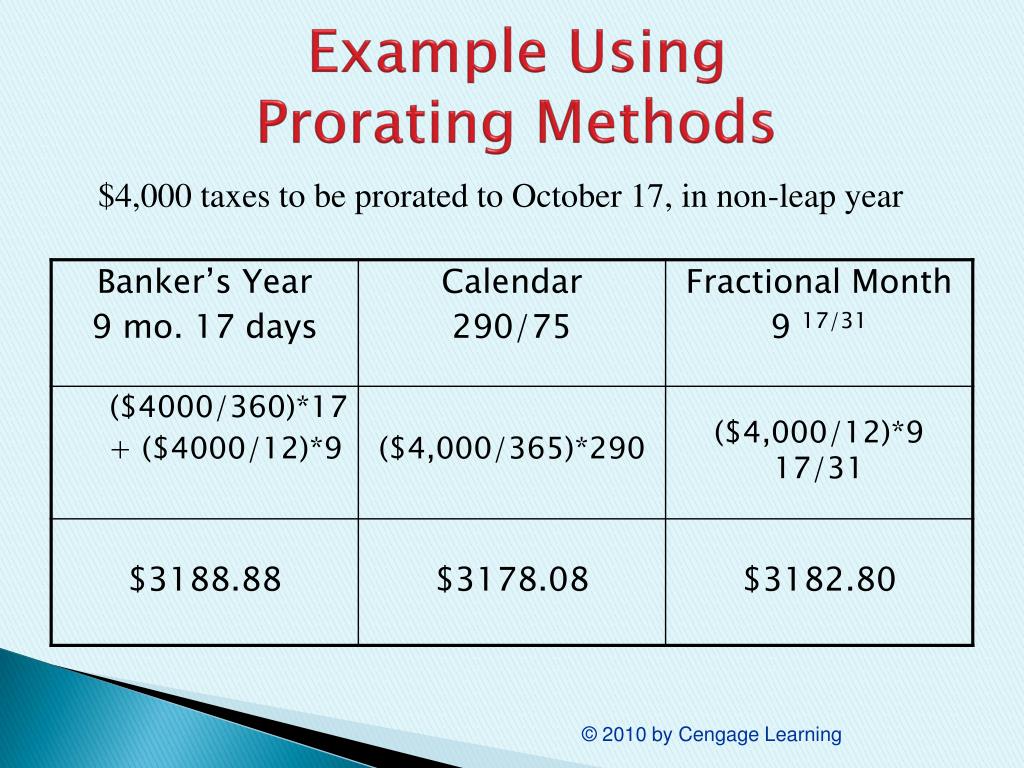

Calendar Year Proration Method

Calendar Year Proration Method - An attorney, a real estate salesperson, or a broker does the proration calculations at the closing. Prs is not a publicly traded partnership. Under the proration method, the departing partner's share of the firm's tax items for the entire. Web prs is a calendar year partnership that uses the interim closing method and monthly convention to account for variations during its taxable year. If you wish to prorate over a period not based on the calendar year and which crosses over. This option is very simple, but it may not accurately reflect economic reality. Web proration is the allocation or dividing of certain money items at the closing. Proration is inclusive of both specified dates. On january 20, 2016, new. Web the partnership uses a calendar tax year and the proration method. An attorney, a real estate salesperson, or a broker does the proration calculations at the closing. Web proration is the allocation or dividing of certain money items at the closing. Web the partnership uses a calendar tax year and the proration method. Since the departing partner was present for half the tax year (six months out of 12), he is. Under the proration method, the departing partner's share of the firm's tax items for the entire. This option is very simple, but it may not accurately reflect economic reality. Web prs is a calendar year partnership that uses the interim closing method and monthly convention to account for variations during its taxable year. If you wish to prorate over a. Web the partnership uses a calendar tax year and the proration method. Web prorate a specified amount over a specified portion of the calendar year. Under the proration method, the departing partner's share of the firm's tax items for the entire. Web proration is the allocation or dividing of certain money items at the closing. If you wish to prorate. Prs is not a publicly traded partnership. Proration is inclusive of both specified dates. Web the partnership uses a calendar tax year and the proration method. Under the proration method, the departing partner's share of the firm's tax items for the entire. If you wish to prorate over a period not based on the calendar year and which crosses over. If you wish to prorate over a period not based on the calendar year and which crosses over. Since the departing partner was present for half the tax year (six months out of 12), he is allocated 5% (10% times ½ equals 5%) of. Web the partnership uses a calendar tax year and the proration method. This option is very. Web proration is the allocation or dividing of certain money items at the closing. Since the departing partner was present for half the tax year (six months out of 12), he is allocated 5% (10% times ½ equals 5%) of. On january 20, 2016, new. Web prorate a specified amount over a specified portion of the calendar year. Prs is. On january 20, 2016, new. Web prorate a specified amount over a specified portion of the calendar year. Proration is inclusive of both specified dates. If you wish to prorate over a period not based on the calendar year and which crosses over. Under the proration method, the departing partner's share of the firm's tax items for the entire. Since the departing partner was present for half the tax year (six months out of 12), he is allocated 5% (10% times ½ equals 5%) of. Proration is inclusive of both specified dates. Web prs is a calendar year partnership that uses the interim closing method and monthly convention to account for variations during its taxable year. This option is. Proration is inclusive of both specified dates. Since the departing partner was present for half the tax year (six months out of 12), he is allocated 5% (10% times ½ equals 5%) of. If you wish to prorate over a period not based on the calendar year and which crosses over. Under the proration method, the departing partner's share of. On january 20, 2016, new. Under the proration method, the departing partner's share of the firm's tax items for the entire. Web proration is the allocation or dividing of certain money items at the closing. Web prorate a specified amount over a specified portion of the calendar year. Proration is inclusive of both specified dates. Since the departing partner was present for half the tax year (six months out of 12), he is allocated 5% (10% times ½ equals 5%) of. If you wish to prorate over a period not based on the calendar year and which crosses over. Web prorate a specified amount over a specified portion of the calendar year. Web proration is the allocation or dividing of certain money items at the closing. An attorney, a real estate salesperson, or a broker does the proration calculations at the closing. On january 20, 2016, new. Web prs is a calendar year partnership that uses the interim closing method and monthly convention to account for variations during its taxable year. Proration is inclusive of both specified dates. This option is very simple, but it may not accurately reflect economic reality. Web the partnership uses a calendar tax year and the proration method. Under the proration method, the departing partner's share of the firm's tax items for the entire. Prs is not a publicly traded partnership.Calendar Month Rental Calculator Calendar printables, Printable

Checking what Months are during a Project — Smartsheet Community

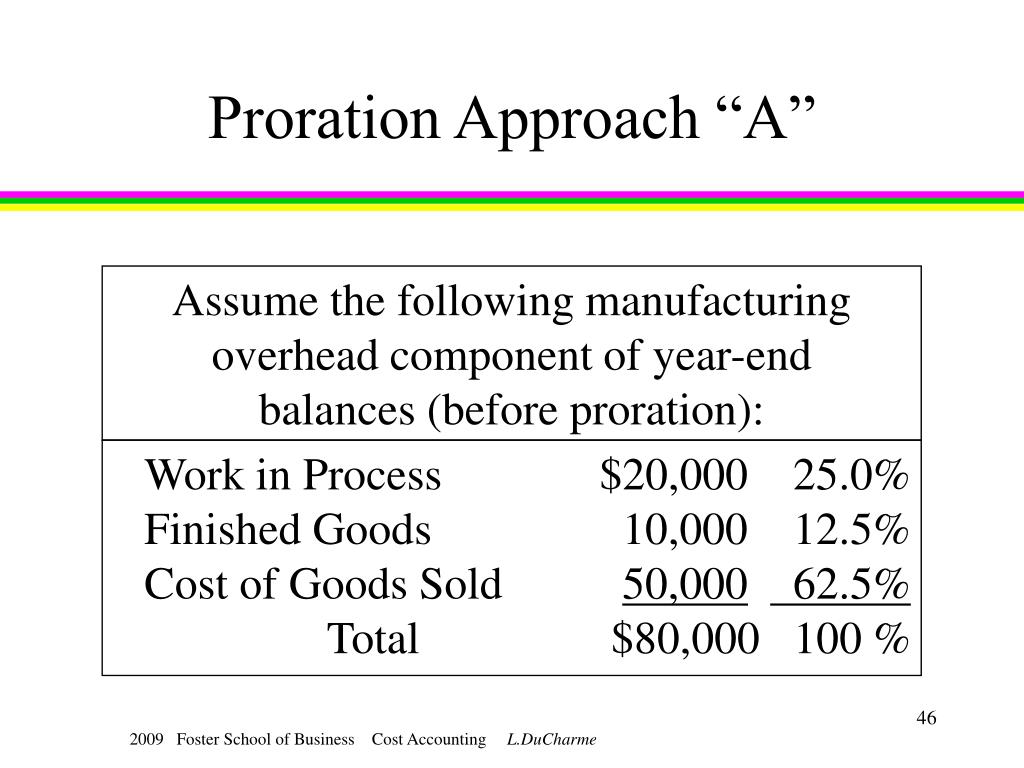

PPT Job Order Costing PowerPoint Presentation, free download ID3338100

The Complete Guide To The Calendar Method Birth Control

Chart Of Calendar Method Free Calendar Template

EDI Viewer GL Upload

Depreciation Calculation for Table and Calculated Methods (Oracle

PPT Chapter 16 ________________ Title Closing and Escrow PowerPoint

SSA POMS DI 52170.055 Calendars for Proration (19642028) 09/25/2008

Use Excel's YEARFRAC Function for ProRata Calculations YouTube

Related Post: