Put Calendar Spread

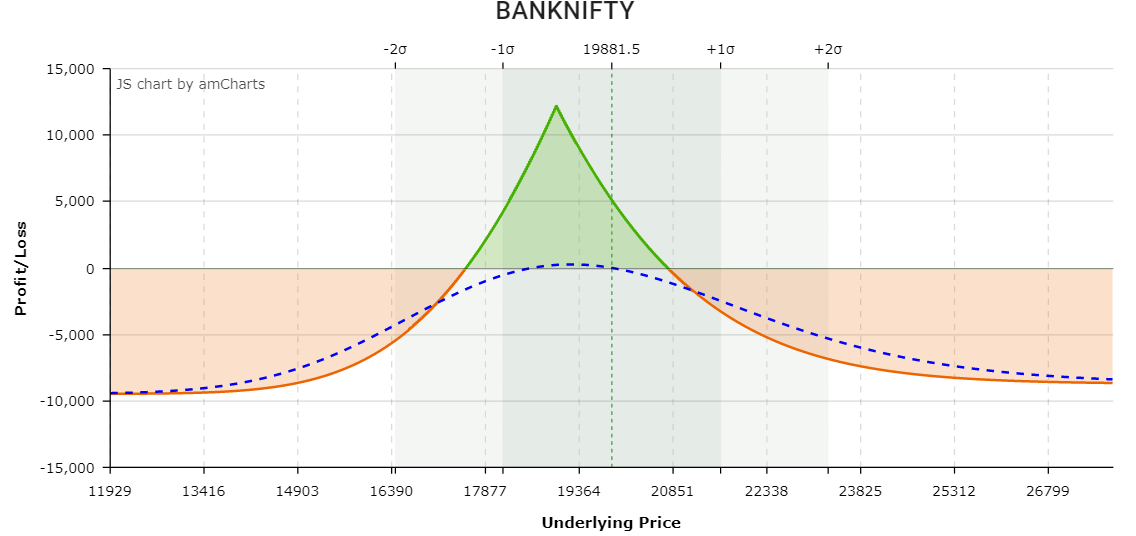

Put Calendar Spread - There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates. Web there are two types of long calendar spreads: Both put options will have the same strike. Web there are two types of long calendar spreads: Both put options will have the same strike. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates. There are inherent advantages to trading a put calendar over a call calendar, but. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates. Both put options will have the same strike. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. Web there are two. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates. Both put options will have the same strike. Web there are two types of long calendar spreads: There are inherent advantages to trading a put calendar over a call calendar, but. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. Web there are two types of long calendar spreads: Both put options will have the same strike. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. Both put options will have the same strike. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates. Web there are two. Web there are two types of long calendar spreads: Both put options will have the same strike. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. Both put options will have the same strike. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates. Web there are two. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates. Web there are two types of long calendar spreads: Both put options. Web there are two types of long calendar spreads: There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates. Both put options. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates. Web there are two types of long calendar spreads: Both put options. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates. Web there are two types of long calendar spreads: There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. Both put options will have the same strike.Bearish Put Calendar Spread Option Strategy Guide

Calendar Put Spread Options Edge

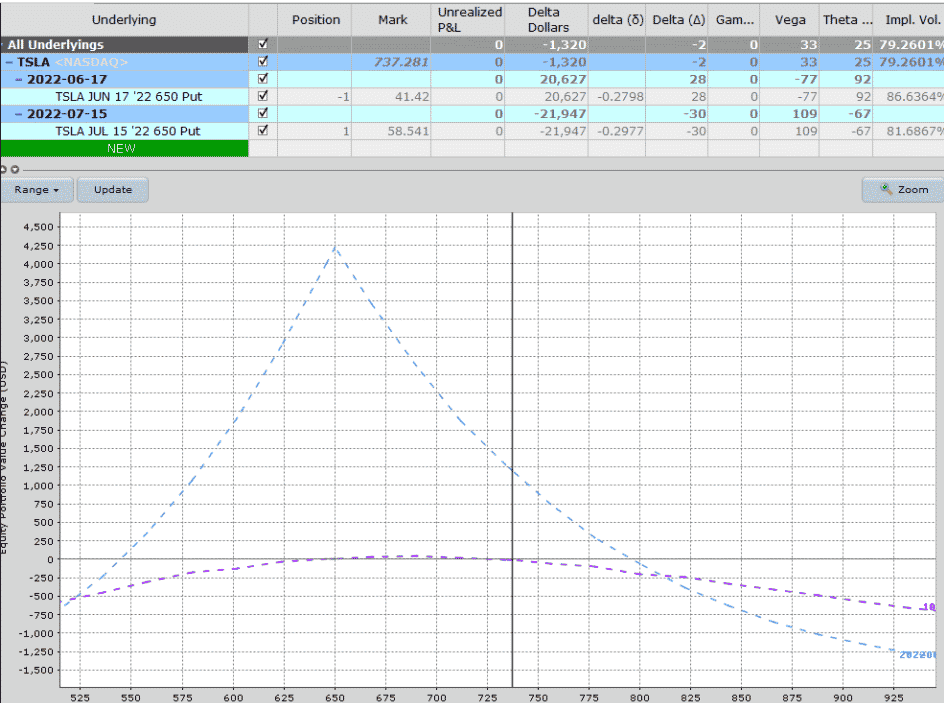

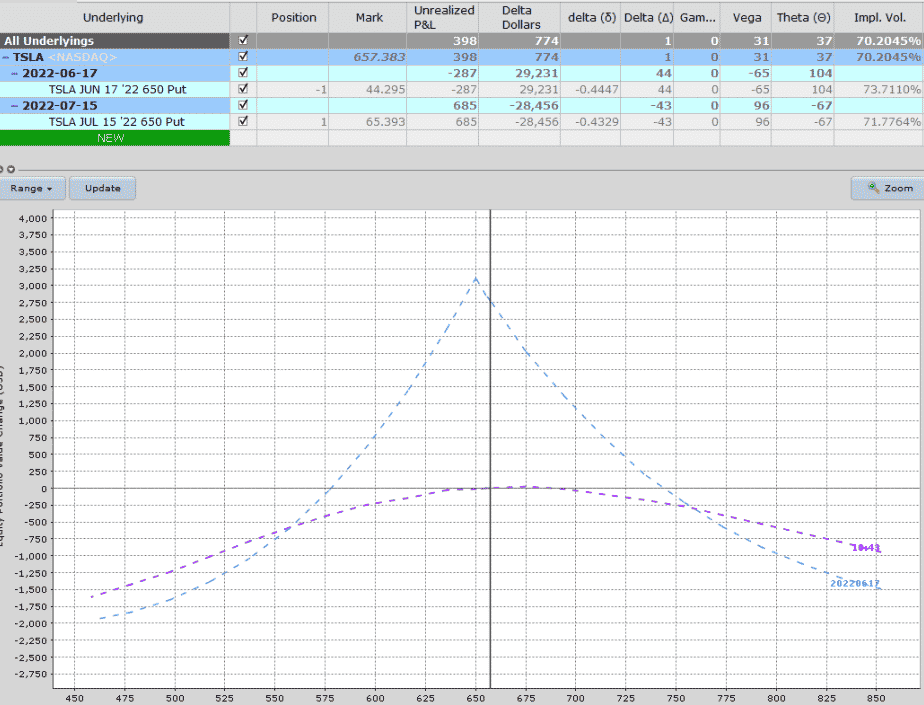

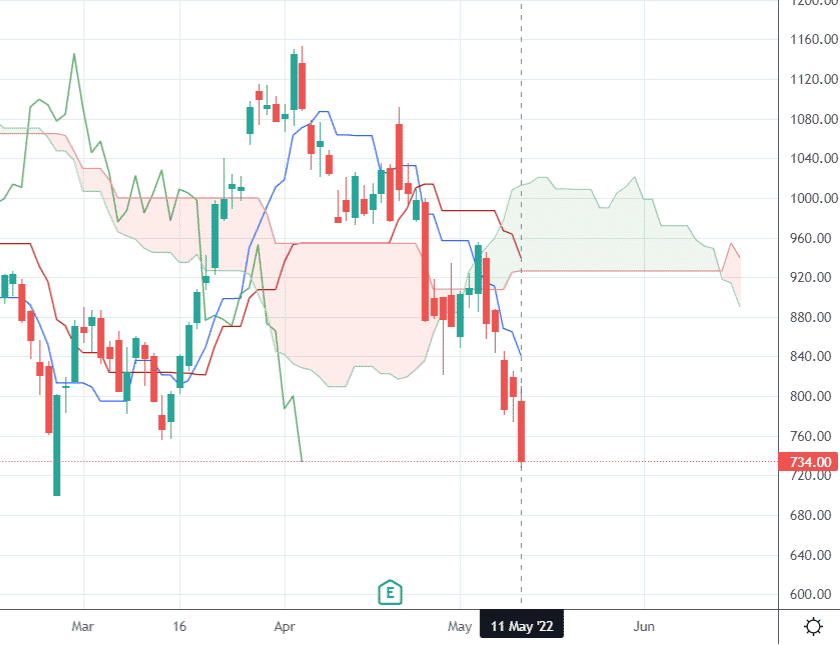

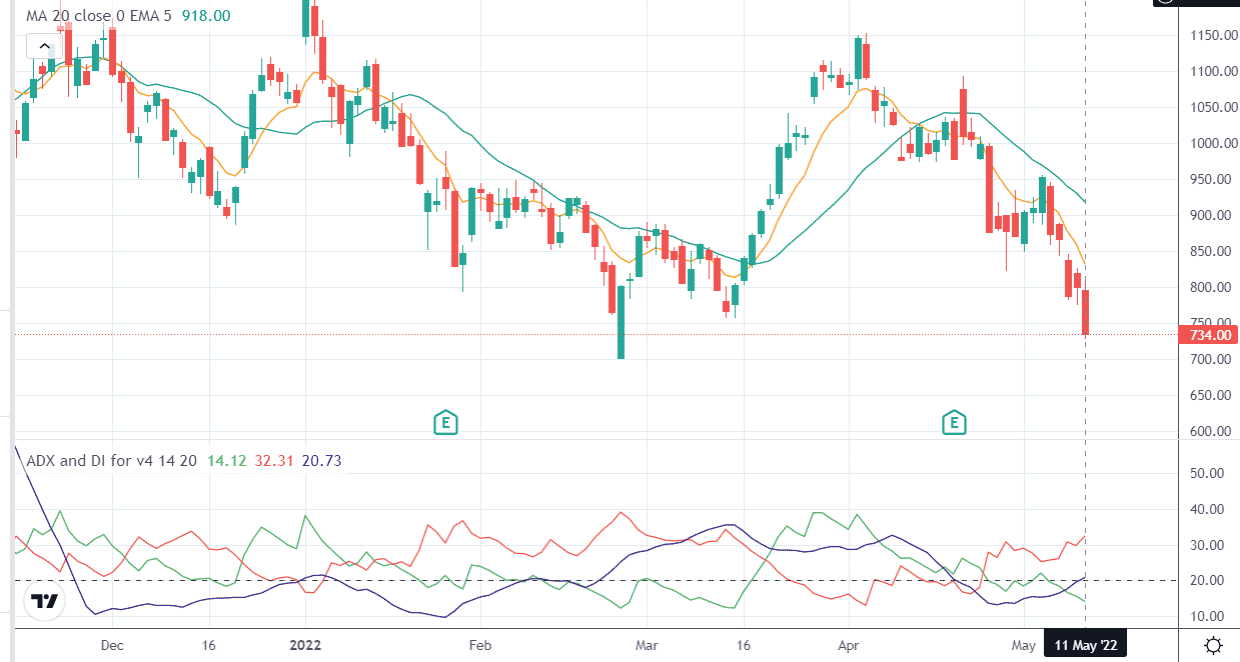

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

Bearish Put Calendar Spread Option Strategy Guide

Bearish Put Calendar Spread Option Strategy Guide

Bearish Put Calendar Spread Option Strategy Guide

Long Calendar Spreads Unofficed

Bearish Put Calendar Spread Option Strategy Guide

Put Calendar Spread

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Related Post:

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)