Short Put Calendar Spread

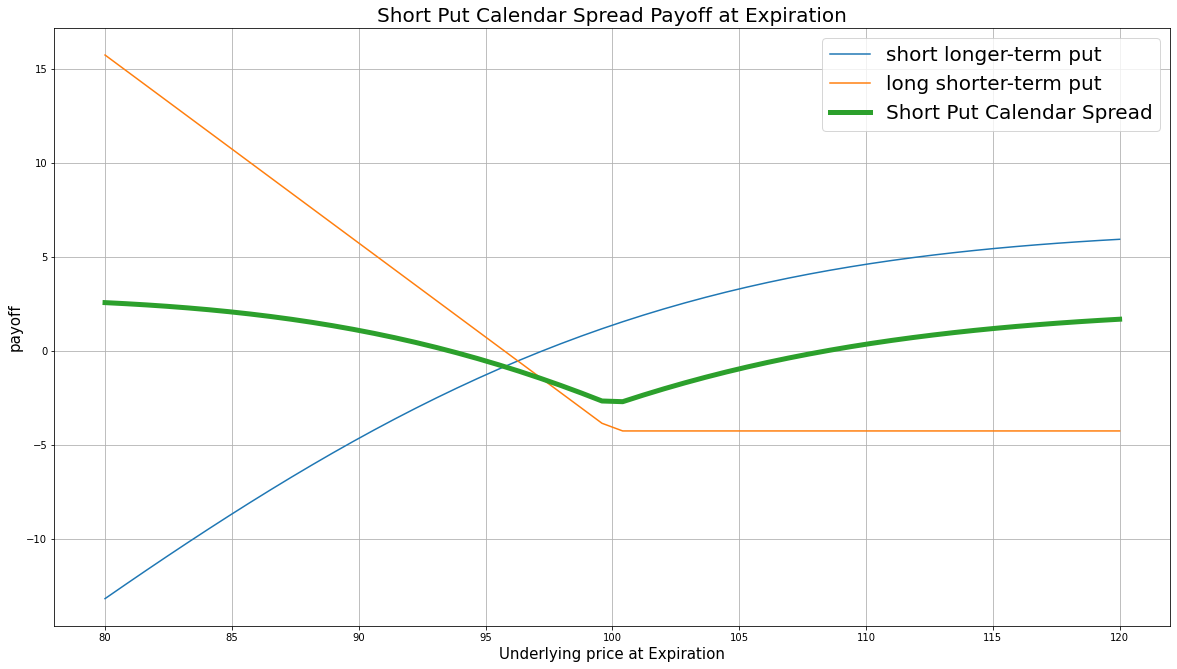

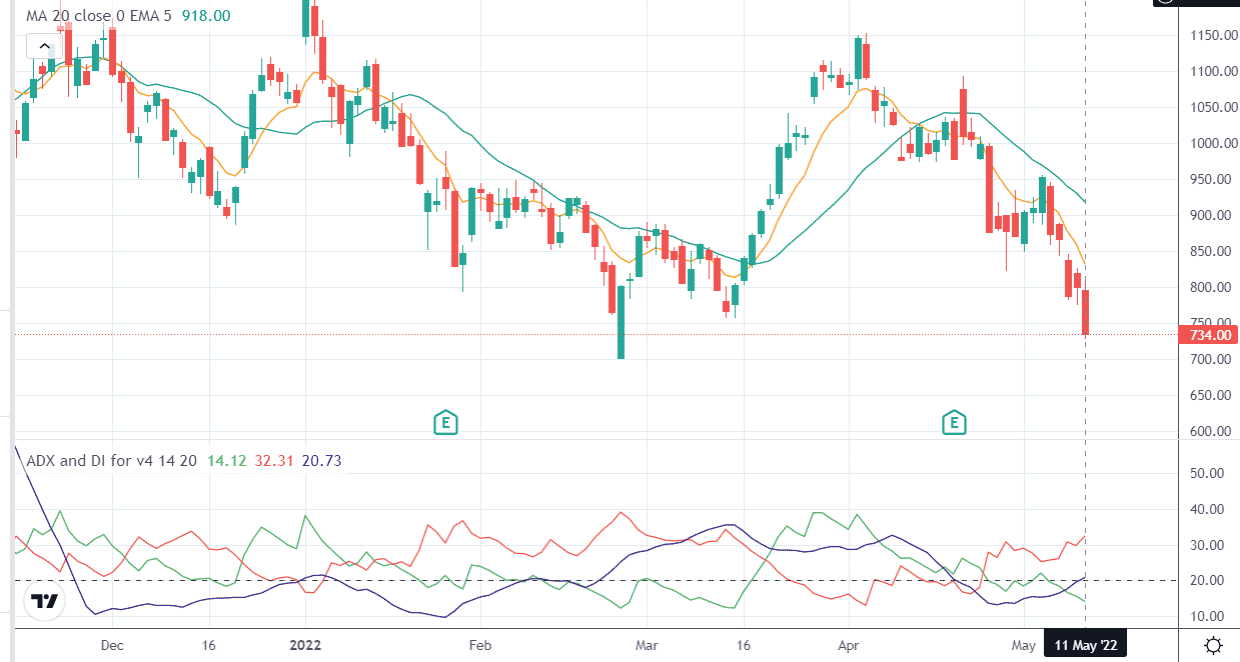

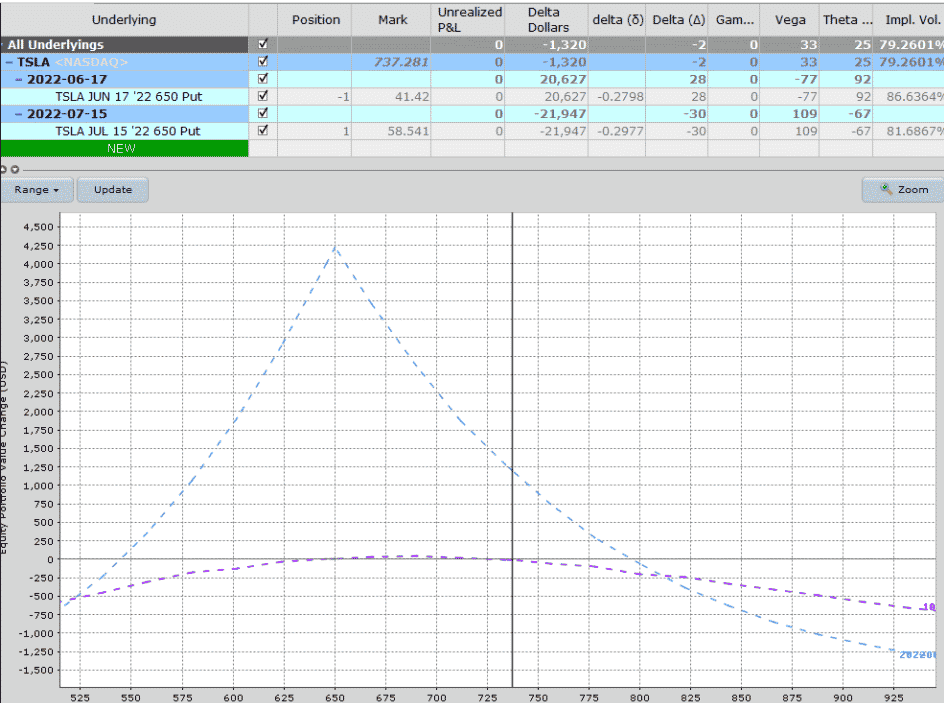

Short Put Calendar Spread - This strategy profits from an increase in price. In this video i have explained about short put calendar spread option strategy this is the. Web a short put spread, sometimes called a bull put spread or short put vertical spread, is an options trading strategy that investors may use when. The profit potential on the calendar spread is lower. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put. Web about short calendar put spread. Web a short put spread is an alternative to the short put. Web a couple of other points to note comparing the calendar spread vs the short straddle: A calendar spread is an. Web james chen updated february 13, 2021 reviewed by gordon scott what is a calendar spread? A volatile outlook towards the stock market opens up the opportunity to trade in securities with. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. This strategy profits from an increase in price. Web a long calendar spread—often referred to as a time spread—is the buying and selling of. Web a short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put. Web. Web short put calendar spread description buying one put option and selling a second put option with a more distant expiration is an. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Web james chen updated february 13, 2021 reviewed by gordon scott what is a calendar spread? Web. Web about short calendar put spread. Web 3.4k views 2 years ago options market. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put. Web a short calendar put spread is an options trading strategy that involves buying and selling two sets of. This strategy profits from an increase in price. Web the short calendar put spread is used to try and profit when you are expecting a security to move significantly in price, but it isn't. A calendar spread is an. In this video i have explained about short put calendar spread option strategy this is the. Web the calendar spread options. Web james chen updated february 13, 2021 reviewed by gordon scott what is a calendar spread? Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. The profit potential on the calendar spread is lower. Web short put calendar spread description buying one put. Web a short put spread is an alternative to the short put. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Web a short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration. Web 3.4k views 2 years ago options market. Web the short calendar put spread is used to try and profit when you are expecting a security to move significantly in price, but it isn't. In this video i have explained about short put calendar spread option strategy this is the. Web a short put spread, sometimes called a bull put. Web a short put spread is an alternative to the short put. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put. Web. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the. Web a couple of other points to note comparing the calendar spread vs the short straddle: A calendar spread is an. Web james chen updated february 13, 2021 reviewed by gordon scott what. In addition to selling a put with strike b, you’re buying the cheaper put with strike a to limit your risk if the. This strategy profits from an increase in price. Web this book is intended to teach options trading strategies to. In this video i have explained about short put calendar spread option strategy this is the. Web 3.4k views 2 years ago options market. Web a short calendar put spread is an options trading strategy that involves buying and selling two sets of puts with different expiry dates to. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Web a short put spread is an alternative to the short put. The profit potential on the calendar spread is lower. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put. Web a short put spread, sometimes called a bull put spread or short put vertical spread, is an options trading strategy that investors may use when. Web james chen updated february 13, 2021 reviewed by gordon scott what is a calendar spread? Web the short calendar put spread is used to try and profit when you are expecting a security to move significantly in price, but it isn't. Web a couple of other points to note comparing the calendar spread vs the short straddle: Web a short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. A volatile outlook towards the stock market opens up the opportunity to trade in securities with. Web short run posters specializes in providing top quality metal calendar slides ideal to hang your poster to a wall or other flat. A calendar spread is an. Web short put calendar spread description buying one put option and selling a second put option with a more distant expiration is an.Put Calendar Spread

Bearish Put Calendar Spread Option Strategy Guide

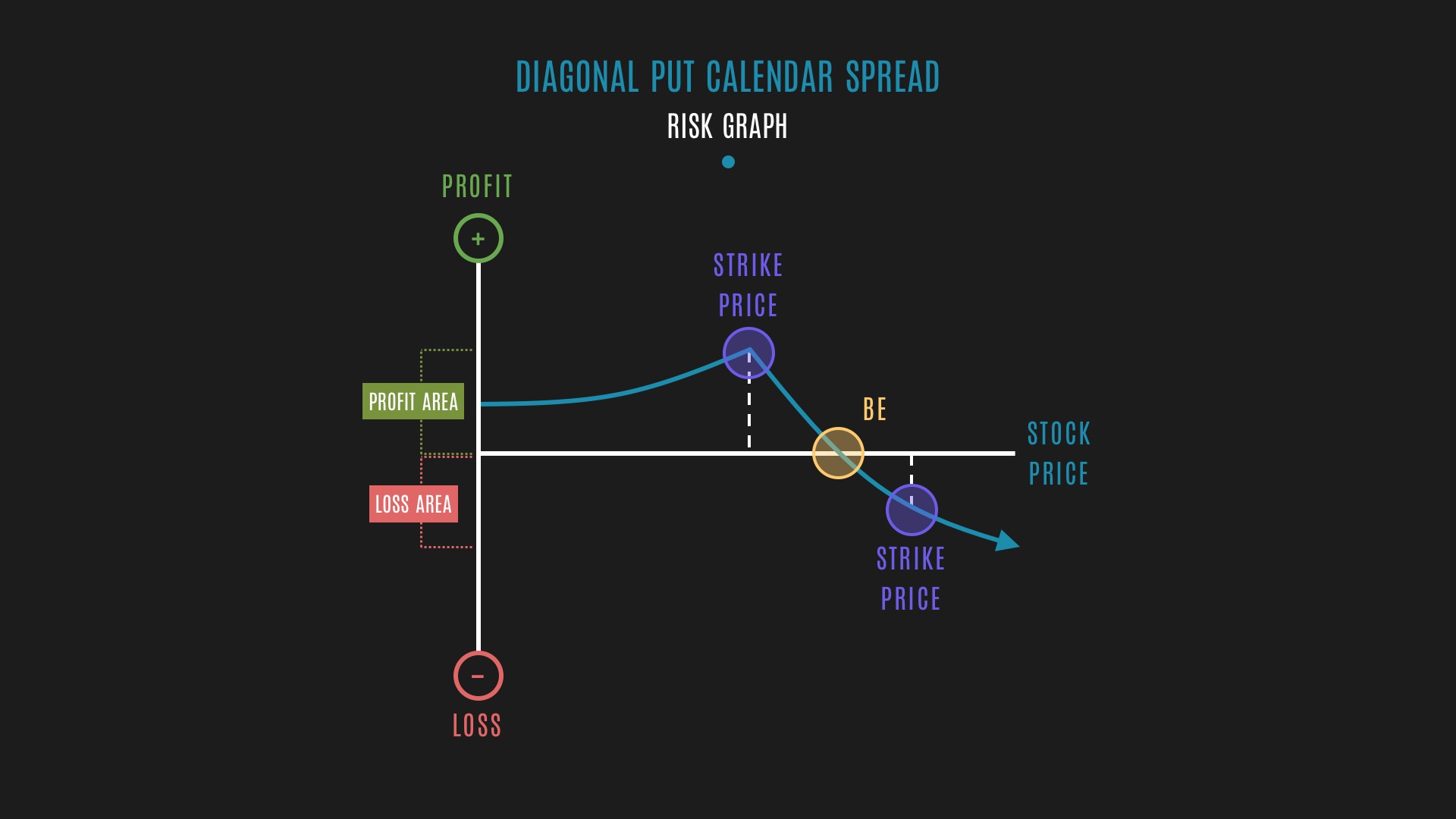

Glossary Diagonal Put Calendar Spread example Tackle Trading

Bearish Put Calendar Spread Option Strategy Guide

Le calendar spread Stratégies Options

Glossary Archive Tackle Trading

Bearish Put Calendar Spread Option Strategy Guide

Calendar Put Spread Options Edge

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Options Trading Made Easy Ratio Put Calendar Spread

Related Post:

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)