Tax Refund Calendar With Earned Income Credit

Tax Refund Calendar With Earned Income Credit - Web and the irs will start accepting returns on january 23 under the 2023 eitc refund schedule. Web below are statistics on current and previous years earned income tax credit (eitc) return by states. Web the outlet said refunds could take longer during peak filing times in april, while. Web by law, the irs cannot issue a refund involving the earned income tax credit or additional child tax credit before. The irs cannot issue a. Web earned income tax credit or additional child tax credit refunds: Web if you have the earned income tax credit or additional child tax credit, your refund does not start processing until february 15. Web taxpayers who claimed the earned income tax credit (eitc) or additional child tax credit (actc) may receive their. Early tax filers who are a due a. Web the 2023 tax year will bring a few changes to the way that taxpayers claim their tax refund. Web taxpayers who claimed the earned income tax credit (eitc) or additional child tax credit (actc) may receive their. Return received refund approved refund sent you get. Web below are statistics on current and previous years earned income tax credit (eitc) return by states. However, taxes for the tax year 2022 are. Web the tool tracks your refund's progress through. Web if you have the earned income tax credit or additional child tax credit, your refund does not start processing until february 15. Early tax filers who are a due a. The eitc is one of the federal government's largest refundable. Web the covid stimulus payments will not affect your income tax refund, though some taxpayers who didn't receive one.. Web below are statistics on current and previous years earned income tax credit (eitc) return by states. By law, the irs cannot issue a refund involving the. Web taxpayers who claimed the earned income tax credit (eitc) or additional child tax credit (actc) may receive their. Paper file with direct deposit. Early tax filers who are a due a. One of the most significant changes for the 2023 tax year is the. Web taxpayers who claimed the earned income tax credit (eitc) or additional child tax credit (actc) may receive their. Web and the irs will start accepting returns on january 23 under the 2023 eitc refund schedule. The irs cannot issue a. Web if you have the earned. Web by law, the irs cannot issue a refund involving the earned income tax credit or additional child tax credit before. Paper file with direct deposit. One of the most significant changes for the 2023 tax year is the. By law, the irs cannot issue a refund involving the. Web if you have the earned income tax credit or additional. Return received refund approved refund sent you get. By law, the irs cannot issue a refund involving the. Web earned income tax credit or additional child tax credit refunds: Web by law, the irs cannot issue a refund involving the earned income tax credit or additional child tax credit before. Web the outlet said refunds could take longer during peak. The irs cannot issue a. Web taxpayers who claimed the earned income tax credit (eitc) or additional child tax credit (actc) may receive their. Web the tool tracks your refund's progress through 3 stages: Web earned income tax credit or additional child tax credit refunds: Web the covid stimulus payments will not affect your income tax refund, though some taxpayers. Early tax filers who are a due a. Web by law, the irs cannot issue a refund involving the earned income tax credit or additional child tax credit before. Web the covid stimulus payments will not affect your income tax refund, though some taxpayers who didn't receive one. By law, the irs cannot issue a refund involving the. Web taxpayers. Web if you have the earned income tax credit or additional child tax credit, your refund does not start processing until february 15. Web for most years, the deadline to submit your and pay your tax bill is april 15. Web taxpayers who claimed the earned income tax credit (eitc) or additional child tax credit (actc) may receive their. Return. Web and the irs will start accepting returns on january 23 under the 2023 eitc refund schedule. However, taxes for the tax year 2022 are. One of the most significant changes for the 2023 tax year is the. Web the 2023 tax year will bring a few changes to the way that taxpayers claim their tax refund. Web childless workers. Return received refund approved refund sent you get. Web below are statistics on current and previous years earned income tax credit (eitc) return by states. One of the most significant changes for the 2023 tax year is the. Web the tool tracks your refund's progress through 3 stages: Web for most years, the deadline to submit your and pay your tax bill is april 15. Web and the irs will start accepting returns on january 23 under the 2023 eitc refund schedule. Web the covid stimulus payments will not affect your income tax refund, though some taxpayers who didn't receive one. Web the outlet said refunds could take longer during peak filing times in april, while. Web the 2023 tax year will bring a few changes to the way that taxpayers claim their tax refund. Paper file with direct deposit. The eitc is one of the federal government's largest refundable. The irs cannot issue a. Web if you have the earned income tax credit or additional child tax credit, your refund does not start processing until february 15. Web by law, the irs cannot issue a refund involving the earned income tax credit or additional child tax credit before. Web taxpayers who claimed the earned income tax credit (eitc) or additional child tax credit (actc) may receive their. By law, the irs cannot issue a refund involving the. Web childless workers this year can claim an earned income tax credit worth up to $1,500 — triple the usual amount. Web earned income tax credit or additional child tax credit refunds: However, taxes for the tax year 2022 are. Early tax filers who are a due a.List Of Tax Refund Calendar 2022 Ideas Blank November 2022 Calendar

Child Tax Credit 2019 Chart What is the Earned Tax Credit

2019 Tax Refund Dates Brown, Brown and Associates & CPA, Tax

Child Tax Credit 2021 Table / Earned Credit Table 2018

Earned Credit Tax Table Chart 2016 Calendar Template 2016

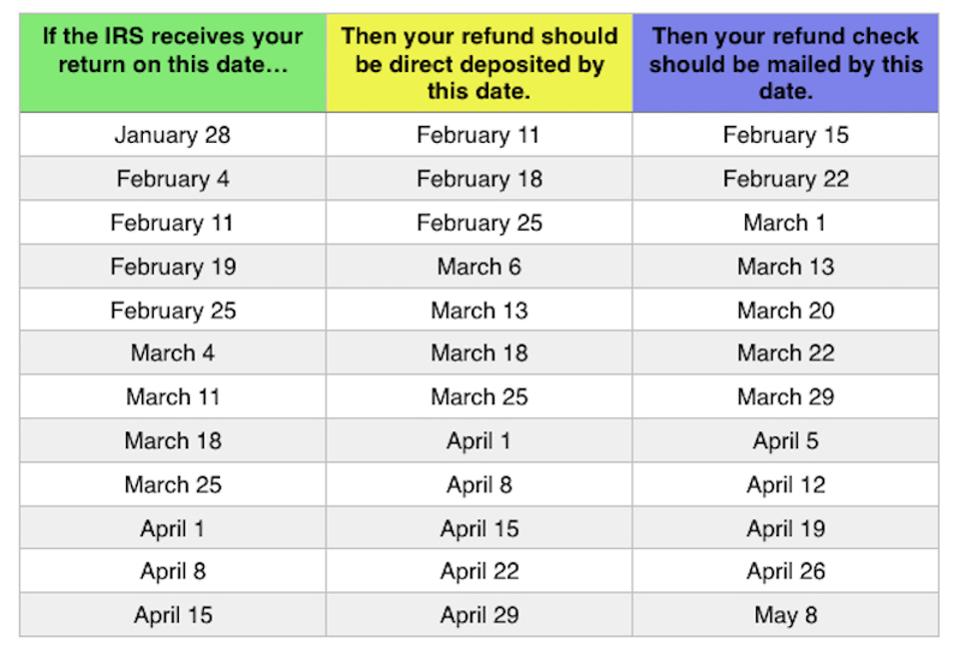

2017 IRS Refund Processing Schedule and Direct Deposit Cycle Chart for

Tax Return Date / tax return due date extension / Below

Tax Refund Dates 2021 Where's My Refund When Am I Going To Get My Tax

Tax Refund Calendar 2022 Customize and Print

When can you Expect Your Tax Refund? Andrews Tax Accounting

Related Post: