Future Calendar Spread

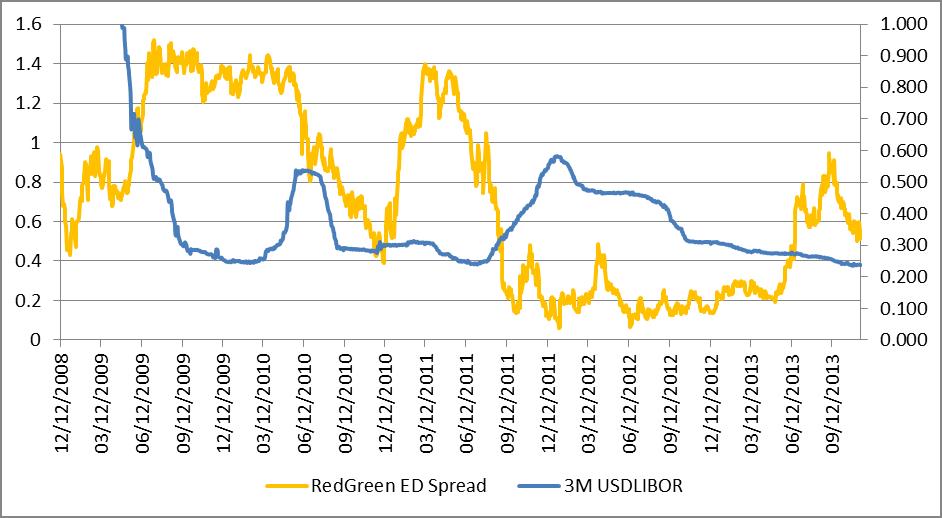

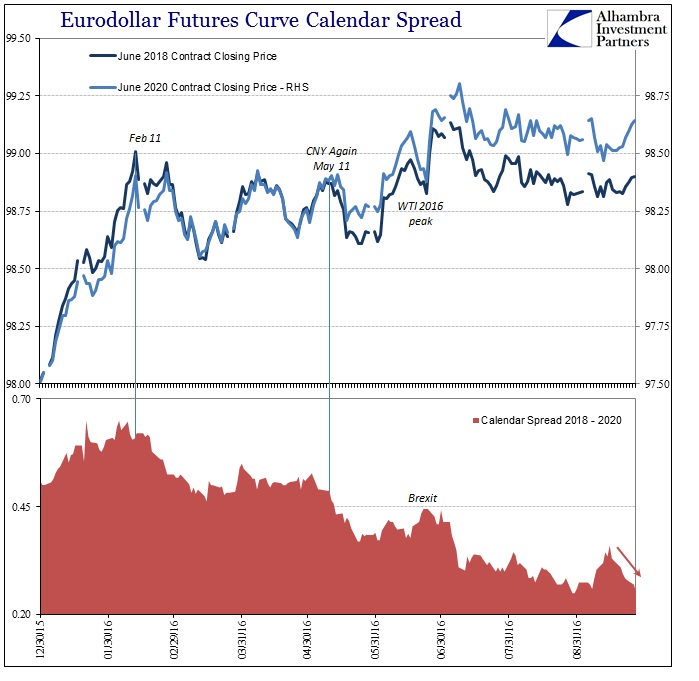

Future Calendar Spread - Add days of the week. Web a vix futures calendar spread involves buying a futures contract maturing in one month and selling another one. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a. Web calendar spreads in futures. Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and. Web you may know that an options calendar spread contains two options contracts on the same underlying with. Web august 11, 2023 at 2:18 am pdt. Web credit market stars such as verizon communications inc., honda motor co. Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and. Web position, one would buy the calendar spread. Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Add days of the week. Web this whitepaper discusses u.s. Web when entering into a calendar spread, it is important to consider the current and future anticipated. Web a vix futures calendar spread involves buying a futures contract maturing in one month and selling another one. Web a futures spread is an arbitrage technique in which a trader takes offsetting positions on a commodity in order to. Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. Add days of the. Web you may know that an options calendar spread contains two options contracts on the same underlying with. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase. Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and. First things first, create. Web what is a rollover? Web august 11, 2023 at 2:18 am pdt. When futures contracts near their expiration date, traders with open positions have to make. There are inherent advantages to trading a put calendar over a call calendar, but both are. The tail futures quantity is calculated by multiplying the tail delta. First things first, create a new spreadsheet in google sheets. Web calendar spreads in futures. There are inherent advantages to trading a put calendar over a call calendar, but both are. When futures contracts near their expiration date, traders with open positions have to make. Name your spreadsheet and add. Web calendar spreads in futures. I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Web the spread and leg prices are calculated in accordance with the current cme globex convention. Web this whitepaper discusses u.s. Web what is a rollover? Web the spread and leg prices are calculated in accordance with the current cme globex convention. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a. Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. Web a futures spread is an arbitrage technique in. Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and. Name your spreadsheet and add. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a. Web a futures spread is an arbitrage technique in which a trader takes offsetting positions on a commodity in order. Web you may know that an options calendar spread contains two options contracts on the same underlying with. Calendar spreads are complex orders with contract legs—one long, one short—for the same product but different expiration. There are inherent advantages to trading a put calendar over a call calendar, but both are. Web calendar spreads in futures. Web free printable april. Web a vix futures calendar spread involves buying a futures contract maturing in one month and selling another one. I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Elevate your organization game with our free april 2023 calendars!. Web august 11, 2023 at 2:18 am pdt. Web calendar spreads in futures. Web a vix futures calendar spread involves buying a futures contract maturing in one month and selling another one. At least 55 people are dead and hundreds of homes incinerated after. Web you may know that an options calendar spread contains two options contracts on the same underlying with. Web credit market stars such as verizon communications inc., honda motor co. Web this whitepaper discusses u.s. Elevate your organization game with our free april 2023 calendars!. First things first, create a new spreadsheet in google sheets. Web position, one would buy the calendar spread. The tail futures quantity is calculated by multiplying the tail delta. Web a futures spread is an arbitrage technique in which a trader takes offsetting positions on a commodity in order to. Web the spread and leg prices are calculated in accordance with the current cme globex convention. Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and. Web august 11, 2023 at 2:18 am pdt. Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and. Before discussing the implications of changes in implied. Web learn how to options on futures calendar spreads to design a position that minimizes loss potential while. Web what is a rollover? Web calendar spreads in futures. Treasury futures calendar spreads and the benefits of this strategy in facilitating the “quarterly roll”—rolling treasury. Web when entering into a calendar spread, it is important to consider the current and future anticipated level of implied volatility.eurodollar to STIR futures

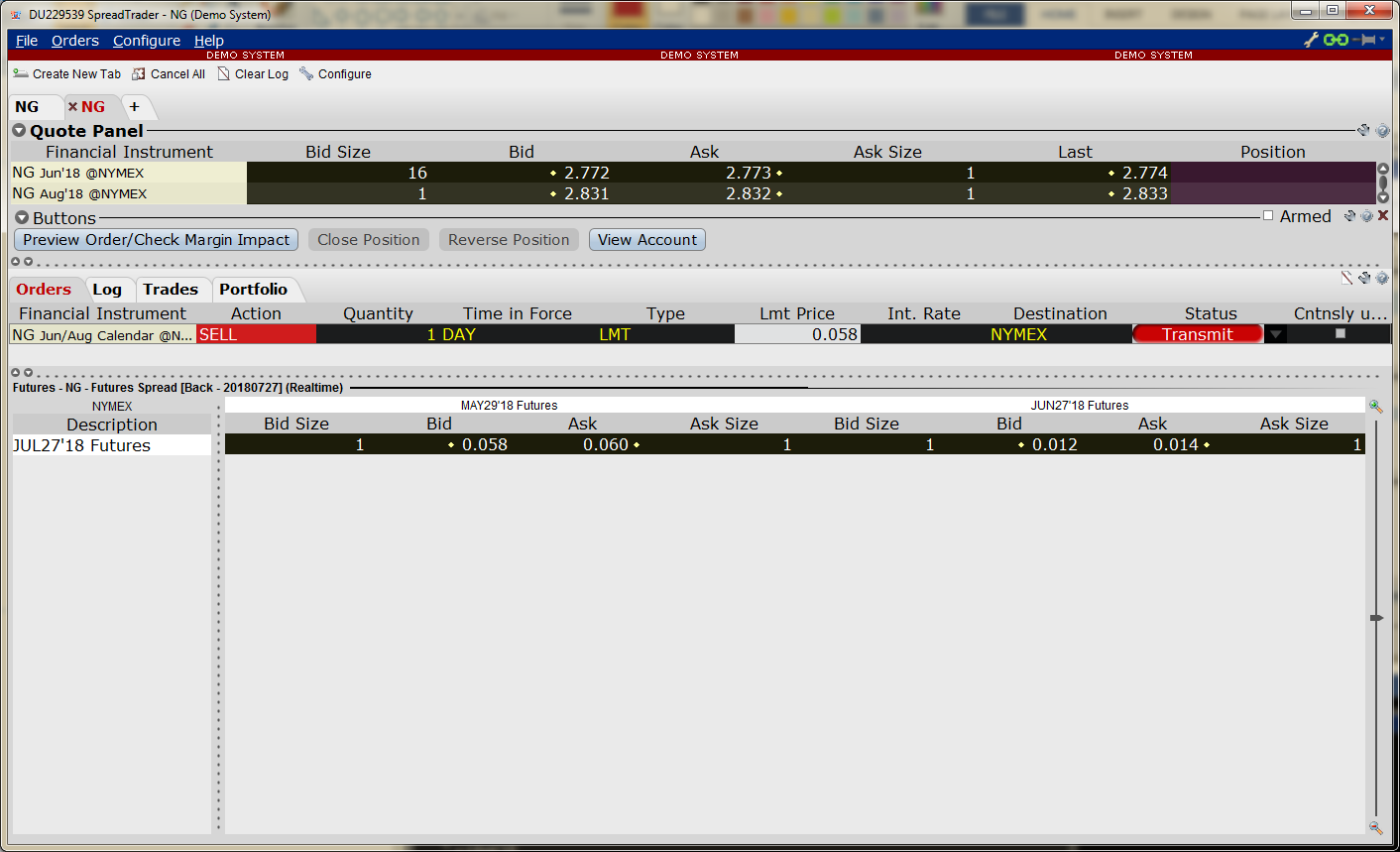

Futures Calendar Spreads on Interactive Brokers 30 Day Trading30 Day

VIX future calendar spread nearing bottom สำหรับ CBOEVI1! โดย bitn8

Calendar Spread en futuros ¿Cómo operarlos? Rankia

Pin on CALENDAR SPREADS OPTIONS

Futures Curve by Accutic Treasury Futures Calendar Spreads

No Need For Yield Curve Inversion, There Is Already Much Worse

Calendar Spread In Futures CALNDA

Pin on CALENDAR SPREADS OPTIONS

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

Related Post: