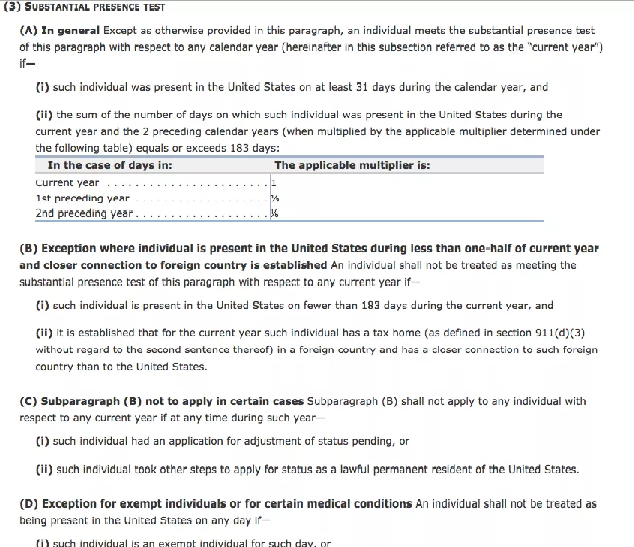

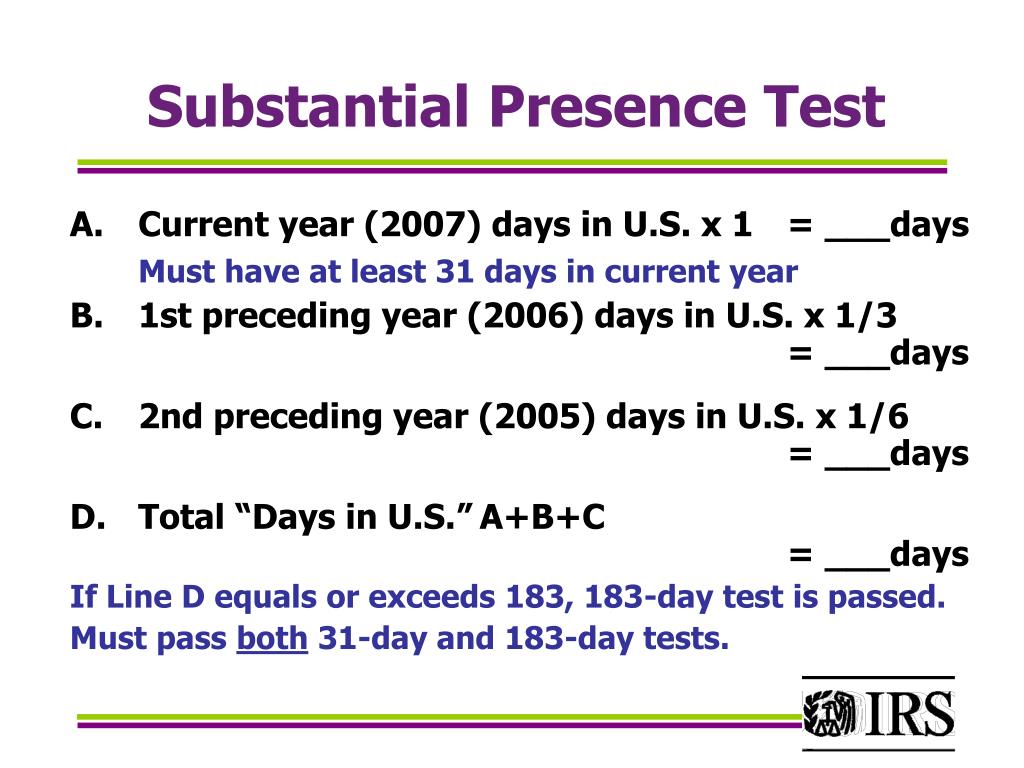

Substantial Presence Test For The Calendar Year

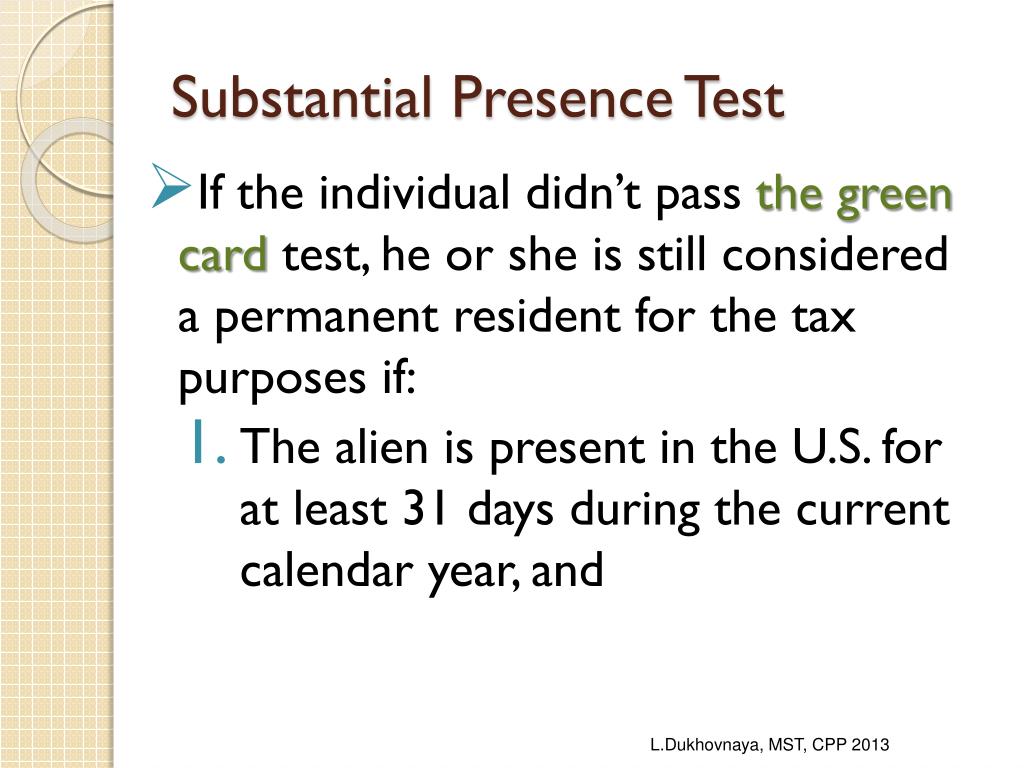

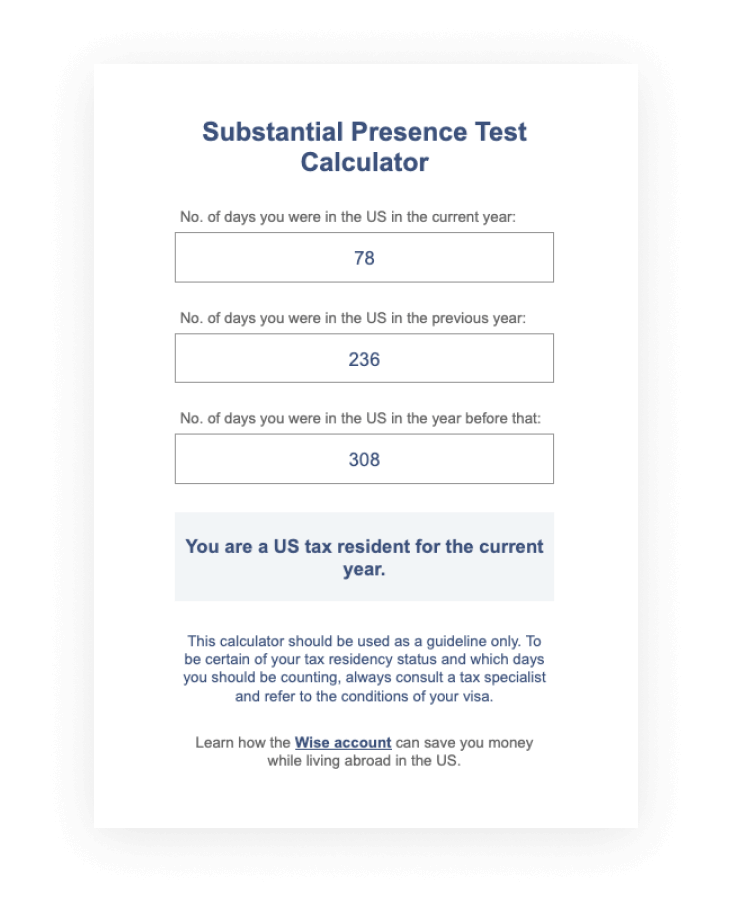

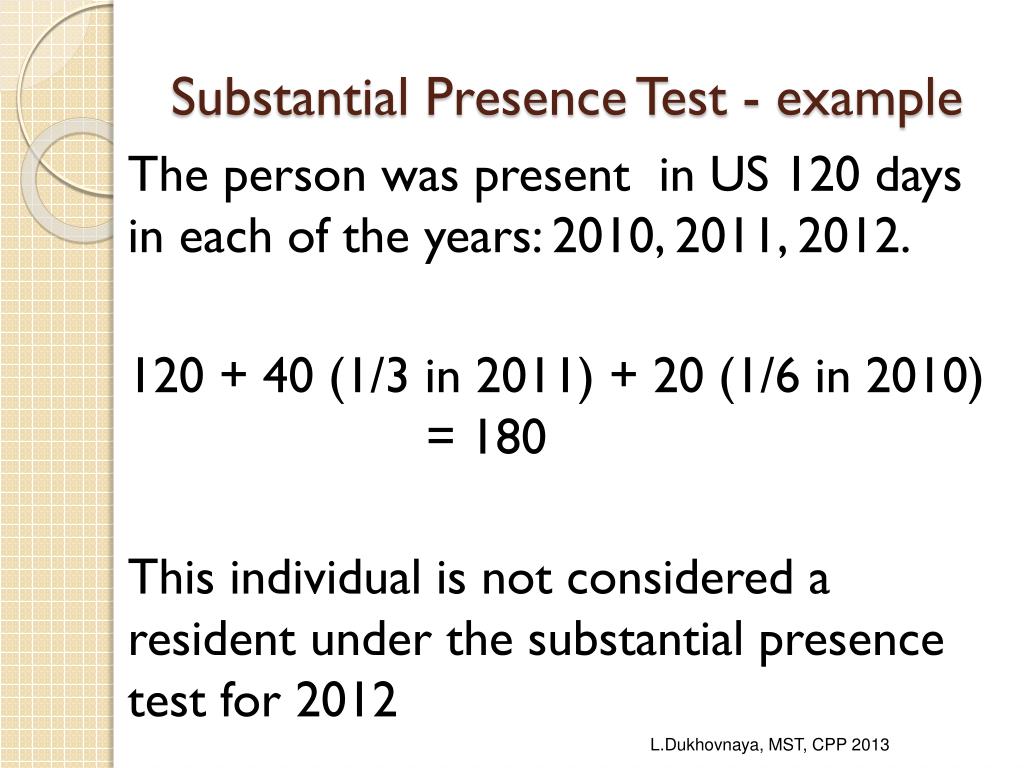

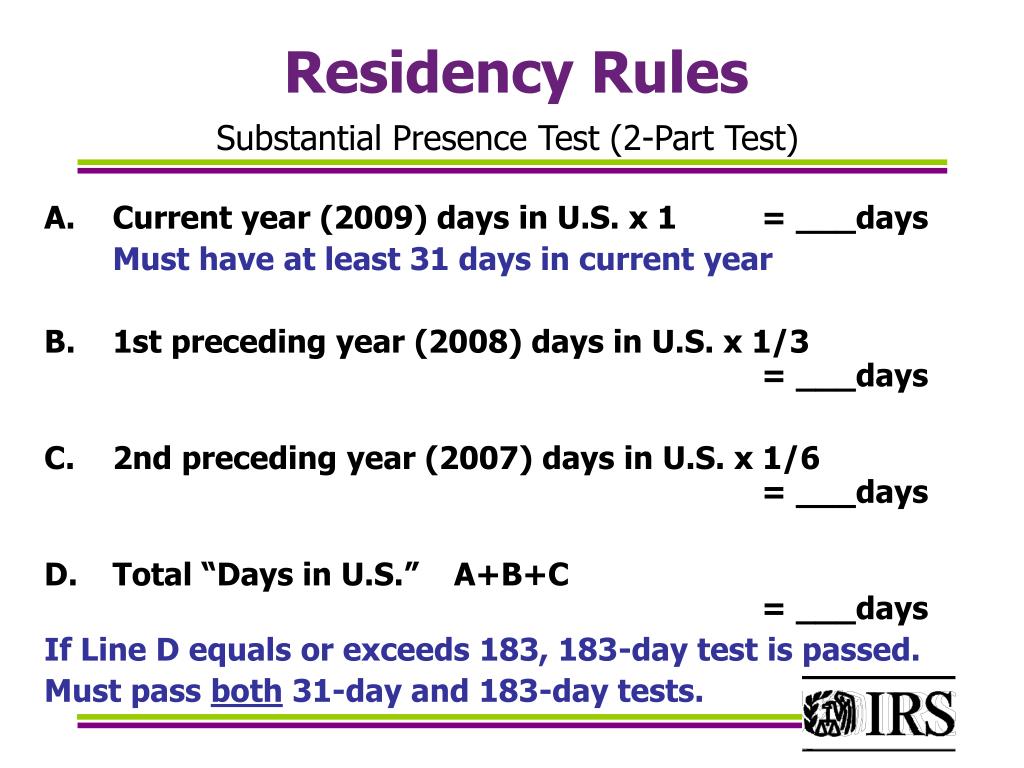

Substantial Presence Test For The Calendar Year - Web if an individual is a u.s. Web irs substantial presence test generally means that you were present in the united states for at least 31 days in the current year and a minimum total of 183. A student, temporarily present in the united states. Web employee presence test usa page. Web general rule under substantial presence test (spt). Web you are a resident of the united states for tax purposes if you meet either the green card test or the. Web the substantial presence test is a calculation that determines the resident or nonresident status of a foreign national for. To satisfy the substantial presence test: Web substantial presence test is a test defined by the irs to determine if a foreign national qualifies as a resident alien or a u.s. You are an exempt individual. Web individual meeting the substantial presence test at the time of tax filing are treated as a resident for tax purposes for the part of. Web employee presence test usa page. Web the substantial presence test is a calculation that determines the resident or nonresident status of a foreign national for. Web you still get 183 days, but the substantial. Web nonresident aliens you're considered a nonresident alien for any period that you're neither a u.s. Web substantial presence test is a test defined by the irs to determine if a foreign national qualifies as a resident alien or a u.s. Residence tests are generally applied on an annual calendar year basis. Web guidance dual residents 2020 (hs302) updated 6. Web you’ll be considered a us tax resident if you meet the substantial presence test requirements for the calendar year. Rongjie zhao last updated by rocio torres: You can work out your tax residency. Web the substantial presence test is a calculation that determines the resident or nonresident status of a foreign national for. Web yes have you been in. Web irs substantial presence test generally means that you were present in the united states for at least 31 days in the current year and a minimum total of 183. Web you are a 'resident for tax purposes' if you were a legal permanent resident of the united states any time during the past calendar. Web general rule under substantial. Web general rule under substantial presence test (spt). Web individual meeting the substantial presence test at the time of tax filing are treated as a resident for tax purposes for the part of. Web you’ll be considered a us tax resident if you meet the substantial presence test requirements for the calendar year. Web you are a 'resident for tax. Web individual meeting the substantial presence test at the time of tax filing are treated as a resident for tax purposes for the part of. For any part of more than 5 calendar years? Date of entry into united states: Web irs substantial presence test generally means that you were present in the united states for at least 31 days. Residence tests are generally applied on an annual calendar year basis. For any part of more than 5 calendar years? Web yes have you been in the u.s. Date of entry into united states: Web substantial presence test is a test defined by the irs to determine if a foreign national qualifies as a resident alien or a u.s. Web you are a resident of the united states for tax purposes if you meet either the green card test or the. Web the substantial presence test is a calculation that determines the resident or nonresident status of a foreign national for. Web the full 183 days in the current calendar year are required for residency because there are no. Web substantial presence test is a test defined by the irs to determine if a foreign national qualifies as a resident alien or a u.s. Web if an individual is a u.s. Web individual meeting the substantial presence test at the time of tax filing are treated as a resident for tax purposes for the part of. Web you’ll be. Web general rule under substantial presence test (spt). For any part of more than 5 calendar years? To satisfy the substantial presence test: Web f1 and j1 student visa holders may exempt 5 calendar years of presence for purposes of the substantial presence test. Web you are a resident of the united states for tax purposes if you meet either. Web if an individual is a u.s. A student, temporarily present in the united states. Web you are a 'resident for tax purposes' if you were a legal permanent resident of the united states any time during the past calendar. Web you are a resident of the united states for tax purposes if you meet either the green card test or the. Residence tests are generally applied on an annual calendar year basis. Run the substantial presence test to determine if alien. You can work out your tax residency. Date of entry into united states: Web you’ll be considered a us tax resident if you meet the substantial presence test requirements for the calendar year. Web the substantial presence test is a calculation that determines the resident or nonresident status of a foreign national for. Web irs substantial presence test generally means that you were present in the united states for at least 31 days in the current year and a minimum total of 183. Rongjie zhao last updated by rocio torres: Web you still get 183 days, but the substantial presence test uses a formula to count all days that you have spent in the us within. For any part of more than 5 calendar years? Web nonresident aliens you're considered a nonresident alien for any period that you're neither a u.s. Web the full 183 days in the current calendar year are required for residency because there are no countable days in the prior two years. You are an exempt individual. Web guidance dual residents 2020 (hs302) updated 6 april 2023 print this page overview if you live in the uk and another. Resident (under the lawful permanent residence or substantial presence test) in. Web employee presence test usa page.PPT Inpatriate / Nonresident Alien PowerPoint Presentation, free

Substantial Presence Test Calculator Wise

Substantial Presence Test Finance and Treasury

2023 Substantial Presence Test News Illinois State

PPT Inpatriate / Nonresident Alien PowerPoint Presentation, free

PPT Internal Revenue Service Wage and Investment Stakeholder

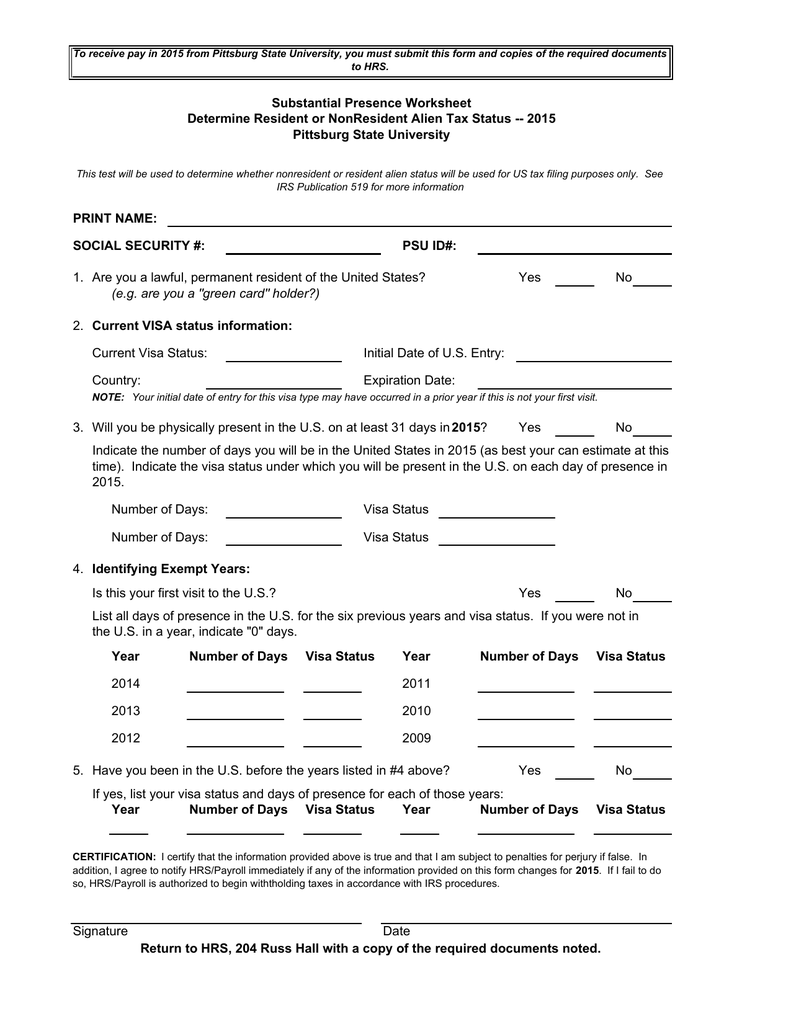

Substantial Presence Worksheet

Investment in U.S. Real Estate United States Tax Seminars

The Isaac Brock Society Why the S. 877A(g)(1)(B) “dual citizen

PPT Internal Revenue Service Wage and Investment Stakeholder

Related Post: