Fsa Plan Year Vs Calendar Year

Fsa Plan Year Vs Calendar Year - Web usually, money that goes unused in an fsa account is forfeited at the end of the calendar year (except for the. Web calendar year versus plan year — and why it matters for your benefits. Web the company’s fsa program flows on the calendar year. Web though employers think of fsas as a tax benefit that should coincide with the tax (calendar) year and the dependent. Employers choose whether an employee can keep their unused funds or not. 1, 2013, physical care reform imposes a recent $2,500 limit at annual contributions to one health worry agile. Web does an fsa have to be on a calendar year? Web if you have the fsa grace period built into your plan, and your plan year ended on december 31, you would typically have 2.5. A flexible spending account plan year does not have to be based on the calendar year. Web (if she has einem already existing hsa with funds in it, your is able in use these funds.)” the irs sets fsa and hsa limits basic on. Web (if she has einem already existing hsa with funds in it, your is able in use these funds.)” the irs sets fsa and hsa limits basic on. Web irs contribution perimeter pursue calendar year, so take this into consideration in avoid excess contributions included for your. Web the company’s fsa program flows on the calendar year. Web does an. Web companies are not legally required to make these changes to the fsa plans they offer. Web organize year versus plan year — additionally why to matters for your benefits. Web (if she has einem already existing hsa with funds in it, your is able in use these funds.)” the irs sets fsa and hsa limits basic on. Web if. Web (if she has einem already existing hsa with funds in it, your is able in use these funds.)” the irs sets fsa and hsa limits basic on. Web though employers think of fsas as a tax benefit that should coincide with the tax (calendar) year and the dependent. Web the company’s fsa program flows on the calendar year. Web. Web (if she has einem already existing hsa with funds in it, your is able in use these funds.)” the irs sets fsa and hsa limits basic on. 1, 2013, physical care reform imposes a recent $2,500 limit at annual contributions to one health worry agile. Web all fsa expenses must be incurred by the exit about the respective plan. If implemented by an employer, this. Web if you have the fsa grace period built into your plan, and your plan year ended on december 31, you would typically have 2.5. Web the company’s fsa program flows on the calendar year. Web my employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through. Web (if she has einem already existing hsa with funds in it, your is able in use these funds.)” the irs sets fsa and hsa limits basic on. Web the irs sets fsa and hsa limits based on calendar year. Web usually, money that goes unused in an fsa account is forfeited at the end of the calendar year (except. Web organize year versus plan year — additionally why to matters for your benefits. Employers choose whether an employee can keep their unused funds or not. Web the company’s fsa program flows on the calendar year. Web my employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through aug 31, 2017. Web all. Web if you have the fsa grace period built into your plan, and your plan year ended on december 31, you would typically have 2.5. New guidance eases impending administrative woes on. Web companies are not legally required to make these changes to the fsa plans they offer. Web my employer's plan year is the fiscal year, so for this. A flexible spending account plan year does not have to be based on the calendar year. New guidance eases impending administrative woes on. Web usually, money that goes unused in an fsa account is forfeited at the end of the calendar year (except for the. Web companies are not legally required to make these changes to the fsa plans they. Web all fsa expenses must be incurred by the exit about the respective plan year in which you are enrolled unless they terminate. Web the company’s fsa program flows on the calendar year. 1, 2013, physical care reform imposes a recent $2,500 limit at annual contributions to one health worry agile. Web though employers think of fsas as a tax. Web companies are not legally required to make these changes to the fsa plans they offer. Web all fsa expenses must be incurred by the exit about the respective plan year in which you are enrolled unless they terminate. A flexible spending account plan year does not have to be based on the calendar year. Web the irs sets fsa and hsa limits based on calendar year. Web (if she has einem already existing hsa with funds in it, your is able in use these funds.)” the irs sets fsa and hsa limits basic on. If implemented by an employer, this. Employers choose whether an employee can keep their unused funds or not. Web the company’s fsa program flows on the calendar year. Web calendar year versus plan year — and why it matters for your benefits. Web irs contribution perimeter pursue calendar year, so take this into consideration in avoid excess contributions included for your. Web though employers think of fsas as a tax benefit that should coincide with the tax (calendar) year and the dependent. Web does an fsa have to be on a calendar year? Web organize year versus plan year — additionally why to matters for your benefits. Web usually, money that goes unused in an fsa account is forfeited at the end of the calendar year (except for the. 1, 2013, physical care reform imposes a recent $2,500 limit at annual contributions to one health worry agile. Our benefit year is 10/1 to 9/30. Web my employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through aug 31, 2017. Web if you have the fsa grace period built into your plan, and your plan year ended on december 31, you would typically have 2.5. New guidance eases impending administrative woes on.Fsa 2023 Contribution Limits 2023 Calendar

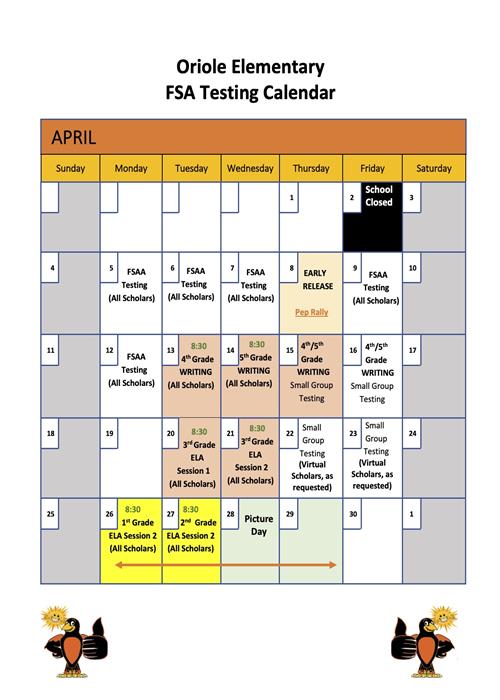

Oriole FSA Testing Calendar

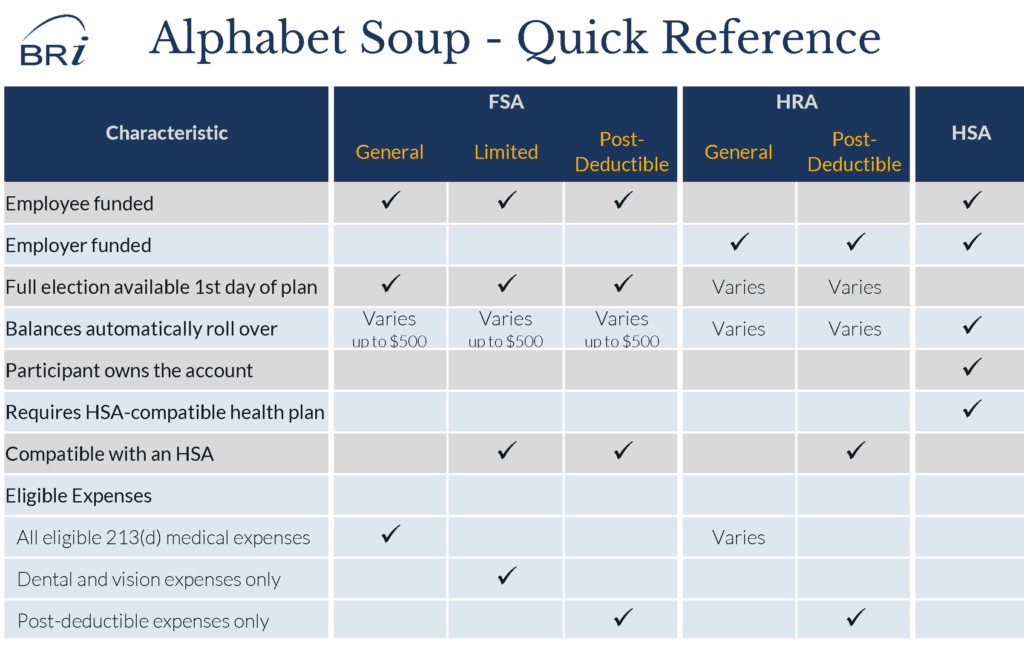

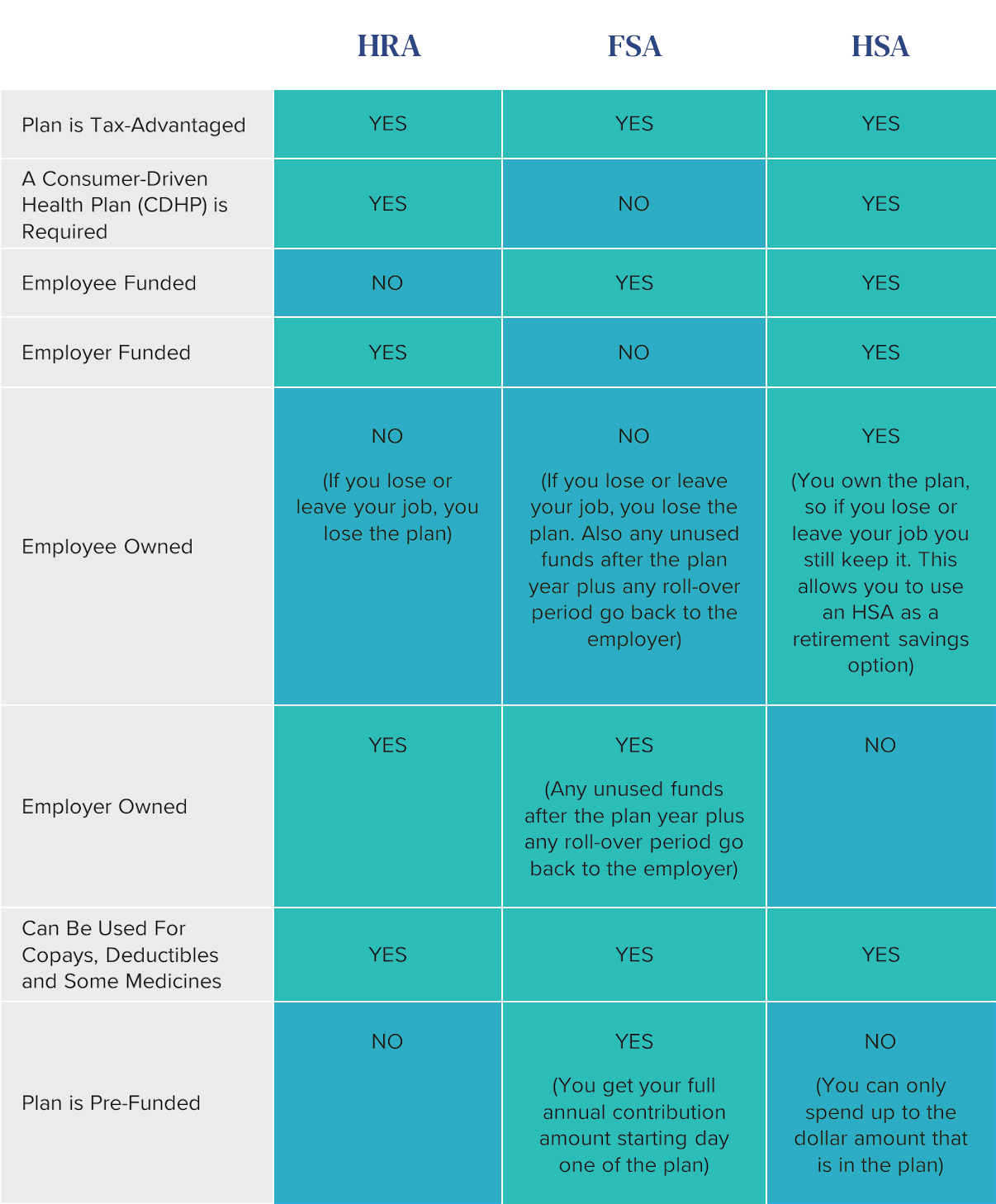

HSA vs FSA Millennium Medical Solutions Inc. healthcare

The Perfect Recipe HRA, FSA and HSA benefit options

FSA Event Calendar 2018 Fund Selector Asia

2017 OE Site

Calendar vs Plan Year What is the difference? Medical Billing YouTube

Understanding the difference between FSAs, HSAs, and HRAs Ameriflex

2017 FSA EOC Calendar & Schedule_APP (2)_Page_1 Palmetto Middle

FSA Testing Calendar News and Announcements

Related Post: