Short Calendar Spread

Short Calendar Spread - Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity to profit in ways not available to those who. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. Web short calendar spread with calls potential goals. Calendar spreads allow traders to construct a trade that. To profit from a large stock price move away from the strike price of the calendar spread with limited. Web the short calendar call spread is an options trading strategy for a volatile market that is designed to be used when you are expecting a security to move dramatically in price, but you are unsure in which direction it will. A short calendar spread with calls is created. Web short calendar spread with calls potential goals. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. To profit from a large stock price move away from the strike price of the calendar. Web short calendar spread with calls potential goals. A short calendar spread with calls is created. Calendar spreads allow traders to construct a trade that. To profit from a large stock price move away from the strike price of the calendar spread with limited. Web a long calendar spread—often referred to as a time spread—is the buying and selling of. Web short calendar spread with calls potential goals. Web the short calendar call spread is an options trading strategy for a volatile market that is designed to be used when you are expecting a security to move dramatically in price, but you are unsure in which direction it will. To profit from a large stock price move away from the. Calendar spreads allow traders to construct a trade that. Web the short calendar call spread is an options trading strategy for a volatile market that is designed to be used when you are expecting a security to move dramatically in price, but you are unsure in which direction it will. Web a long calendar spread—often referred to as a time. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity to. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity to profit in ways not available to those who. To profit from a large stock price move away from the strike price of the calendar spread with limited. Web the short calendar call spread is an options. Calendar spreads allow traders to construct a trade that. Web the short calendar call spread is an options trading strategy for a volatile market that is designed to be used when you are expecting a security to move dramatically in price, but you are unsure in which direction it will. To profit from a large stock price move away from. Web the short calendar call spread is an options trading strategy for a volatile market that is designed to be used when you are expecting a security to move dramatically in price, but you are unsure in which direction it will. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option. Web short calendar spread with calls potential goals. To profit from a large stock price move away from the strike price of the calendar spread with limited. A short calendar spread with calls is created. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of. Web the short calendar call spread is an options trading strategy for a volatile market that is designed to be used when you are expecting a security to move dramatically in price, but you are unsure in which direction it will. Calendar spreads allow traders to construct a trade that. Web a long calendar spread—often referred to as a time. To profit from a large stock price move away from the strike price of the calendar spread with limited. Calendar spreads allow traders to construct a trade that. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity to profit in ways not available to those who. Web short calendar spread with calls potential goals. A short calendar spread with calls is created. Web the short calendar call spread is an options trading strategy for a volatile market that is designed to be used when you are expecting a security to move dramatically in price, but you are unsure in which direction it will. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different.Calendar Spreads 101 Everything You Need To Know

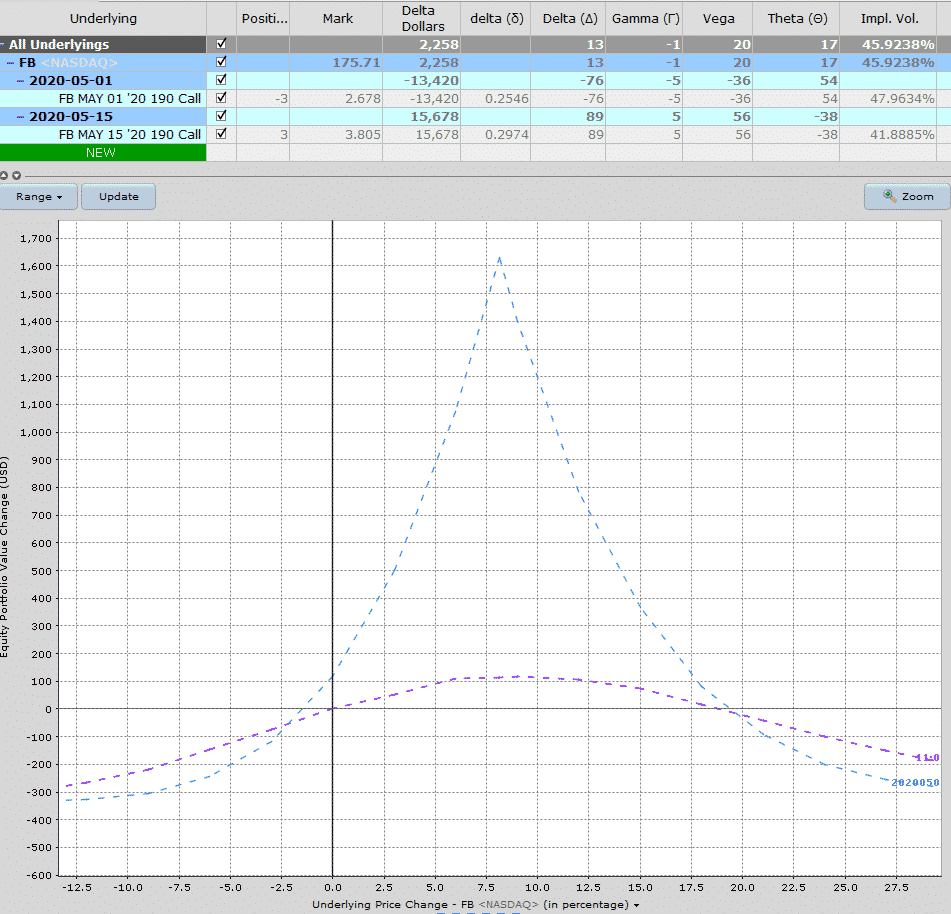

Pin on CALENDAR SPREADS OPTIONS

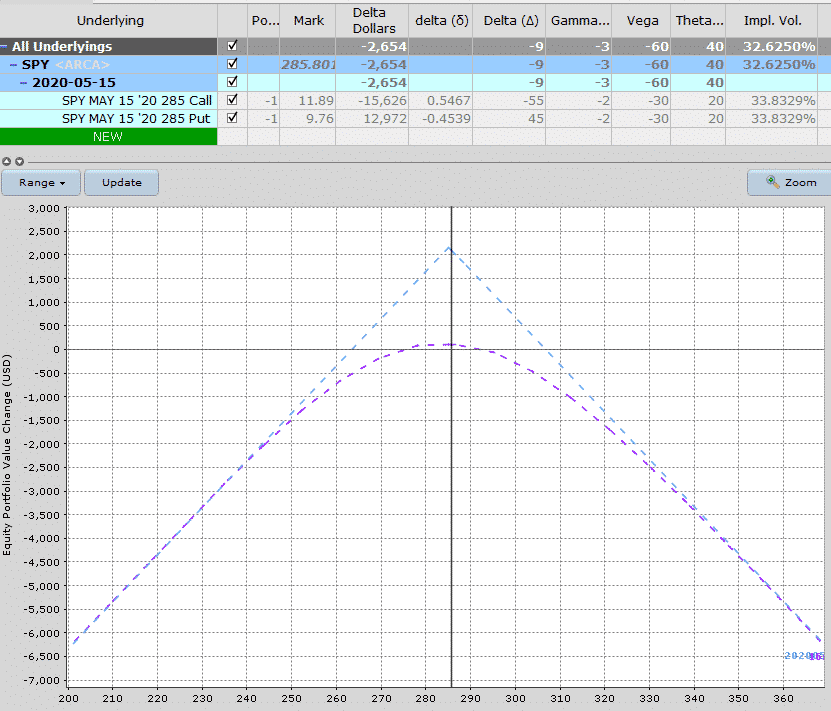

Le calendar spread Stratégies Options

Calendar Spreads 101 Everything You Need To Know

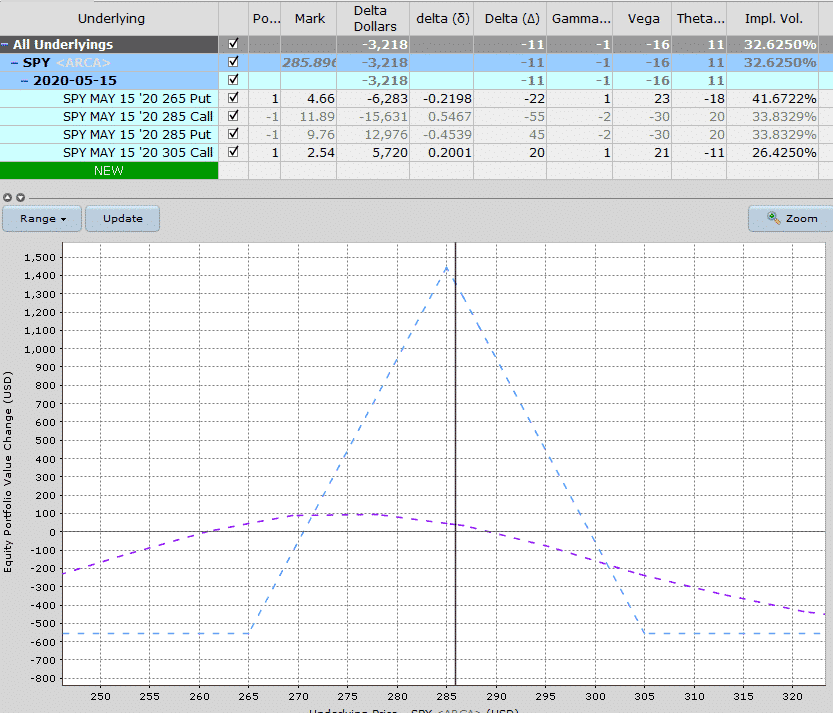

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Calendar Spread, stratégie d’options sur deux échéances différentes

Options Strategy Calendar Spread (Setting Up the Calendar) Tradersfly

Calendar Spreads 101 Everything You Need To Know

Le calendar spread Stratégies Options

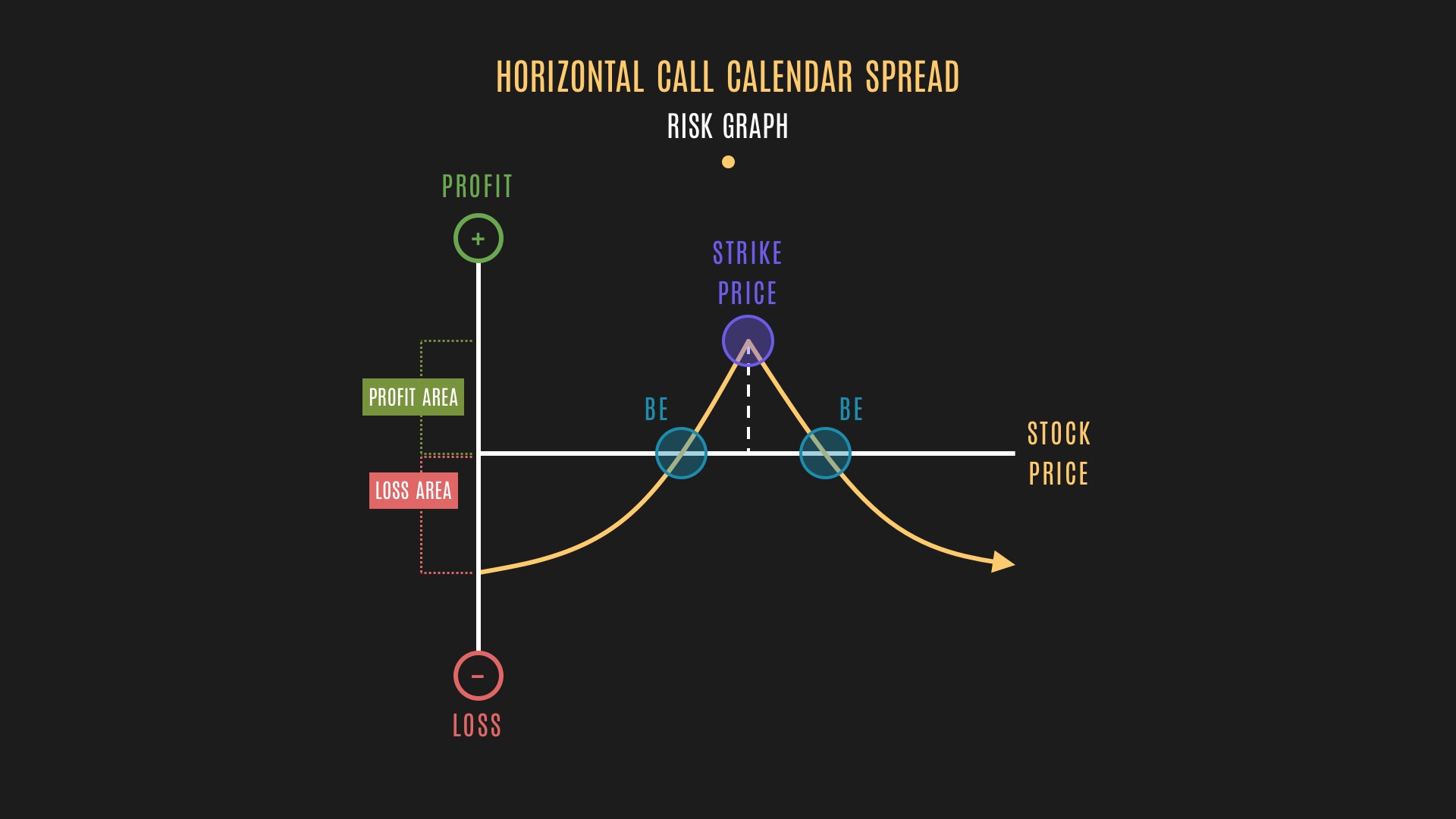

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

Related Post:

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)