How To Trade Calendar Spreads

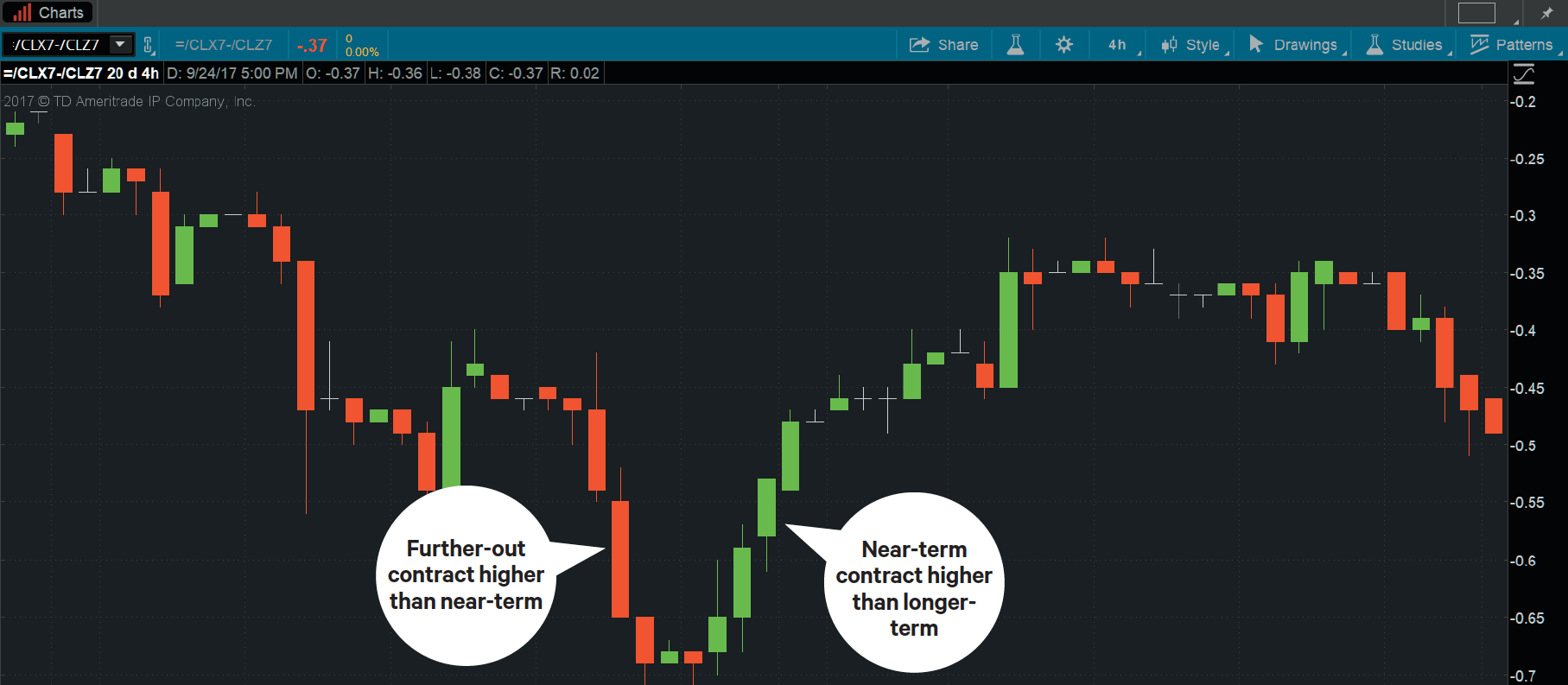

How To Trade Calendar Spreads - The simple definition of a calendar spread is that it is basically an options spread that involves. In this episode, i walk through setting up and building. Web here are three options strategies for exiting a trade: Options trading last updated on february 28th, 2022 , 02:36 pm the. For this outlook, market participants can consider the calendar spread. Web how do i sell calendar spreads? Expecting a stock to trade sideways for the foreseeable future? Long options, vertical spreads, and calendar spreads. Web calendar spreads and how to trade a calendar spread the right way. It is not, and should not be considered, individualized advice or a recommendation. Expecting a stock to trade sideways for the foreseeable future? It is not, and should not be considered, individualized advice or a recommendation. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. Sell a straddle or strangle. Web to set up a call calendar spread,. Web here are three options strategies for exiting a trade: Web a calendar spread is defined as an investment strategy for derivative contracts in which the investor buys and. Web to set up a call calendar spread, select the underlying crypto you want to trade using the highlighted menu from the “predefined. Take our advanced options course:. Web trading option. Web a calendar spread allows option traders to take advantage of elevated premium in near term options with a. Options trading last updated on february 28th, 2022 , 02:36 pm the. Web key points to trading calendar spreads how to find bullish calendar spread entry points? Web here are three options strategies for exiting a trade: For this outlook, market. Web calendar spreads and how to trade a calendar spread the right way. Learn the strategy, roll decision, and risks by ticker tape editors february 14, 2023 5 min read photo by td ameritrade the following, like all our strategy discussions, is strictly for educational purposes only. Web trading calendar spreads: Web how to trade options calendar spreads: Web a. Web trading option calendar spreads being long a calendar spread consists of a selling an option in a near. What is a calendar spread option? Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. Buying a futures contract for a certain grain in one month. But what if one expects a calm market for several weeks, followed by a sharp increase in market volatility? Web key points to trading calendar spreads how to find bullish calendar spread entry points? Buying a futures contract for a certain grain in one month and selling. Web here are three options strategies for exiting a trade: Learn the strategy,. Web explanation of calendar spreads. Web trading calendar spreads: Learn the strategy, roll decision, and risks by ticker tape editors february 14, 2023 5 min read photo by td ameritrade the following, like all our strategy discussions, is strictly for educational purposes only. This is your complete guide to calendar spreads. Web a calendar spread allows option traders to take. This is your complete guide to calendar spreads. Take our advanced options course:. For this outlook, market participants can consider the calendar spread. Web the calendar spread is a great beginner's options trading strategy because it involves limited risk and can be executed with smaller amounts of. Web how do i sell calendar spreads? The simple definition of a calendar spread is that it is basically an options spread that involves. Web the calendar spread is a great beginner's options trading strategy because it involves limited risk and can be executed with smaller amounts of. Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. Web how to. Web a calendar spread allows option traders to take advantage of elevated premium in near term options with a. Expecting a stock to trade sideways for the foreseeable future? Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. Web explanation of calendar spreads. The simple definition of a calendar spread is that it. Web a calendar spread allows option traders to take advantage of elevated premium in near term options with a. Learn the strategy, roll decision, and risks by ticker tape editors february 14, 2023 5 min read photo by td ameritrade the following, like all our strategy discussions, is strictly for educational purposes only. Web calendar spreads and how to trade a calendar spread the right way. Buying a futures contract for a certain grain in one month and selling. Web trading calendar spreads: Web explanation of calendar spreads. Web here are three options strategies for exiting a trade: Web trading option calendar spreads being long a calendar spread consists of a selling an option in a near. Web buy a call or sell a put. The simple definition of a calendar spread is that it is basically an options spread that involves. Web to set up a call calendar spread, select the underlying crypto you want to trade using the highlighted menu from the “predefined. For this outlook, market participants can consider the calendar spread. It is not, and should not be considered, individualized advice or a recommendation. To sell a calendar spread, you need to have a trading account with an options. Web a calendar spread is defined as an investment strategy for derivative contracts in which the investor buys and. Sell a straddle or strangle. Options trading last updated on february 28th, 2022 , 02:36 pm the. Web how to trade options calendar spreads: Web some tips for trading calendar spreads include choosing the right strike price, selecting options with appropriate expiration dates,. Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product.The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

Dollar vs. World Turn Down the Noise, Hear the Marke... Ticker Tape

Calendar Spread Exit Strategy CALNDA

Pin on Calendar Spreads Options

How To Trade Calendar Spreads The Complete Guide

Trading an Options Calendar Spread for profit complete how to. YouTube

Pin on CALENDAR SPREADS OPTIONS

Pin on CALENDAR SPREADS OPTIONS

Pin on CALENDAR SPREADS OPTIONS

Pin on Option Trading Strategies

Related Post: