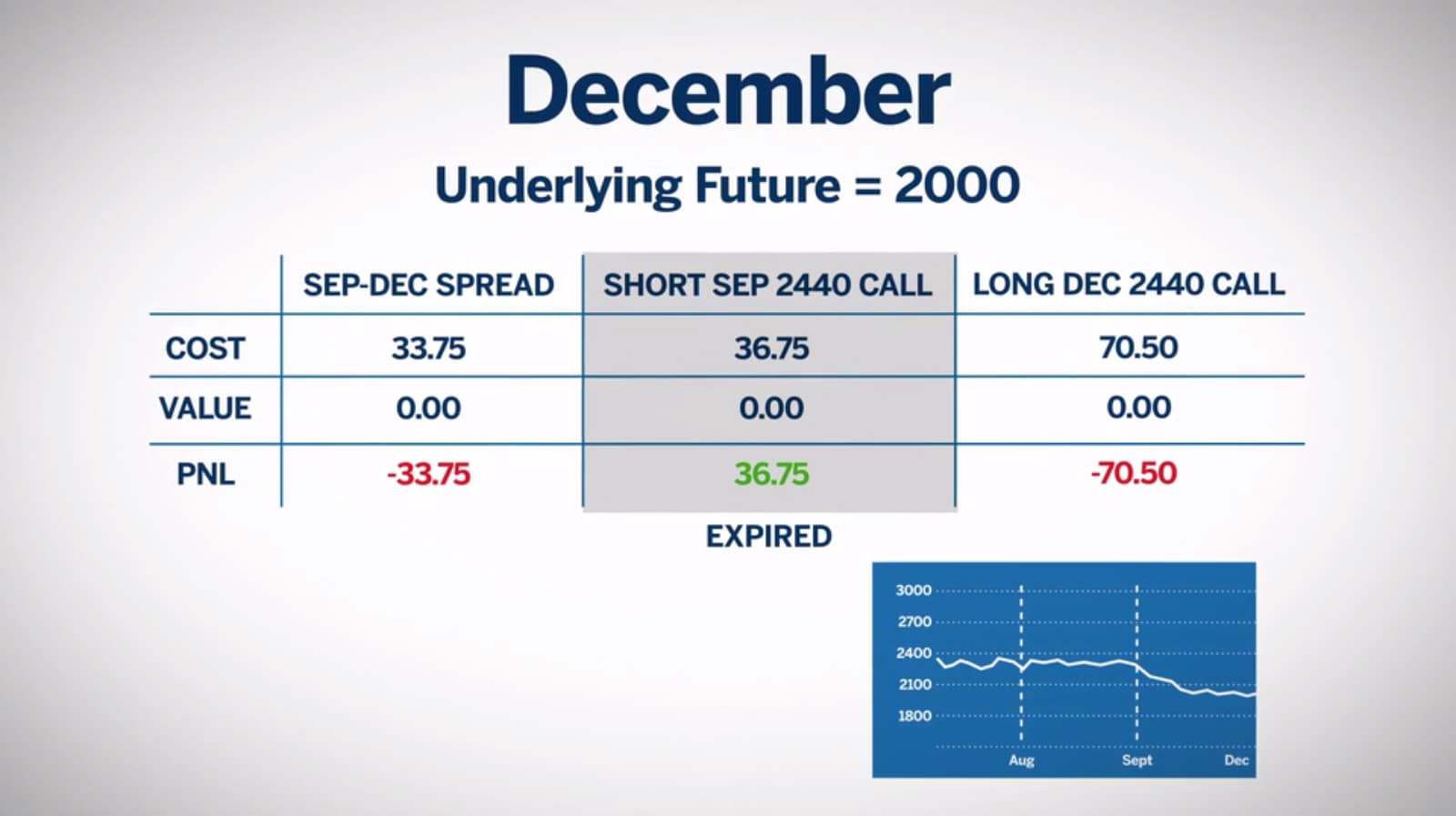

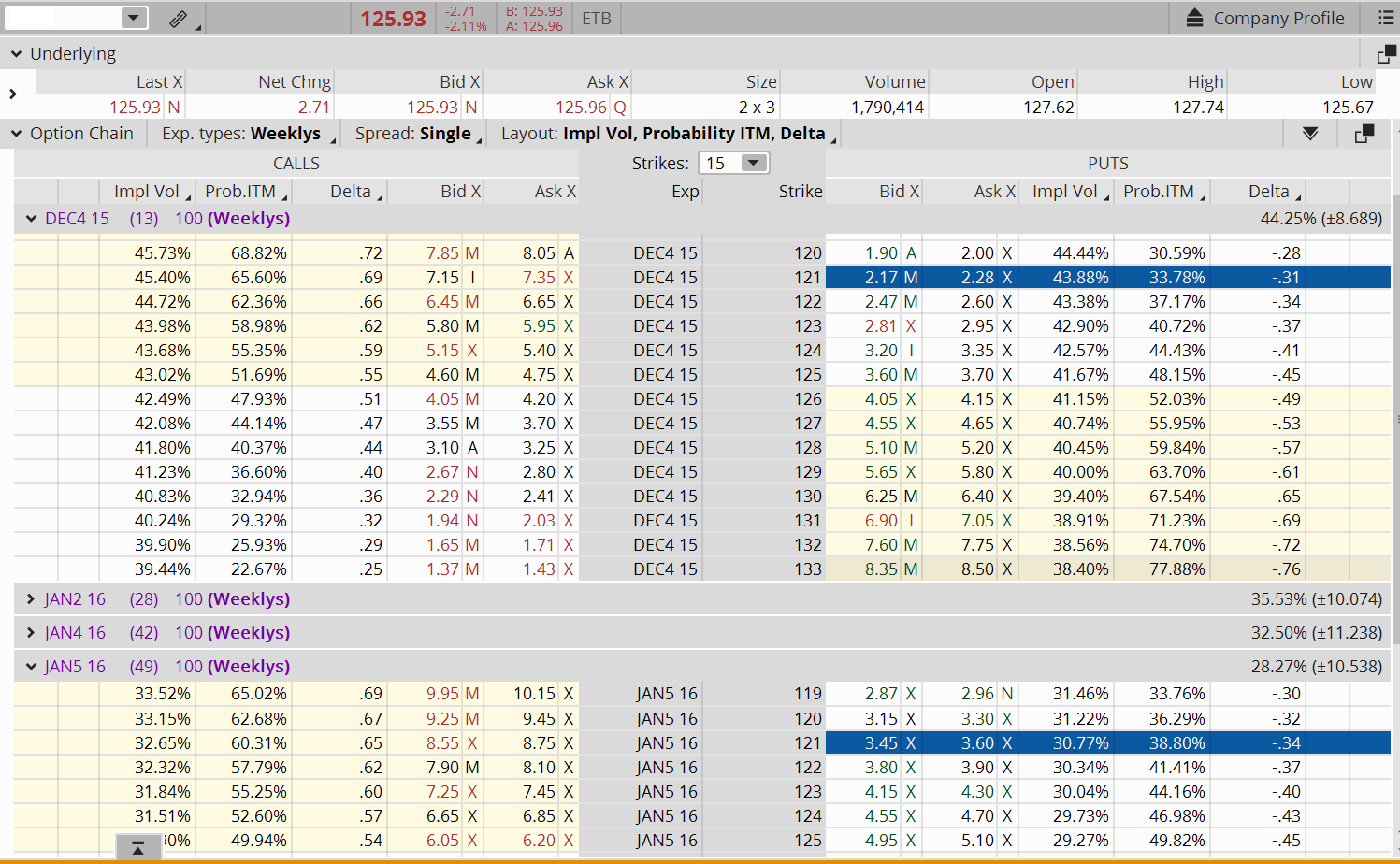

Calendar Spreads Options - Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or. Web a calendar spread is an options or futures strategy established. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike. Web a calendar spread is. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity. Web the calendar spread options strategy is a market neutral strategy for. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity. Web a long calendar spread—often referred to as a time. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike. Web the calendar spread options. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or. Web a long calendar spread—often referred to. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or. Web the calendar spread options strategy is a market. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity. Web a long calendar spread—often referred to as a time spread—is. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity. Web a calendar spread is an options or futures strategy. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity. Web a long calendar spread—often referred to as a time spread—is the. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying.How Calendar Spreads Work (Best Explanation) projectoption

Pair Trading Strategy Spread Trading Strategy Calendar Spread

Pin on Option Trading Strategies

Option Calendar Spreads

Options Strategy Calendar Spread (Setting Up the Calendar) Tradersfly

How To Trade Calendar Spreads The Complete Guide

Pin on CALENDAR SPREADS OPTIONS

Pin on CALENDAR SPREADS OPTIONS

Pin on CALENDAR SPREADS OPTIONS

Consider Calendar Spreads to Help Navigate Earnings S... Ticker Tape

Related Post: