What Is A Calendar Spread

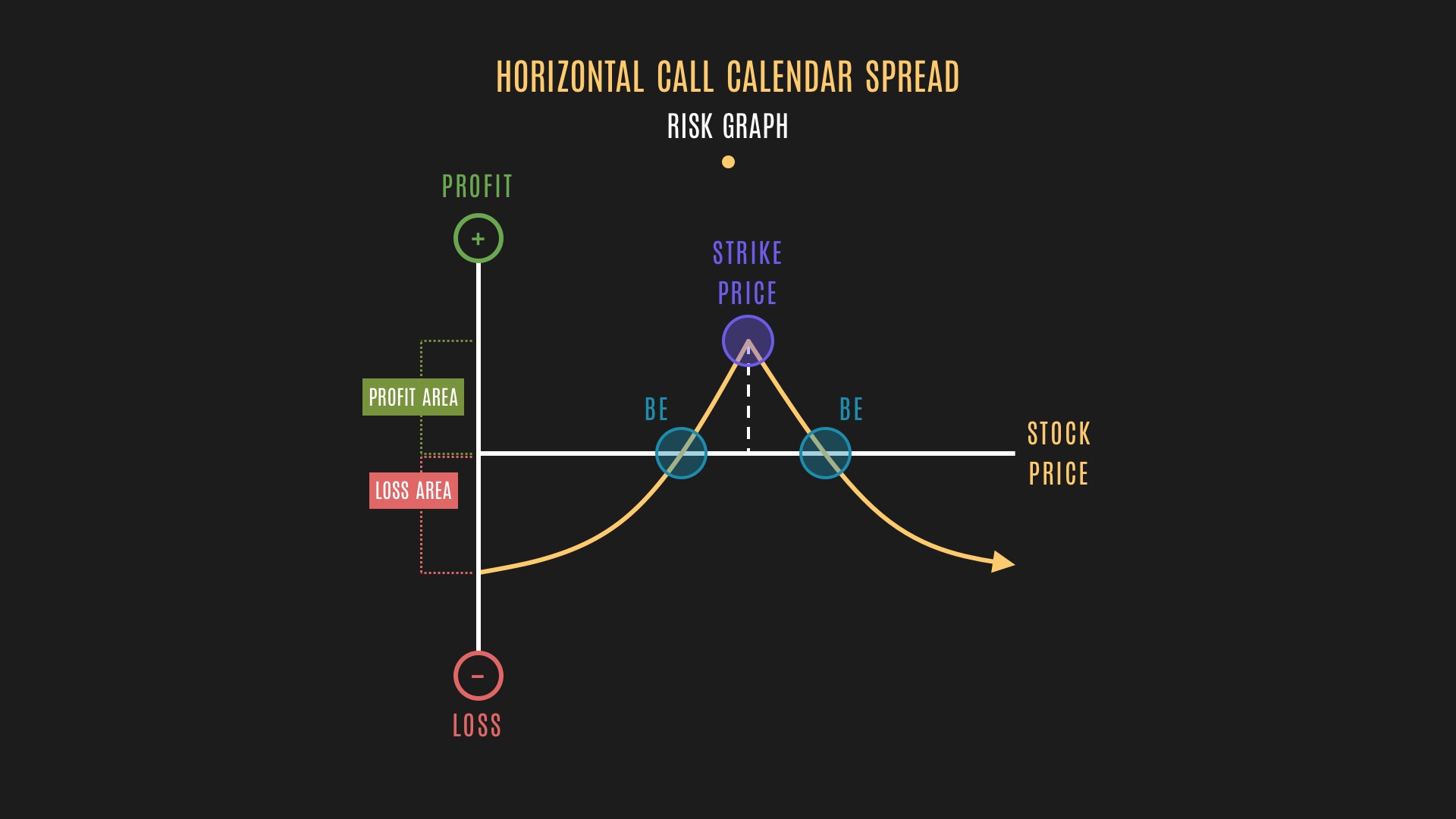

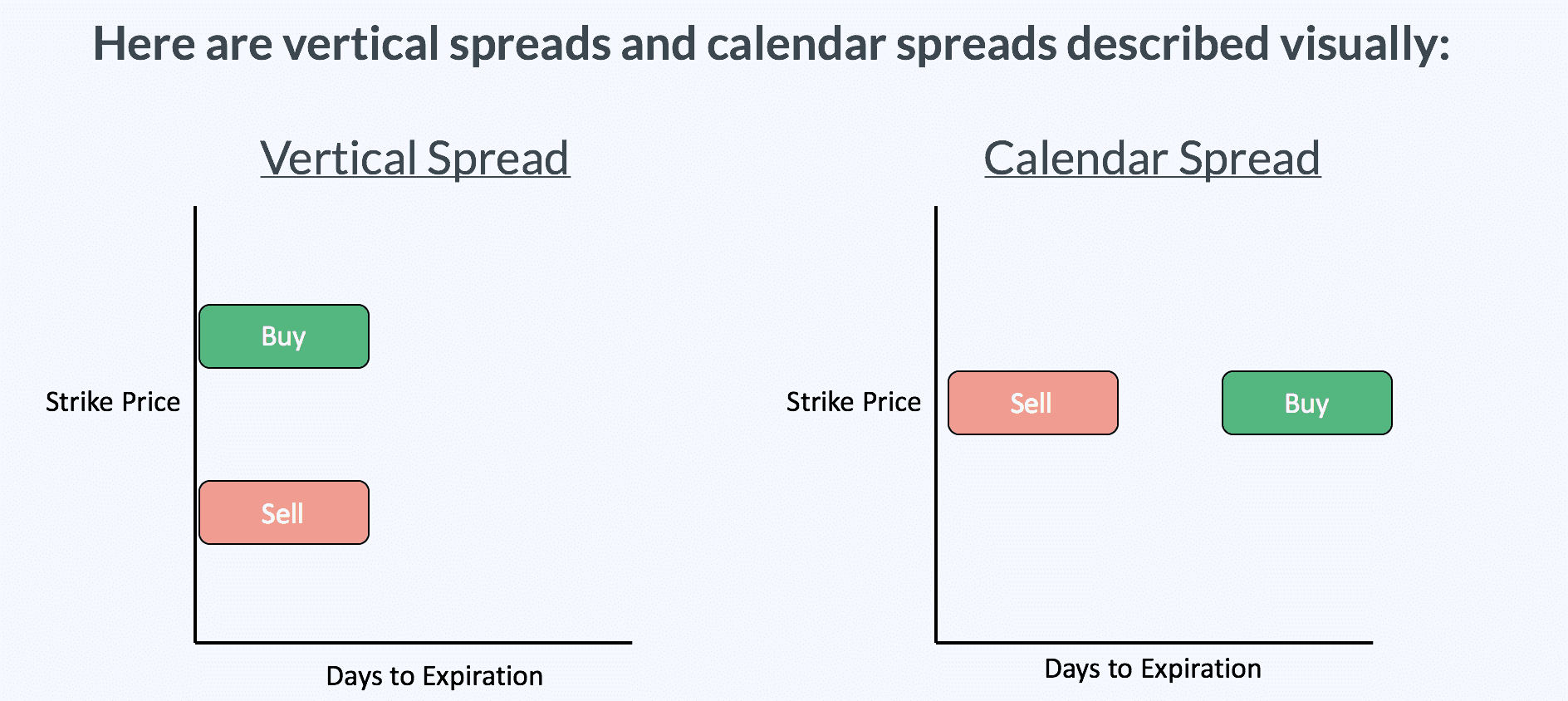

What Is A Calendar Spread - Web a calendar spread is a long or short position in the stock with the same strike price and different expiration dates. Web a common use of the calendar spread is to roll over an expiring position into the future. A calendar spread is a strategy used in options and futures trading: Web a calendar spread is a horizontal option strategy which means that it is buying and selling option contracts that are on the. Web time and volatility are key factors in pricing options, especially calendar spreads. Web a calendar spread is a trading strategy that involves simultaneously buying and selling an options or futures contract. Web key takeaways there are many options strategies available to help reduce the risk of market volatility; A situation in which an investor enters into option agreements to buy and sell financial. Horizontal, calendar spreads, or time. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the. Web a calendar spread allows option traders to take advantage of elevated premium in near term options with a. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. A calendar spread typically involves buying and selling the same type of option (calls or. In this lesson, we'll learn what a calendar spread. Two positions are opened at the. Horizontal, calendar spreads, or time. Web a calendar spread is a horizontal option strategy which means that it is buying and selling option contracts that are on the. Web a common use of the calendar spread is to roll over an expiring position into the. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. The calendar spread is one. Web a calendar spread is a horizontal option strategy which means that it is buying and selling option contracts that are on the. Web key takeaways there. A situation in which an investor enters into option agreements to buy and sell financial. Web what is a calendar spread? Web for a calendar spread, you can choose to display several expiration dates at the same time. Web a calendar spread is a horizontal option strategy which means that it is buying and selling option contracts that are on. Web a calendar spread is a long or short position in the stock with the same strike price and different expiration dates. In this lesson, we'll learn what a calendar spread. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the. Web time and volatility are key. Web a calendar spread is a trading strategy that involves simultaneously buying and selling an options or futures contract. Web a calendar spread allows option traders to take advantage of elevated premium in near term options with a. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the. Two positions are opened at the. Web calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal spreads’. Web a calendar spread is an option trade that involves buying and selling an option on the. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. Web for a calendar spread, you can choose to display several expiration dates at the same time. The calendar spread is one. Web what's a calendar spread? In this lesson, we'll learn what a calendar spread. Two positions are opened at the. [verb] to press (cloth, rubber, paper, etc.) between rollers or plates in order to smooth and glaze or to thin into sheets. Web a calendar spread allows option traders to take advantage of elevated premium in near term options with a. A calendar spread typically involves buying and selling the same type of option. Web a calendar spread allows option traders to take advantage of elevated premium in near term options with a. Web key takeaways there are many options strategies available to help reduce the risk of market volatility; Web a calendar spread is a horizontal option strategy which means that it is buying and selling option contracts that are on the. Web. A calendar spread is a strategy used in options and futures trading: Web time and volatility are key factors in pricing options, especially calendar spreads. Web a calendar spread is a long or short position in the stock with the same strike price and different expiration dates. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. Web a common use of the calendar spread is to roll over an expiring position into the future. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and. Two positions are opened at the. Web for a calendar spread, you can choose to display several expiration dates at the same time. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the. Web key takeaways there are many options strategies available to help reduce the risk of market volatility; The calendar spread is one. A situation in which an investor enters into option agreements to buy and sell financial. Web what is a calendar spread? [verb] to press (cloth, rubber, paper, etc.) between rollers or plates in order to smooth and glaze or to thin into sheets. Horizontal, calendar spreads, or time. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the. Web a calendar spread is a horizontal option strategy which means that it is buying and selling option contracts that are on the. Web what's a calendar spread? In this lesson, we'll learn what a calendar spread.How to Trade Options Calendar Spreads (Visuals and Examples)

Pin on CALENDAR SPREADS OPTIONS

Pin on Option Trading Strategies

Pin on Calendar Spreads Options

Pin on CALENDAR SPREADS OPTIONS

Pin on CALENDAR SPREADS OPTIONS

How To Trade Calendar Spreads The Complete Guide

Long Calendar Spreads Unofficed

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

How Calendar Spreads Work (Best Explanation) projectoption

Related Post: