Diagonal Calendar Spread Option Strategy

Diagonal Calendar Spread Option Strategy - Web calendar spreads and diagonal spreads have many similarities but also some important differences. Web the diagonal calendar call spread, also known as the calendar diagonal call spread, is a neutral options strategy that profits. Calendar spreads, time spreads, horizontal. A calendar spread is an options or futures spread established by simultaneously entering a. Each diagonal spread is made up of a long and a short option—both calls or both. Web the diagonal spread is a popular options trading strategy that involves the simultaneous purchase and sale of options of the same type but with different. Web straight lines and hard angles usually indicate that all options in the strategy have the same expiration date. Lecture 1, what is a diagonal and a double diagonal. Web what is a diagonal spread? Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. Web a diagonal spread is an options trading strategy that combines the vertical nature of different strike selections in a vertical spread, with the horizontal nature of. A calendar spread is an options or futures spread established by simultaneously entering a. Web a diagonal spread would thus mean presence of options in different row and columns with different strike prices.. Jim schultz in episode #4 of. Web the diagonal calendar call spread, also known as the calendar diagonal call spread, is a neutral options strategy that profits. Calendar spreads, time spreads, horizontal. Web the diagonal spread is a popular options trading strategy that involves the simultaneous purchase and sale of options of the same type but with different. Web to. Web a diagonal spread allows option traders to collect premium and time decay similar to the calendar spread, except these trades take a. Web 1k share 39k views 1 year ago options crash course: Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at.. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. Web a diagonal spread allows option traders to collect premium and time decay similar to the calendar spread, except these trades take a. Web 1k share 39k views 1 year ago options crash course:. Calendar spreads, time spreads, horizontal. Web the diagonal calendar call spread, also known as the calendar diagonal call spread, is a neutral options strategy that profits. Web the istanbul diagonal calendar strategy course includes seven lectures: Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying. Web the istanbul diagonal calendar strategy course includes seven lectures: Web straight lines and hard angles usually indicate that all options in the strategy have the same expiration date. Web to better understand the diagonal call calendar spread, an option spread is constructed by buying an option and. Calendar spreads, time spreads, horizontal. Jim schultz in episode #4 of. Web a diagonal spread is an options trading strategy that combines the vertical nature of different strike selections in a vertical spread, with the horizontal nature of. Web a diagonal spread would thus mean presence of options in different row and columns with different strike prices. Web the istanbul diagonal calendar strategy course includes seven lectures: Each diagonal spread is. A calendar spread is an options or futures spread established by simultaneously entering a. Web 1k share 39k views 1 year ago options crash course: Web to better understand the diagonal call calendar spread, an option spread is constructed by buying an option and. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that. Calendar spreads, time spreads, horizontal. A calendar spread is an options or futures spread established by simultaneously entering a. Web a diagonal spread allows option traders to collect premium and time decay similar to the calendar spread, except these trades take a. Web to better understand the diagonal call calendar spread, an option spread is constructed by buying an option. Diagonal spreads what's the difference between calendar spreads and diagonal spreads? Web to better understand the diagonal call calendar spread, an option spread is constructed by buying an option and. A calendar spread is an options or futures spread established by simultaneously entering a. Web the istanbul diagonal calendar strategy course includes seven lectures: Web straight lines and hard angles. Web what is a diagonal spread? Diagonal spreads what's the difference between calendar spreads and diagonal spreads? Web a diagonal spread allows option traders to collect premium and time decay similar to the calendar spread, except these trades take a. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. Lecture 1, what is a diagonal and a double diagonal. Web to better understand the diagonal call calendar spread, an option spread is constructed by buying an option and. A calendar spread is an options or futures spread established by simultaneously entering a. Web the diagonal spread is a popular options trading strategy that involves the simultaneous purchase and sale of options of the same type but with different. Web straight lines and hard angles usually indicate that all options in the strategy have the same expiration date. Web calendar spreads and diagonal spreads have many similarities but also some important differences. Web a diagonal spread would thus mean presence of options in different row and columns with different strike prices. Web a diagonal spread is an options trading strategy that combines the vertical nature of different strike selections in a vertical spread, with the horizontal nature of. Calendar spreads, time spreads, horizontal. Web the istanbul diagonal calendar strategy course includes seven lectures: Web the diagonal calendar call spread, also known as the calendar diagonal call spread, is a neutral options strategy that profits. Web 1k share 39k views 1 year ago options crash course: Each diagonal spread is made up of a long and a short option—both calls or both. Jim schultz in episode #4 of.Pin on CALENDAR SPREADS OPTIONS

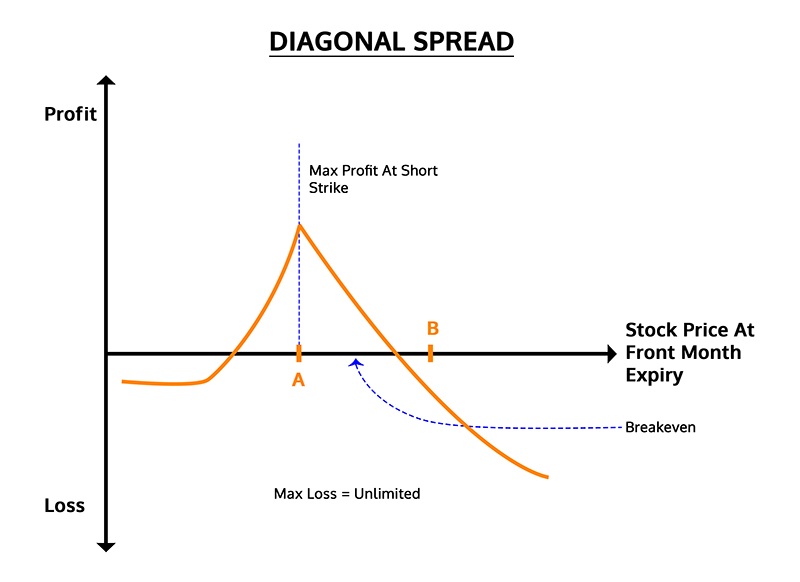

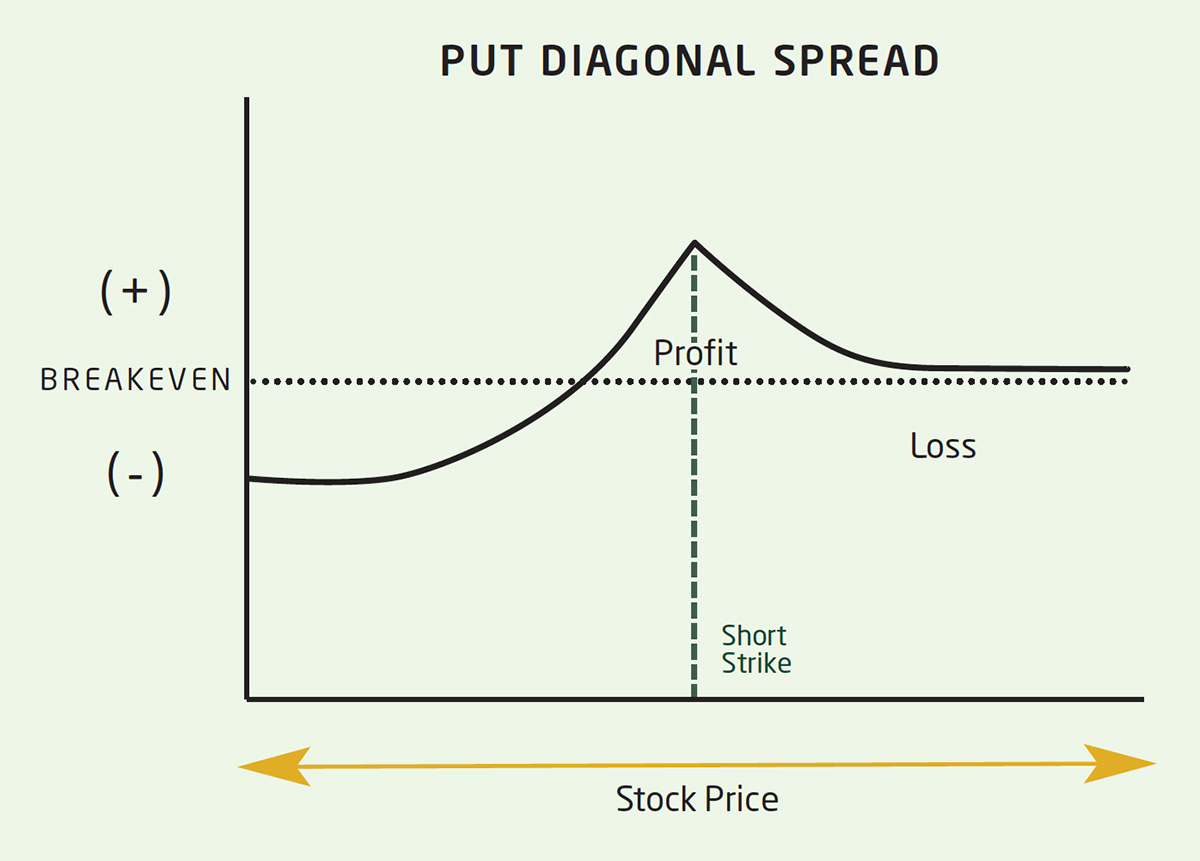

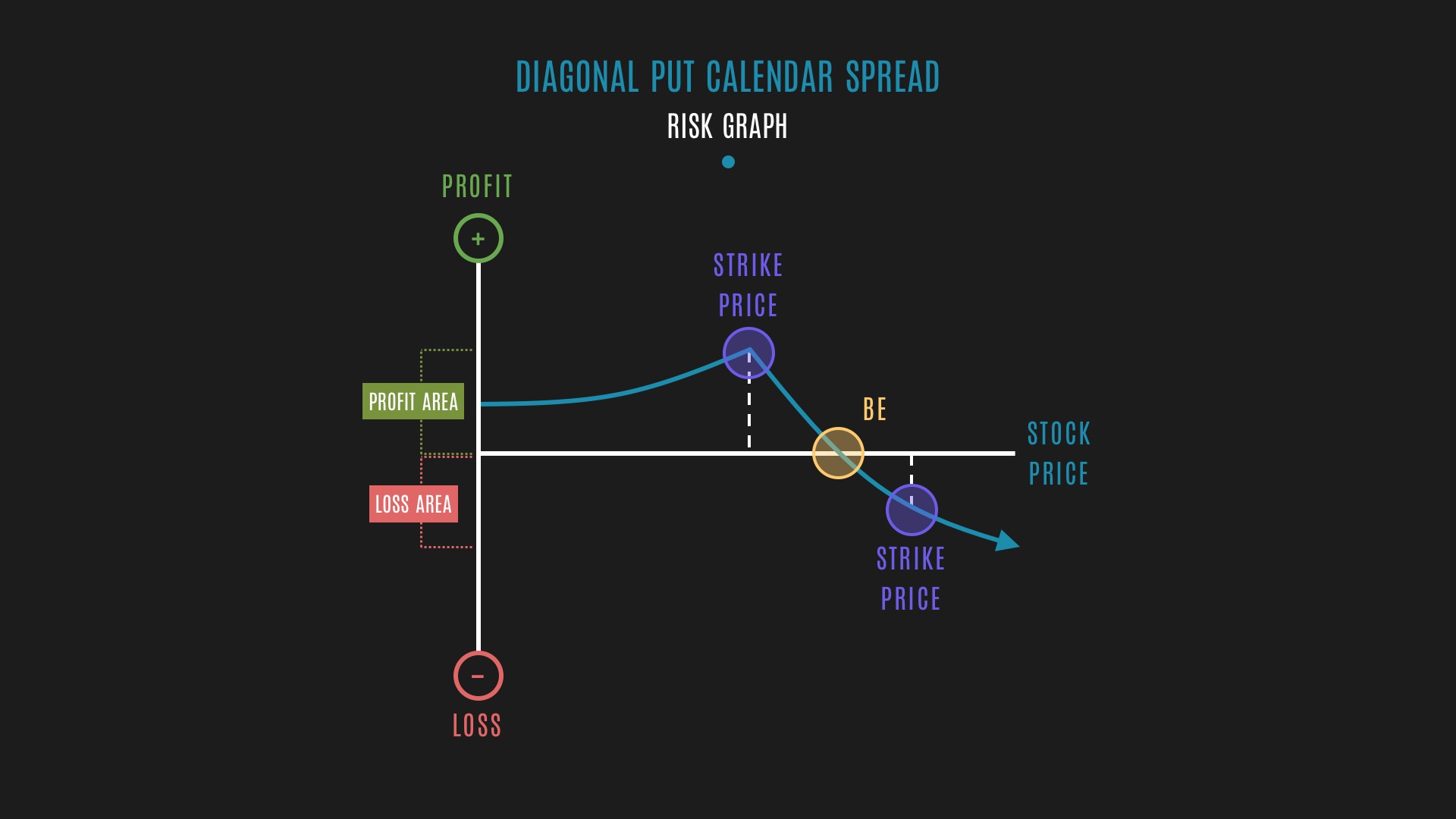

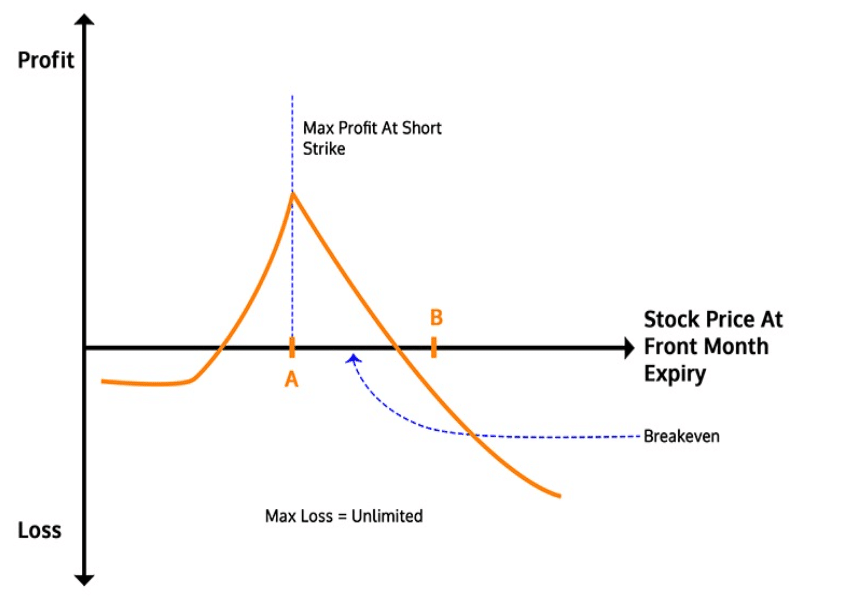

Options Trading Made Easy Diagonal Spread

Diagonal Call Calendar Spread Smart Trading

Diagonal Spread Options Trading Strategy In Python

When Calendar Met Vertical A Diagonal Spread Tale Ticker Tape

Glossary Archive Tackle Trading

Special Focus Spread Trading // Building a Better Mo... Ticker Tape

Pair Trading Strategy Spread Trading Strategy Calendar Spread

Glossary Diagonal Put Calendar Spread example Tackle Trading

Long Call Diagonal Spread An Advance Option Strategy MarketXLS

Related Post: