I Bond Limit Per Calendar Year

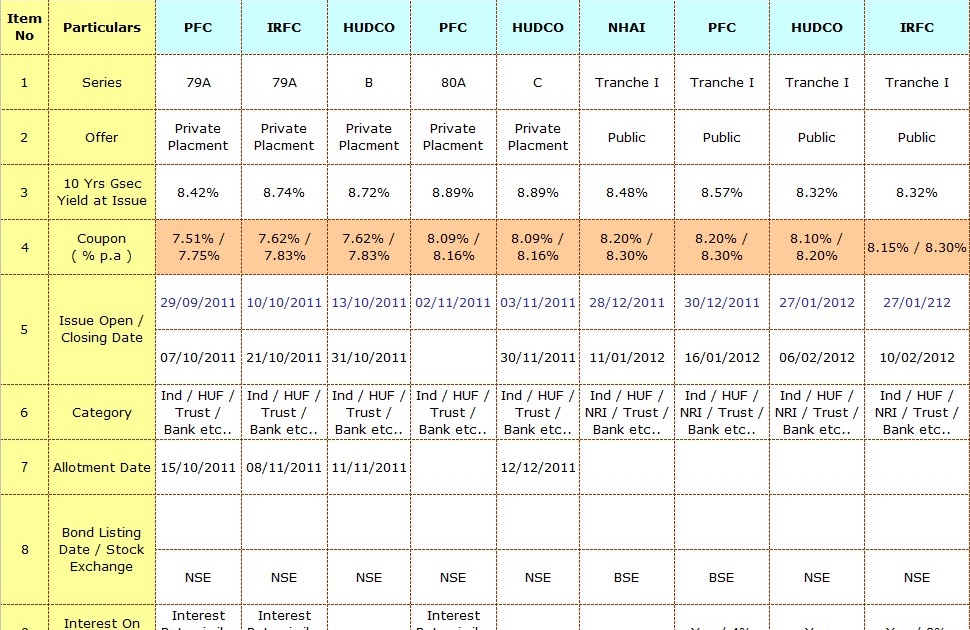

I Bond Limit Per Calendar Year - Web a given social security number or employer identification number can buy up to these amounts in savings bonds each calendar. Web as with an adult, the purchase limit for a child — including gifts received — is $10,000 per calendar year for electronic. Web for example, you could buy an i bond for $36.73. Web investments are limited to $10,000 per person per calendar year for electronic i bonds held at treasurydirect. Overpay your taxes you can buy an additional $5,000 in i bonds if you elect to get your tax refund in i bonds. You can only buy up to $15,000 worth of i bonds. $50, $100, $200, $500, or $1,000. Web there isn't a limit to the number of times you can purchase i bonds in a given year, but there are limits to how much you can spend on them per year. I understand there's a $10k/person + $5k/filing annual limit. Web the key downside has been that individuals are limited to buying $10,000 in series i bonds each year. $50, $100, $200, $500, or $1,000. There is also the option to get. Web the bond duration runs from one year to 30 years. Web paper i bonds have a minimum purchase amount of $50 and a maximum of $5,000 per calendar year. Web the limit for purchasing i bonds is per person, so a married couple can each put. Series i and ee bonds have annual electronic limits of $10,000 each and up to. Web you may purchase up to $10,000 each of electronic ee and i savings bonds, per person (individual or entity), each calendar year. Web what are the purchase limits? I understand there's a $10k/person + $5k/filing annual limit. Web rather, i bonds come with some. $10,000 per person every calendar year, plus an extra $5,000 in paper i bonds via your. Web investments are limited to $10,000 per person per calendar year for electronic i bonds held at treasurydirect. Web for example, you could buy an i bond for $36.73. Series i and ee bonds have annual electronic limits of $10,000 each and up to.. Web paper i bonds have a minimum purchase amount of $50 and a maximum of $5,000 per calendar year. Web the bond duration runs from one year to 30 years. Overpay your taxes you can buy an additional $5,000 in i bonds if you elect to get your tax refund in i bonds. Web the limit for purchasing i bonds. Web there isn't a limit to the number of times you can purchase i bonds in a given year, but there are limits to how much you can spend on them per year. Web you can only buy a maximum of $10,000 in i bonds per calendar year (though as little as $25), and they must be. Web for example,. Web each year, you only can buy up to $10,000 in electronic i bonds or $20,000 per married couple. Web the limit for purchasing i bonds is per person, so a married couple can each put up to $10,000 in the investment. Web what are the purchase limits? Web rather, i bonds come with some limitations, such as: Web the. Web the bond duration runs from one year to 30 years. Web a single entity can purchase up to $25,000 worth of savings bonds in a year. Web rather, i bonds come with some limitations, such as: Web in any one calendar year, you may buy up to $10,000 in series ee electronic savings bonds and up to $10,000 in. Web a given social security number or employer identification number can buy up to these amounts in savings bonds each calendar. Web as with an adult, the purchase limit for a child — including gifts received — is $10,000 per calendar year for electronic. Interest is paid on a monthly basis and compounds every six. Web the key downside has. Web rather, i bonds come with some limitations, such as: There is also the option to get. Web in any one calendar year, you may buy up to $10,000 in series ee electronic savings bonds and up to $10,000 in series. Web a given social security number or employer identification number can buy up to these amounts in savings bonds. Web you may purchase up to $10,000 each of electronic ee and i savings bonds, per person (individual or entity), each calendar year. Web for example, you could buy an i bond for $36.73. Web each year, you only can buy up to $10,000 in electronic i bonds or $20,000 per married couple. Web the limit for purchasing i bonds. I understand there's a $10k/person + $5k/filing annual limit. $50, $100, $200, $500, or $1,000. Series i savings bond is the purchase cap of. Web a given social security number or employer identification number can buy up to these amounts in savings bonds each calendar. $10,000 per person every calendar year, plus an extra $5,000 in paper i bonds via your. Web you may purchase up to $10,000 each of electronic ee and i savings bonds, per person (individual or entity), each calendar year. Web rather, i bonds come with some limitations, such as: Web paper i bonds have a minimum purchase amount of $50 and a maximum of $5,000 per calendar year. Series i bonds with issue dates prior to february 2003 became eligible for redemption six months from the issue. Web a single entity can purchase up to $25,000 worth of savings bonds in a year. There is also the option to get. Web the limit for purchasing i bonds is per person, so a married couple can each put up to $10,000 in the investment. Web there isn't a limit to the number of times you can purchase i bonds in a given year, but there are limits to how much you can spend on them per year. Web in any one calendar year, you may buy up to $10,000 in series ee electronic savings bonds and up to $10,000 in series. Web as with an adult, the purchase limit for a child — including gifts received — is $10,000 per calendar year for electronic. You can only buy up to $15,000 worth of i bonds. Overpay your taxes you can buy an additional $5,000 in i bonds if you elect to get your tax refund in i bonds. Web investments are limited to $10,000 per person per calendar year for electronic i bonds held at treasurydirect. Web the key downside has been that individuals are limited to buying $10,000 in series i bonds each year. Web what are the purchase limits?Jigisha Shah's World Tax Free Bonds Calendar 2011 2012

Is Us Savings Bond Interest Taxable

Bob Brinker Fan Club Blog New Series I Bond & EE Bonds Interest Rates

What Are the Series I Savings Bond Annual Purchase Limits?

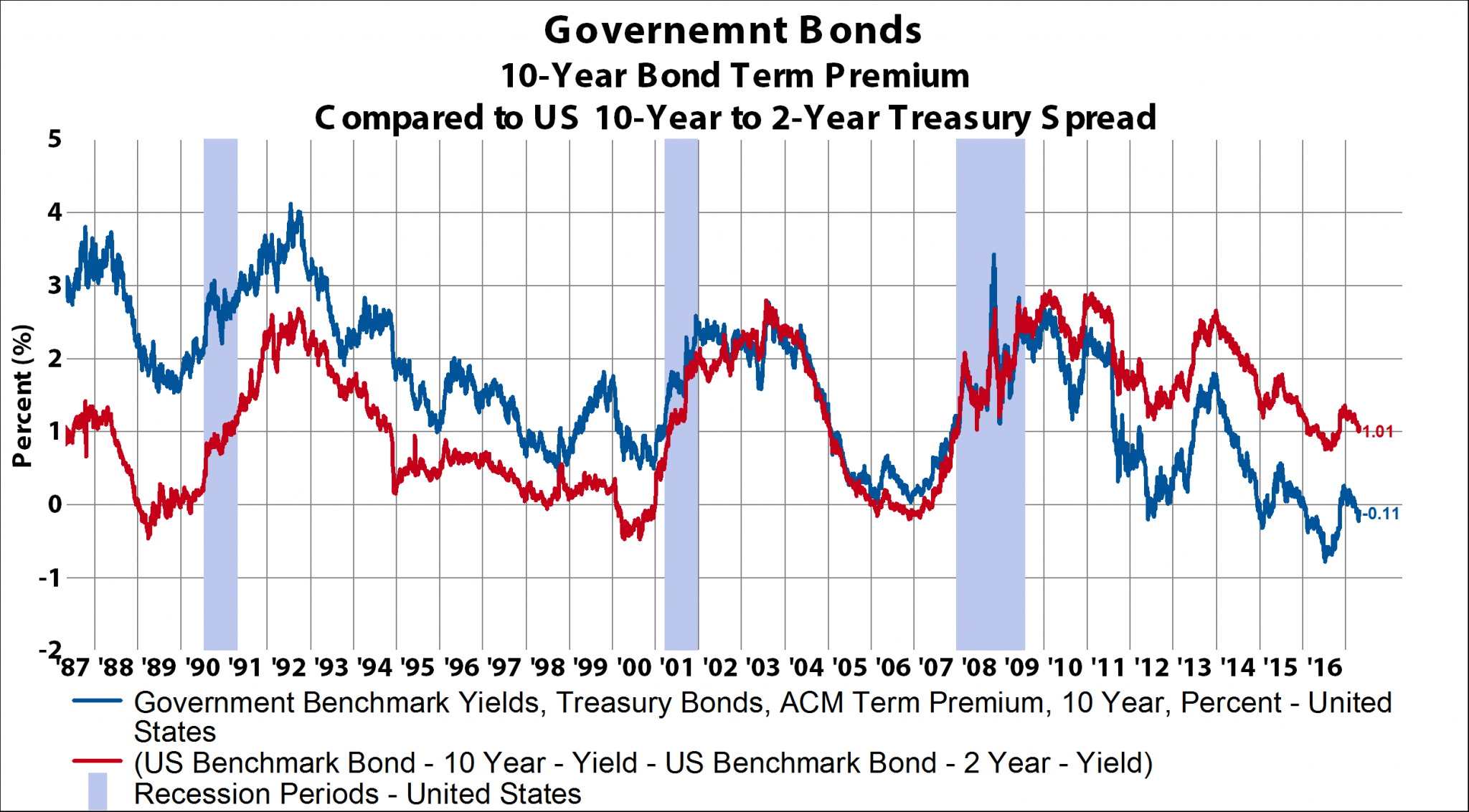

Credit Spreads Limit Bond Performance Outlook Wappingers Falls, NY

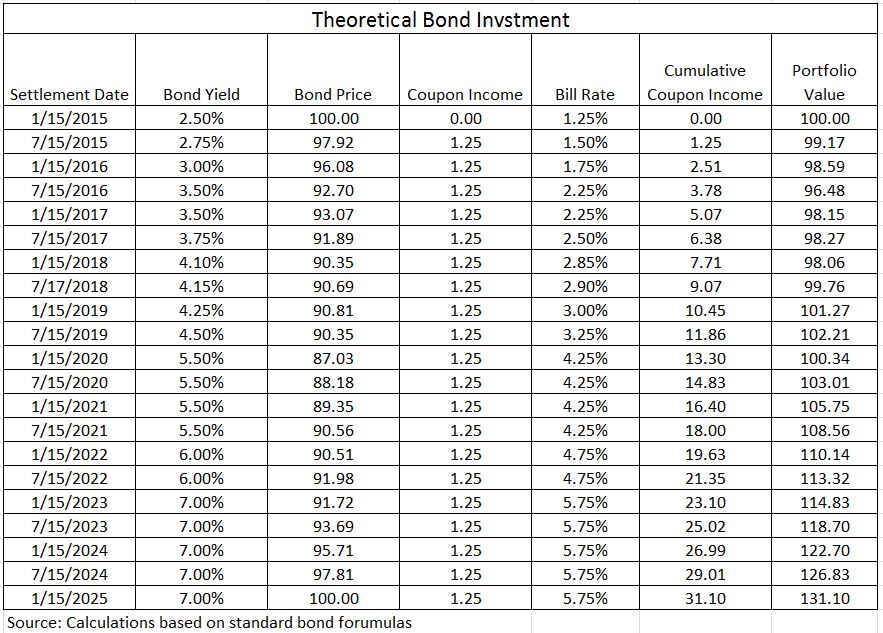

How to evaluate bonds? Part 1 Bond prices, interest rates, inflation

InflationAdjusted (Real) US Treasury Bond Yield, 19552019 — My Money Blog

An effective tool for investors bond ladders

Bonds in a Rising Interest Rate Environment David Blitzer says

A Complete Guide to Investing in I Bonds and TIPS (2023) Money for

Related Post:

/series-i-bond-annual-purchase-limits-58902ec85f9b5874eeb6dadb.jpg)