Option Calendar Spread

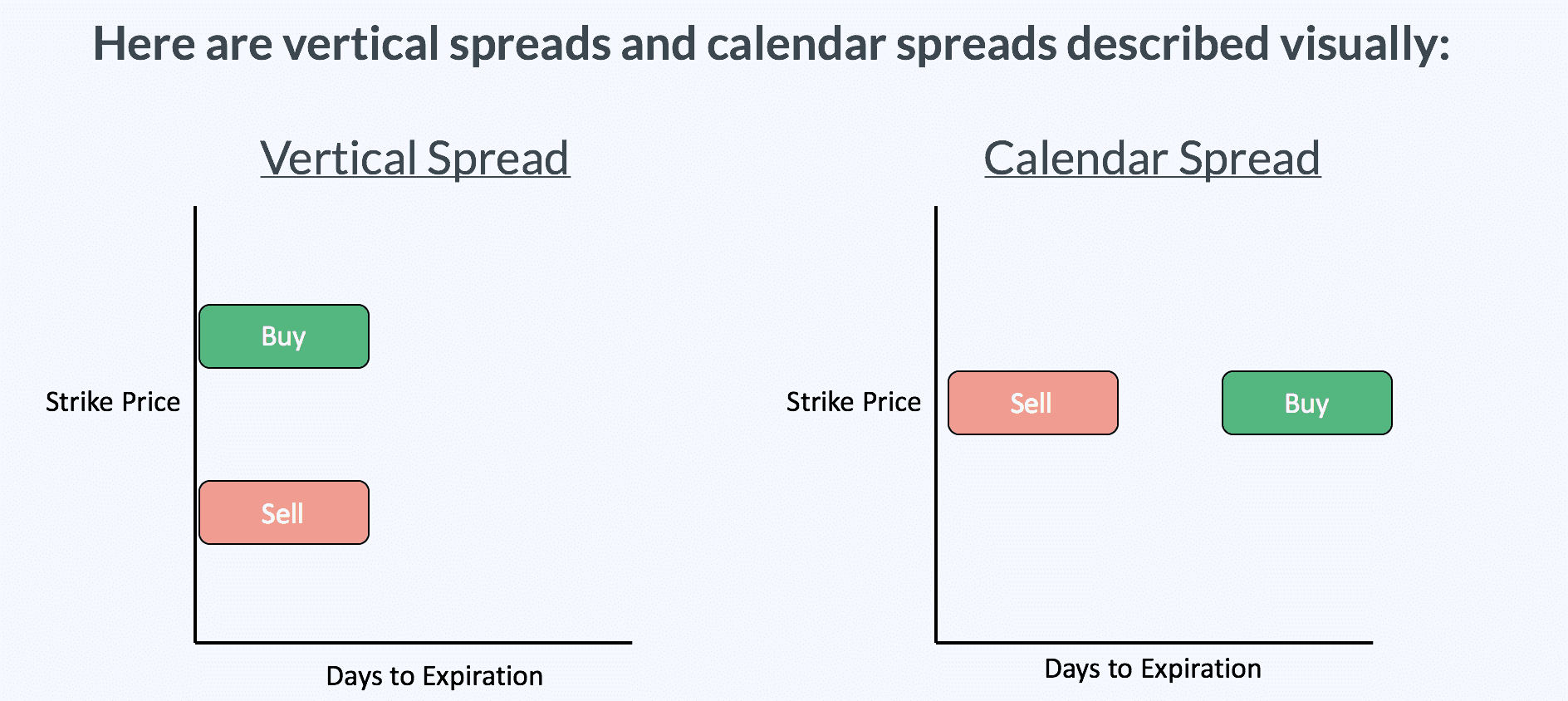

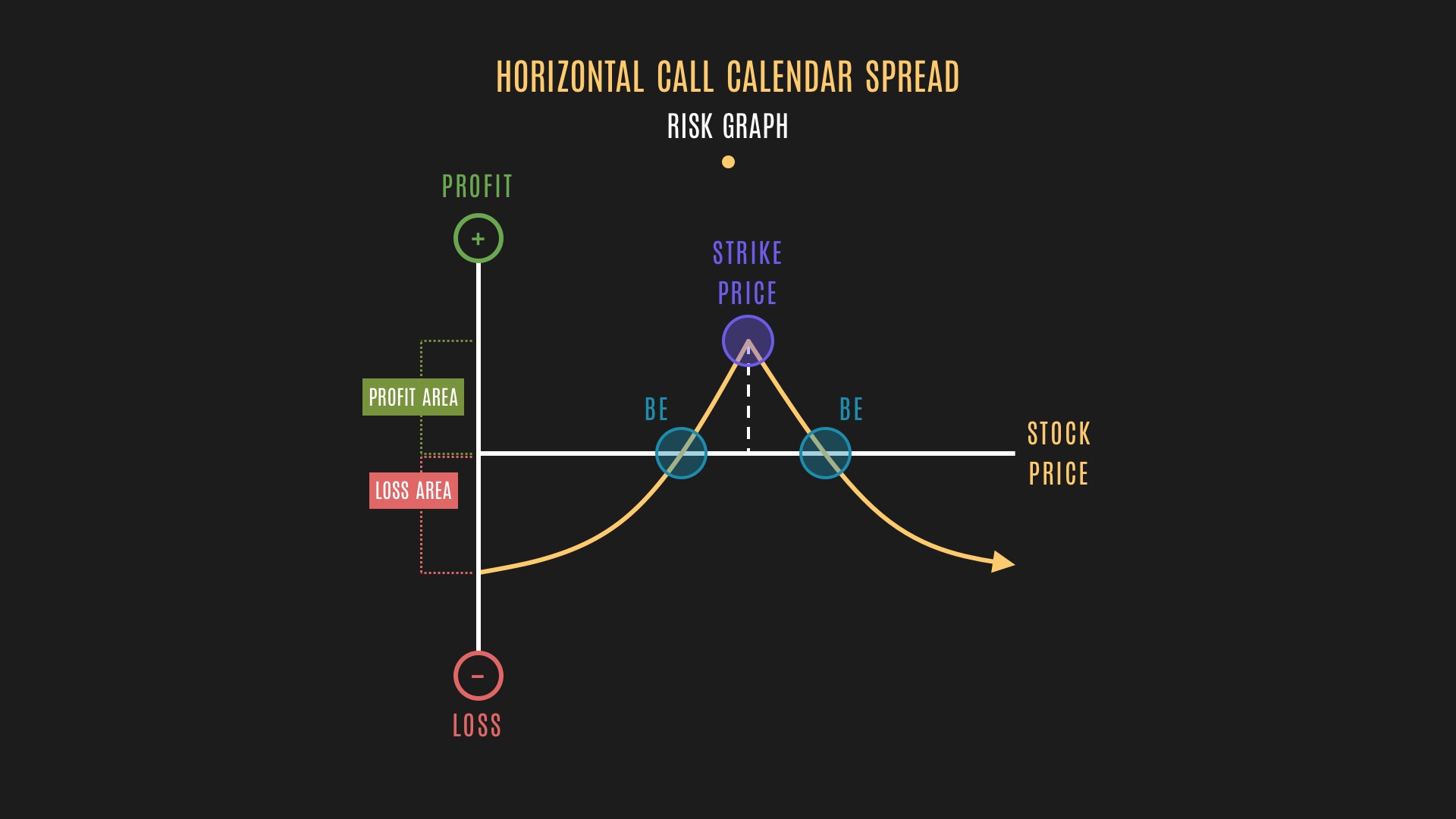

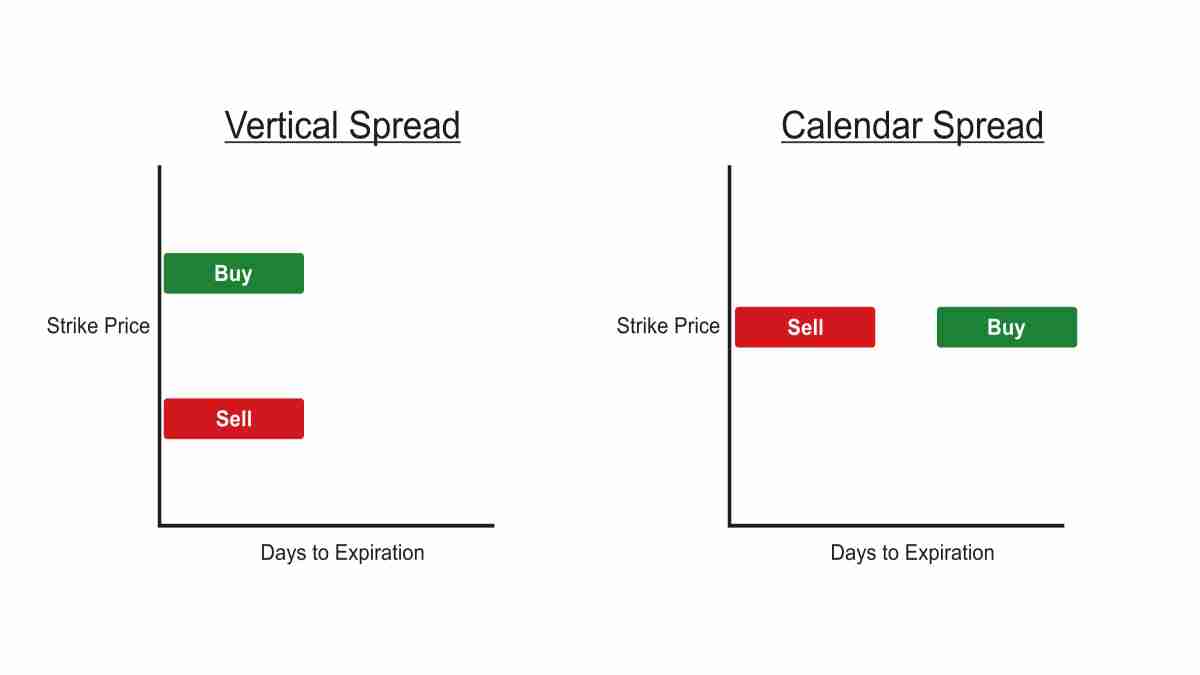

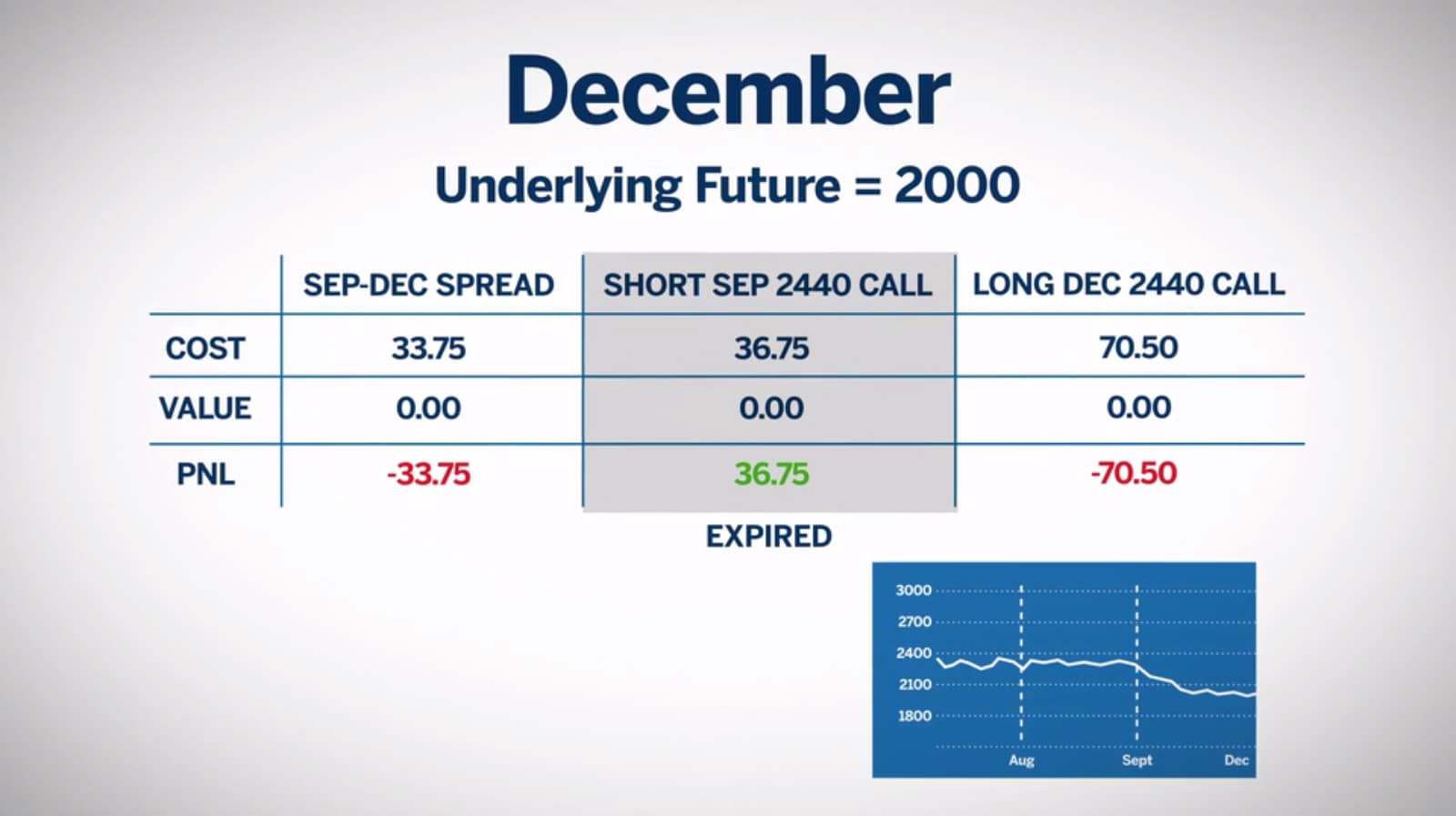

Option Calendar Spread - Web a calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different (albeit. A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but. A long calendar spread—often referred to as a time spread—is the buying. Web what is a calendar spread? Web using calendar trading and spread option strategies long calendar spreads. A long calendar spread—often referred to as a time spread—is the buying. A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but. Web what is a calendar spread? Web a calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying. Web a calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different (albeit. Web what is a calendar spread? A long calendar spread—often referred to as a time spread—is the buying. A calendar spread is an options trading strategy that involves buying. Web a calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different (albeit. Web using calendar trading and spread option strategies long calendar spreads. A calendar spread is an options trading strategy that involves buying and selling two options with the same. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but. A long calendar spread—often referred to as a time spread—is the buying. A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but. Web a. A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but. Web what is a calendar spread? Web using calendar trading and spread option strategies long calendar spreads. A long calendar spread—often referred to as a time spread—is the buying. Web a calendar spread is an options or futures strategy. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but. A long calendar spread—often referred to as a time spread—is the buying. Web a calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at. Web a calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different (albeit. Web using calendar trading and spread option strategies long calendar spreads. A calendar spread is an options trading strategy that involves buying and selling two options with the same. Web what is a calendar spread? A long calendar spread—often referred to as a time spread—is the buying. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but. Web using calendar trading and spread option strategies long calendar spreads. Web a calendar spread typically involves. Web using calendar trading and spread option strategies long calendar spreads. Web what is a calendar spread? Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but. A long calendar spread—often referred to as a time spread—is the buying. Web a calendar spread typically involves. Web using calendar trading and spread option strategies long calendar spreads. A long calendar spread—often referred to as a time spread—is the buying. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but. Web a calendar spread typically involves buying and selling the same type. Web a calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different (albeit. A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but. A long calendar spread—often referred to as a time spread—is the buying. Web using calendar trading and spread option strategies long calendar spreads. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but. Web what is a calendar spread?How Calendar Spreads Work (Best Explanation) projectoption

Pin on CALENDAR SPREADS OPTIONS

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

Pin on CALENDAR SPREADS OPTIONS

Pin on Option Trading Strategies

Options Strategy Calendar Spread (Setting Up the Calendar) Tradersfly

Forex Trading Strategies That Work 20+ Types of Trading Strategies

Trading an Options Calendar Spread for profit complete how to. YouTube

Option Calendar Spreads

Calendar Spread, stratégie d’options sur deux échéances différentes

Related Post: