Trading Calendar Spreads

Trading Calendar Spreads - Web august 17, 2023 at 4:00 pm pdt. Web what are calendar spreads? Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. In general, market timing is much. Web a calendar spread is technique traders employ to buy and sell the same derivative of the same strike price but with different. Web calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal spreads’. Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and. To create a new call calendar spread for uso, sell january's. In the options strategy version,. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. Ensure that both options have sufficient liquidity to ensure. Web the last risk to avoid when trading calendar spreads is an untimely entry. Web trading option calendar spreads being long a calendar spread consists of a selling an option in a near. Web august. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Web a calendar spread is technique traders employ to buy and sell the same derivative of the same strike price but with different. Web august 17, 2023 at 4:00 pm pdt. Web the last. Web a double calendar spread is an option trading strategy that involves selling near month calls and puts and buying. Web what are calendar spreads? Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index with the same strike price. Web a calendar. Web a calendar spread is a strategy used in options and futures trading: Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. Web here are some tips for trading calendar spreads: Web calendar spreads are a great way to combine the advantages of spreads and directional options trades in the. Web the last. Web a double calendar spread is an option trading strategy that involves selling near month calls and puts and buying. Web a calendar spread is technique traders employ to buy and sell the same derivative of the same strike price but with different. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index with the same strike price. In the options strategy version,. Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and. A. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index with the same strike price. Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different. Web description *****join over 2,000 happy. Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different. Web description *****join over 2,000 happy students enrolled in this course***** learn how i profit from trading calendar spreads. A calendar spread uses the different option expiration dates to create. Web calendar spreads are a great way to. Web calendar spreads are a great way to combine the advantages of spreads and directional options trades in the. Web august 17, 2023 at 4:00 pm pdt. In the options strategy version,. In general, market timing is much. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the. Web august 17, 2023 at 4:00 pm pdt. Web what are calendar spreads? Web a calendar spread is technique traders employ to buy and sell the same derivative of the same strike price but with different. To create a new call calendar spread for uso, sell january's. In general, market timing is much. Ensure that both options have sufficient liquidity to ensure. Web august 17, 2023 at 4:00 pm pdt. In general, market timing is much. Web what are calendar spreads? Web trading option calendar spreads being long a calendar spread consists of a selling an option in a near. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Web a double calendar spread is an option trading strategy that involves selling near month calls and puts and buying. Web key points to trading calendar spreads. Web calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal spreads’. Web here are some tips for trading calendar spreads: Web the last risk to avoid when trading calendar spreads is an untimely entry. Web description *****join over 2,000 happy students enrolled in this course***** learn how i profit from trading calendar spreads. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. Web a calendar spread is an options trading strategy in which you enter a long or short position in the stock with the same. To create a new call calendar spread for uso, sell january's. In the options strategy version,. Web a calendar spread is a strategy used in options and futures trading: Web a calendar spread is technique traders employ to buy and sell the same derivative of the same strike price but with different. A calendar spread uses the different option expiration dates to create. Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different.Pin on CALENDAR SPREADS OPTIONS

Pin on CALENDAR SPREADS OPTIONS

Pin on CALENDAR SPREADS OPTIONS

How To Trade Calendar Spreads The Complete Guide

Pin on CALENDAR SPREADS OPTIONS

Trading an Options Calendar Spread for profit complete how to. YouTube

Pin on Option Trading Strategies

Pin on Double Calendar Spreads and Adjustments

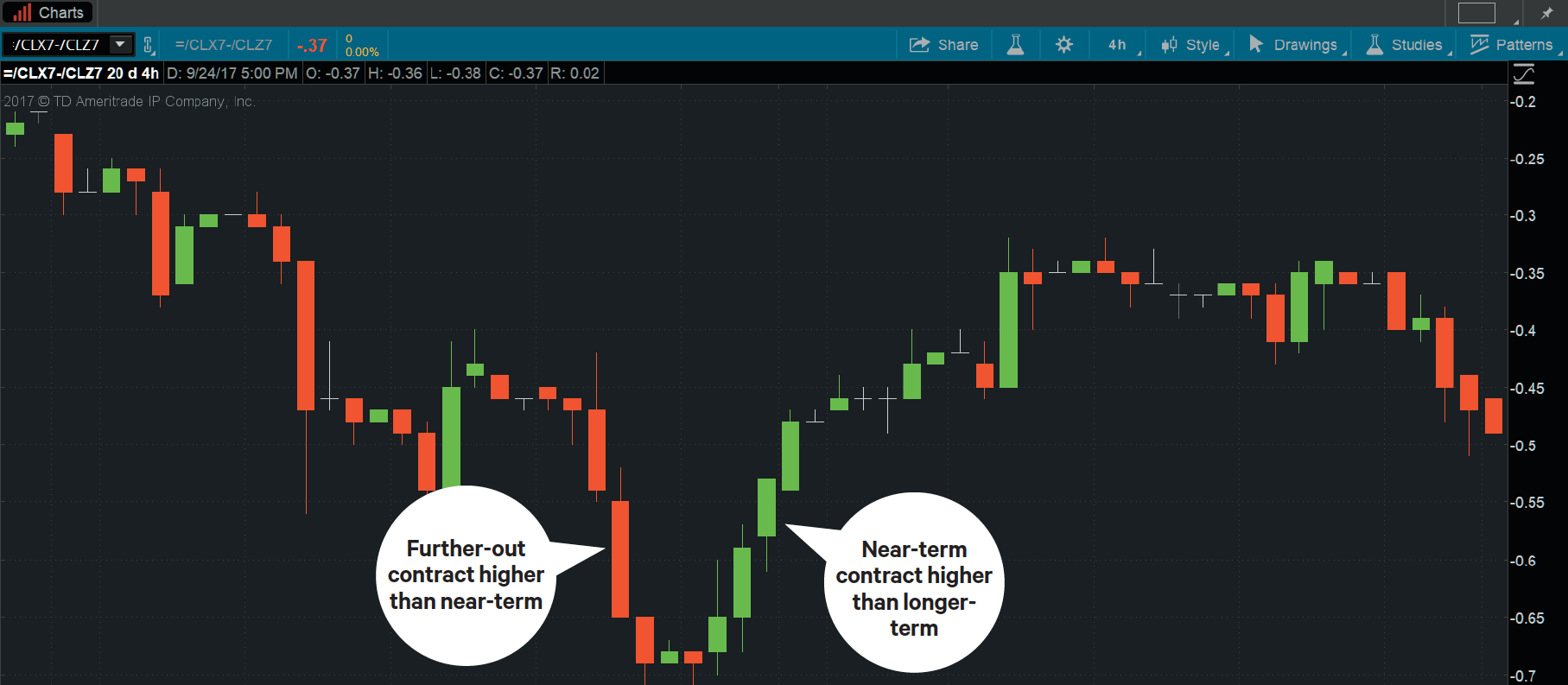

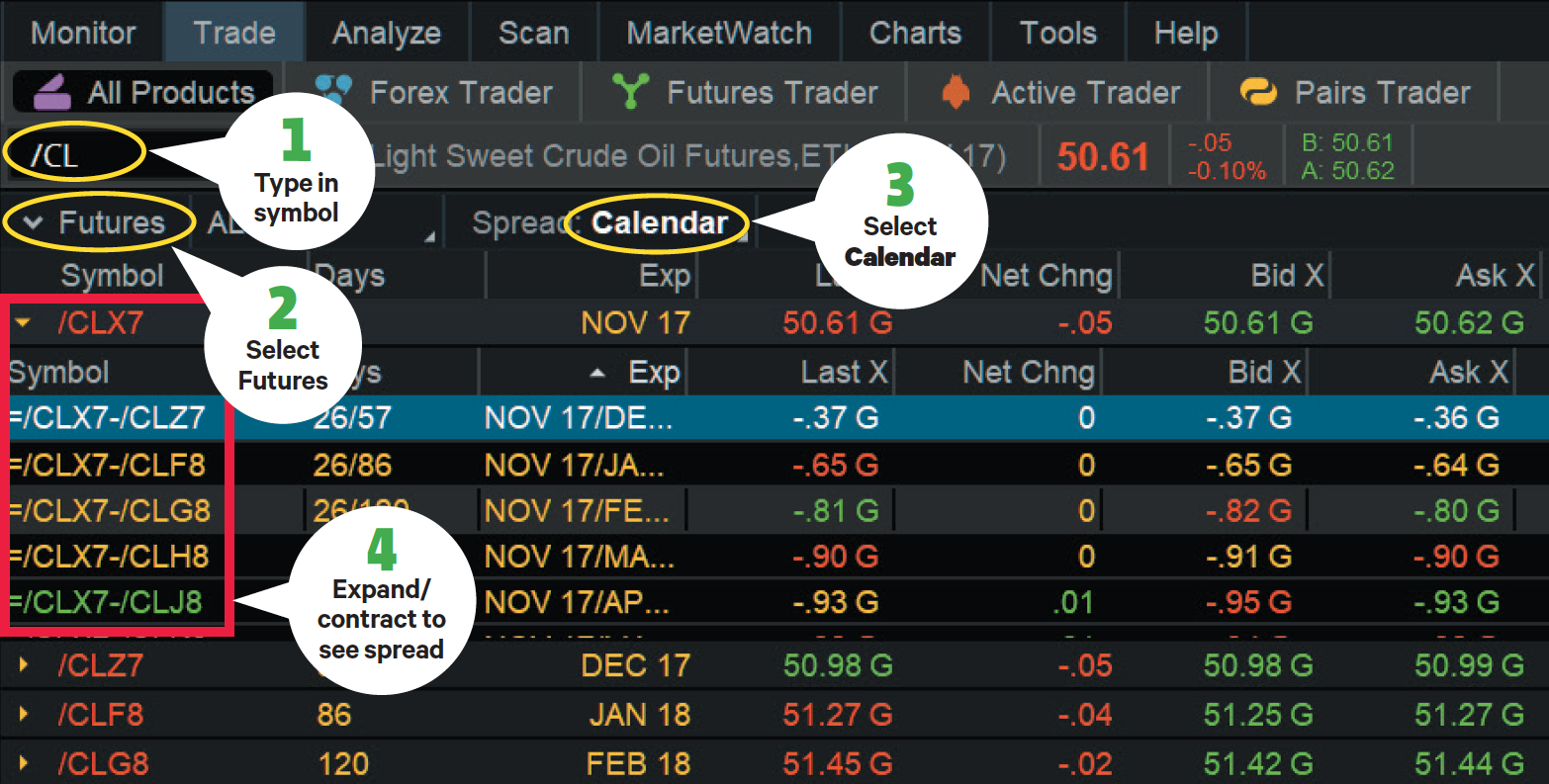

Dollar vs. World Turn Down the Noise, Hear the Marke... Ticker Tape

Dollar vs. World Turn Down the Noise, Hear the Marke... Ticker Tape

Related Post: