Tax Year Vs Calendar Year

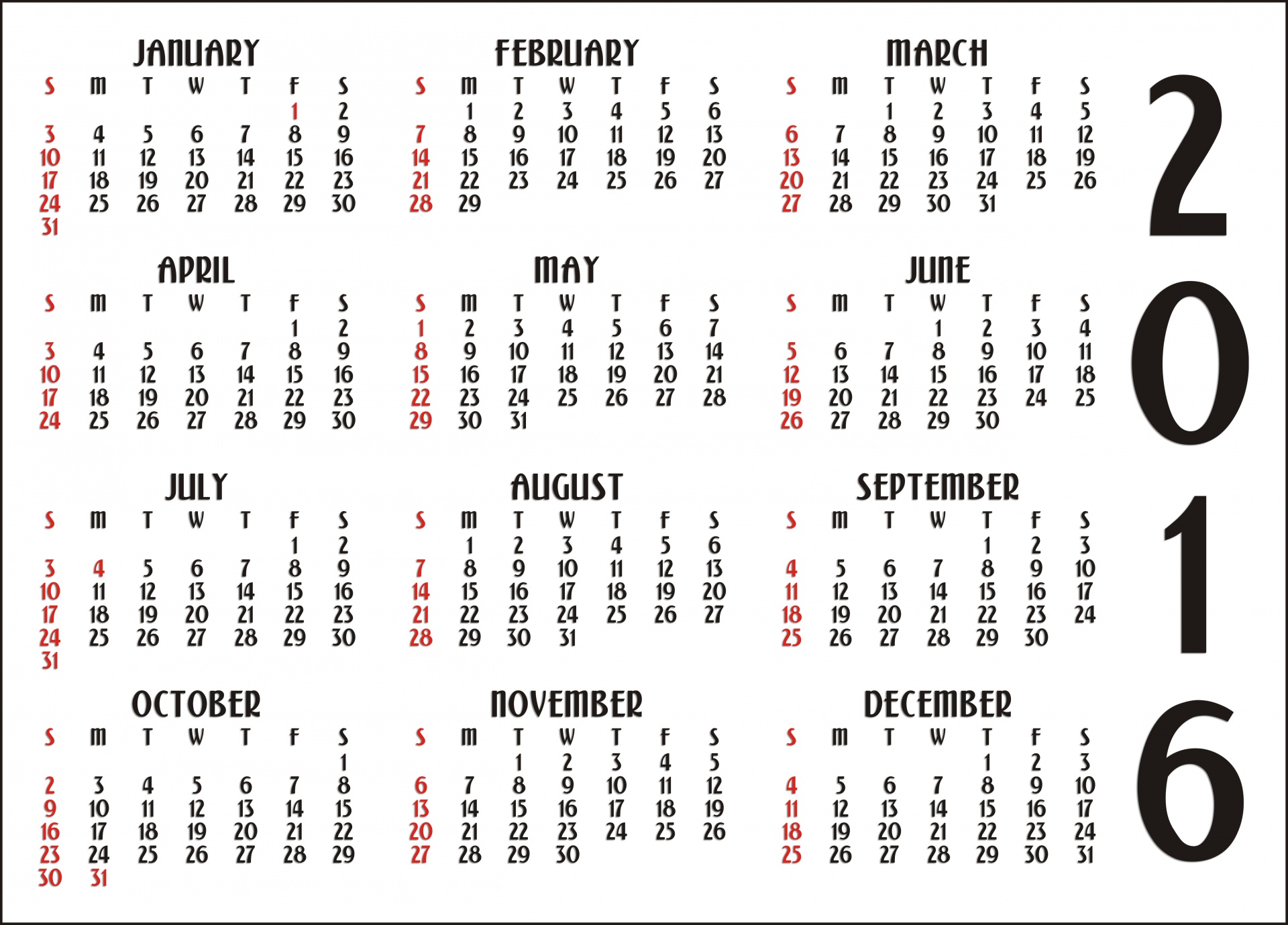

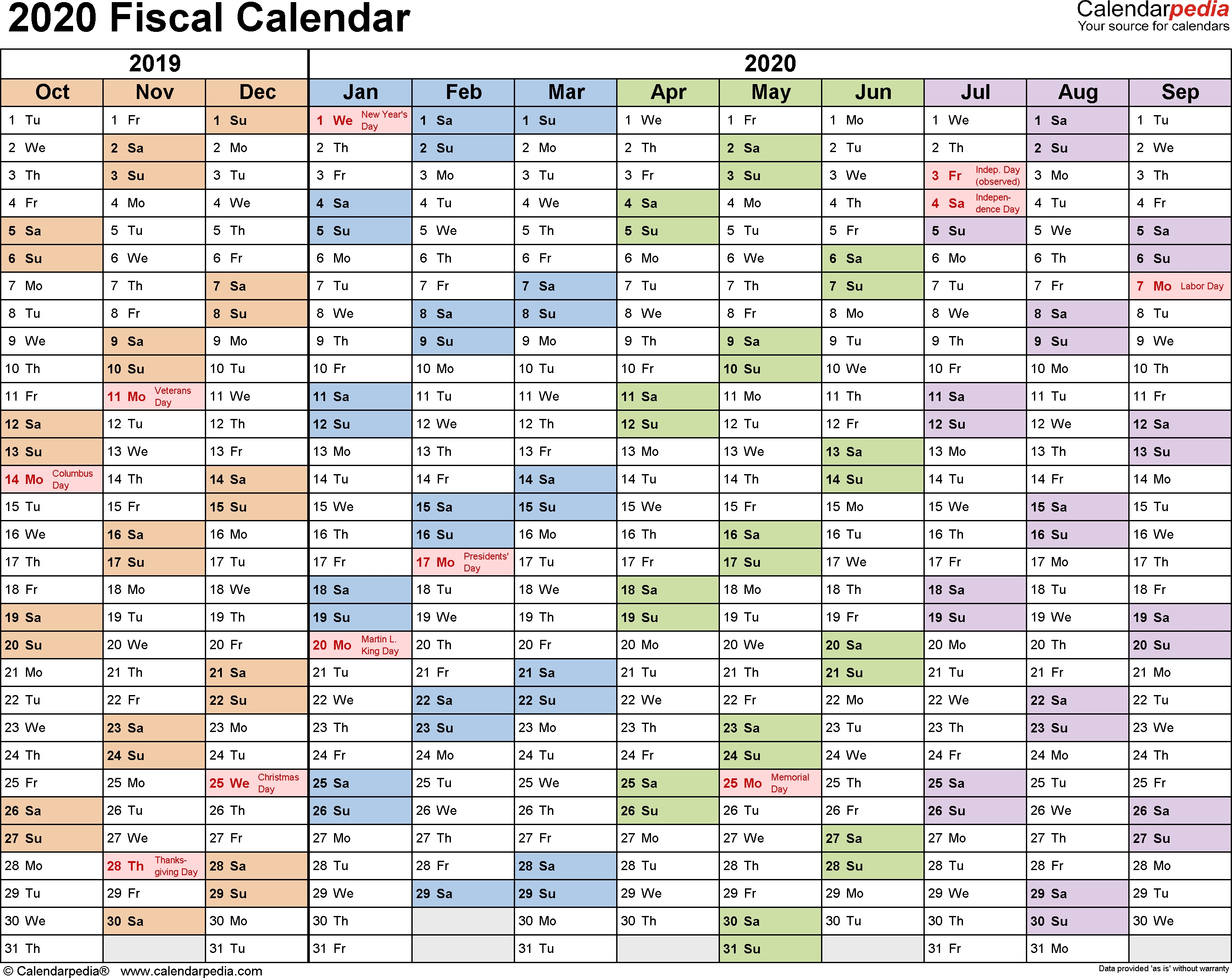

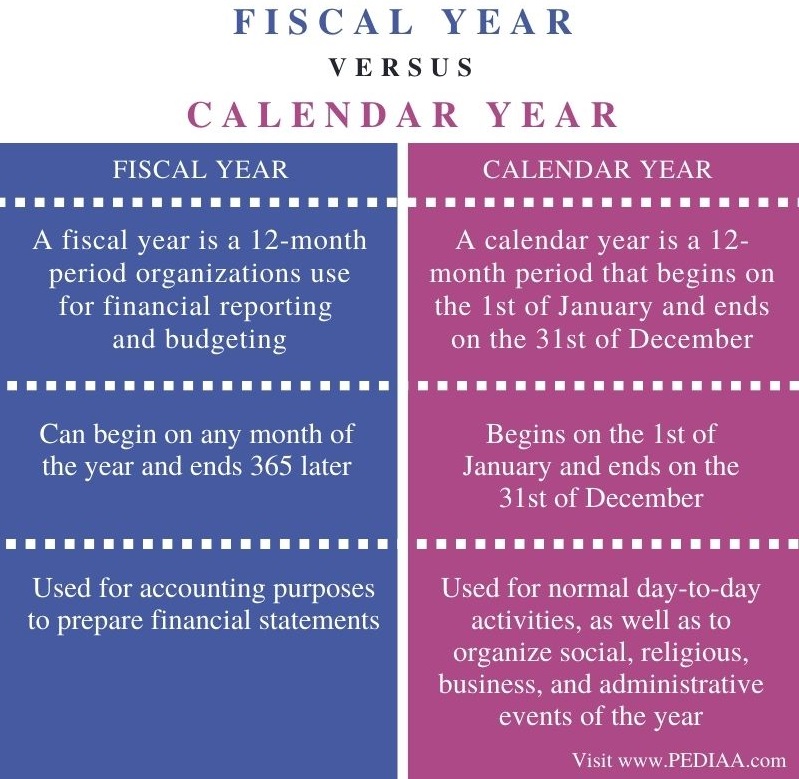

Tax Year Vs Calendar Year - Differences between a calendar year vs fiscal. A fiscal year starts whenever a business chooses to start their year, and. Web a tax year typically lasts 12 months or 52 to 53 weeks, and is the period of activity that you consider when. Web unfortunately, a tax year cannot be adopted by simply submitting an application for an employer identification number, paying. Web a fiscal year is most commonly used for accounting purposes to prepare financial statements. Using a calendar year as a company’s tax year is often the simplest approach. Web the calendar year begins on the first of january and ends on 31st december every year, while the fiscal year can begin on. Hence this type of company should. Web the fiscal year is more suitable for tax reporting if the business cycle splits into two calendar years. Web a calendar year extends from january 1 to december 31. However, you choose the start date with. Hence this type of company should. Web difference the only difference between these terms i.e. Web by froehling anderson | oct 19, 2018 abstract: Web a tax year that follows the calendar year refers to the 12 consecutive months beginning jan. Web a fiscal year is most commonly used for accounting purposes to prepare financial statements. Web frequently asked questions tax questions fiscal year vs. Does the irs require a. However, you choose the start date with. Web a calendar year extends from january 1 to december 31. What is a calendar year? Web the fiscal year is more suitable for tax reporting if the business cycle splits into two calendar years. Does the irs require a. Hence this type of company should. President donald trump faces a tangled calendar in the year ahead as he seeks the 2024 republican. Web a fiscal tax year consists of 12 consecutive months that don’t begin on january 1 or end on december 31 — for. Fiscal year, financial year, tax year and accounting year is: Web a calendar year extends from january 1 to december 31. However, you choose the start date with. What is a calendar year? Does the irs require a. Calendar year is the period from january. Using a calendar year as a company’s tax year is often the simplest approach. Web the tax years you can use are: • under the tax or. Web a tax year that follows the calendar year refers to the 12 consecutive months beginning jan. However, you choose the start date with. A fiscal year starts whenever a business chooses to start their year, and. Using a calendar year as a company’s tax year is often the simplest approach. Hence this type of company should. Web by froehling anderson | oct 19, 2018 abstract: Web the calendar year begins on the first of january and ends on 31st december every year, while the fiscal year can begin on. What is a calendar year? Web the tax years you can use are: Calendar year is the period from january. Hence this type of company should. Web a calendar year extends from january 1 to december 31. Web understanding what each involves can help you determine which to use for accounting or tax purposes. Web a tax year is an annual accounting period for keeping records and reporting income and expenses. Fiscal year, financial year, tax year and accounting year. Web unfortunately, a tax year cannot be adopted by simply submitting an application for an employer identification number, paying. Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than. Web the calendar year begins on the first of january and ends on 31st december every year, while. Businesses can use either the. Web a fiscal tax year consists of 12 consecutive months that don’t begin on january 1 or end on december 31 — for. Web since the tax year can vary, it can be necessary to understand the difference between different account. Web by froehling anderson | oct 19, 2018 abstract: Web a tax year is. The year on a physical calendar is a calendar year. Web calendar starts january 1 and ends december 31. Does the irs require a. President donald trump faces a tangled calendar in the year ahead as he seeks the 2024 republican. Web the calendar year begins on the first of january and ends on 31st december every year, while the fiscal year can begin on. A fiscal year starts whenever a business chooses to start their year, and. Web a fiscal tax year consists of 12 consecutive months that don’t begin on january 1 or end on december 31 — for. Differences between a calendar year vs fiscal. Web since the tax year can vary, it can be necessary to understand the difference between different account. Web a fiscal year is most commonly used for accounting purposes to prepare financial statements. However, you choose the start date with. Businesses can use either the. Web understanding what each involves can help you determine which to use for accounting or tax purposes. Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than. Hence this type of company should. Using a calendar year as a company’s tax year is often the simplest approach. Web a tax year typically lasts 12 months or 52 to 53 weeks, and is the period of activity that you consider when. Fiscal year, financial year, tax year and accounting year is: • under the tax or. Web unfortunately, a tax year cannot be adopted by simply submitting an application for an employer identification number, paying.PPT Basic Accounting Concepts PowerPoint Presentation ID5002391

What is the Difference Between Fiscal Year and Calendar Year

Fiscal Year Vs. Calendar Year Inscription on Blue Keyboard Key Stock

Fiscal Year vs Calendar Year What’s Right for Your Business?

Pin on Finance

Fiscal Year Vs Calendar Year Marketing calendar template, Yearly

Fiscal Year Vs Calendar Year

What is the Difference Between Fiscal Year and Calendar Year

Difference Between Fiscal Year and Calendar Year Difference Between

Calendar Year vs Fiscal Year Top 6 Differences You Should Know (2022)

Related Post: