Wash Sale Rule 30 Calendar Days

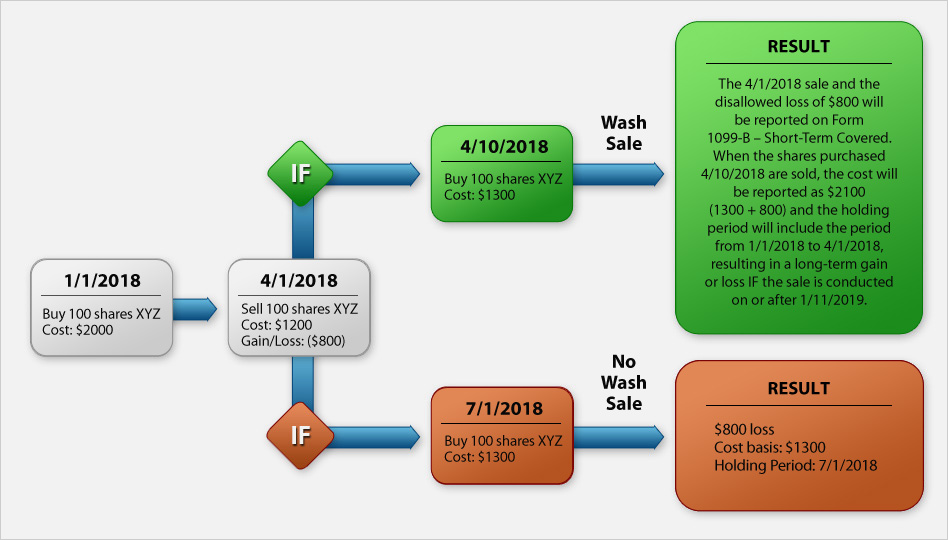

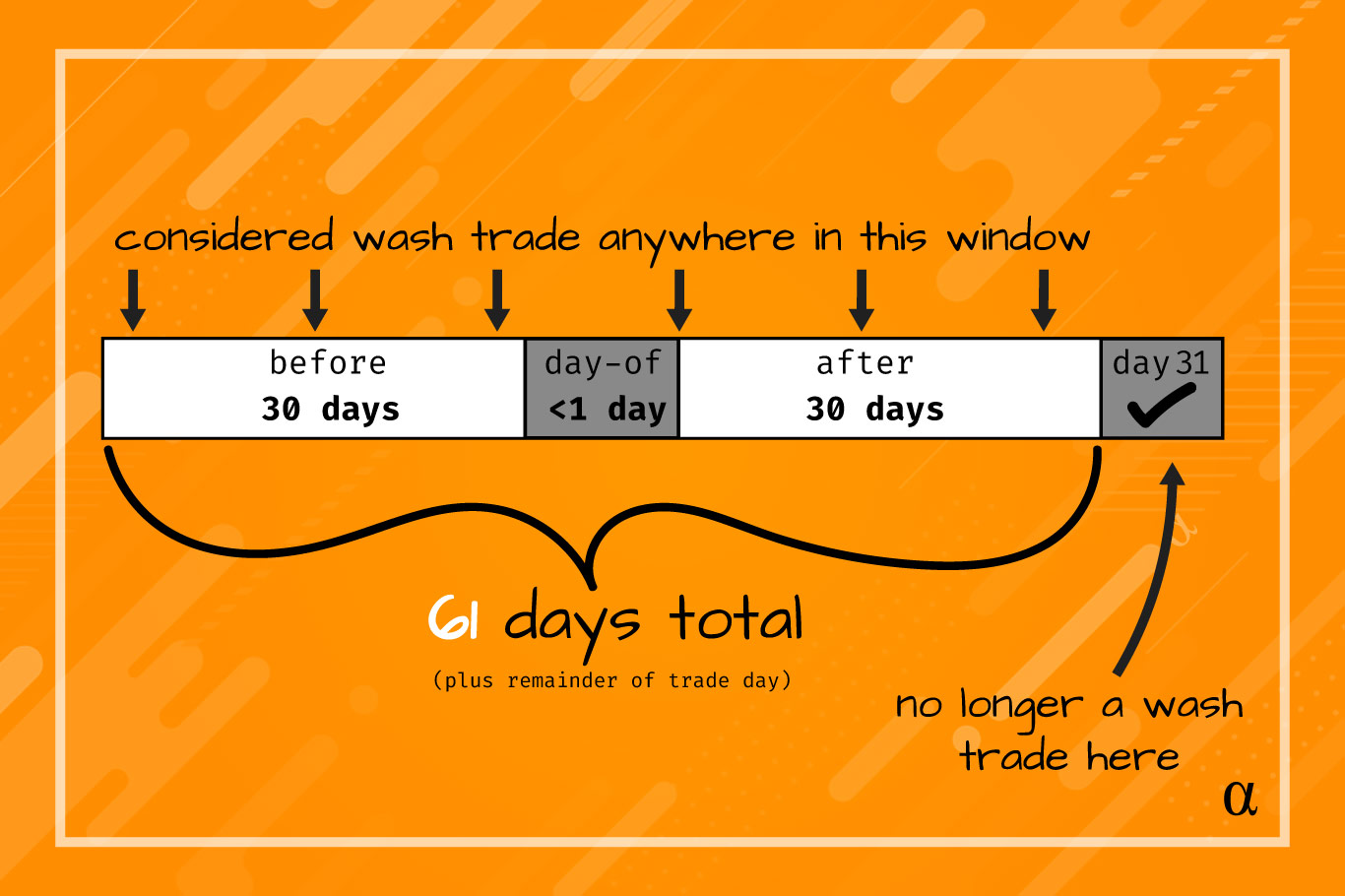

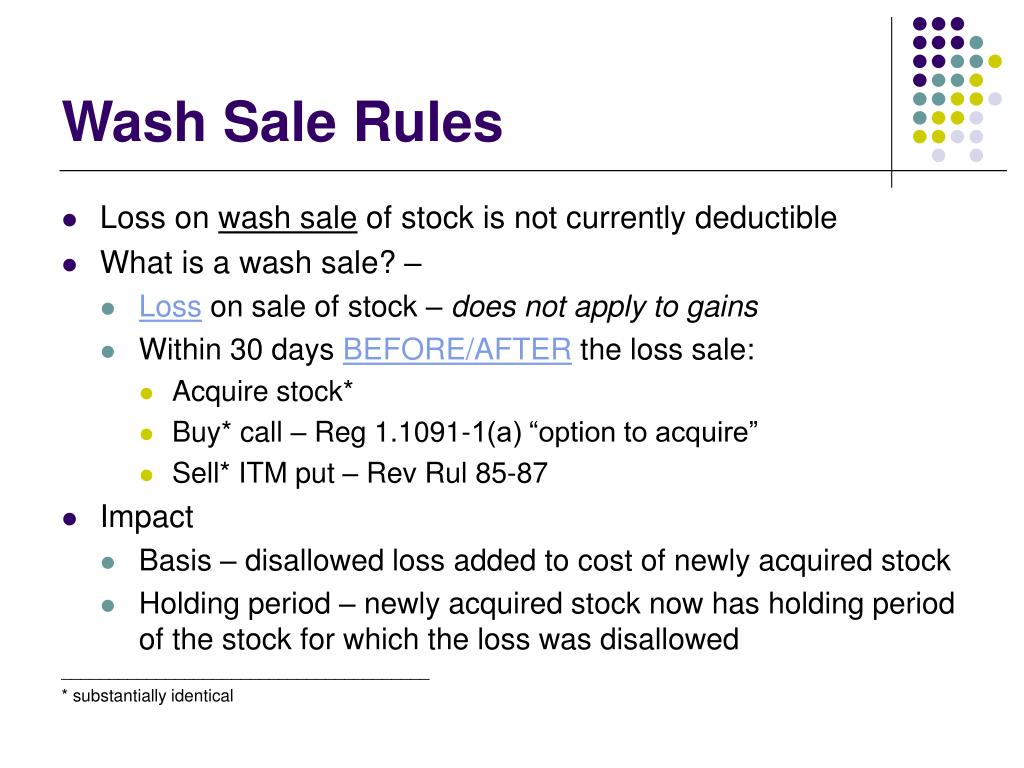

Wash Sale Rule 30 Calendar Days - Web a wash sale occurs when you sell or trade securities at a loss and within 30 days before or after the sale you: The wash sale rule prohibits taxpayers from claiming a loss on the sale or other. Web pop up the calendar app on your device and advance by 31 days from the sale with any loss: In this situation and your loss would be disallowed if you reacquired the security. Web is the wash sale rule 30 calendar days or business days? Irs rule that prohibits a capital loss to be realized for tax benefits on a security when an equivalent. Web the wash sale rule prohibits an investor from taking a tax deduction if they sell an investment at a loss and. Wash sale rule explained a wash. You can’t sell shares at a loss and. Most people understand the wash sale to mean you have to wait 30 days after the sale of. Web wash sale rules can also be avoided by not buying a security within 30 days of selling the same one or a similar one for a loss.. This is the first day you can. You can’t sell shares at a loss and. In this situation and your loss would be disallowed if you reacquired the security. Web a wash. Web the wash sale involves selling a stock for a loss and then buying back the same security within 30 days of selling. Web is the wash sale rule 30 calendar days or business days? Most people understand the wash sale to mean you have to wait 30 days after the sale of. Web pop up the calendar app on. Most people understand the wash sale to mean you have to wait 30 days after the sale of. Web the wash sale rule prohibits an investor from taking a tax deduction if they sell an investment at a loss and. Web in general you have a wash sale if you sell a specified asset at a loss, and buy substantially. Web the wash sale involves selling a stock for a loss and then buying back the same security within 30 days of selling. Web a wash sale occurs when you sell or trade securities at a loss and within 30 days before or after the sale you: Web what is the wash sale rule? Web is the wash sale rule. Web in general you have a wash sale if you sell a specified asset at a loss, and buy substantially identical securities within 30. This is the first day you can. Web what is the wash sale rule? In this situation and your loss would be disallowed if you reacquired the security. You can’t sell shares at a loss and. You can’t sell shares at a loss and. Wash sale rule explained a wash. The wash sale rule prohibits taxpayers from claiming a loss on the sale or other. Most people understand the wash sale to mean you have to wait 30 days after the sale of. Web pop up the calendar app on your device and advance by 31. Web a wash sale occurs when you sell or trade securities at a loss and within 30 days before or after the sale you: Web the wash sale involves selling a stock for a loss and then buying back the same security within 30 days of selling. Web what is the wash sale rule? Most people understand the wash sale. In this situation and your loss would be disallowed if you reacquired the security. Web what is the wash sale rule? Irs rule that prohibits a capital loss to be realized for tax benefits on a security when an equivalent. You can’t sell shares at a loss and. Web pop up the calendar app on your device and advance by. Web a wash sale occurs when you sell or trade stock or securities at a loss and within 30 days before or after the sale. Most people understand the wash sale to mean you have to wait 30 days after the sale of. Wash sale rule explained a wash. Web the wash sale involves selling a stock for a loss. Web a wash sale occurs when you sell or trade securities at a loss and within 30 days before or after the sale you: Web is the wash sale rule 30 calendar days or business days? Most people understand the wash sale to mean you have to wait 30 days after the sale of. In this situation and your loss. Web a wash sale occurs when you sell or trade stock or securities at a loss and within 30 days before or after the sale. Web is the wash sale rule 30 calendar days or business days? Web a wash sale occurs when you sell or trade securities at a loss and within 30 days before or after the sale you: Web wash sale rules can also be avoided by not buying a security within 30 days of selling the same one or a similar one for a loss.. Wash sale rule explained a wash. The wash sale rule prohibits taxpayers from claiming a loss on the sale or other. Web the wash sale involves selling a stock for a loss and then buying back the same security within 30 days of selling. In this situation and your loss would be disallowed if you reacquired the security. This is the first day you can. You can’t sell shares at a loss and. Most people understand the wash sale to mean you have to wait 30 days after the sale of. Irs rule that prohibits a capital loss to be realized for tax benefits on a security when an equivalent. Web what is the wash sale rule? Web the wash sale rule prohibits an investor from taking a tax deduction if they sell an investment at a loss and. Web in general you have a wash sale if you sell a specified asset at a loss, and buy substantially identical securities within 30. Web pop up the calendar app on your device and advance by 31 days from the sale with any loss:PPT Trader Tax Management PowerPoint Presentation, free download ID

Wash Sale Rule For Options YouTube

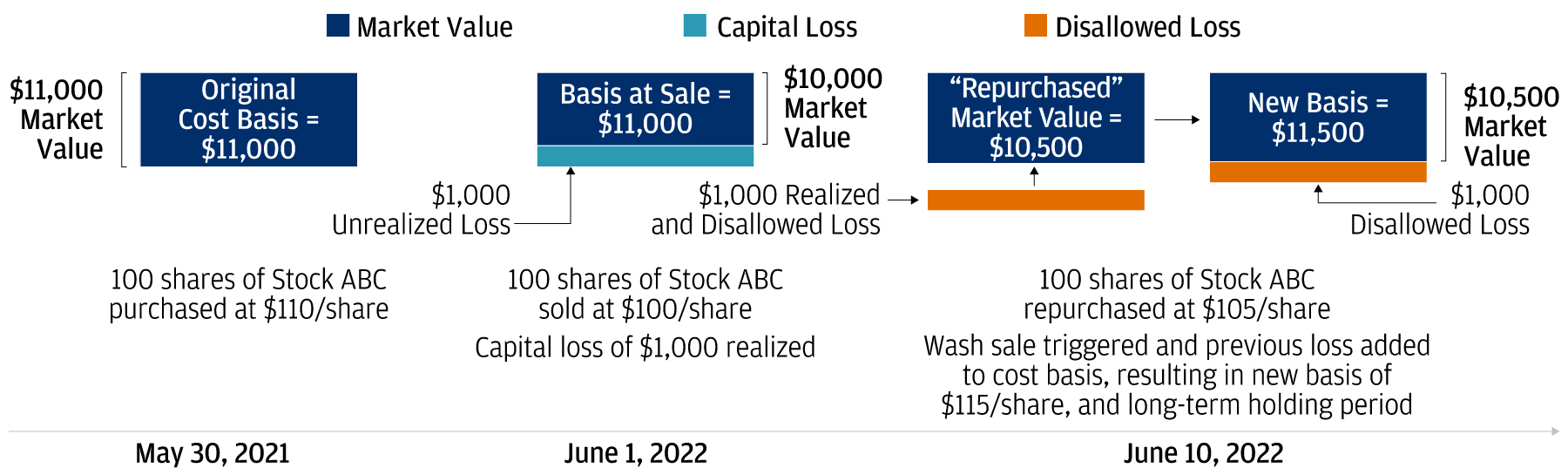

The WashSale Rule and the Considerations Involved Before Triggering It

Tax Information and Reporting

Wash Sale Rule Maximizing Tax Deductible Losses when Investing

Wash sale definition and meaning Market Business News

PPT Trader Tax Management PowerPoint Presentation, free download ID

For your yearend tax planning, beware the wash sale rule J.P.

Back To school 3 Tips To Begin The New Semester (With Confident)

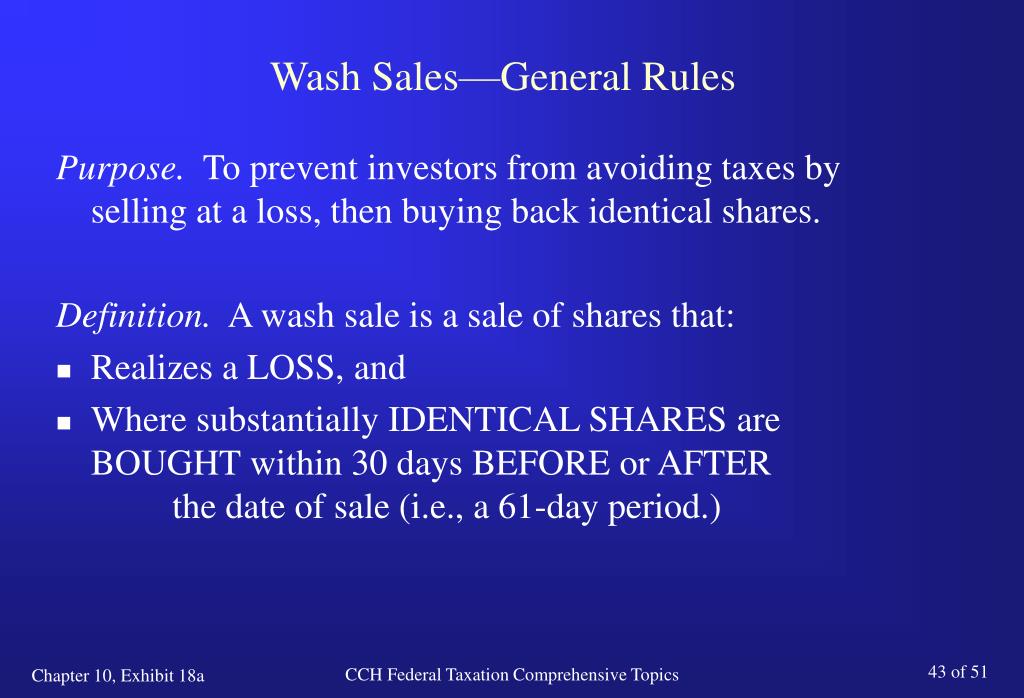

PPT CCH Federal Taxation Comprehensive Topics Chapter 10 Property

Related Post: