Long Calendar Spread

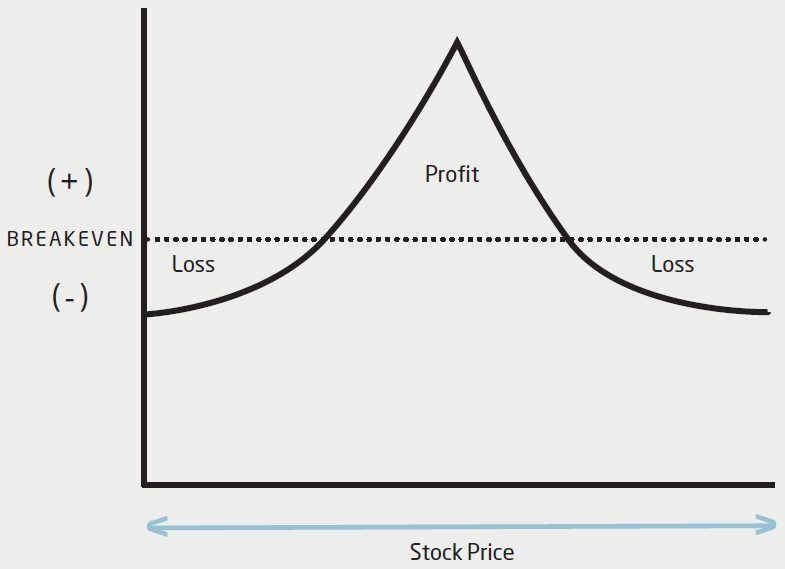

Long Calendar Spread - Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Depending on where the stock is relative. Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take advantage of near term time decay. Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take advantage of near term time decay. Depending on where the stock is relative. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates. Web a long calendar. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Depending on where the stock is relative. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. Depending on where the stock is relative. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web the objective for. Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take advantage of near term time decay. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web. Depending on where the stock is relative. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take. Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take advantage of near term time decay. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same. Depending on where the stock is relative. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates. Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration. Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take advantage of near term time decay. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates. Depending on where the stock is relative. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later.The Long Calendar Spread Explained 1 Options Trading Software

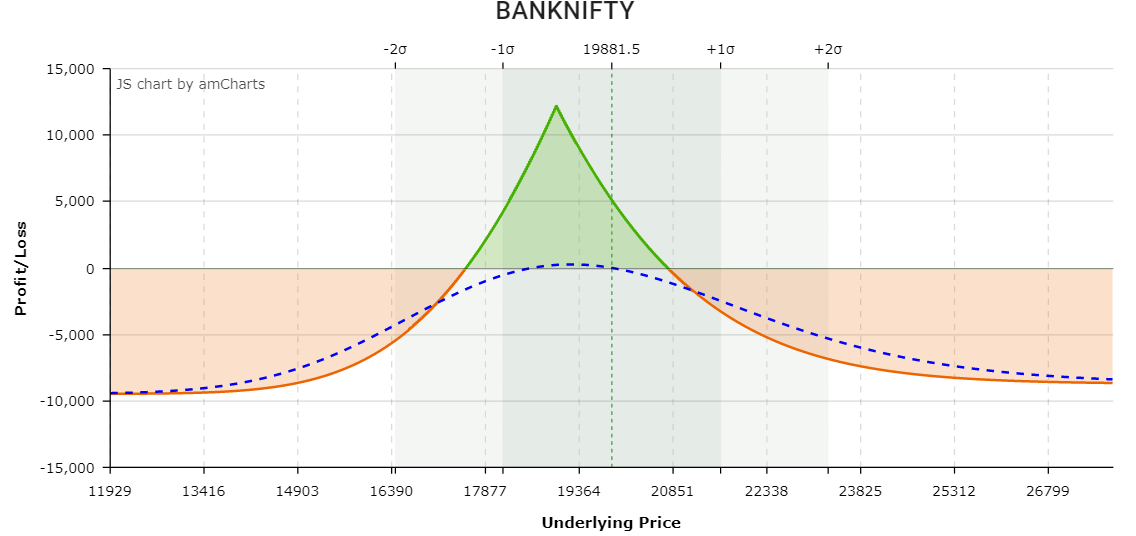

Long Calendar Spreads Unofficed

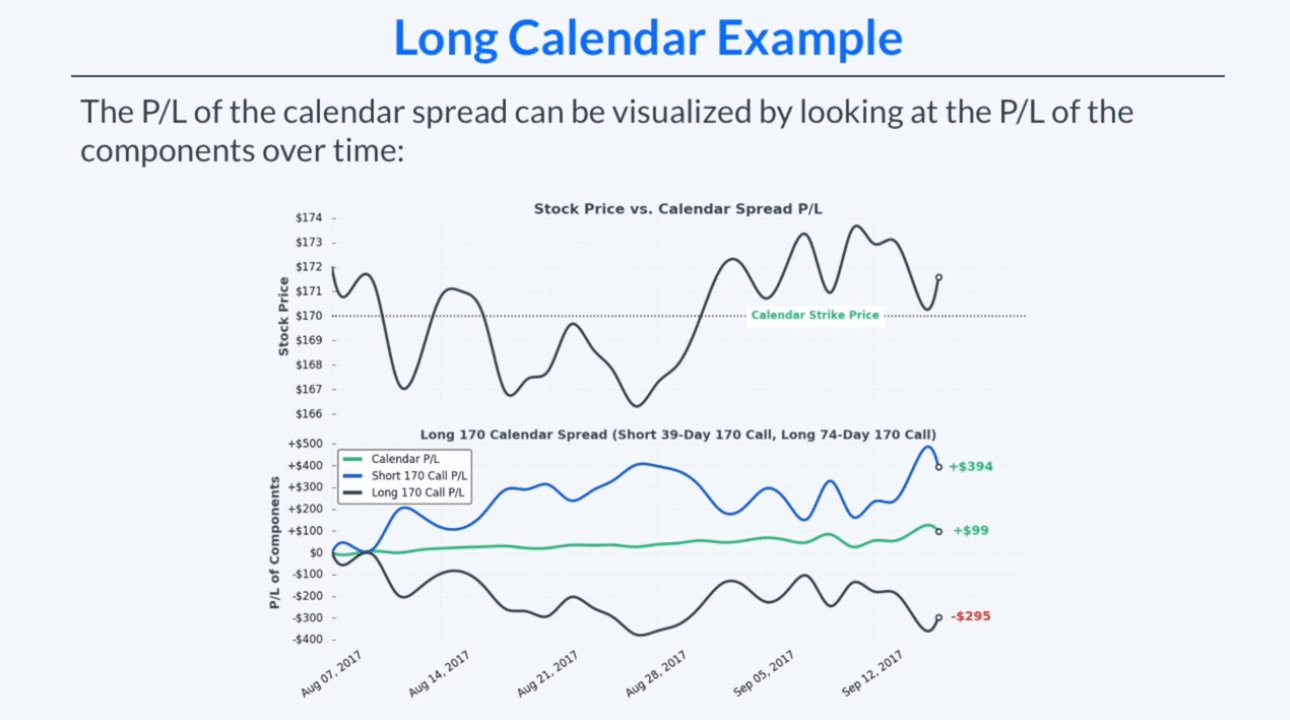

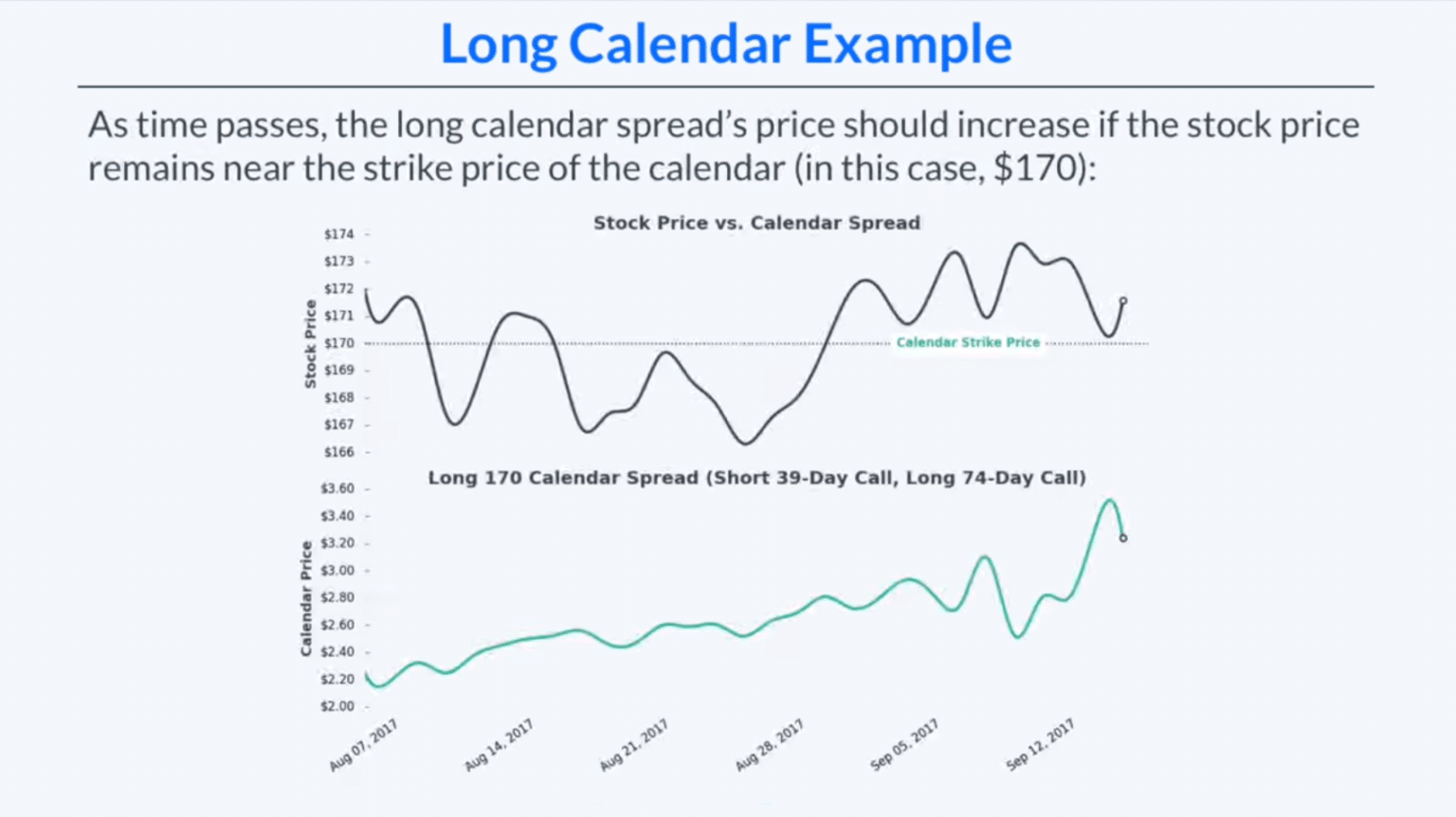

Long Calendar Spreads for Beginner Options Traders projectfinance

Long Calendar Spreads for Beginner Options Traders projectfinance

Le calendar spread Stratégies Options

Long Calendar Spreads Unofficed

How to Trade Options Calendar Spreads (Visuals and Examples)

What Is A Calendar Spread

Le calendar spread le delta ∆ Stratégies Options

Options Cafe Blog Education 1 Options Trading Software

Related Post: