Texas Sales Tax Calendar

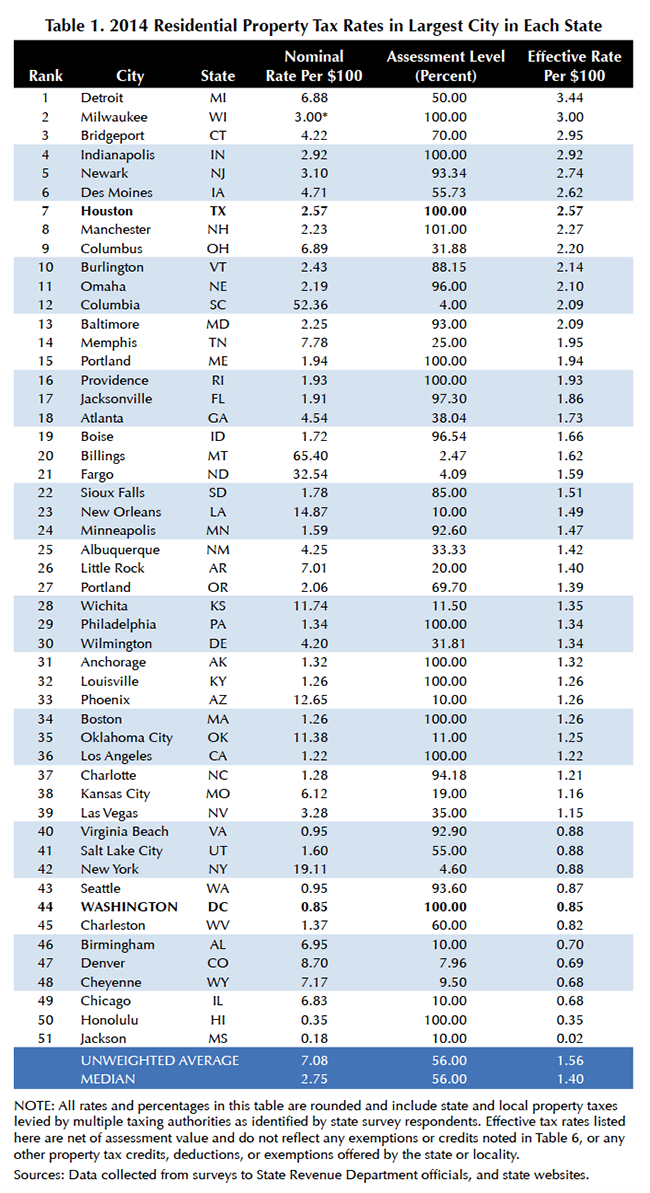

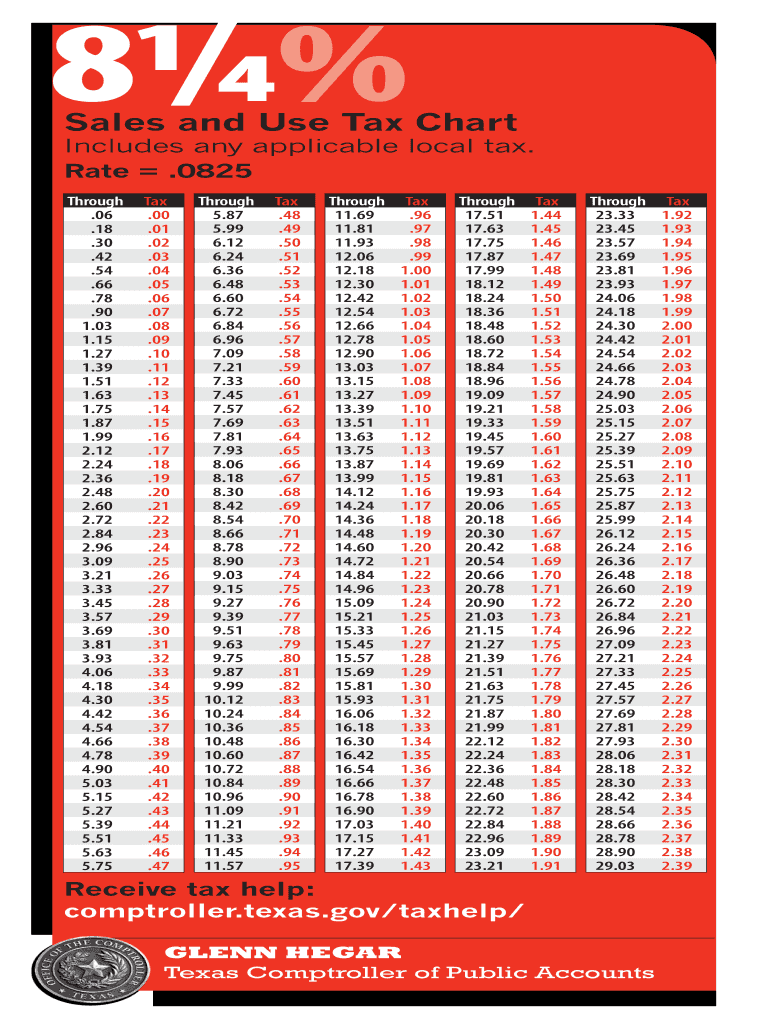

Texas Sales Tax Calendar - Web local tax rates in texas range from 0.125% to 2%, making the sales tax range in texas 6.375% to 8.25%. Web does texas have any sales tax holidays? Web calendar of texas sales tax filing dates depending on the volume of sales taxes you collect and the status of your sales tax. This is the distribution schedule for sales tax allocation payment distributions to cities, counties, special. Qualifying “sellers of meals” could opt to. Aug 5, 2022 / 01:52 pm cdt. Aug 5, 2022 / 12:10 pm cdt. So if you live in texas, collecting sales tax is fairly easy. Web the bureau of internal revenue has issued the following guidance: Web the texas sales tax rate is 6.25% as of 2023, with some cities and counties adding a local sales tax on top of the tx state sales tax. Web for applicable taxes, quarterly reports are due in april, july, october and january. In addition, local taxing jurisdictions such as counties, cities, special purpose districts,. Qualifying “sellers of meals” could opt to. Web local tax rates in texas range from 0.125% to 2%, making the sales tax range in texas 6.375% to 8.25%. Web calendar of texas sales tax. Aug 5, 2022 / 12:10 pm cdt. Web taxes sales tax holiday: Collect sales tax at the tax. Web calendar of texas sales tax filing dates depending on the volume of sales taxes you collect and the status of your sales tax. Taxcloud's texas sales tax guide covers rates, due dates and helps. In addition, local taxing jurisdictions such as counties, cities, special purpose districts,. Taxpayers can buy certain items tax free during texas’ four annual sales and. Web taxes sales tax holiday: Aug 5, 2022 / 12:10 pm cdt. Web the holiday begins on the friday preceding the 15th day before the state’s uniform start date for public school classes and ends. In addition, local taxing jurisdictions such as counties, cities, special purpose districts,. Aug 5, 2022 / 01:52 pm cdt. Aug 5, 2022 / 12:10 pm cdt. Taxpayers can buy certain items tax free during texas’ four annual sales and. Web local tax rates in texas range from 0.125% to 2%, making the sales tax range in texas 6.375% to 8.25%. Aug 5, 2022 / 12:10 pm cdt. Web connecticut carved out temporary sales tax relief for restaurants: Web calendar of texas sales tax filing dates depending on the volume of sales taxes you collect and the status of your sales tax. Collect sales tax at the tax. In addition, local taxing jurisdictions such as counties, cities, special purpose districts,. Web taxes sales tax holiday: Qualifying “sellers of meals” could opt to. Taxpayers can buy certain items tax free during texas’ four annual sales and. Web texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. In addition, local taxing jurisdictions such as counties, cities, special. Taxpayers can buy certain items tax free during texas’ four annual sales and. Web taxes sales tax holiday: In addition, local taxing jurisdictions such as counties, cities, special purpose districts,. Web texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. Web local tax rates in. Web the texas sales tax rate is 6.25% as of 2023, with some cities and counties adding a local sales tax on top of the tx state sales tax. Aug 5, 2022 / 01:52 pm cdt. Web local tax rates in texas range from 0.125% to 2%, making the sales tax range in texas 6.375% to 8.25%. Collect sales tax. Web does texas have any sales tax holidays? Aug 5, 2022 / 01:52 pm cdt. Collect sales tax at the tax. Qualifying “sellers of meals” could opt to. Taxcloud's texas sales tax guide covers rates, due dates and helps. Web texas comptroller glenn hegar is reminding shoppers they can save money on clothes and school supplies during the. Web there is a statewide sales tax of 6.25%. Aug 5, 2022 / 12:10 pm cdt. Taxcloud's texas sales tax guide covers rates, due dates and helps. Collect sales tax at the tax. Web does texas have any sales tax holidays? Web the texas sales tax rate is 6.25% as of 2023, with some cities and counties adding a local sales tax on top of the tx state sales tax. Web the bureau of internal revenue has issued the following guidance: Aug 5, 2022 / 12:10 pm cdt. Taxpayers can buy certain items tax free during texas’ four annual sales and. Web texas comptroller glenn hegar is reminding shoppers they can save money on clothes and school supplies during the. Web texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. So if you live in texas, collecting sales tax is fairly easy. Taxcloud's texas sales tax guide covers rates, due dates and helps. This is the distribution schedule for sales tax allocation payment distributions to cities, counties, special. Austin (kxan) — texas’ 23rd annual. Web for applicable taxes, quarterly reports are due in april, july, october and january. In addition, local taxing jurisdictions such as counties, cities, special purpose districts,. Web taxes sales tax holiday: Web connecticut carved out temporary sales tax relief for restaurants: When a reporting due date happens to fall. Aug 5, 2022 / 01:52 pm cdt. Web calendar of texas sales tax filing dates depending on the volume of sales taxes you collect and the status of your sales tax. Web everything you need to know about texas sales tax! Collect sales tax at the tax.Texas Tax Due Date TXASCE

Article

Sales Tax Chart Fill Out and Sign Printable PDF Template signNow

How to File and Pay Sales Tax in Texas TaxValet

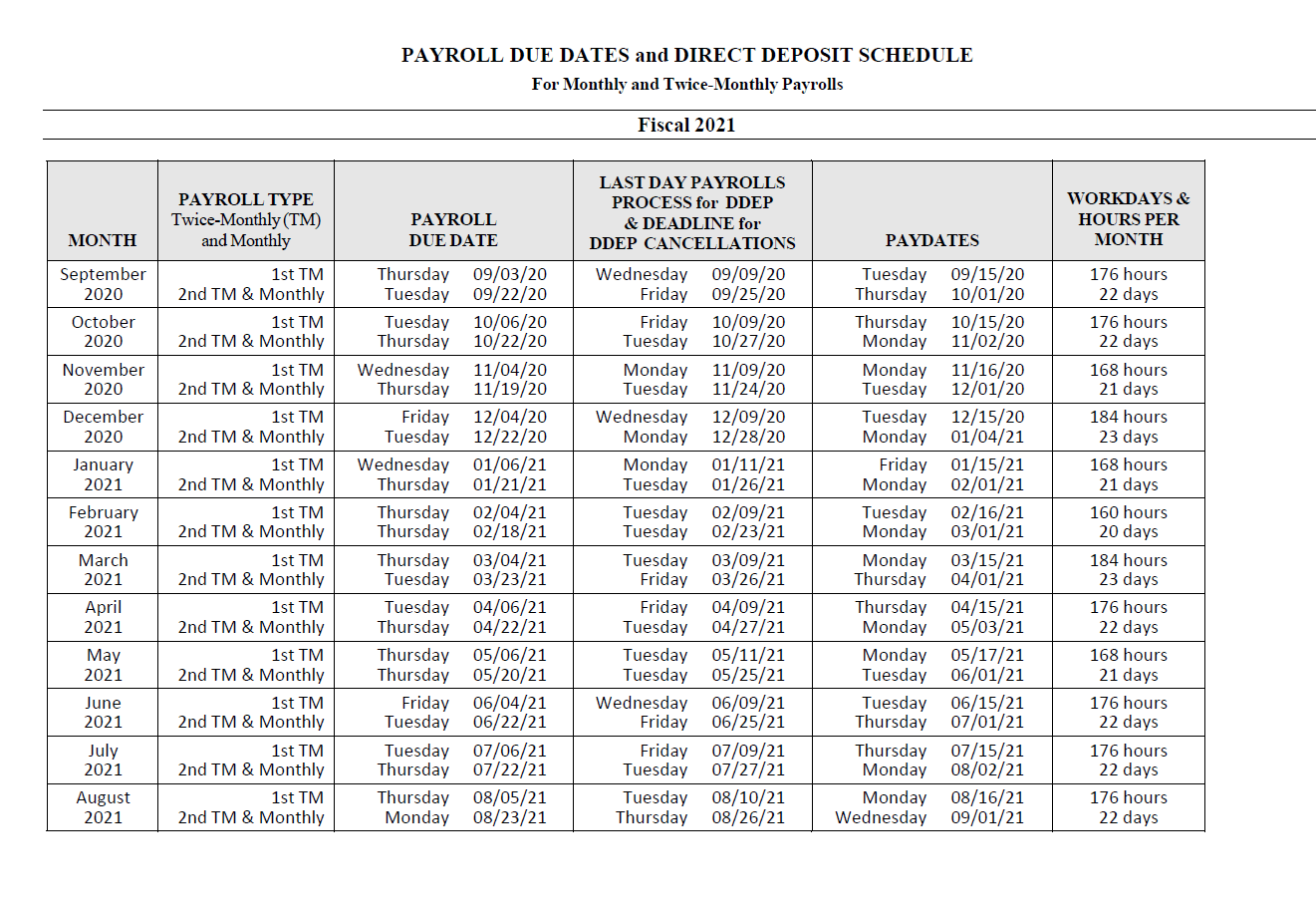

State of Texas Payroll Calendar 2023 2023 Payroll Calendar

Texas Sales Tax Map Printable Maps

Texas collects record 2.86 billion in sales tax for July Bond Buyer

Texas Sales Tax Chart

Texas sale tax rises 3.5 to 2.89B Bond Buyer

TX Sales Tax Return Monthly Form Denver City & County Fill out Tax

Related Post: