Double Calendar Spread Option Strategy

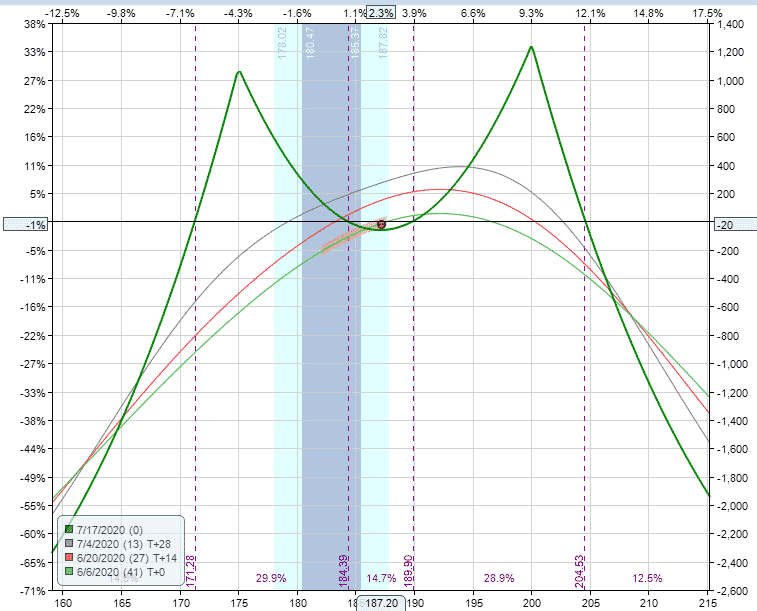

Double Calendar Spread Option Strategy - When you trade basic options strategies—individual calls and puts, vertical spreads, and even straddles and strangles—volatility (vol) and time decay ( theta) are locked in a tug of war. Web a double calendar spread is one of these strategies. Web a double calendar spread is a trading strategy used to exploit time differences in the volatility of an. Puts and calls options come in two basic forms, both of which are used in a double calendar. Web a calendar spread is an options trading strategy that involves buying and selling two options with the same strike. Web key takeaways there are many options strategies available to help reduce the risk of market volatility; The double calendar spread normally. Set take profit level after earnings shifts in the expiration line step 3: Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. How and when to set up a double calendar. Web a double calendar spread is a trading strategy used to exploit time differences in the volatility of an. Web the double calendar spread and the double diagonal spread are two popular option trading strategies with the. The usual setup is to sell the front. Web strategy overview a double diagonal spread is made up of a diagonal call spread. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. How and when to set up a double calendar. It is a fairly advanced option. When you trade basic options strategies—individual calls and puts, vertical spreads, and even straddles and strangles—volatility (vol) and time. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. Web the double calendar spread and the double diagonal spread are two popular option trading strategies with the. Web strategy overview a double diagonal spread is made up of a diagonal call spread and a diagonal. The usual setup is to sell the front. Setting up a double calendar. Web the stock market double calendar spread strategy is a very safe options trading strategy which profits. Web strategy overview a double diagonal spread is made up of a diagonal call spread and a diagonal put spread. Web double calendar spreads are a short vol play and. Web option trading strategy: Web the double calendar is a combination of two calendar spreads. Web what is a calendar spread? How and when to set up a double calendar. It is a fairly advanced option. One put and one call. The double calendar spread normally. Web the double calendar spread and the double diagonal spread are two popular option trading strategies with the. When you trade basic options strategies—individual calls and puts, vertical spreads, and even straddles and strangles—volatility (vol) and time decay ( theta) are locked in a tug of war. Web key takeaways. Web the stock market double calendar spread strategy is a very safe options trading strategy which profits. The usual setup is to sell the front. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. When you trade basic options strategies—individual calls and puts, vertical spreads, and even straddles and strangles—volatility (vol). It is a fairly advanced option. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. The double calendar spread normally. Initiate the double calendar step 2: Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. The double calendar spread normally. Web the double calendar spread and the double diagonal spread are two popular option trading strategies with the. Web the double calendar is a combination of two calendar spreads. Puts and. A calendar spread is a strategy used in options and futures trading: Web a double calendar spread is a trading strategy used to exploit time differences in the volatility of an. Web a calendar spread is an options trading strategy that involves buying and selling two options with the same strike. The usual setup is to sell the front. Web. When you trade basic options strategies—individual calls and puts, vertical spreads, and even straddles and strangles—volatility (vol) and time decay ( theta) are locked in a tug of war. Web double calendar spreads are a short vol play and are typically used around earnings to take advantage of a vol crush. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. Web a calendar spread is an options trading strategy that involves buying and selling two options with the same strike. Web a double calendar spread is one of these strategies. It’s sasha evdakov founder of rise2learn and in this. The double calendar spread normally. How and when to set up a double calendar. Web a double calendar spread is a trading strategy used to exploit time differences in the volatility of an. Setting up a double calendar. Web the stock market double calendar spread strategy is a very safe options trading strategy which profits. Web the double calendar spread and the double diagonal spread are two popular option trading strategies with the. Initiate the double calendar step 2: Set take profit level after earnings shifts in the expiration line step 3: Web key takeaways there are many options strategies available to help reduce the risk of market volatility; In our sample, we’ll look at selling a weekly option about. Web the double calendar is a combination of two calendar spreads. Web what is a calendar spread? A calendar spread is a strategy used in options and futures trading: One put and one call.Pin on CALENDAR SPREADS OPTIONS

Double Calendar Spreads Ultimate Guide With Examples

Pin on Calendar Spreads Options

Pin on CALENDAR SPREADS OPTIONS

Pin on Calendar Spreads Options

Option expiry trading strategy (Double calendar spread) no direction

Pin on CALENDAR SPREADS OPTIONS

Pin on CALENDAR SPREADS OPTIONS

Pin on CALENDAR SPREADS OPTIONS

Pin on CALENDAR SPREADS OPTIONS

Related Post: