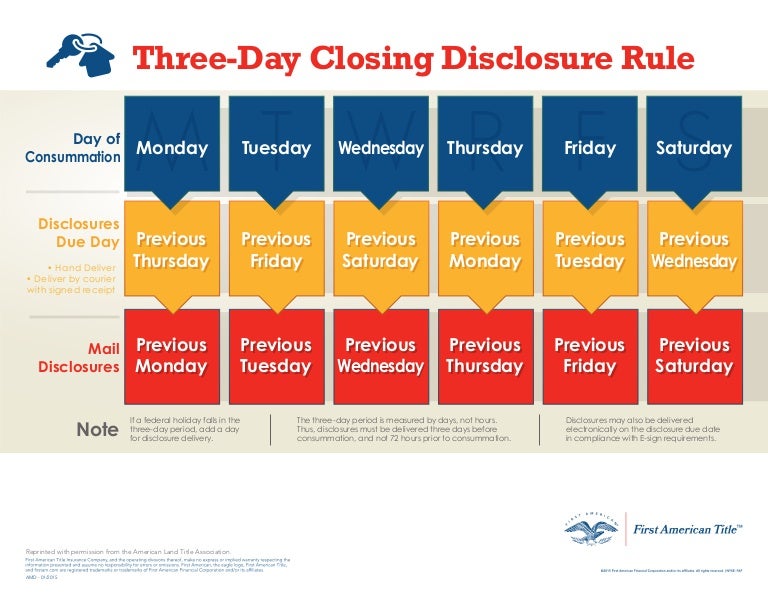

Closing Disclosure 3 Day Rule Calendar

Closing Disclosure 3 Day Rule Calendar - You should also not go through with the closing until you receive and review the closing disclosure. Thus, disclosure must be delivered three days before closing, and not 72 hours prior to closing. Web if you have not received this document, you should request one from your lender immediately. Web according to the consumer financial protection bureau’s final rule, the creditor must deliver the closing disclosure to the consumer at least three business days prior to the date of consummation of the. Web as discussed in the faqs above, if the apr disclosed pursuant to the trid rule becomes inaccurate, the creditor must ensure that a consumer receives the corrected closing disclosure at least three business days. Disclosures may also be delivered electronically to the delivery. This means you may technically have more than three days before closing to review. But sundays and nationally recognized holidays do not count. Web as discussed in the faqs above, if the apr disclosed pursuant to the trid rule becomes inaccurate, the creditor must ensure that a consumer receives the corrected closing disclosure at least three business days. Web if you have not received this document, you should request one from your lender immediately. But sundays and nationally recognized holidays do not count.. Web as discussed in the faqs above, if the apr disclosed pursuant to the trid rule becomes inaccurate, the creditor must ensure that a consumer receives the corrected closing disclosure at least three business days. Web if you have not received this document, you should request one from your lender immediately. Web according to the consumer financial protection bureau’s final. Web if you have not received this document, you should request one from your lender immediately. Web according to the consumer financial protection bureau’s final rule, the creditor must deliver the closing disclosure to the consumer at least three business days prior to the date of consummation of the. This means you may technically have more than three days before. But sundays and nationally recognized holidays do not count. You should also not go through with the closing until you receive and review the closing disclosure. This means you may technically have more than three days before closing to review. Disclosures may also be delivered electronically to the delivery. Web as discussed in the faqs above, if the apr disclosed. Web if you have not received this document, you should request one from your lender immediately. You should also not go through with the closing until you receive and review the closing disclosure. Disclosures may also be delivered electronically to the delivery. This means you may technically have more than three days before closing to review. But sundays and nationally. Web as discussed in the faqs above, if the apr disclosed pursuant to the trid rule becomes inaccurate, the creditor must ensure that a consumer receives the corrected closing disclosure at least three business days. But sundays and nationally recognized holidays do not count. Web if you have not received this document, you should request one from your lender immediately.. Web if you have not received this document, you should request one from your lender immediately. But sundays and nationally recognized holidays do not count. You should also not go through with the closing until you receive and review the closing disclosure. This means you may technically have more than three days before closing to review. Web according to the. You should also not go through with the closing until you receive and review the closing disclosure. But sundays and nationally recognized holidays do not count. Web if you have not received this document, you should request one from your lender immediately. Web as discussed in the faqs above, if the apr disclosed pursuant to the trid rule becomes inaccurate,. Web according to the consumer financial protection bureau’s final rule, the creditor must deliver the closing disclosure to the consumer at least three business days prior to the date of consummation of the. Web as discussed in the faqs above, if the apr disclosed pursuant to the trid rule becomes inaccurate, the creditor must ensure that a consumer receives the. Thus, disclosure must be delivered three days before closing, and not 72 hours prior to closing. But sundays and nationally recognized holidays do not count. Web as discussed in the faqs above, if the apr disclosed pursuant to the trid rule becomes inaccurate, the creditor must ensure that a consumer receives the corrected closing disclosure at least three business days.. This means you may technically have more than three days before closing to review. Web if you have not received this document, you should request one from your lender immediately. Web according to the consumer financial protection bureau’s final rule, the creditor must deliver the closing disclosure to the consumer at least three business days prior to the date of consummation of the. But sundays and nationally recognized holidays do not count. Disclosures may also be delivered electronically to the delivery. You should also not go through with the closing until you receive and review the closing disclosure. Web as discussed in the faqs above, if the apr disclosed pursuant to the trid rule becomes inaccurate, the creditor must ensure that a consumer receives the corrected closing disclosure at least three business days. Thus, disclosure must be delivered three days before closing, and not 72 hours prior to closing.Closing Disclosure And 3 Day Photo Calendar Template 2022

How to Comply with the Closing Disclosure's Threeday Rule ALTA Blog

Three Day Closing Rule Calendar, Mortgage, 3 day rule

ThreeDay Closing Disclosure Rule Infographic

Three Day Trid Closing Rule Calendar Image Calendar Template 2022

3 Day Closing Disclosure Calendar Calendar Template 2022

Closing Disclosure 3 Day Rule Calendar Graphics Calendar Template 2022

3day closing disclosure rule chart Calendar examples, Calendar

The 3 Day Closing Disclosure Rule Twin City Title

Three Day Trid Closing Rule Calendar Image Calendar Template 2022

Related Post: