Double Calendar Spread Weekly Options

Double Calendar Spread Weekly Options - And with weekly options (not monthly expiration) comes. Learn how theta and vega can give your. Web a double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike. A double calendar has two peaks or price points. Understand when it may be better to set up a double calendar spread. Web like the single calendar, the double calendar is designed to benefit from an increase in implied volatility (iv). Web explore our expanded education library. Web for some option traders, double calendar spreads are one substitute strategy to consider for iron condors. Understand when it may be better to set up a double calendar spread. Learn how theta and vega can give your. Web explore our expanded education library. And with weekly options (not monthly expiration) comes. Web for some option traders, double calendar spreads are one substitute strategy to consider for iron condors. Understand when it may be better to set up a double calendar spread. Web a double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike. Learn how theta and vega can give your. Web like the single calendar, the double calendar is designed. Web a double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike. Web like the single calendar, the double calendar is designed to benefit from an increase in implied volatility (iv). And with weekly options (not monthly expiration) comes. A double calendar has. Web a double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike. And with weekly options (not monthly expiration) comes. Web like the single calendar, the double calendar is designed to benefit from an increase in implied volatility (iv). Web for some option. Web explore our expanded education library. Web for some option traders, double calendar spreads are one substitute strategy to consider for iron condors. Web a double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike. Understand when it may be better to set. Web a double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike. Web for some option traders, double calendar spreads are one substitute strategy to consider for iron condors. A double calendar has two peaks or price points. And with weekly options (not. Web for some option traders, double calendar spreads are one substitute strategy to consider for iron condors. Web a double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike. Understand when it may be better to set up a double calendar spread. Web. Learn how theta and vega can give your. And with weekly options (not monthly expiration) comes. A double calendar has two peaks or price points. Understand when it may be better to set up a double calendar spread. Web for some option traders, double calendar spreads are one substitute strategy to consider for iron condors. Web like the single calendar, the double calendar is designed to benefit from an increase in implied volatility (iv). A double calendar has two peaks or price points. Web explore our expanded education library. Understand when it may be better to set up a double calendar spread. Learn how theta and vega can give your. And with weekly options (not monthly expiration) comes. Understand when it may be better to set up a double calendar spread. Learn how theta and vega can give your. Web explore our expanded education library. Web like the single calendar, the double calendar is designed to benefit from an increase in implied volatility (iv). A double calendar has two peaks or price points. Understand when it may be better to set up a double calendar spread. And with weekly options (not monthly expiration) comes. Web for some option traders, double calendar spreads are one substitute strategy to consider for iron condors. Web a double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike. Web explore our expanded education library. Web like the single calendar, the double calendar is designed to benefit from an increase in implied volatility (iv). Learn how theta and vega can give your.Pin on CALENDAR SPREADS OPTIONS

Pin on Double Calendar Spreads and Adjustments

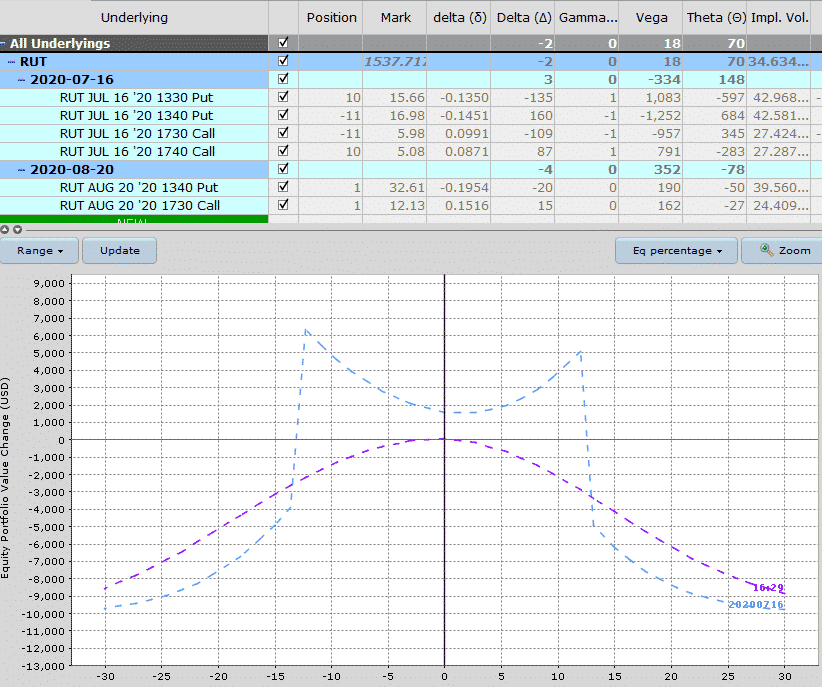

Setting up a Double Calendar on thinkorswim Weekly Options Course

Double Calendar Spreads Ultimate Guide With Examples

Pin on CALENDAR SPREADS OPTIONS

Pin on Double Calendar Spreads and Adjustments

Pin on Double Calendar Spreads and Adjustments

Double Calendar Spread Weekly Options CALNDA

Double Calendar Spread Weekly Options CALNDA

Pin on CALENDAR SPREADS OPTIONS

Related Post: