Long Call Calendar Spread

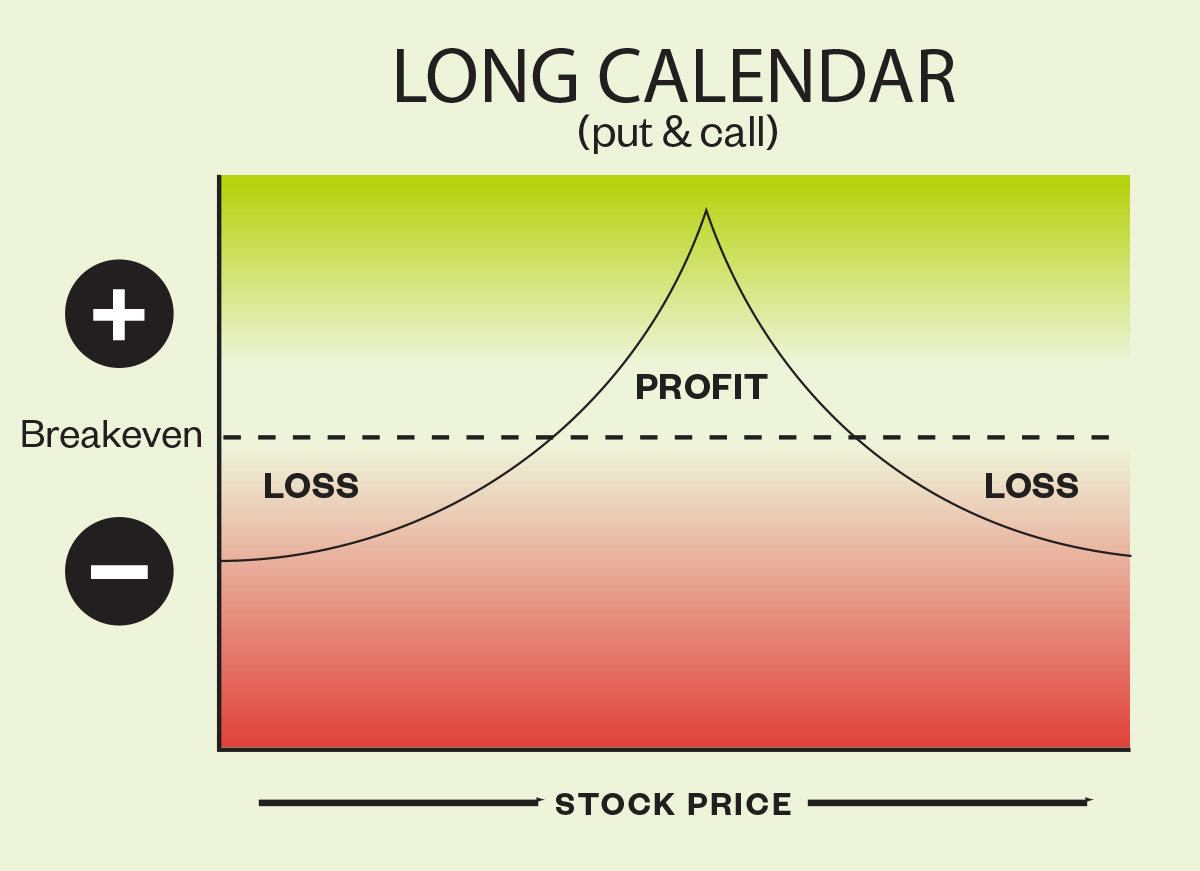

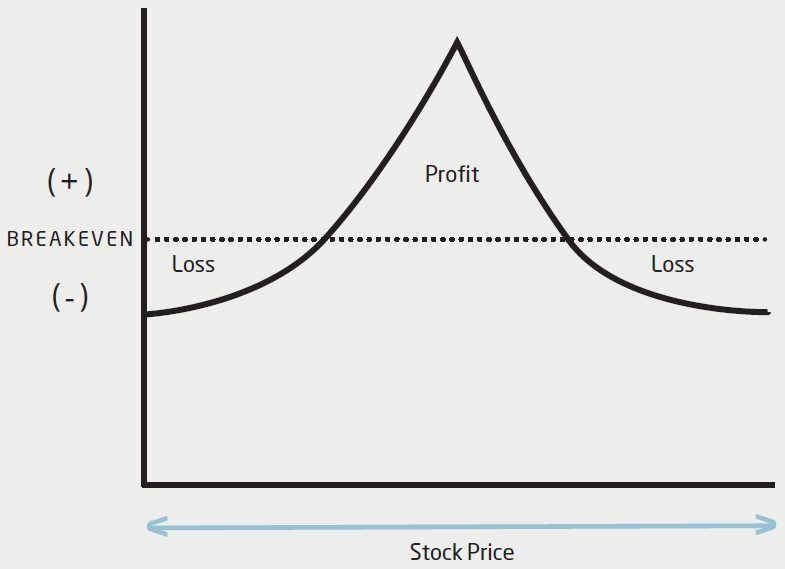

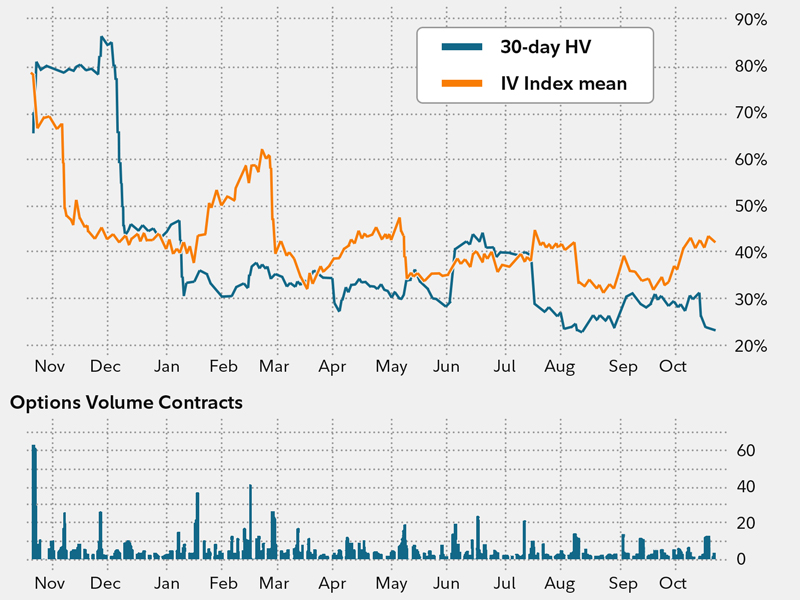

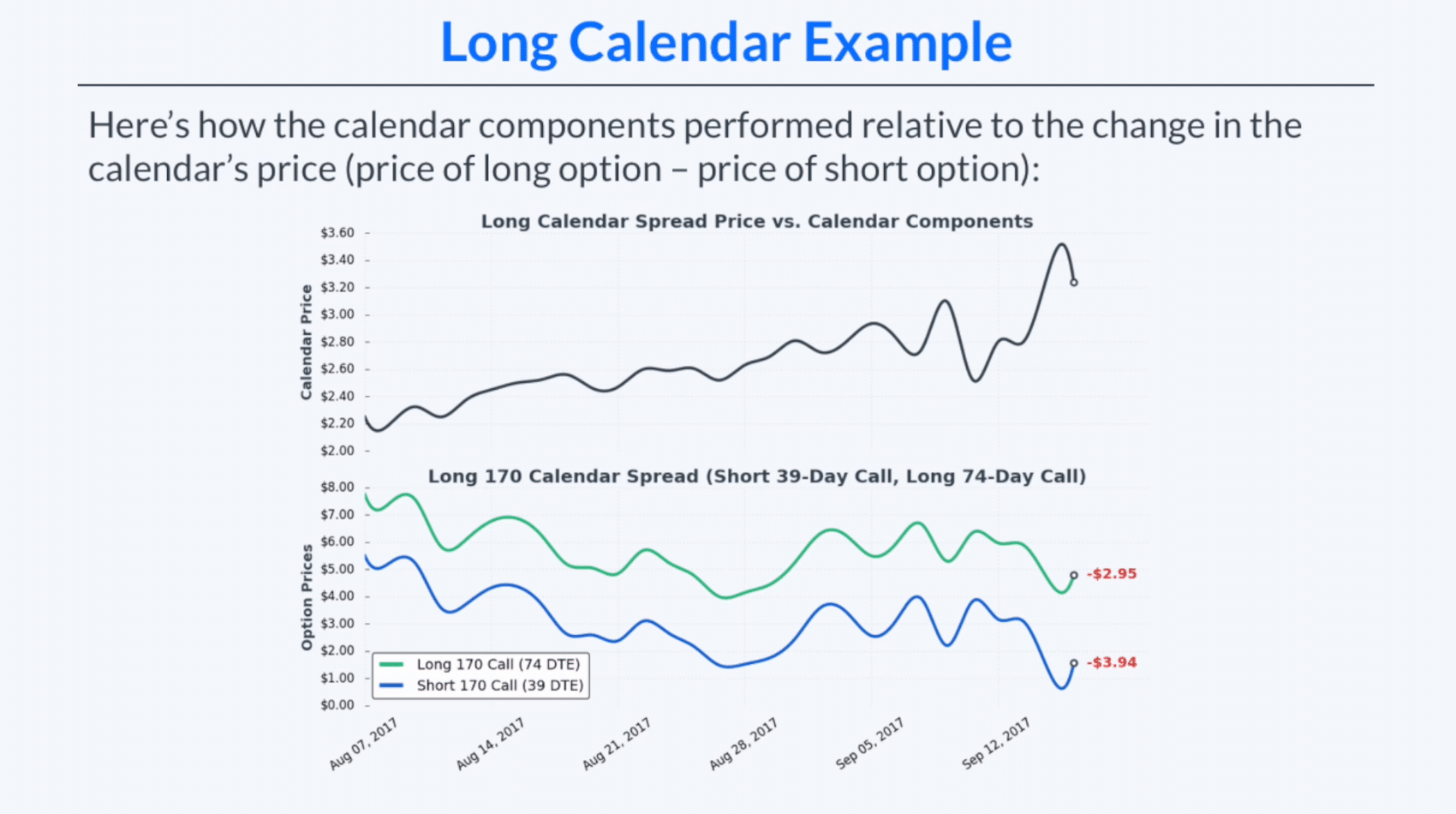

Long Call Calendar Spread - A long call calendar spread is the combination of short call and long. Lu meng and calvin lin contributed. This strategy is used when the trader thinks the underlying asset will experience little price movement in the near term but will increase in price over the longer term. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Short one call option and long a second call option with a more distant expiration is an example of a long call. Web a calendar spread involves buying and selling the same type of option (calls or puts) for the same underlying. Web long calendar spreads are great strategies for options traders who believe the stock price will trade near the. Running a calendar spread with calls means you’re selling and buying a call with the same strike price,. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Short one call option and long a second call option with a more distant expiration is an example of a long call. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a calendar spread involves buying and selling the same type of option (calls or puts) for the same underlying.. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same. Web what is a long call calendar spread? Web the long call calendar spread is engineered to allow you to profit from fluctuations in time value. Web analysis of long call calendar spread strategy. Web a calendar spread is. Web a long calendar call spread is an options strategy that involves buying and selling call options with different expiration months but the same strike price. Running a calendar spread with calls means you’re selling and buying a call with the same strike price,. Short one call option and long a second call option with a more distant expiration is. Web what is a long call calendar spread? Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Running a calendar spread with calls means you’re selling and buying a call with the same strike price,. This strategy is used when the trader. Web a calendar spread involves buying and selling the same type of option (calls or puts) for the same underlying. Lu meng and calvin lin contributed. Web analysis of long call calendar spread strategy. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web the long call calendar. Running a calendar spread with calls means you’re selling and buying a call with the same strike price,. This strategy is used when the trader thinks the underlying asset will experience little price movement in the near term but will increase in price over the longer term. Web a calendar spread involves buying and selling the same type of option. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Running a calendar spread with calls means you’re selling and buying a call with the same strike price,. Web a calendar spread involves buying and selling the same type of option (calls or puts) for the same underlying. Web. Web long calendar spreads are great strategies for options traders who believe the stock price will trade near the. A long call calendar spread is the combination of short call and long. Web the long call calendar spread is engineered to allow you to profit from fluctuations in time value. Web a calendar spread is an option trade that involves. Web a calendar spread involves buying and selling the same type of option (calls or puts) for the same underlying. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web what is a long call calendar spread? Web long calendar spreads are great strategies for options traders who. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web a long calendar call spread is an options strategy that involves buying and selling call options with different expiration months but the same strike price. Web a calendar call spread is an. Lu meng and calvin lin contributed. Web the long call calendar spread is engineered to allow you to profit from fluctuations in time value. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web what is a long call calendar spread? Short one call option and long a second call option with a more distant expiration is an example of a long call. Web long calendar spreads are great strategies for options traders who believe the stock price will trade near the. A long call calendar spread is the combination of short call and long. A calendar spread (time spread) refers to selling a near term expiry option. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same. Web a calendar spread involves buying and selling the same type of option (calls or puts) for the same underlying. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web analysis of long call calendar spread strategy. This strategy is used when the trader thinks the underlying asset will experience little price movement in the near term but will increase in price over the longer term. Web a long calendar call spread is an options strategy that involves buying and selling call options with different expiration months but the same strike price. Running a calendar spread with calls means you’re selling and buying a call with the same strike price,.The Long Calendar Spread Explained 1 Options Trading Software

Can I Do Calendar Spreads In Robinhood Option Strategies Which Are

Long Calendar Spreads for Beginner Options Traders projectfinance

Calendar Call Spread Options Edge

Long Calendar Spreads Unofficed

Credit Spread Options Strategies (Visuals and Examples) projectfinance

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Trading on Time Decay How to Approach Calendar Spreads Ticker Tape

How Calendar Spreads Work (Best Explanation) projectoption

Related Post:

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)