What Is Considered A Calendar Year

What Is Considered A Calendar Year - A period of a year beginning and ending with the dates that are conventionally accepted as marking the beginning and end of a numbered year. Web a tax year is an annual accounting period for keeping records and reporting income and expenses. 1 and ending on dec. The tax years you can use are:. For individual and corporate taxation purposes, the. Generally speaking, a calendar year begins on the new year's day of the given calendar system and ends on the day before the following new year's day, and thus consists of a whole number of days. A period of time equal in length to that of the. An annual accounting period does not include a short tax year. Based on the gregorian calendar, a calendar year lasts 365 days and 366 days during a. An annual accounting period does not include a short tax year. Generally speaking, a calendar year begins on the new year's day of the given calendar system and ends on the day before the following new year's day, and thus consists of a whole number of days. Based on the gregorian calendar, a calendar year lasts 365 days and 366. 1 and ending on dec. The tax years you can use are:. A period of a year beginning and ending with the dates that are conventionally accepted as marking the beginning and end of a numbered year. Generally speaking, a calendar year begins on the new year's day of the given calendar system and ends on the day before the. Web a tax year is an annual accounting period for keeping records and reporting income and expenses. 1 and ending on dec. The tax years you can use are:. Based on the gregorian calendar, a calendar year lasts 365 days and 366 days during a. A period of a year beginning and ending with the dates that are conventionally accepted. The tax years you can use are:. Web a tax year is an annual accounting period for keeping records and reporting income and expenses. 1 and ending on dec. An annual accounting period does not include a short tax year. A period of time equal in length to that of the. An annual accounting period does not include a short tax year. A period of a year beginning and ending with the dates that are conventionally accepted as marking the beginning and end of a numbered year. Generally speaking, a calendar year begins on the new year's day of the given calendar system and ends on the day before the following. 1 and ending on dec. A period of a year beginning and ending with the dates that are conventionally accepted as marking the beginning and end of a numbered year. For individual and corporate taxation purposes, the. Generally speaking, a calendar year begins on the new year's day of the given calendar system and ends on the day before the. Based on the gregorian calendar, a calendar year lasts 365 days and 366 days during a. An annual accounting period does not include a short tax year. Web a tax year is an annual accounting period for keeping records and reporting income and expenses. A period of time equal in length to that of the. Generally speaking, a calendar year. An annual accounting period does not include a short tax year. A period of a year beginning and ending with the dates that are conventionally accepted as marking the beginning and end of a numbered year. Generally speaking, a calendar year begins on the new year's day of the given calendar system and ends on the day before the following. An annual accounting period does not include a short tax year. Based on the gregorian calendar, a calendar year lasts 365 days and 366 days during a. A period of time equal in length to that of the. For individual and corporate taxation purposes, the. Generally speaking, a calendar year begins on the new year's day of the given calendar. Based on the gregorian calendar, a calendar year lasts 365 days and 366 days during a. The tax years you can use are:. A period of time equal in length to that of the. Web a tax year is an annual accounting period for keeping records and reporting income and expenses. A period of a year beginning and ending with. A period of time equal in length to that of the. For individual and corporate taxation purposes, the. 1 and ending on dec. Based on the gregorian calendar, a calendar year lasts 365 days and 366 days during a. A period of a year beginning and ending with the dates that are conventionally accepted as marking the beginning and end of a numbered year. Web a tax year is an annual accounting period for keeping records and reporting income and expenses. An annual accounting period does not include a short tax year. Generally speaking, a calendar year begins on the new year's day of the given calendar system and ends on the day before the following new year's day, and thus consists of a whole number of days. The tax years you can use are:.Year Calendar Free Printable Calendar Printables Free Templates

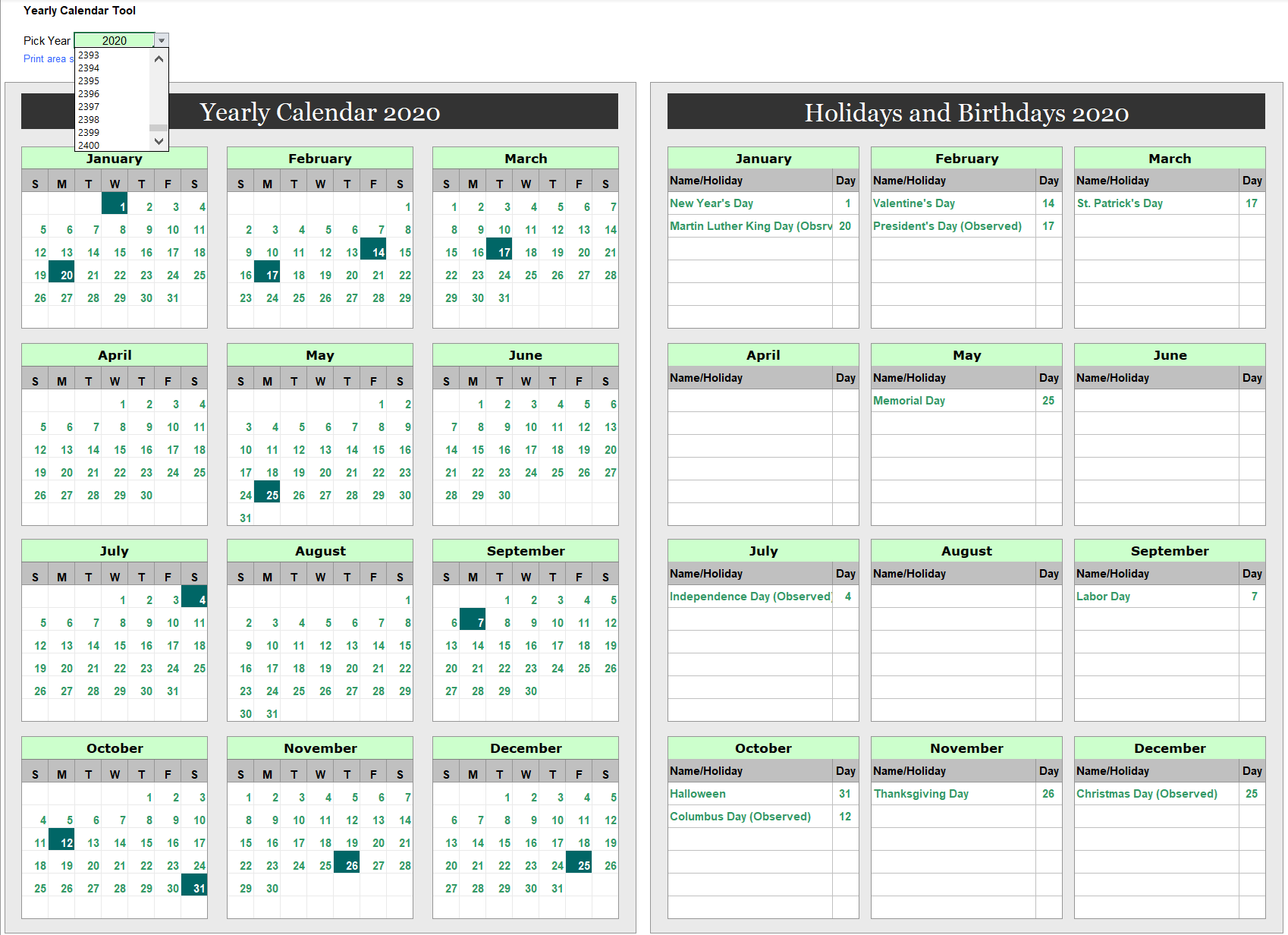

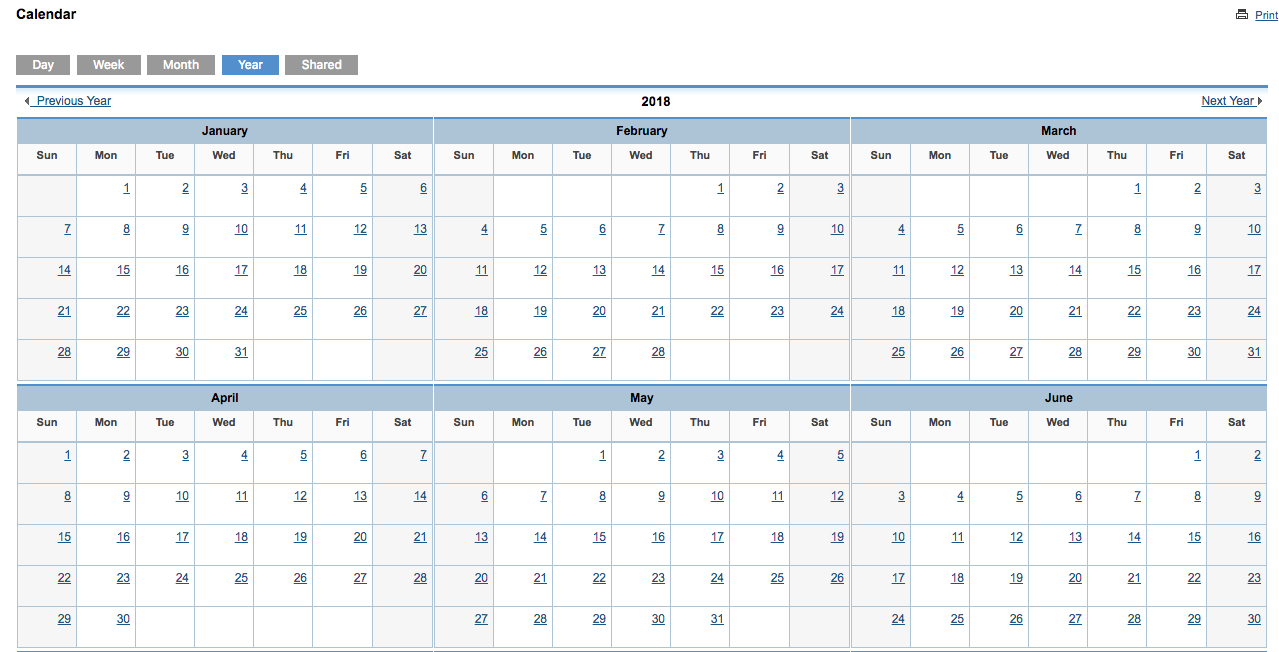

Dynamic yearly calendar Vintage app for Excel Excel Effects

Yearly Blank Calendar Potrait Free Printable Templates

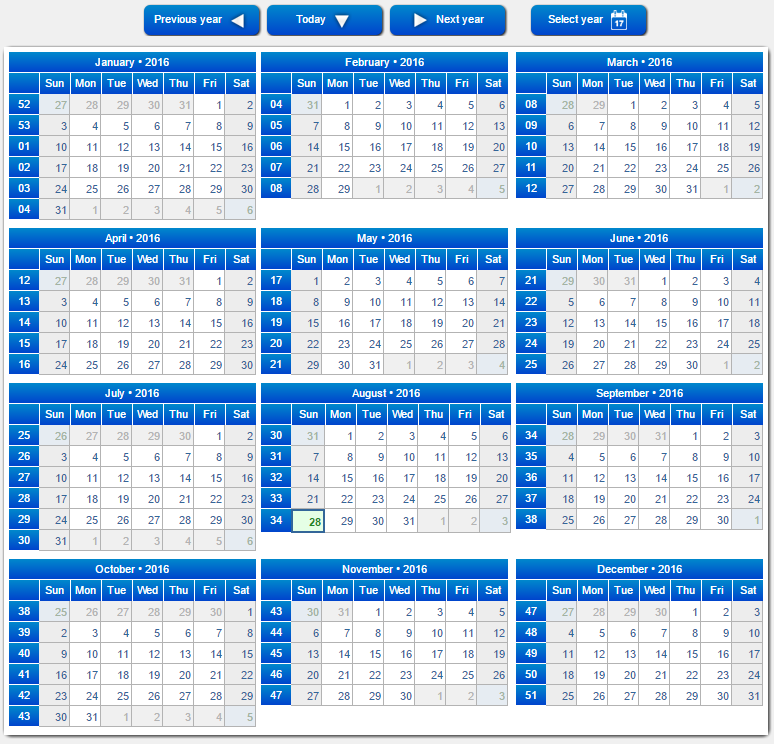

Year view

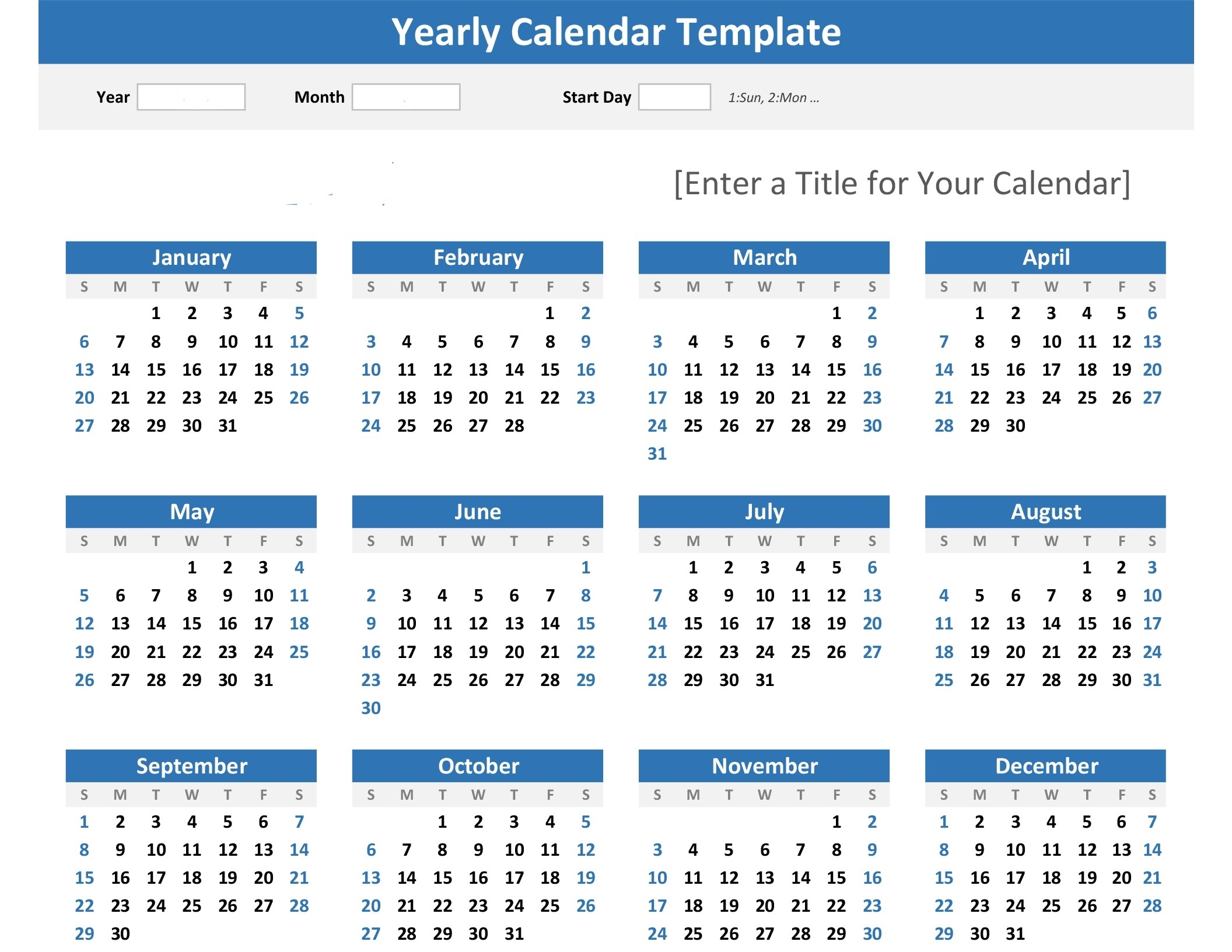

Yearly Calendar Sheet » Template Haven

Download Printable Yearly Planning Calendar Template PDF

Calendars Year At A Glance

Year View Wall Calendar A101 American Calendar

Blank Calendars Free Printable PDF templates

Calendar Community Data Solutions

Related Post: