What Is A Calendar Spread In Options

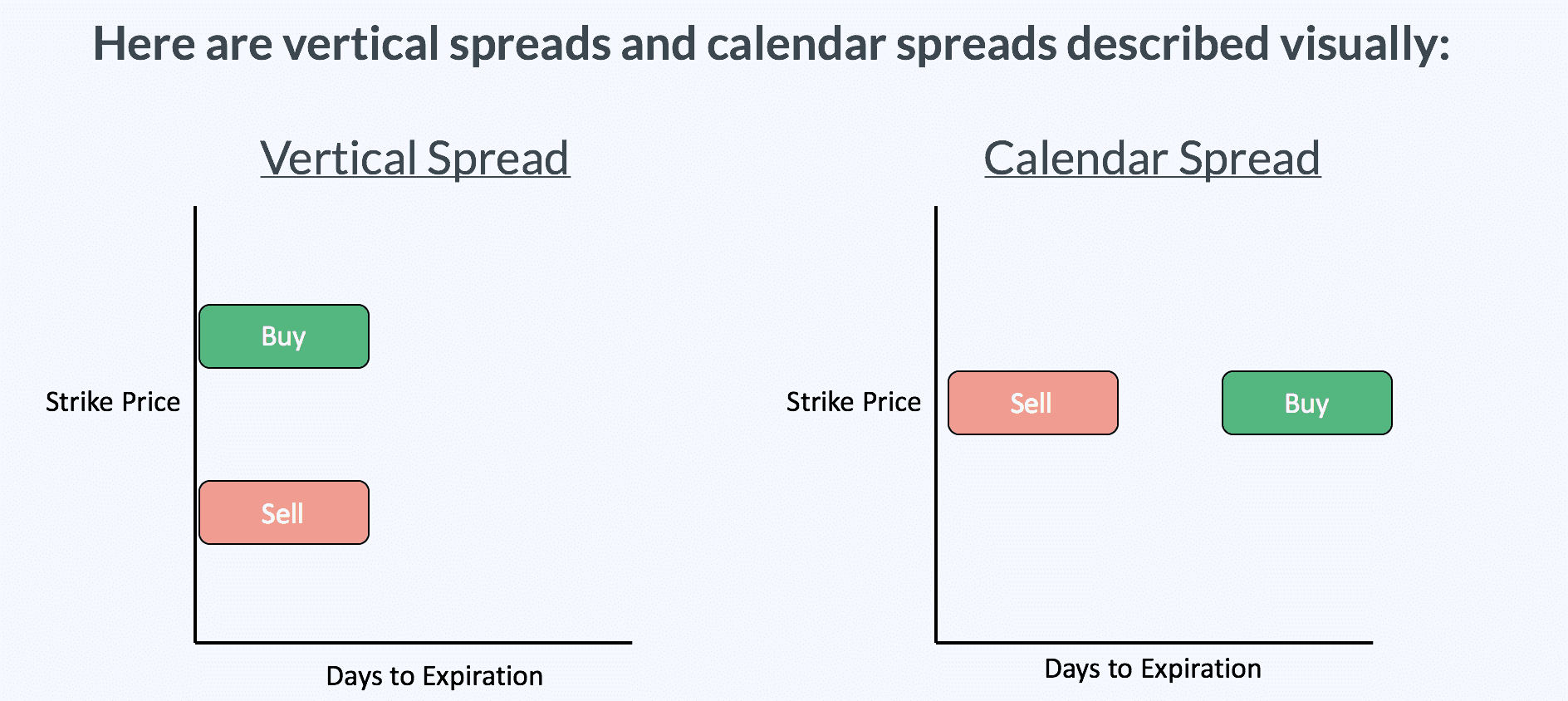

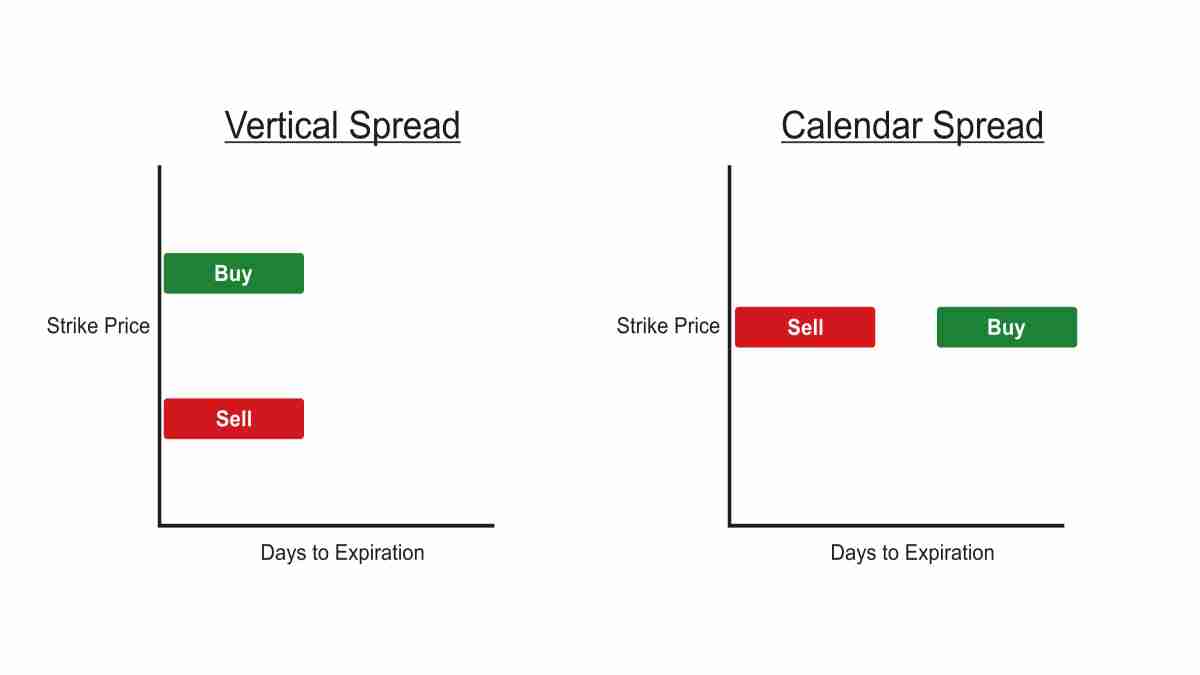

What Is A Calendar Spread In Options - Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. Web to summarize, a calendar spread strategy is a fairly popular option trading strategy that allows you to profit. Web the calendar spread is a beginner strategy that can work well under neutral assumptions. Explore how to use calendar. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. Web a calendar spread is an options trading strategy in which you enter a long or short position in the stock with the same. Web a calendar spread is a strategy used in options and futures trading: Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an. Web a calendar spread is an options strategy that has a relatively low buying power requirement. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the. Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different. Web a calendar spread is an options strategy that is constructed by simultaneously buying and. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different. Web key takeaways there are many options strategies available to help reduce the risk of market volatility; Web a. Web the calendar spread is a beginner strategy that can work well under neutral assumptions. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. Web because your long spread has “widened” from $1 to $2, your profit, if you were able to sell to close. Web the calendar spread is a beginner strategy that can work well under neutral assumptions. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web the intricacies of. Explore how to use calendar. Web to summarize, a calendar spread strategy is a fairly popular option trading strategy that allows you to profit. Web a calendar spread is a strategy used in options and futures trading: Web the calendar spread is a beginner strategy that can work well under neutral assumptions. Web the idea behind the calendar spread is. Web a calendar spread is a strategy used in options and futures trading: Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an. Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different. Web to summarize, a calendar spread strategy is. Explore how to use calendar. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an. Web the intricacies of calendar spread options now that we’ve covered the basics, let’s delve a little deeper into how calendar. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and. Web the idea behind the calendar spread is to sell time, which is why calendar spreads are also known as time spreads. Explore how to use calendar. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web a calendar spread is an investment strategy for derivative contracts in which the. A calendar spread is an options trading strategy that involves buying and selling two. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. Web a calendar spread is an options strategy that has a relatively low buying power requirement. Web what is a. Web because your long spread has “widened” from $1 to $2, your profit, if you were able to sell to close that position,. Web the calendar spread is a beginner strategy that can work well under neutral assumptions. Web the idea behind the calendar spread is to sell time, which is why calendar spreads are also known as time spreads.. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase. Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an. Web the calendar spread is a beginner strategy that can work well under neutral assumptions. Web a calendar spread is an options strategy that has a relatively low buying power requirement. Explore how to use calendar. Web key takeaways there are many options strategies available to help reduce the risk of market volatility; Web because your long spread has “widened” from $1 to $2, your profit, if you were able to sell to close that position,. Web a calendar spread is an options trading strategy in which you enter a long or short position in the stock with the same. A calendar spread is an options trading strategy that involves buying and selling two. Web the intricacies of calendar spread options now that we’ve covered the basics, let’s delve a little deeper into how calendar. Web a calendar spread is a strategy used in options and futures trading: Web the idea behind the calendar spread is to sell time, which is why calendar spreads are also known as time spreads. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web what is a calendar spread? Web to summarize, a calendar spread strategy is a fairly popular option trading strategy that allows you to profit.Calendar Spread, stratégie d’options sur deux échéances différentes

Options Strategy Calendar Spread (Setting Up the Calendar) Tradersfly

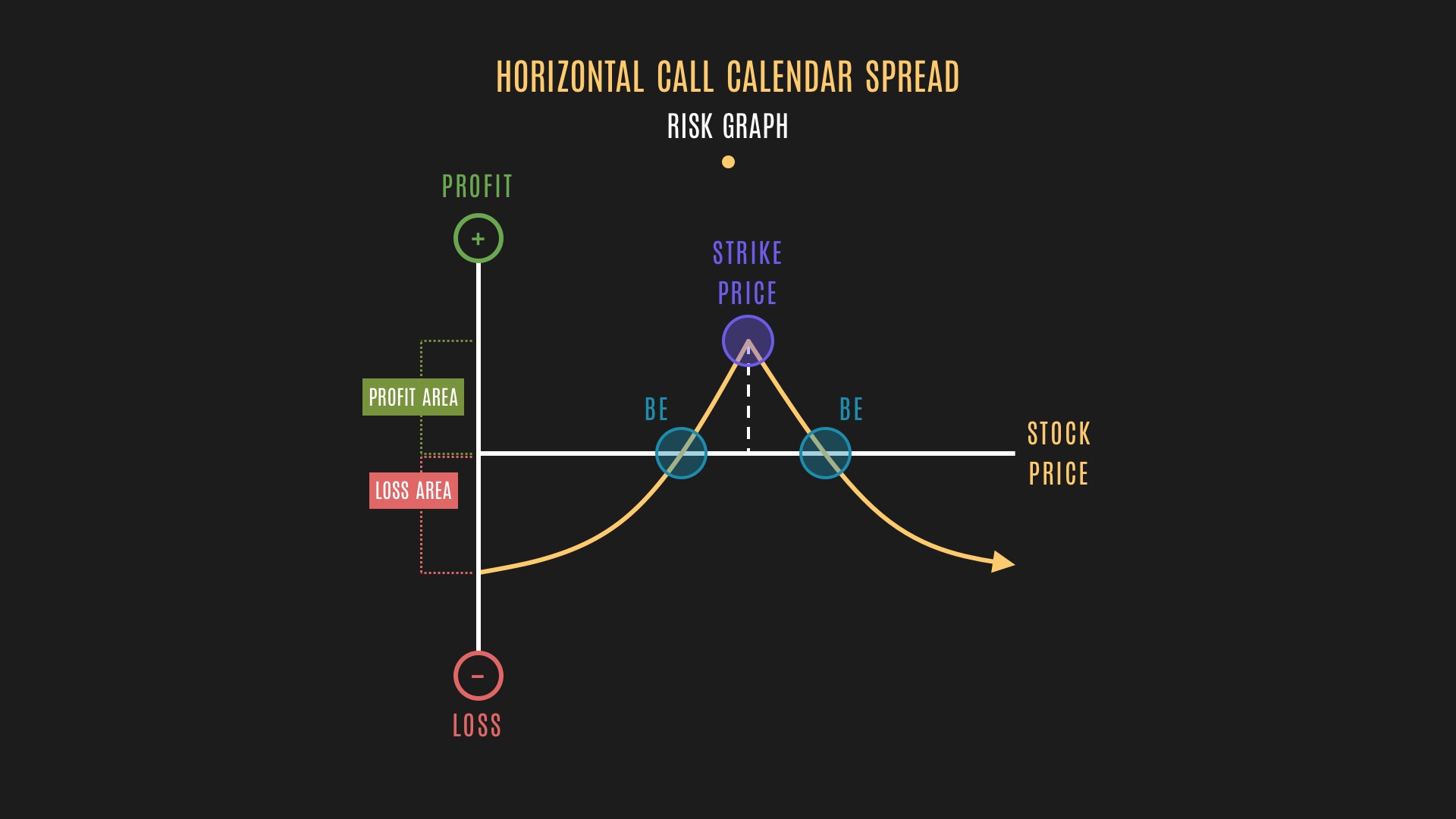

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

Options Trading Made Easy Basic Calendar Spreads

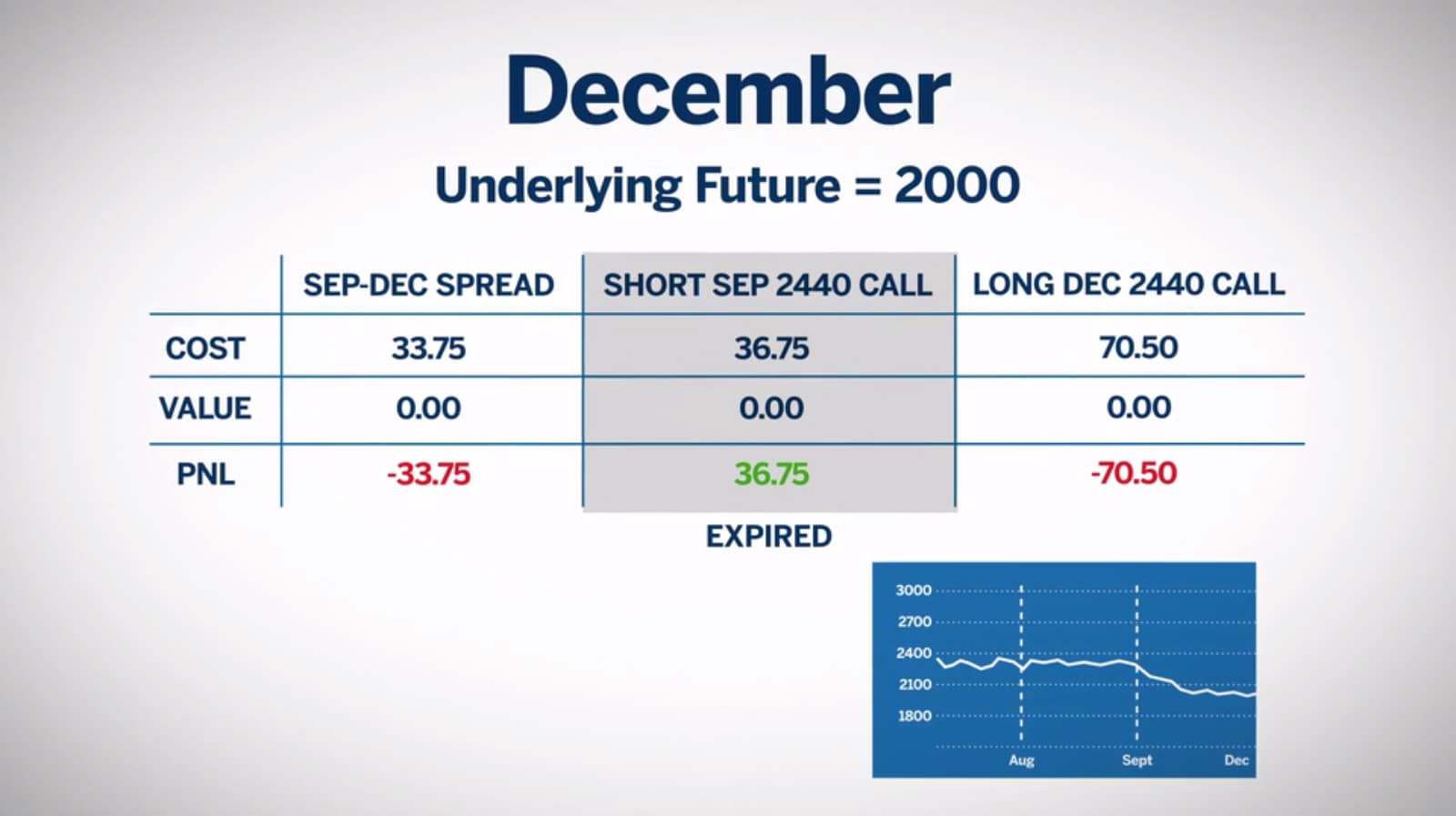

How Calendar Spreads Work (Best Explanation) projectoption

Forex Trading Strategies That Work 20+ Types of Trading Strategies

Pin on CALENDAR SPREADS OPTIONS

Option Calendar Spreads

Pin on Option Trading Strategies

Pin on Calendar Spreads Options

Related Post: