Double Calendar Spreads

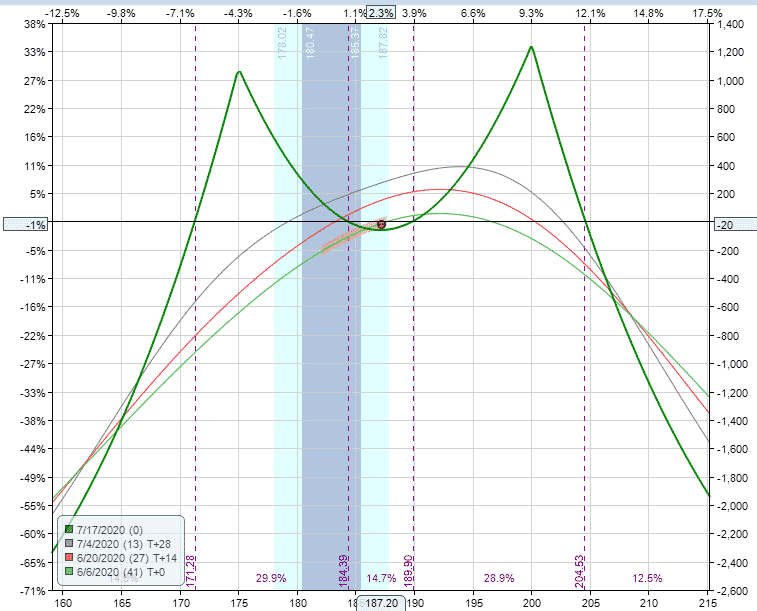

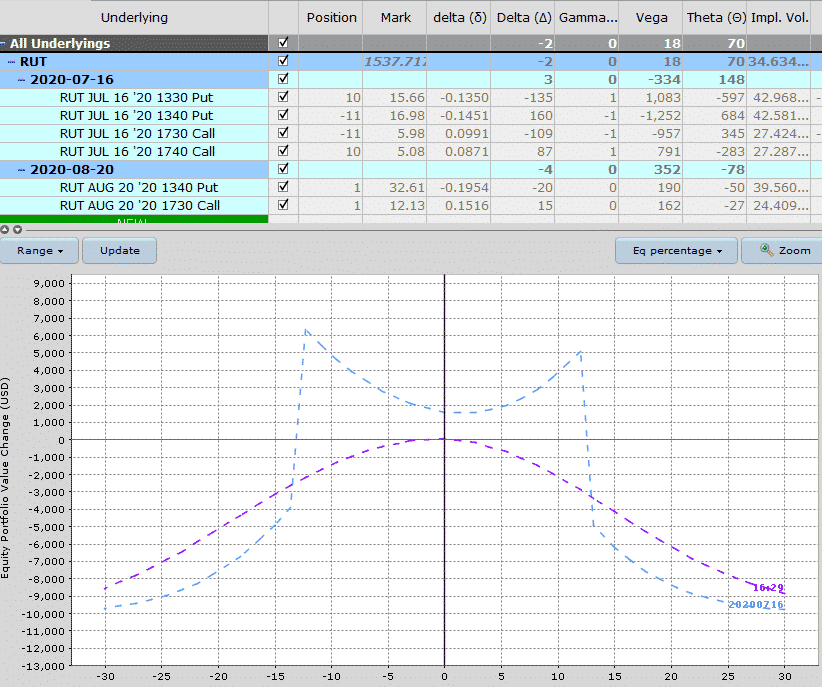

Double Calendar Spreads - Calendar spreads are created by buying an option in a future. And with weekly options (not monthly expiration) comes the additional opportunity to design a double calendar spread that allows for a quick response to changing market conditions. Web updated february 13, 2021 reviewed by gordon scott what is a calendar spread? While this spread is fairly advanced, it’s also relatively easy to understand once you’re able to look at its inner workings. Initiate the double calendar step 2: Web a calendar spread is a strategy used in options and futures trading: Web understand when it may be better to set up a double calendar spread; Web calendar spreads in futures and options trading explained. The usual setup is to sell the front. Learn how theta and vega can give your calendar and double calendar spread a boost; It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Web frontier communications is considering moving its headquarters from norwalk, connecticut, to either texas or. Web summary this chapter explains calendar and double calendar spreads. Web for some option traders, double calendar spreads are. Initiate the double calendar step 2: Learn how theta and vega can give your calendar and double calendar spread a boost; Set take profit level after earnings shifts in the expiration line step. While this spread is fairly advanced, it’s also relatively easy to understand once you’re able to look at its inner workings. Web updated february 13, 2021 reviewed. It involves selling near expiry calls and puts and buying further. Web the stock market double calendar spread strategy is a very safe options trading strategy which profits. Web summary this chapter explains calendar and double calendar spreads. While this spread is fairly advanced, it’s also relatively easy to understand once you’re able to look at its inner workings. Web. Web the stock market double calendar spread strategy is a very safe options trading strategy which profits. Web a double calendar spread is a trading strategy used to exploit time differences in the volatility of an underlying asset. A calendar spread is an options or. Web as the name suggests, a double calendar spread is created by using two calendar. And with weekly options (not monthly expiration) comes the additional opportunity to design a double calendar spread that allows for a quick response to changing market conditions. Web the double calendar spread is essentially two calendar spreads. Here’s what you need to know about double calendar spreads and how they are used in options trading. Web a calendar spread is. I try to set up my double calendars with about a 70%. Web the stock market double calendar spread strategy is a very safe options trading strategy which profits. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Know how to strategize and. And with weekly options (not monthly expiration) comes the additional opportunity to design a double calendar spread that allows for a quick response to changing market conditions. Web understand when it may be better to set up a double calendar spread; Web a calendar spread is an option trade that involves buying and selling an option on the same instrument. Web updated february 13, 2021 reviewed by gordon scott what is a calendar spread? Web 19 subscribers subscribe 506 views 8 months ago in this video i will be going over double calendar spreads which. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical. Web as the name suggests, a double calendar spread is created by using two calendar spreads. And with weekly options (not monthly expiration) comes the additional opportunity to design a double calendar spread that allows for a quick response to changing market conditions. A calendar spread is an options or. The usual setup is to sell the front. Web frontier. I try to set up my double calendars with about a 70%. Web double calendar spreads are a short vol play and are typically used around earnings to take advantage of a vol crush. Web there are two types of long calendar spreads: And with weekly options (not monthly expiration) comes the additional opportunity to design a double calendar spread. Web note that the double calendar is just a double diagonal with spread width = 0, so it's a continuous spectrum between really wide. Here’s what you need to know about double calendar spreads and how they are used in options trading. Web for some option traders, double calendar spreads are one substitute strategy to consider for iron condors. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Set take profit level after earnings shifts in the expiration line step. And with weekly options (not monthly expiration) comes the additional opportunity to design a double calendar spread that allows for a quick response to changing market conditions. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. I try to set up my double calendars with about a 70%. Web calendar spreads in futures and options trading explained. Web the stock market double calendar spread strategy is a very safe options trading strategy which profits. Web the double calendar spread is essentially two calendar spreads. Web updated february 13, 2021 reviewed by gordon scott what is a calendar spread? Web summary this chapter explains calendar and double calendar spreads. There are inherent advantages to trading a put calendar over a call calendar, but both are. Web understand when it may be better to set up a double calendar spread; Web there are two types of long calendar spreads: The double calendar is a combination of two calendar spreads. Initiate the double calendar step 2: Web a calendar spread is a strategy used in options and futures trading: Web a double calendar spread is a trading strategy used to exploit time differences in the volatility of an underlying asset.Pin on Double Calendar Spreads and Adjustments

Pin on Double Calendar Spreads and Adjustments

Pin on CALENDAR SPREADS OPTIONS

Pin on Double Calendar Spreads and Adjustments

Pin on Calendar Spreads Options

Pin on Double Calendar Spreads and Adjustments

Double Calendar Spreads Ultimate Guide With Examples

Pin on CALENDAR SPREADS OPTIONS

Double Calendar Spreads Ultimate Guide With Examples

Pin on CALENDAR SPREADS OPTIONS

Related Post: