Triple Calendar Spread

Triple Calendar Spread - This is your complete guide to calendar spreads. Web double/triple calendar spreads as an earnings play. In this spread, the breakeven will be even a bit higher. Web buying three calendars is called a triple calendar spread. So i’ve been paper trading a strategy for only a week so far that. A double calendar has positive vega so it is best entered in a low volatility environment. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or. Web trading option calendar spreads. A double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike price. Web offers a free lesson on triple calendar spreads using a real world example with amgen, amgn. In this spread, the breakeven will be even a bit higher. Web on 14 feb 2022, i exited the triple calendar trade that i entered on 10 feb 2022. In this episode, i walk. This trade is short term and is designed to be closed on this coming friday. Web 63 save 2.4k views 1 year ago #options #calendar #weekly_income. Web what is a double calendar spread? A double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike price. This is your complete guide to calendar spreads. In this episode, i walk. In this spread, the breakeven will be even a bit higher. Web what is a double calendar spread? Web on 14 feb 2022, i exited the triple calendar trade that i entered on 10 feb 2022. In this episode, i walk. Web 63 save 2.4k views 1 year ago #options #calendar #weekly_income i have discussed triple calendar spread in detail. This trade is short term and is designed to be closed. In this spread, the breakeven will be even a bit higher. Web nearly $2.3 billion has streamed into the the direxion daily 20+ year treasury bull 3x etf (ticker tmf) this year,. Web triple calendar spread gives you profit in all market conditions, when it goes up, down or move sideways. This is your complete guide to calendar spreads. In. Web triple calendar spread | 3 leg calendar spread | non directional strategy | derive trading 16,733 views premiered aug 4, 2021 587 dislike share save derive. This is your complete guide to calendar spreads. Web 63 save 2.4k views 1 year ago #options #calendar #weekly_income i have discussed triple calendar spread in detail. Web double/triple calendar spreads as an. Web nearly $2.3 billion has streamed into the the direxion daily 20+ year treasury bull 3x etf (ticker tmf) this year,. Web 63 save 2.4k views 1 year ago #options #calendar #weekly_income i have discussed triple calendar spread in detail. In this spread, the breakeven will be even a bit higher. Web what is a double calendar spread? Web triple. Being long a calendar spread consists of a selling an option in a near. Web offers a free lesson on triple calendar spreads using a real world example with amgen, amgn. Web trading option calendar spreads. A double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts. Web double/triple calendar spreads as an earnings play. In this spread, the breakeven will be even a bit higher. Web nearly $2.3 billion has streamed into the the direxion daily 20+ year treasury bull 3x etf (ticker tmf) this year,. Web triple calendar spread gives you profit in all market conditions, when it goes up, down or move sideways. Web. This is your complete guide to calendar spreads. Being long a calendar spread consists of a selling an option in a near. This trade is short term and is designed to be closed on this coming friday. A double calendar has positive vega so it is best entered in a low volatility environment. Web triple calendar spread gives you profit. This trade is short term and is designed to be closed on this coming friday. Web what is a double calendar spread? Web buying three calendars is called a triple calendar spread. Web 63 save 2.4k views 1 year ago #options #calendar #weekly_income i have discussed triple calendar spread in detail. Web double/triple calendar spreads as an earnings play. Web triple calendar spread | 3 leg calendar spread | non directional strategy | derive trading 16,733 views premiered aug 4, 2021 587 dislike share save derive. In this spread, the breakeven will be even a bit higher. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or. Web on 14 feb 2022, i exited the triple calendar trade that i entered on 10 feb 2022. Web buying three calendars is called a triple calendar spread. Web a calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at. Web trading option calendar spreads. I made a profit of +19% from this trade. This is your complete guide to calendar spreads. A double calendar has positive vega so it is best entered in a low volatility environment. Being long a calendar spread consists of a selling an option in a near. In this episode, i walk. Web the goog triple calendar p&l curve is presented below: Web nearly $2.3 billion has streamed into the the direxion daily 20+ year treasury bull 3x etf (ticker tmf) this year,. Web double/triple calendar spreads as an earnings play. Web offers a free lesson on triple calendar spreads using a real world example with amgen, amgn. So i’ve been paper trading a strategy for only a week so far that. A double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike price. Web what is a double calendar spread? Web 63 save 2.4k views 1 year ago #options #calendar #weekly_income i have discussed triple calendar spread in detail.Pin on Option Trading Strategies

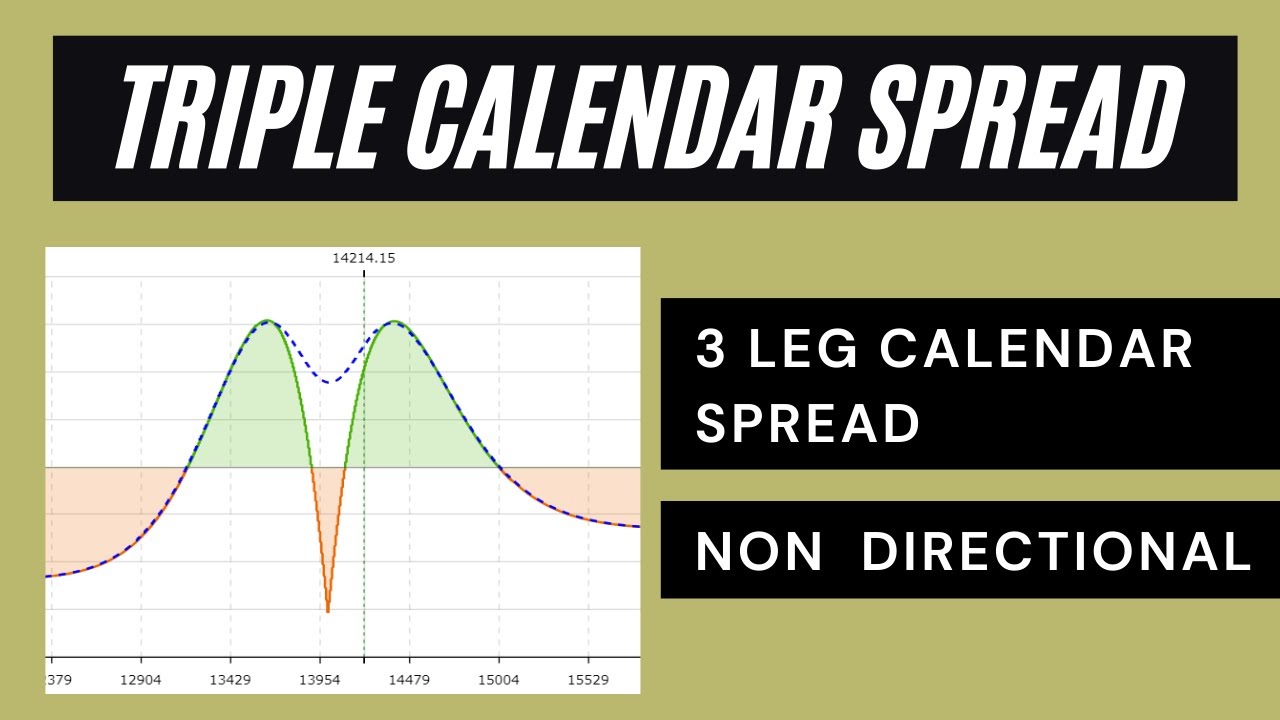

Triple Calendar Spread 3 Leg Calendar Spread Non Directional

Pin on CALENDAR SPREADS OPTIONS

TRIPLE CALENDAR SPREAD OPTIONS TRADING STRATEGY Post Market

Weekly Safe Option Strategy Triple Calendar Spread

Triple Calendar Spread 10 Feb 2022 Exit Made profit of 19 Weekly

Pin on Calendar Spreads Options

Pin on FX

Pin on CALENDAR SPREADS OPTIONS

Pin on Double Calendar Spreads and Adjustments

Related Post: