Diagonal Calendar Spread

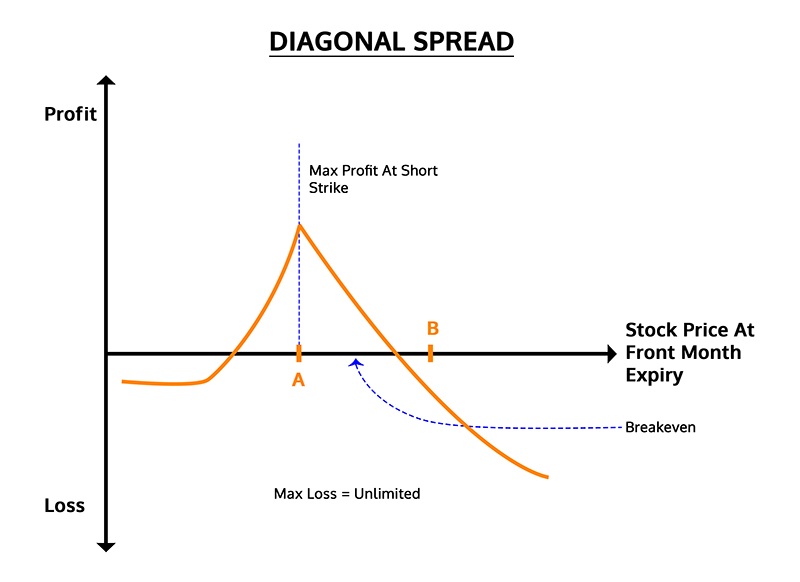

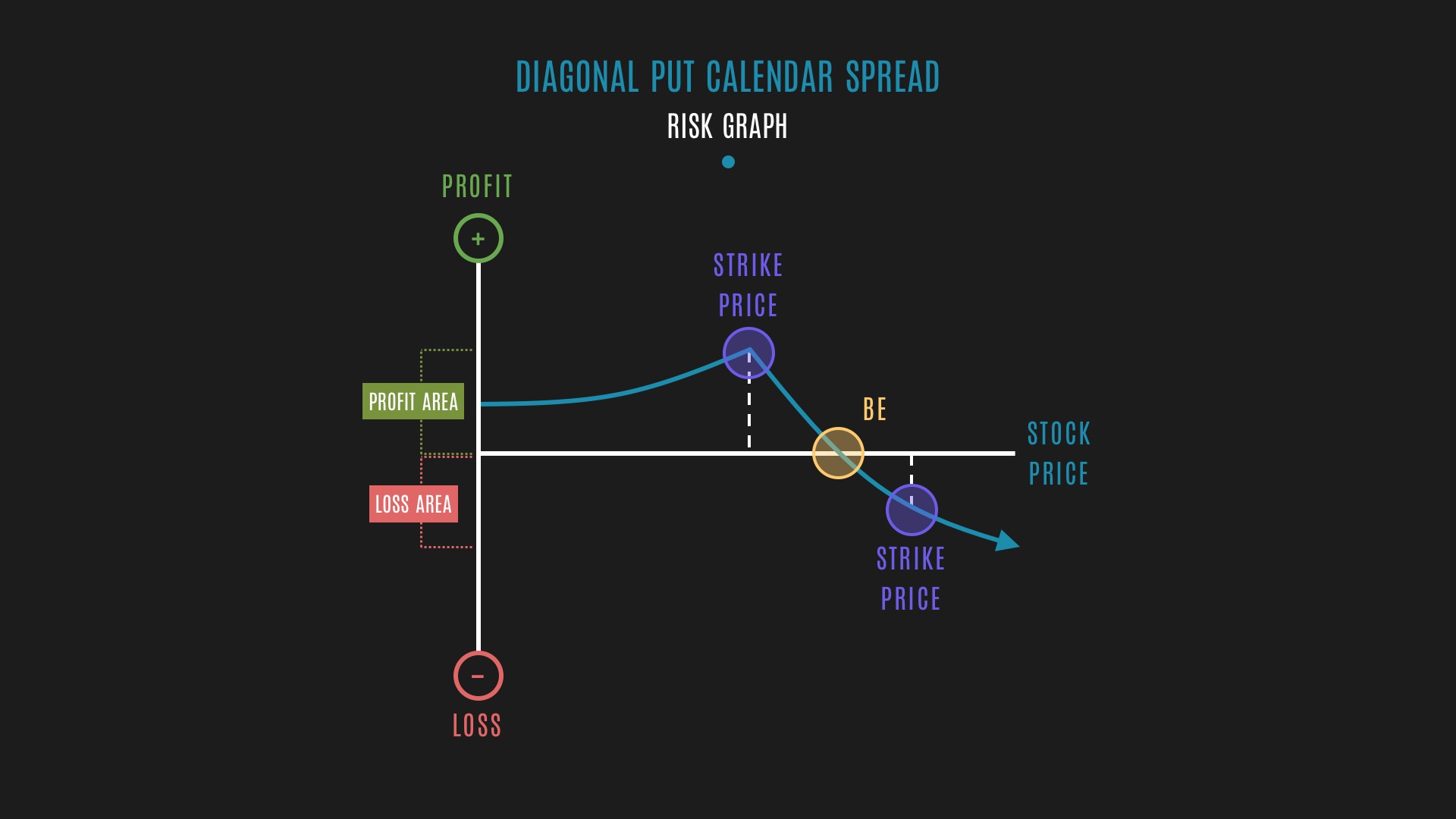

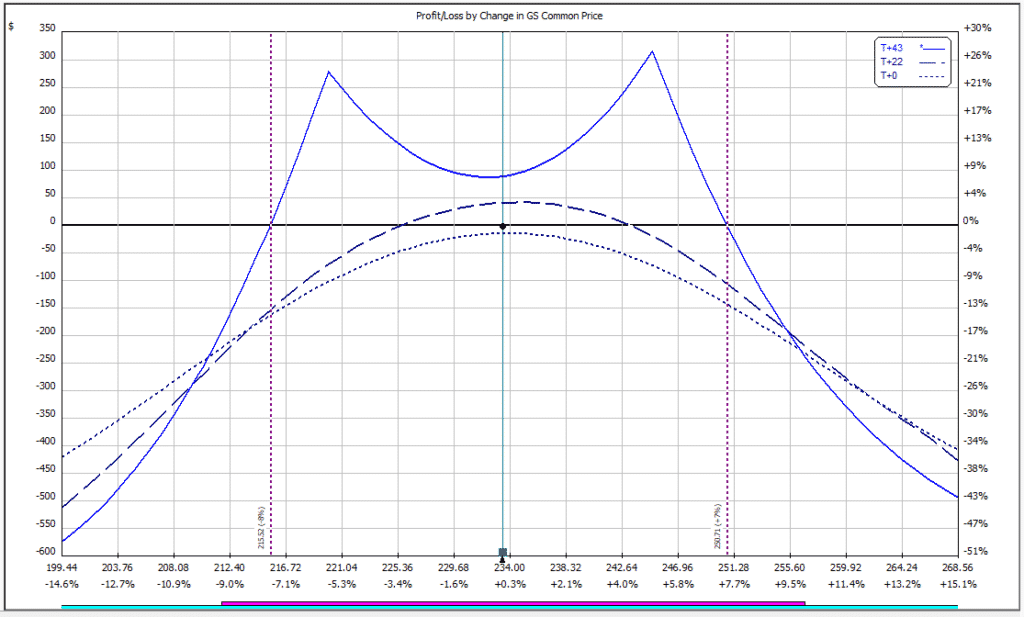

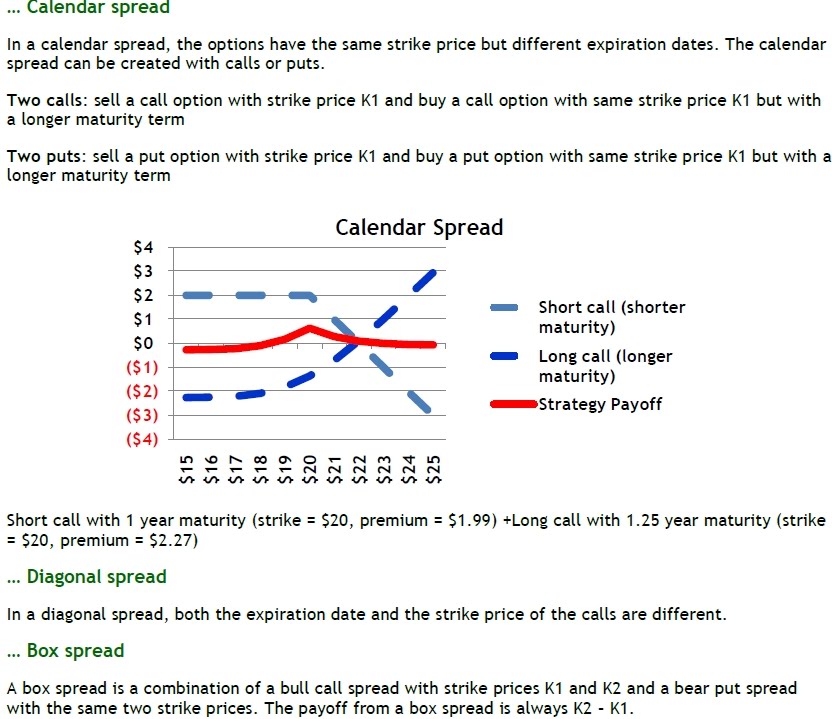

Diagonal Calendar Spread - Sell 1 out of the money front month call. Web as you can see my calendar has these diagonal lines throughout the whole week. Whether a diagonal is “long” or “short” depends on the deferred leg. A long diagonal is long the deferred month and short the near month. Web the istanbul diagonal calendar strategy is one of the most profitable of the seven deadly strategies series. Web a diagonal with two calls is a call diagonal spread (see figure 1). Web a diagonal spread is similar to a calendar spread with the only difference being that the strikes are different. One page year at a. Here's a screenshot of what would officially be called. Web the following rules should be adhered to when using the calendar/diagonal spread strategy: Web the short diagonal calendar put spread is one of two types of short calendar spreads utilizing only put options. Web as you can see my calendar has these diagonal lines throughout the whole week. Follow me on twitter @cboesib One page year at a. Web the following rules should be adhered to when using the calendar/diagonal spread strategy: Sell 1 out of the money front month call. Web a calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. Whether a diagonal is “long” or “short” depends on the deferred leg. One page year at a. Web a diagonal with two calls is a call diagonal spread (see. Web the istanbul diagonal calendar strategy is one of the most profitable of the seven deadly strategies series. A diagonal spread allows option traders to collect premium and time decay similar to the calendar spread, except these trades take a directional bias. Follow me on twitter @cboesib Web the following rules should be adhered to when using the calendar/diagonal spread. A put diagonal spread has two puts. Web the diagonal calendar put spread, also known as the put diagonal calendar spread, is a neutral options strategy that profits. A short diagonal is short the deferred expiration date. Web diagonal spreads market commentary options risk managment scott bauer calendar spreads and diagonal spreads have many similarities but also some important differences.. Web the diagonal calendar call spread, also known as the calendar diagonal call spread, is a neutral options strategy that profits when the underlying stock. Web the diagonal spread is a popular options trading strategy that involves the simultaneous purchase and sale of. A long diagonal is long the deferred month and short the near month. Web a diagonal with. A put diagonal spread has two puts. Web the diagonal spread is a popular options trading strategy that involves the simultaneous purchase and sale of. A diagonal spread has both different months and different strike prices. A long diagonal is long the deferred month and short the near month. Web a diagonal with two calls is a call diagonal spread. Web diagonal spreads market commentary options risk managment scott bauer calendar spreads and diagonal spreads have many similarities but also some important differences. This just popped up yesterday and i can't. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Here's a screenshot of what would officially be called. A diagonal. Web a diagonal spread is similar to a calendar spread with the only difference being that the strikes are different. Web the diagonal calendar put spread, also known as the put diagonal calendar spread, is a neutral options strategy that profits. This just popped up yesterday and i can't. Web the short diagonal calendar put spread is one of two. Web the diagonal spread is a popular options trading strategy that involves the simultaneous purchase and sale of. A short diagonal is short the deferred expiration date. Sell 1 out of the money front month call. Web the short diagonal calendar put spread is one of two types of short calendar spreads utilizing only put options. Web the diagonal calendar. Web the diagonal calendar put spread, also known as the put diagonal calendar spread, is a neutral options strategy that profits. A diagonal spread has both different months and different strike prices. A put diagonal spread has two puts. Web the short diagonal calendar put spread is one of two types of short calendar spreads utilizing only put options. A. 1) when in doubt, adjust. Sell 1 out of the money front month call. A diagonal spread allows option traders to collect premium and time decay similar to the calendar spread, except these trades take a directional bias. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the. This just popped up yesterday and i can't. Whether a diagonal is “long” or “short” depends on the deferred leg. Web the short diagonal calendar put spread is one of two types of short calendar spreads utilizing only put options. Follow me on twitter @cboesib Web the diagonal spread is a popular options trading strategy that involves the simultaneous purchase and sale of. Web a diagonal spread is an options trading strategy that combines the vertical nature of different strike selections in a vertical spread, with the horizontal nature of. Buy 1 out of the money back month call, at a higher month strike price. A long diagonal is long the deferred month and short the near month. Web the following rules should be adhered to when using the calendar/diagonal spread strategy: Web the diagonal calendar put spread, also known as the put diagonal calendar spread, is a neutral options strategy that profits. Web a diagonal spread is similar to a calendar spread with the only difference being that the strikes are different. A short diagonal is short the deferred expiration date. One page year at a. Web the istanbul diagonal calendar strategy is one of the most profitable of the seven deadly strategies series. Web a call diagonal spread is a combination of a call credit spread and a call calendar spread. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short.kthwow calendar spread, diagonal spread, box spread

Diagonal Call Calendar Spread Smart Trading

Options Trading Made Easy Diagonal Spread

Calendar Diagonal Option Spread [Why FB]? YouTube

Trading Calendar and Diagonal Spreads l Options Trading YouTube

Diagonal Spread Options Trading Strategy In Python

Glossary Archive Tackle Trading

Glossary Diagonal Put Calendar Spread example Tackle Trading

What is a Diagonal Put Calendar Spread YouTube

Case Study Goldman Sachs Double Calendar and Double Diagonal

Related Post:

![Calendar Diagonal Option Spread [Why FB]? YouTube](https://i.ytimg.com/vi/qjfTMDLcmew/maxresdefault.jpg)