Refund Calendar For Child Tax Credit

Refund Calendar For Child Tax Credit - Web playlist download embed transcript enlarge this image lindsey balbierz for npr the deadline for most. Here’s when you’ll get your refund ronda. When will you get your refund? How much is the child tax credit in 2022? Web you are able to get a refund by march 1, 2022, if you filed your return online, you chose to receive your refund by direct deposit and there were no issues. Web 2023 tax deadline: Web by law, the irs cannot issue a refund involving the earned income tax credit or additional child tax credit before. Web january 17, 2023 — 02:12 pm est what changes were made to the child tax credit for 2021? 13 (opt out by aug. Your tax refund may come march 1 natasha. Web the 2022 tax season is underway. Web by law, the irs cannot issue a refund involving the earned income tax credit or additional child tax credit before. Your tax refund may come march 1 natasha. Web taxpayers who qualify for the newly expanded child tax credit will receive a letter in the mail from the irs in the. Web. And how do you incorporate child tax. Web for more information regarding how to claim the full amount of your child tax credit, see topic c: Web august 16, 2023. Web you are able to get a refund by march 1, 2022, if you filed your return online, you chose to receive your refund by direct deposit and there were. Web democrats also beefed up the total child tax credit to a maximum of $3,600 per year for each younger child and $3,000. I was getting child tax credit monthly payments in 2021. And how do you incorporate child tax. Web some of that money will come in the form of advance payments, via either direct deposit or paper check,. Web january 17, 2023 — 02:12 pm est what changes were made to the child tax credit for 2021? Web by law, the irs cannot issue a refund involving the earned income tax credit or additional child tax credit before. Web parents in those income brackets will get another $260 per child, for up to three kids. Web two recent. Because you received part of your refund in the form of advanced child tax payments. Your tax refund may come march 1 natasha. Web august 16, 2023. Web democrats also beefed up the total child tax credit to a maximum of $3,600 per year for each younger child and $3,000. Web no more checks coming. Web you are able to get a refund by march 1, 2022, if you filed your return online, you chose to receive your refund by direct deposit and there were no issues. Web received child tax credit? Web no more checks coming. Web the 2021 child tax credit payment dates — along with the deadlines to opt out — are. Web taxpayers who qualify for the newly expanded child tax credit will receive a letter in the mail from the irs in the. And how do you incorporate child tax. Web for more information regarding how to claim the full amount of your child tax credit, see topic c: Because you received part of your refund in the form of. Web taxpayers who qualify for the newly expanded child tax credit will receive a letter in the mail from the irs in the. When will you get your refund? Here’s when you’ll get your refund ronda. Web the child tax credit is a tax benefit for people with qualifying children. Web for more information regarding how to claim the full. Web the 2021 child tax credit payment dates — along with the deadlines to opt out — are as follows: Web by law, the irs cannot issue a refund involving the earned income tax credit or additional child tax credit before. Web 2023 tax deadline: Web august 16, 2023. When will you get your refund? Web as a result of all of this, the deadline for filing federal income tax returns (generally form 1040), will be tuesday, april 18, 2023, and most states usually. Web the deadline to file 2021 income tax returns is monday, april 18, for most people, three days later than the. 13 (opt out by aug. Because you received part of. Here’s when you’ll get your refund ronda. And how do you incorporate child tax. Web two recent expansions of the child tax credit have helped millions of american parents. Web you are able to get a refund by march 1, 2022, if you filed your return online, you chose to receive your refund by direct deposit and there were no issues. Web according to an irs update, the agency says it will be releasing refunds that include the ctc on march 1, 2022, or later. I was getting child tax credit monthly payments in 2021. For 2023, taxpayers may be eligible for a credit of up to $2,000 — and. Web by law, the irs cannot issue a refund involving the earned income tax credit or additional child tax credit before. Web received child tax credit? Web january 17, 2023 — 02:12 pm est what changes were made to the child tax credit for 2021? Web the child tax credit is a tax benefit for people with qualifying children. Web the 2021 child tax credit payment dates — along with the deadlines to opt out — are as follows: Web the 2022 tax season is underway. Your tax refund may come march 1 natasha. When will you get your refund? Web the deadline to file 2021 income tax returns is monday, april 18, for most people, three days later than the. Web playlist download embed transcript enlarge this image lindsey balbierz for npr the deadline for most. Because you received part of your refund in the form of advanced child tax payments. Web taxpayers who qualify for the newly expanded child tax credit will receive a letter in the mail from the irs in the. How much is the child tax credit in 2022?Trump/RyanCare Really Screws Over Older, and Rural Americans

Child Tax Credit 2021 Status Trending US

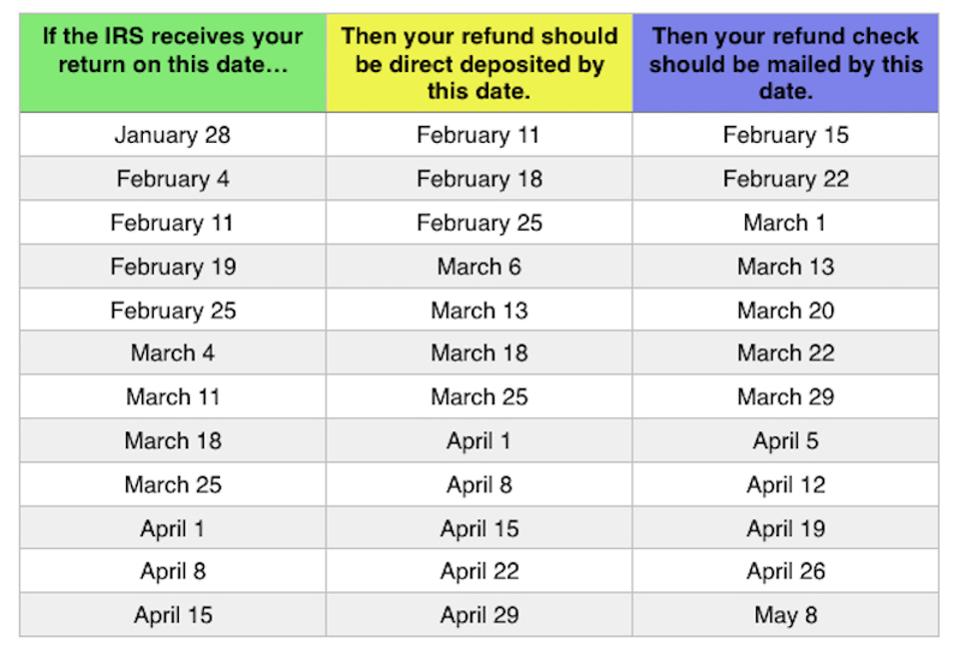

When can you Expect Your Tax Refund? Andrews Tax Accounting

Child Tax Credit 2022 Schedule Payments

2022 Tax Refund Schedule Chart Path Act » Veche.info 28

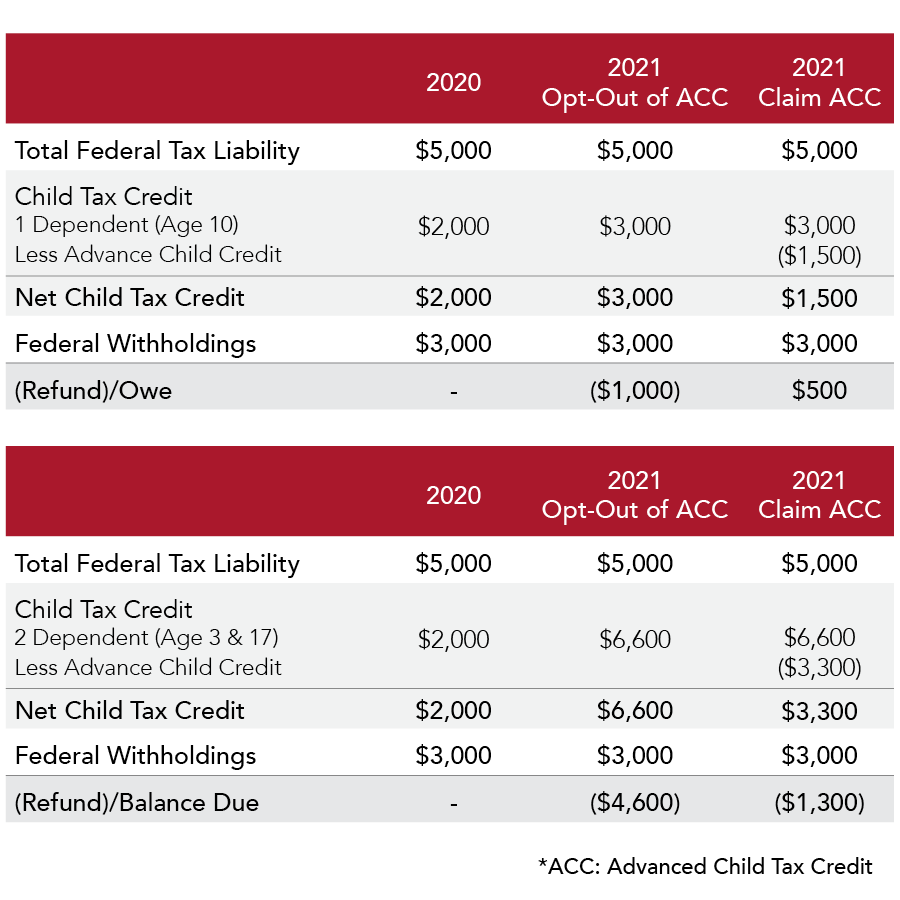

2021 Child Tax Credit What should I know Collins Consulting

2022 Child Tax Credit Refundable Amount Latest News Update

Child Tax Credit Payment Schedule 2022

Tax Refund When will I receive my refund? The estimated schedule Marca

Child Tax Credit 2019 / 5 Things To Know About U S Expat Taxes Tax

Related Post: