Roth Ira Calendar Year

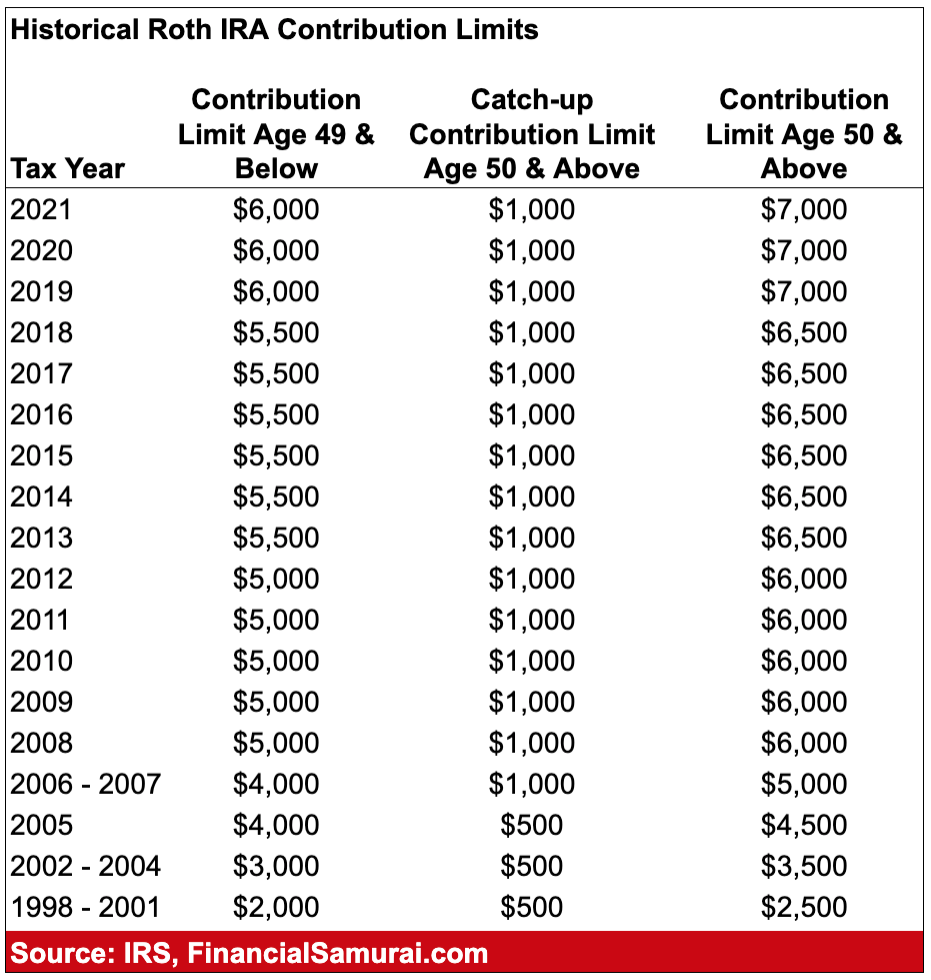

Roth Ira Calendar Year - Web when is it best to make annual roth ira contributions? Web ira contribution limits for 2022 and 2023. Web by beverly deveny, ira technical expert follow me on twitter: Web maximizing your roth ira contributions during the calendar year is an important step in ensuring your financial. Web modified agi (magi) income limits on roth ira contributions for the 2023 tax year are $153,000 ($144,000 in 2022). Ago you can contribute for your ira in 2020 up to april 15, 2021. Web updated march 23, 2023 reviewed by thomas brock fact checked by jared ecker a roth ira can be a great. Web our free roth ira calculator can calculate your maximum annual contribution and estimate how much you'll have in your. This limit is reduced by. Web contributions to an ira or a roth ira are required by the end of the tax year, which is april 15th the following year. Web you have until the tax filing deadline of the following year to make contributions to your roth ira. Web published mon, feb 6 202312:02 pm est updated mon, feb 6 20231:59 pm est greg iacurci @gregiacurci share key. Web christopher futcher / getty images individual retirement accounts (iras) are not only great tools for saving and. Web here are. Web the roth ira does not require distributions based on age. Web christopher futcher / getty images individual retirement accounts (iras) are not only great tools for saving and. Web a roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. Web published mon, feb 6 202312:02 pm est. Web by beverly deveny, ira technical expert follow me on twitter: Web any contributions for the year to a roth ira on behalf of the spouse with the greater compensation. Web you can contribute to a roth ira for the prior year up to april 15 of the following year. Alex harring 4 hours ago. Ago you can contribute for. Web here are friday’s biggest analyst calls: Web updated march 23, 2023 reviewed by thomas brock fact checked by jared ecker a roth ira can be a great. Web ira contribution limits for 2022 and 2023. Web you have until the tax filing deadline of the following year to make contributions to your roth ira. Web you can contribute to. Web published mon, feb 6 202312:02 pm est updated mon, feb 6 20231:59 pm est greg iacurci @gregiacurci share key. Web updated march 23, 2023 reviewed by thomas brock fact checked by jared ecker a roth ira can be a great. Web contributions to an ira or a roth ira are required by the end of the tax year, which. This means that you can contribute to a roth. Web when is it best to make annual roth ira contributions? Web generally, the designated beneficiary is determined on september 30 of the calendar year following the calendar year of the ira. Web our free roth ira calculator can calculate your maximum annual contribution and estimate how much you'll have in. The contribution limit sets how much you can contribute to a qualifying. Web here are friday’s biggest analyst calls: Web you have until the tax filing deadline of the following year to make contributions to your roth ira. So, if you have the. Web generally, the designated beneficiary is determined on september 30 of the calendar year following the calendar. Web ira contribution limits for 2022 and 2023. For anyone who did a. Web any contributions for the year to a roth ira on behalf of the spouse with the greater compensation. This means that you can contribute to a roth. The contribution limit sets how much you can contribute to a qualifying. Web is it wise to start converting my 401(k) into an ira (and then roth) by 10% per year in order to avoid having to claim. The contribution limit sets how much you can contribute to a qualifying. This means that you can contribute to a roth. Web when is it best to make annual roth ira contributions? Web here. Web when is it best to make annual roth ira contributions? Web at fidelity, the average age of the child when an account is opened is 13.7 years, and the average balance is around. This means that you can contribute to a roth. Web the backdoor roth is much easier when you contribute to a traditional account and complete the. The irs limits your ability to contribute to roth iras. Web a roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. Web any contributions for the year to a roth ira on behalf of the spouse with the greater compensation. Web is it wise to start converting my 401(k) into an ira (and then roth) by 10% per year in order to avoid having to claim. Web generally, the designated beneficiary is determined on september 30 of the calendar year following the calendar year of the ira. Cvs, hawaiian electric, peloton, aflac and more. Web published mon, feb 6 202312:02 pm est updated mon, feb 6 20231:59 pm est greg iacurci @gregiacurci share key. Web december 31, jan 1, july 32nd, doesn't matter btf91 • 3 yr. Alex harring 4 hours ago. Web here are friday’s biggest analyst calls: Web the backdoor roth is much easier when you contribute to a traditional account and complete the conversion in. So, if you have the. Web contributions to an ira or a roth ira are required by the end of the tax year, which is april 15th the following year. This limit is reduced by. Web the roth ira contribution limit for 2023 is $6,500 for those under 50, and $7,500 for those 50 and older. This means that you can contribute to a roth. Web by beverly deveny, ira technical expert follow me on twitter: Web ira contribution limits for 2022 and 2023. Web if you filed your 2022 taxes timely, october 17 is the deadline to correct an excess contribution for 2022 and to. Web our free roth ira calculator can calculate your maximum annual contribution and estimate how much you'll have in your.How Many People Live In Rother

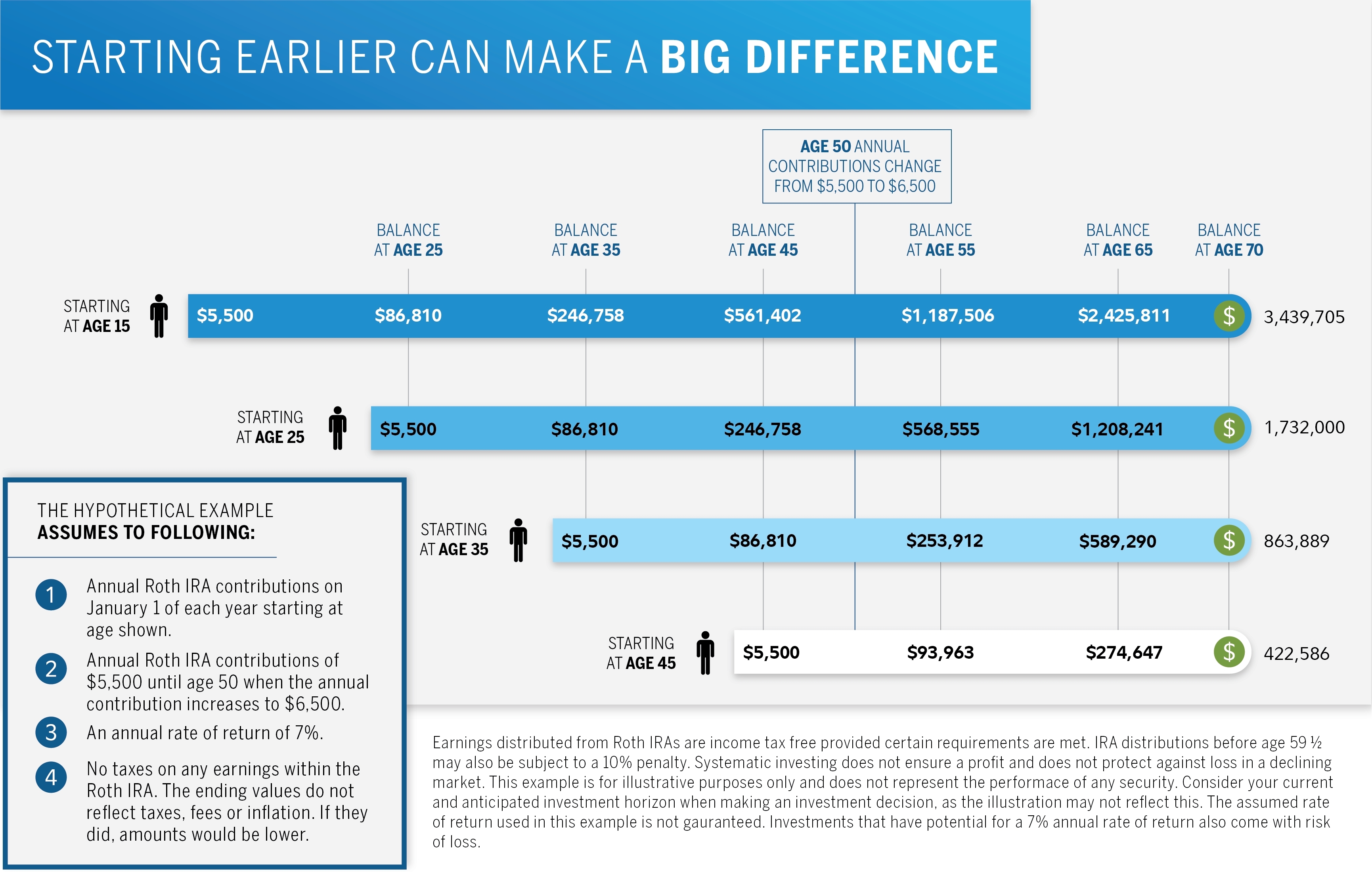

Opening A Roth IRA For Your Kids To Build Wealth And Save On Taxes

Opening A Roth IRA For Your Kids To Build Wealth And Save On Taxes

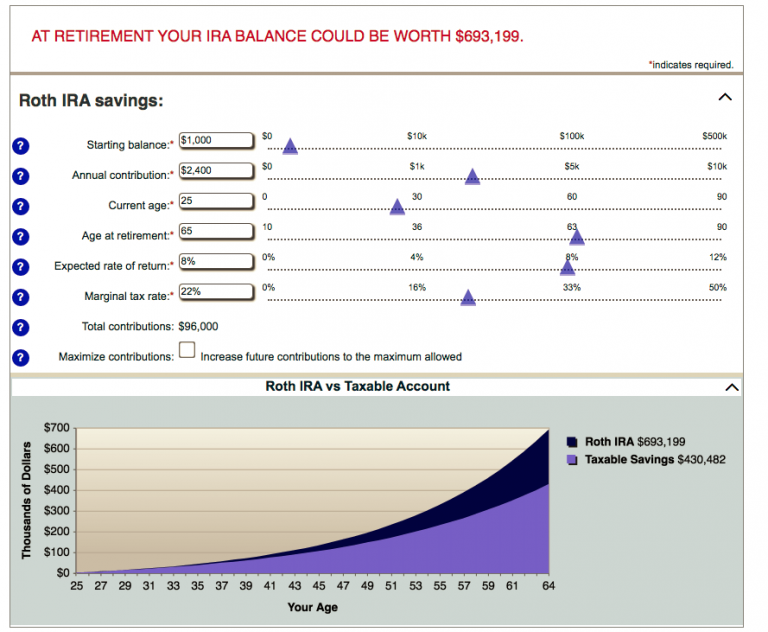

How to Use a Roth IRA Calculator Ready to Roth

Funding 401 K S And Roth Iras Worksheet Answers Investment quotes

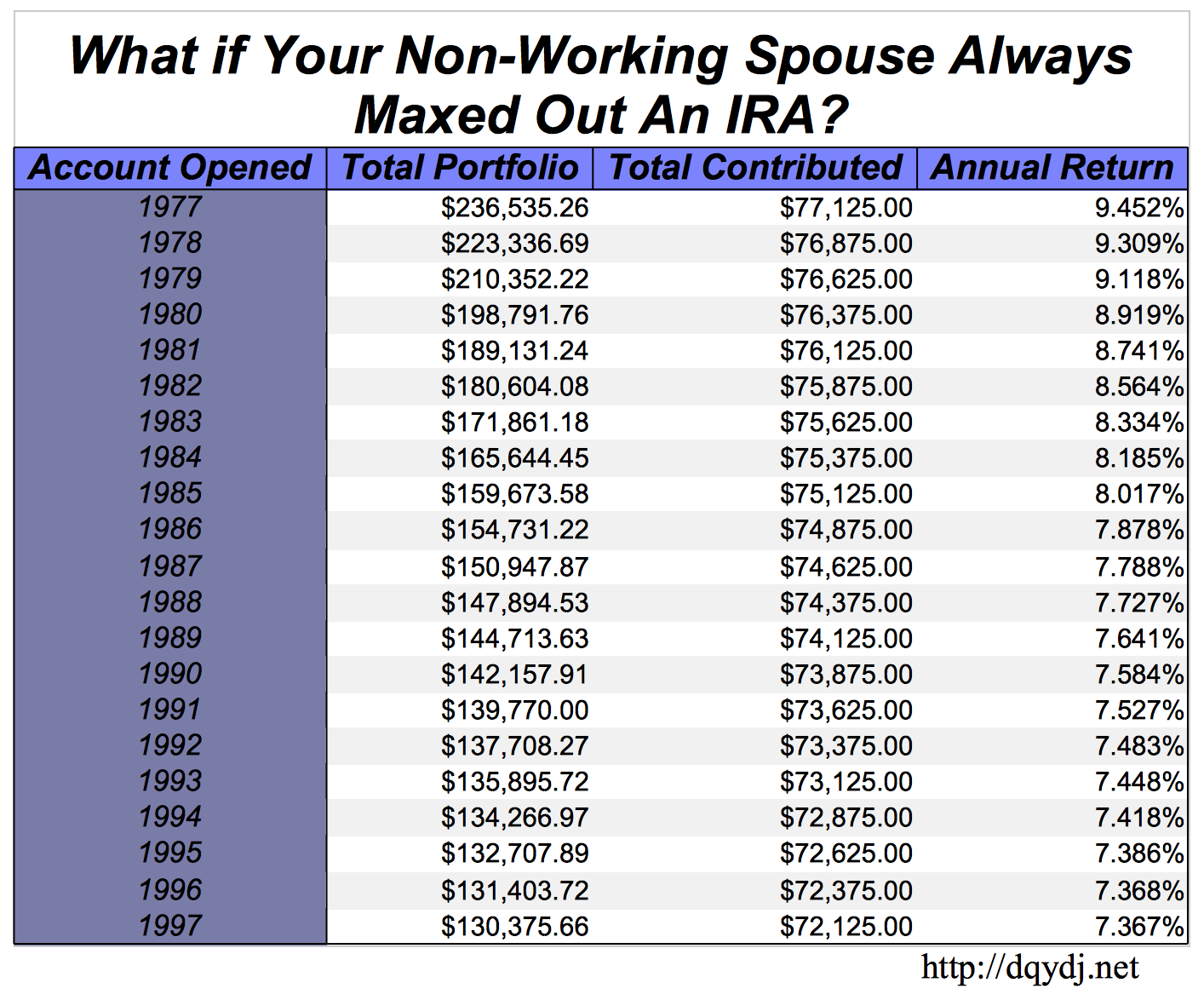

if i max out my roth ira every year how much will i have Choosing

RE403 IRA Account Fundamentals

What Is a Roth IRA? Do You Qualify for a Roth IRA? (Free Guide)

How To Use A Roth IRA To A Millionaire Dollar After Dollar

Fidelity’s® Roth IRA for Kids Sees Strong Growth as Parents Prioritize

Related Post: